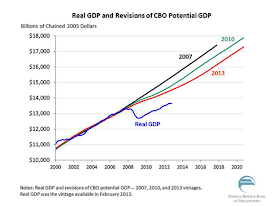

Philadelphia Fed President Charles Plosser made this nice graph, showing how reduced views of potential GDP are closing the gap, not rises in actual GDP. The source is a nice speech here. This fits in the recent series of blog posts on forecasts and slump. By contrast, here is the last big recession, where GDP closed the "gap."

Monday, May 12, 2014

In praise of bottom-feeders

A fascinating quote in today's Wall Street Journal: Warren Buffett to Tim Geithner just after the Bear Sterns bailout:

Absolutely wrong on number 2, Mr. Buffett. There is no more patriotic act an American sitting on a few billion dollars can perform, than to show up at a fire sale with a fat checkbook and a pen.

"I was sort of hoping you wouldn't do it, because then everything would have crashed and I would have been first in line to buy."Buffett continued,

"It would have been terrible for the country, but I would've made a lot more money"Amen on number one. A's fire sale is B's buying opportunity. In the end, a lot of finance depends on flexible long-only money to come in and take risks when others are selling.

Absolutely wrong on number 2, Mr. Buffett. There is no more patriotic act an American sitting on a few billion dollars can perform, than to show up at a fire sale with a fat checkbook and a pen.

Sunday, May 11, 2014

Forecast Followup

A follow-up to "groundhog day," reflecting some comments and email. Here is a pretty up to date graph of real GDP, the CBO's current assessment of "potential" and the previous trendline, which is a pretty good approximation to what the CBO thought potential was just before the crisis. The surprising thing about this recession is how sadly-diminishing expectations of "potential" are behind the closing of the gap, rather than GDP rising to meet potential.

Groundhog Day

Torsten Slok once again makes a beautiful graph, of the kind I posted at the bottom of Punditonomics, reminding us of the foibles of forecasting. (I would have connected each projection to the actual value at the time it was made, but should make my own graphs if I want to criticize.)

Torsten views the result as an indication of failure for the Fed's models. I think the message is deeper, and tells us a lot more about the macroeconomic situation.

Plus ça change

Corresponding on the "Run Free Financial System," François Velde at the Chicago Fed sends me an interesting paper, "Early Public Banks" with William Roberds. François and William document nicely just how long bank runs have been going on, just how long we've been struggling with money-like bank liabilities, and just how long narrow-banking proposals have been around.

Friday, May 9, 2014

AQR on momentum

Cliff Asness, Andrea Frazzini, Ronen Israel and Toby J. Moskowitz have a lovely SSRN paper "`Fact, Fiction and Momentum Investing."

The whole momentum literature is so huge, it's hard to know where to sum up, and this is a great place, especially if you're teaching an MBA class. Since they're obviously a bit conflicted (momentum + value is one of AQR's core strategies), their emphasis on the simple facts, which you (or your students) can replicate from Ken French's databse, is great.

Some "Myths,"

Myth #1: Momentum returns are too “small and sporadic”. Like any factor, it's not an aribtrage opportunity.

The whole momentum literature is so huge, it's hard to know where to sum up, and this is a great place, especially if you're teaching an MBA class. Since they're obviously a bit conflicted (momentum + value is one of AQR's core strategies), their emphasis on the simple facts, which you (or your students) can replicate from Ken French's databse, is great.

Some "Myths,"

Myth #1: Momentum returns are too “small and sporadic”. Like any factor, it's not an aribtrage opportunity.

The return premium is evident in 212 years (yes, this is not a typo, two hundred and twelve years of data from 1801 to 2012) of U.S. equity data

So, to sum up, who you calling small and sporadic?A writing style more bold than my own.

Tuesday, May 6, 2014

Are you SIFI?

"Financial crises are always and everywhere due to problems of short-term debt" quoth Doug Diamond, and wisely. Not so, according to the Office of Financial Research and the Financial Stability Council, which are, apparently, planning to "designate" as "systemically important" asset managers such as BlackRock and Fidelity.

The depths of this silliness are hard to fathom.

The depths of this silliness are hard to fathom.

Stuff cheap, people expensive

|

| Source: New York Times |

The deeper point is that things are getting cheaper and cheaper, and people -- services provided with their expertise -- are getting more and more expensive.

On the back of my mind: What does the economy look like when goods are essentially free, and all value consists of paying other people for their expertise?

I explored this a little in covering Larry Summers' Martin Feldstein speech. But it remains, I think, an important question for deep microeconomic research.

In just about any transaction you name, from electronics to fashion to health care, most of the value comes from the expertise of the seller, not the physical good.

The characteristics of the production, value, and sale of expertise are completely different from those of the standard widget. Just the measurement of GDP and inflation in such a world raise lots of open questions.

Monday, May 5, 2014

The cost of regulation

Gordon Crovitz has a nice piece in the Wall Street Journal, Monday May 5, titled "The end of the permissionless web" which sparks several thoughts.

What has made the Internet revolutionary is that it's permissionless. No one had to get approval from Washington or city hall to offer Google searches, Facebook profiles or Apple apps, as Adam Thierer of George Mason University notes in his new book, "Permissionless Innovation." [Available free and ungated here. - JC]

The central fault line in technology policy debates today can be thought of as 'the permission question,' " Mr. Thierer writes. "Must the creators of new technologies seek the blessing of public officials before they develop and deploy their innovations?"

Saturday, May 3, 2014

Punditonomics

James Surowiecki at The New Yorker had a nice column last month on "Punditonomics," the tendency of much public discussion to focus on individuals who seem to have forecast one or two big events in the past.

The economic incentive is clear:

The economic incentive is clear:

Experts in a wide range of fields are prone to making daring and confident forecasts, even at the risk of being wrong, because when they're right the rewards are immense. An expert who makes one great prediction can live off the success for a long time; we assume that the feat is repeatable.But, being right once is pretty meaningless