The whole momentum literature is so huge, it's hard to know where to sum up, and this is a great place, especially if you're teaching an MBA class. Since they're obviously a bit conflicted (momentum + value is one of AQR's core strategies), their emphasis on the simple facts, which you (or your students) can replicate from Ken French's databse, is great.

Some "Myths,"

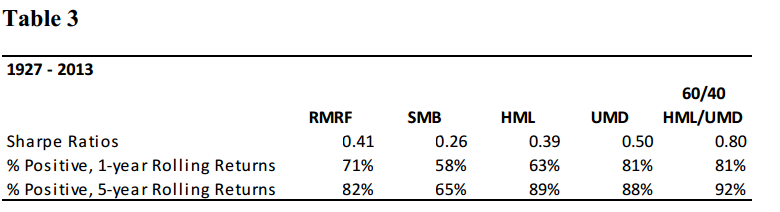

Myth #1: Momentum returns are too “small and sporadic”. Like any factor, it's not an aribtrage opportunity.

The return premium is evident in 212 years (yes, this is not a typo, two hundred and twelve years of data from 1801 to 2012) of U.S. equity data

So, to sum up, who you calling small and sporadic?A writing style more bold than my own.

Myth #2: Momentum cannot be captured by long-only investors as “momentum can only

be exploited on the short side.

(evidence that the long side works as well)

Myth #3: Momentum is much stronger among small cap stocks than large caps.

Putting it starkly: in-sample, out-of-sample, calculated in Greenwich Connecticut, Chicago, Boston, Palo Alto, Santa Monica, Austin, or in the library with a candlestick, wherever or however you want to look, along any dimension, those who make the claim that momentum fails for large caps, while being supporters of value investing, are not simply mistaken, they have it backwards.Myth #4: Momentum does not survive, or is seriously limited by, trading costs.

Frazzini, Israel,and Moskowitz (2013), “FIM”, which uses trades from a large institutional investor [hmm, I wonder who that could be] over a long period of time. . Their conclusion is that per dollar trading costs for momentum are quite low...

... Trading patiently (by breaking orders up into small sizes and setting limit order prices that provide, not demand, liquidity) and allowing some tracking error to a theoretical style portfolio can significantly reduce trading costs...

Where did this myth come from? ... First, the studies that find much larger trading costs do so because they estimate costs for the average investor...which turn out to be about ten times larger than the costs of a large institutional manager,...Second,...these other studies examine portfolios that do not consider transactions costs in their design, which can significantly reduce turnover and therefore trading costs further.This really is the DFA sales pitch. Momentum, a simple strategy may work. But if you try to do it, you'll get swamped by trading costs.

Myth #5: Momentum does not work for a taxable investor.

and so on.

This isn't a 100 percent endorsement. I've seen other cuts of the data that suggest other results, particularly Fama and French's finding that momentum didn't exist 1926-1963, the big left tail of the financial crisis, the question whether it's finally being arbitraged away, and Fama and French's evidence that it's weaker in large stocks, though not absent. I need to reconcile all the evidence, and it's still a huge project that I've put off for another day.

Also, momentum is either large or small depending on how you look at it. Suppose returns have a 0.1 autocorrelation, and thus a 0.01 R2 in R_t+1 = a + b R_t + error_t+1. The top 1/10 of stocks in the previous year went up about 50%. The bottom 10% of stocks in the previous year went down about 50%. So, a 100% previous year return spread, and a 0.01 R2 implies a 10% return spread next year -- about what we see in the 1-10 momentum portfolios. You might say that a 0.01 R2 is a tiny bit of forecastability. You might say that a 10% return spread is a huge phenomenon. They are the same.

But if you want one great paper to read and assign your students about momentum, this is it.

Momentum trading seems like a way to tax investors in index funds for their herd-like behaviour. And these investors are merely following the advice of people like Burt Malkiel, who helps Wealthfront.com implement index investing on behalf of ordinary people.

ReplyDeleteThe knowledge of people like Malkiel should be baked into the financial architecture so that we all can save money without enriching him and your friends at AQR (even if that means fewer endowed positions at business schools). Let's record our savings in a ledger denominated in shares of the aggregate economy, not in dollars that banks (of all kinds) try to guarantee, even when deposits are not backed fully by risk-free assets.

this is great news! now we can all achieve "abnormal returns" er... I mean "normal risk adjusted returns" ...wait which is it again?

ReplyDeleteNice attempt by a large institutional investor to justify their high fees.

ReplyDeleteIn hindsight everything is profitable or can become profitable with a few parameter adjustments. Concluson: either show your portfolio results or never write a book. Information chaos is increasing to the point that everything is a myth and is not a myth or p AND ~p is true. Result: the end is near.

ReplyDeleteI agree that every finance or economics paper, no matter how urbane, or how dense the calculus, alwats supports the foregone conclusions of the authors.Still, check out ETF momentum investing...

DeleteNice artice, but isn't momentum just another form of value investing?

ReplyDeleteValue investing works, because it identifies companies that are undervalued relative to book equity or (any other measure of company value), so either have low growth expectations or high risk premium. Sometimes it's one, sometimes it's the other. On average, you're going to find risky companies, and that's how value works. Factors don't encapsulate everything that scares investors, so value is just a way of finding fear without understanding what is so scary.

Momentum works the same way. If we have some value function that includes changes of historical price in the valuation function, we find a postive coefficient on past changes. So, we're saying that companies that have had big positive changes in the past, on average, have something scary about them.

And, this makes sense too. In fixed-income, securities that have appreciated recently, on average, have done so because there has been a flow of information and risk has been reduced. If a security has been risky in the past, there's a good chance it's still risky.

So that's it. Momentum is a way of identifying companies that have above-average risk without resorting to some meausure of "scale" (as Fama puts it).

So, yes, the authors are right that momentum is a "real" investing tool. But they are wrong to treat it fundamentally differently than "scale" based value investing methods.

Hi Fish,

DeleteThe problem starts with your second sentence "Value investing works, " - it works in small and micro-cap companies, but doesn't seem to work in large cap company indexes, particularly in the United States.

And if I could think about two styles of investing that are as far away from each other as possible, I would think about momentum and value investing. To claim that momentum is fundamentally the same as "scale" based value investing is an extraordinary claim.

I would love to see your detailed justification for that.

I would have liked to see the paper mention the phenomena of "momentum crashes". Instead, the paper is completely silent on this issue. We know now that, there are months when, returns to momentum is highly negative, making the strategy somewhat similar to the one selling options and reaping the premiums consistently, but with occasionally large losses.

ReplyDeleteIt must be noted that the real value of a strategy for the average investor, lies not in the absolute profits (or losses) that it generates, but in what situations those profits (or losses) manifest.

Well, proper momentum in say futures as implemented by old school CTAs is exactly option like. Essentially it is a short gamma strategy, which depends strongly on the ratio of "signal" to "noise". If noise is high those strategies will loose money even if the underlying actually moves a lot.

DeleteMomentum crashes have been the subject of a couple of recent papers. Turns out that the most likely time to lose a chunk of money in a momentum strategy is when you have made a colossal amount of money by being in the strategy (i.e. you could say it is the "best kind of crash possible").

DeleteFor example, momentum strategies made a fortune during the GFC, offsetting the very large losses suffered in stock portfolios, and then gave back a decent chunk of the returns as stocks rebounded. The timing was perfect.

If that is the biggest concern that investors have about momentum investing, then set yourself an "extreme returns" rule to wind back momentum positions when stocks have fallen 50%, and you'll do just fine.