Deflation returns to Japan. Tyler Cowen has a thoughtful Marginal Revolution post, expressing puzzlment. Scott Sumner discussion here, and Financial Times coverage.

Let's look at the bigger picture. Here is the discount rate, 10 year government bond rate and core CPI for Japan. (CPI data here if you want to dig.)

If you parachute down from Mars and all you remember from economics is the Fisher equation, this looks utterly sensible. Expected inflation = nominal interest rate - real interest rate. So, if you peg the nominal interest rate, inflation shocks will slowly melt away. Most inflation shocks are individual prices that go up or down, and then it takes some time for the overall price level to work itself out.

Monday, September 28, 2015

Wednesday, September 23, 2015

After the ACA

After the ACA, a longish essay on what to do instead of Obamacare. Relative to the policy obsession with health insurance, it focuses more on the market for health care, and relative to the usual focus on demand -- people paying with other people's money -- it focuses on supply restrictions. Paying with your own money doesn't manifest a cab on a rainy Friday afternoon, if you face supply restrictions.

Long time blog readers saw the first drafts. Polished up, it is published at last in the volume The Future of Healthcare Reform in the United States edited by Anup Malani and Michael H. Schill, just published by the University of Chicago Press.

The rest of the volume is interesting, and the conference was enlightening to me, a part-timer in the massive health-policy area. As the U of C press puts it with perhaps unintentional wry wit: "By turns thought-provoking, counterintuitive, and even contradictory, the essays together cover the landscape of positions on the PPACA's prospects."

Long time blog readers saw the first drafts. Polished up, it is published at last in the volume The Future of Healthcare Reform in the United States edited by Anup Malani and Michael H. Schill, just published by the University of Chicago Press.

The rest of the volume is interesting, and the conference was enlightening to me, a part-timer in the massive health-policy area. As the U of C press puts it with perhaps unintentional wry wit: "By turns thought-provoking, counterintuitive, and even contradictory, the essays together cover the landscape of positions on the PPACA's prospects."

Tuesday, September 22, 2015

Who is walking who?

Click here for the rest

It's a graphic novel treatment of Gene Fama's Does the Fed Control Interest Rates? paper, from the Booth school's Capital Ideas magazine, by Eric Cochrane (yes, we're related). If it appears squished, use a wide browser window. The art is better in the printed form.

Eric captured cointegration and error correction, and Gene's regressions of short and long-term interest rates, cleverly with the story. Does Sally take Lucy for a walk, or is Lucy really leading Sally around? Well, when Lucy goes off hunting for a squirrel, who then moves to catch up?

Friday, September 18, 2015

Is the Fed Pulling or Pushing?

I did a little interview with Mary Kissel of the Wall Street Journal, following up on thursday's oped. Mary is, as you can tell, a well-informed interviewer and asks some tough questions. She did a great job of pushing hard on the usual Wall Street wisdom about how the Fed, though it has not done anything but talk in years, is secretly behind every gyration of stock or housing prices.

The central point came to me hours later, as it usually does. Is the Fed in fact "holding down" interest rates? Is there some sort of natural market equilibrium that features higher rates now, but the Fed is pushing down rates? That's the conventional view, clearly expressed in Mary's questions.

Wednesday, September 16, 2015

WSJ oped, director's cut

WSJ Oped, The Fed Needn’t Rush to ‘Normalize’ An ungated version here via Hoover.

Teaser:

Yes, I'm aware of recent empirical work that QE has some effect:

Teaser:

The outcomes we desire from monetary policy are about as good as one could hope. Inflation is low and steady. Interest rates are lower than Americans have seen in generations. Unemployment, at 5.1%, has recovered to near normal. And banks and businesses sitting on huge piles of cash don’t go bust, a boon to financial stability.Opeds are real Haikus -- 950 words is torture for me. So lots of good stuff got left on the cutting room floor, especially acknowledgement of objections and criticisms.

Yes, economic growth is too slow, too many Americans have dropped out of the workforce, earnings are stagnant, and the country faces other serious challenges. But monetary policy can’t solve long-term structural problems.

Yes, I'm aware of recent empirical work that QE has some effect:

Tuesday, September 15, 2015

Conundrum Redux

FT's Alphaville has an excellent post by Matthew Klein on long-term interest rates, organized around Greenspan's "conundrum." The "conundrum" was that Greenspan couldn't control long term rates as he wished. Long rates do not always track short rates or Fed pronouncements. As the post nicely shows, it was ever thus.

The following graph from the post struck me as very useful, especially as so much bond discussion tends to have short memories.

If the 10 year rate had followed the pink line, you would not have made any more buying 10 year bonds than buying short term bonds. (The pink line is the forward-looking moving average of the one year rates.)

What the graph shows beautifully, then, is this: Until 1981, long-term bonds were awful. You routinely lost money buying 10 year bonds relative to buying one year bonds. It goes on year in and year out and starts to look like a constant of nature.

From 1981 until today, the actual 10 year rate has been well above this ex-post breakeven rate. It's been a great 35 years for long-term bond investors. That too seems like a constant of nature now.

Of course, inflation going down was good for long term bonds. But we usually don't think there can be surprises in the same direction 35 years in a row.

The following graph from the post struck me as very useful, especially as so much bond discussion tends to have short memories.

If the 10 year rate had followed the pink line, you would not have made any more buying 10 year bonds than buying short term bonds. (The pink line is the forward-looking moving average of the one year rates.)

What the graph shows beautifully, then, is this: Until 1981, long-term bonds were awful. You routinely lost money buying 10 year bonds relative to buying one year bonds. It goes on year in and year out and starts to look like a constant of nature.

From 1981 until today, the actual 10 year rate has been well above this ex-post breakeven rate. It's been a great 35 years for long-term bond investors. That too seems like a constant of nature now.

Of course, inflation going down was good for long term bonds. But we usually don't think there can be surprises in the same direction 35 years in a row.

Monday, September 14, 2015

Two for growth

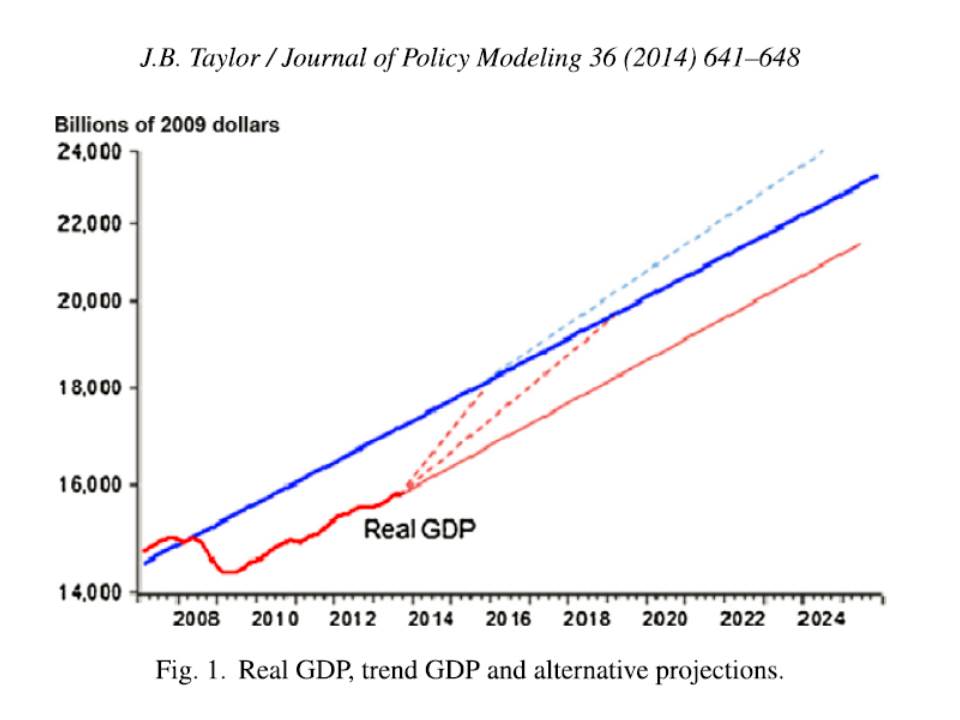

I saw two very nice, short views on growth: John Taylor Can We Restart This Recovery All Over Again? and Andy Atkeson, Lee Ohanian, and William E. Simon, Jr., 4% Economic Growth? Yes, We Can Achieve That.

John gets the art prize

Andy, Lee and William get the boil-it-down-to-basics prose prize

John gets the art prize

Andy, Lee and William get the boil-it-down-to-basics prose prize

Safety-net policies should not discourage work through high implicit tax rates resulting from means-tested programs. Regulatory policies should not erect barriers to competition and raise costs. Education policies should expand competition and reward the most successful teachers. Immigration policies should expand the number of skilled workers and immigrant entrepreneurs. And tax policies should simplify the tax code, reduce business and personal marginal income tax rates and broaden the tax base.

Friday, September 11, 2015

Sargent on Friedman

I ran across a little gem by Tom Sargent, "The Evolution of Monetary Policy Rules." Alas, it's gated in the JEDC so you'll need a university IP address to read it, and I haven't found a free copy. It's a transcript of a talk, so doesn't have Tom's usual prose polish, but insightful nonetheless.

Milton Friedman, like the rest of us, changed his mind over the course of a lifetime.

Coordinating monetary and fiscal policy:

Milton Friedman, like the rest of us, changed his mind over the course of a lifetime.

Coordinating monetary and fiscal policy:

...At different times, Friedman advocated two apparently polar opposite recommendations. In Friedman (1948), he proposed the following rule. He recommended to the fiscal authorities that they run a balanced budget over the business cycle. And he said what the monetary authorities should do, whatever the fiscal authority does, is to monetize 100% of government debt. That monetary rule implies that the entire government deficit is going to be financed with money creation. That is it.

It is interesting to contemplate what Friedman׳s monetary policy rule would imply if the fiscal authority chooses to deviate from Friedman׳s fiscal recommendation by running sustained deficits over the business cycle. Friedman׳s monetary rule then throws responsibility for inflation control immediately at the foot of the fiscal authority. Friedman׳s (1948) monetary rule tells the fiscal authority that if it wants stable money, then it better do the right things. If you want a stable price level, you had better recognize that you need a sound fiscal policy, period. The division of responsibilities between monetary and fiscal authorities is clearly and unambiguously delineated. It is a completely clean set of rules. And this is what Friedman advocated until 1960.

Friedman (1960) advocated what looks to be exactly an opposite set of rules for coordinating monetary and fiscal policy. Friedman now advocated that the Federal Reserve, come hell or high water – it is not a Taylor Rule (for technical reasons) – should increase high-powered money, or something close to it, at k-percent a year, where k is the growth rate of the economy. The Fed is told to stick to the k-percent rule no matter what, recession or no recession. Under this rule, the arithmetic of the government budget constraint will force the fiscal authority to balance its budget in a present value sense.

Thursday, September 10, 2015

Cheaper sugar

A nice trade epigram from David Henderson

Nothing new. It's in Adam Smith. But nicely expressed. Economics needs good stories.

I don't think Trump understands that when we open trade to other countries, we gain not just as exporters but as consumers. But then, what U.S. politician running for president does? Marco Rubio? Rubio argued a few years ago that he would favour getting rid of quotas on sugar imports if we got something in return. But we do get something in return: it's called cheaper sugar. And getting cheaper sugar, by the way, might have caused LifeSavers not to move from Michigan to Quebec.David might have added, we also get more exports automatically without political deals. When other countries sell us sugar, they get dollars, of every single one ends up buying US exports or invested in the US.

Nothing new. It's in Adam Smith. But nicely expressed. Economics needs good stories.

Saturday, September 5, 2015

Greece and Banking, the oped

| Source: Wall Street Journal; Getty Images |

Local pdf here.

Greece's Ills [and, more importantly, the Euro's] Require a Banking Fix

Greece suffered a run on its banks, closing them on June 29. Payments froze and the economy was paralyzed. Greek banks reopened on July 20 with the help of the European Central Bank. But many restrictions, including those on cash withdrawals and international money transfers, remain. The crash in the Greek stock market when it reopened Aug. 3 reminds us that Greece’s economy and financial system are still in awful shape.

Thursday, September 3, 2015

Historical Fiction

Steve Williamson has a very nice post "Historical Fiction", rebutting the claim, largely by Paul Krugman, that the late 1970s Keynesian macroeconomics with adaptive expectations was vindicated in describing the Reagan-Volker era disinflation.

The claims were startling, to say the least, as they sharply contradict received wisdom in just about every macro textbook: The Keynesian IS-LM model, whatever its other virtues or faults, failed to predict how quickly inflation would take off in the 1970, as the expectations-adjusted Phillips curve shifted up. It then failed to predict just how quickly inflation would be beaten in the 1980s. It predicted agonizing decades of unemployment. Instead, expectations adjusted down again, the inflation battle ended quickly. The intellectual battle ended with rational expectations and forward-looking models at the center of macroeconomics for 30 years.

Just who said what in memos or opeds 40 years ago is somewhat of a fodder for a big blog debate, which I won't cover here.

Steve posted a graph from an interesting 1980 James Tobin paper simulating what would happen. This is a nicer source than old memos or opeds from the early 1980s warning of impeding doom. Memos and opeds are opinions. Simulations capture models.

The graph:

I thought it would be more effective to contrast this graph with the actual data, rather than rely on your memories of what happened.

The black lines are the Tobin simulation. The blue lines are what actually happened. (I'm not good enough with photoshop to superimpose the graphs, so I read Tobin's data off his chart.)

The two curves parallel in 81 to 83, with reality moving much faster. But In 1984 it all falls apart. You can see the "Phillips curve shift" in the classic rational expectations story; the booming recovery that followed the 82 recession.

And you can see the crucial Keynesian prediction error: After the monetary tightening is over in 1986, no, we do not need years and years of grinding 10% unemployment.

So, conventional history is, it turns out, right after all. Adaptive-expectations ISLM models and their interpreters were predicting years and years of unemployment to quash inflation, and it didn't happen.

The claims were startling, to say the least, as they sharply contradict received wisdom in just about every macro textbook: The Keynesian IS-LM model, whatever its other virtues or faults, failed to predict how quickly inflation would take off in the 1970, as the expectations-adjusted Phillips curve shifted up. It then failed to predict just how quickly inflation would be beaten in the 1980s. It predicted agonizing decades of unemployment. Instead, expectations adjusted down again, the inflation battle ended quickly. The intellectual battle ended with rational expectations and forward-looking models at the center of macroeconomics for 30 years.

Just who said what in memos or opeds 40 years ago is somewhat of a fodder for a big blog debate, which I won't cover here.

Steve posted a graph from an interesting 1980 James Tobin paper simulating what would happen. This is a nicer source than old memos or opeds from the early 1980s warning of impeding doom. Memos and opeds are opinions. Simulations capture models.

The graph:

|

| Source: James Tobin, BPEA. |

The two curves parallel in 81 to 83, with reality moving much faster. But In 1984 it all falls apart. You can see the "Phillips curve shift" in the classic rational expectations story; the booming recovery that followed the 82 recession.

And you can see the crucial Keynesian prediction error: After the monetary tightening is over in 1986, no, we do not need years and years of grinding 10% unemployment.

So, conventional history is, it turns out, right after all. Adaptive-expectations ISLM models and their interpreters were predicting years and years of unemployment to quash inflation, and it didn't happen.