I gave a talk at the Minneapolis Fed's "Ending Too Big to Fail" symposium, May 16.

Agenda and video of the event here.

My talk is based on "

towards a run-free financial system," and a bit on

a new structure for federal debt, and blog readers will notice many recycled ideas. But it incorporates some current thinking both on substance and on marketing -- the proposal is so simple, most of the work is on meeting objections.

Here's my talk. This is also

available as a pdf here.

Equity-financed banking and a run-free financial system

Premises

We have to define what “sytstemic” and “crisis” mean before we can try to fix them.

My premise is that, at its core, our financial crisis was a systemic run. The mechanism is familiar from Diamond and Dybvig, and especially Gary Gorton’s description of how “information-insensitive” assets suddenly lose that property and become illiquid.

You see a problem at a bank – a word I will use loosely to include shadow-banks, overnight debt, and other intermediaries. You wonder, what about my bank? You don’t really know. The point of short-term debt is that you don’t generally pay attention to the bank’s assets. But you also have the right to take your money out at any time, and the last one out gets the rotten egg. When uncertain, you might as well forego a few basis points of interest and get out now. Everyone does this, and the bank fails.

Runs at specific institutions, caused by identifiable problems, are not really a danger. My story includes a specific “contagion,” that troubles at one institution spread to another, because they cause people to wonder about the other bank’s assets. That “systemic run” element means that banks cant’ easily sell assets to raise cash, or issue new equity.

This description is important for what it denies, and thus for “problems” we don’t have to “solve.”

It’s not a chain of dominoes: A fails, B loses money, B falls, and so forth, so by saving A the whole system is saved.

Contrariwise, even saving A is not enough to assure investors that B’s assets are ok. In fact, saving A might verify investor’s worries about B’s assets, and set off a run!

It’s not huge losses on particularly unsafe assets. Bank assets are not that risky. Bank liabilities are fragile. Small losses spark large runs.

Our crisis and recession were not the result of specific business operations failing. Failure is failure to pay creditors, not a black hole where there once was a business. Operations keep going in bankruptcy. The ATMs did not go dark.

In my premises, the 2000 stock market bust was not a crisis, because it was not a run. Yes, there were huge losses. But when stocks plunge, all you can do is go home, pour a drink, yell at the dog, and bemoan your dumb decisions. You can’t demand your money back from the issuing company, and you can’t drive the company to bankruptcy if it does not pay. Panic selling, even if “irrational,” even if it causes “herding” by others, even if it drives prices down, is not a crisis, and it’s not a run, because the issuing company doesn’t have to do anything about it.

If we want to stop crises, we have to describe when we will say “good enough” and stop trying to fix things in the name of crisis prevention. My premise: an economy with booms and busts, risks taken, and losses transparently absorbed by falling prices, is good enough for now.

If we try to create a financial system in which nobody ever loses money, we will just create a system in which nobody ever takes any risk, and does not fund any remotely risky investment opportunity. That is the direction we are going. And steps that actually matter to fixing crises are getting lost in the effort rush to “fix” every perceived financial “problem.”

(A small random sample of current causes being commingled with crisis prevention, some worthy but separate, some silly: Fannie and Freddie, the community reinvestment act, “predatory lending,” insufficient down payments, FICO scores, Wall Street "greed," executive compensation, credit card fees, disparate-impact analysis, the last names of auto-loan customers, the terms of student loans, hedge fund fees, active management and its fees, “herding” and “crowding” by equity portfolio managers (OFR), over-the-counter versus exchange-traded derivatives, swap margins, position limits, risk-weights, credit ratings, the Volker rule, insider trading, global imbalances, savings gluts, bubbles in houses and stocks, and the ridiculous tiny type on my credit-card agreement.)

I do not mean that other financial regulation is not necessarily bad, or even that one shouldn’t contemplate policies to reduce stock market volatility. But if we actually want to fix crises, or end TBTF, we have to separate those other measures into everyday regulation.

A better world

Given these premises, the central weakness in financial system is clear: fragile, run-prone liabilities.

The answer then is simple too: we should have no more large-scale funding of risky or potentially illiquid assets by run-prone securities – short term debt in particular, but any promise that is fixed-value, first-come first-served, if unpaid instantly bankrupts the company, and in volumes that could even remotely trigger such bankruptcy.

(The caveats here exempt bills, receivables, trade credit, and so on, which are fixed value but not run-prone. “Funding” is the important qualifier. You can trade in short term debt without funding the bulk of investments with it.)

Banks and shadow banks must get the money they use to hold risky and potentially illiquid loans and securities overwhelmingly from run-proof, floating-value assets – common equity mostly, some long term debt. (I say “hold” specifically to distinguish it from “originate” or “make” loans, which are then securitized and sold. )

Once we have done this, financial crises are over. A 100% equity-financed institution cannot fail, and cannot suffer a run. Fail means fail to pay your debts, and if you have no debts you cannot fail.

(OK, technically you can take on such a huge derivatives position that you can lose more than 100% of equity, but it takes very little attention from regulators and analysts to make sure that doesn’t happen.)

Such an institution needs next to no risk regulation, beyond the regular transparency we demand of any public corporation.

Any remaining fixed-value demandable assets must be backed entirely by short-term government debt, or reserves. These are run-proof because there is no doubt on the value and liquidity of the assets (at least for the US, and away from sovereign debt worries, which I also put off the table for now.)

Objections

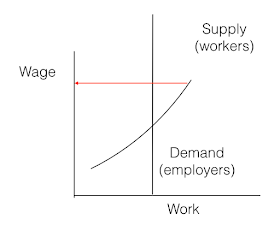

The major objection is the flow of credit. If banks can’t issue conventional deposits and unconventional short-term debt, they won’t have money to lend and the economy will dry up, the objection goes. Others object similarly that without bank “transformation” of maturity and risk, economic growth would be slower.

This perception is false. Not one cent more or less money needs to be provided, not one iota more risk needs to be shouldered, not one cent less credit need be extended. And I think the case is strong that growth will be substantially higher than the current run-prone but highly regulated system. Let’s look.

Structure (1) is a simplified version of today’s “bank.” There are a lot of complex or illiquid assets. The bank is too complicated to go through bankruptcy. It is funded by very little equity and a huge amount of debt. The debt is prone to runs. (“People” here includes non financial business and institutions such as pension funds and endowments.)

Structure (2) is the simplest equity-financed bank. Banks issue only equity. Households hold that equity, in a diversified form, potentially through a mutual fund or ETF.

In this structure, households provide the same amount of money, and shoulder the same amount of risk, and the bank makes the same amount of loans. But runs and crises are now eliminated.

You will laugh, but I’d like to take this structure seriously. With today’s technology, people can have floating-value accounts.

This was not technically possible in the 1930s, when our country chose instead the path of deposit insurance and risk regulation. But now, you could easily go to an ATM, ask for $20, and it sells $20 of bank shares at the current market value, within milliseconds. “Liquidity” now is divorced from “fixed-value” and “runnable.” Even better, you could go to the ATM, or swipe your card or smartphone, and instantly sell shares in an ETF that holds mortgage-backed securities. This is a “bank,” providing transactions services based on a pool of mortgages and shows that money still flows from people to mortgages. But with floating value, it is run proof.

Unlevered bank equity would have 1/10 or less the volatility it has today. So, we’re talking about something like 2% volatility on an annual basis. Shouldering 2% price volatility is not hard for the majority of depositors (especially dollar-weighted). To argue otherwise, you need some fundamentally non-economic, psychological theory; you need to assert that the same households who are up to their ears in debt, handle 401(k) stock investments, health care copayments, cable and phone bills, and vacation in Las Vegas, can’t somehow stomach 2% volatility in their bank accounts.

(Wait, you ask, the Modigliani-Miller theorem fails for banks, no? The MM theorem for risk is an identity, not a theorem. Risk is not created, destroyed or transformed, it is simply parceled up differently and people end up holding all of it one way or another (even as taxpayers). The contentious part of the MM theorem is whether the price of risk or cost of capital depends on how you slice it. A pizza sliced 10 ways has the same calories, but might sell for more or less than whole.)

But if you want, we can even keep exactly the household assets we have today. Consider structure 3. Banks still issue 100% equity, but that equity is held in a mutual fund, ETF, or similar holding company, which in turn issues debt and equity.

The bank – complex, full of illiquid assets, Ben Bernanke’s specialized human capital, hard to resolve – still can’t fail. The fund can fail. But this failure can be resolved in a morning, and still make it to a 3-martini lunch and golf. The fund’s assets are publicly traded bank equity and nothing else. The bank’s liabilities are common equity and debt. The equity holders get zero, the debt holders get the bank equity. It can be done by computer.

The funds do have debt. But there is little risk of a systemic run on the funds, because their assets are supremely liquid, and visible on a millisecond basis. The failure of one fund need not inspire a run on the next one.

One might object to structure (2) that the Modigliani Miller theorem fails for banks, so it would imply a higher cost of equity. If so, structure (3), by giving households exactly the same assets as they have not, must give exactly the same cost of capital as now — minus the value of taxpayer guarantees.

Structure (3) emphasizes that the issue is not whether “transformation” must occur, whether people really need to hold a lot of fixed-value debt. The issue is whether “transformation,” if it is needed, must be tied to bankruptcy and liquidation of the institution handling the complex assets. One can cook up stories why this must be the case — corporate finance and banking theorists are a clever lot — but are such stories remotely understood and well-tested enough to justify either our occasional crises, or our massive regulatory response? I think not, but I’ll leave that case to be made by our panelists, if they are so inclined.

Structure (3) is a rhetorical point, not a proposal. I do not think it is necessary or desirable to exactly replicate the securities on both ends of the financial system. The point is just that eliminating financial crises by moving to equity-financed banking does not require any new money, any less credit, any less economic growth or any different risk taking. People will likely choose different assets in my world, and thereby improve on it.

Structure (4) elaborates. Not all bank assets are complex and illiquid. Once we remove short-term financing, I suspect that securitized debt and other liquid securities will move off bank balance sheets. They will migrate to long-only floating-value mutual funds and ETFs, and people will move money out of savings accounts and bank CDs into those very safe investment vehicles. The banks will be smaller, holding only those complex and illiquid risks that can’t easily be securitized.

On the other side, banks now have about $2.3 trillion of reserves, (May 5 H.4.1) and $1.2 trillion of demand deposits. Narrow deposit taking is here! We just need to move the deposits and their backing reserves to bankruptcy-remote vehicles (which banks can still operate for a fee, if that makes sense).

How much risk-free assets do people really need? We can provide them up to $14 trillion and counting with narrow deposits backed directly or indirectly (through the Fed) by Treasury debt.

The Fed’s huge balance sheet is a great innovation. Better yet, the Treasury should issue fixed-value floating rate debt so we can all have “reserves.” The last 8 years have taught a revolutionary lesson in monetary economics: huge quantities of interest-bearing money are not inflationary. We can live the Friedman optimal quantity of money, and displace all the private interest-bearing moneys that fell apart in the crisis. As our ancestors got rid of run-prone banknotes in favor of treasury notes, we can get rid of run-prone debt in favor of treasury and fed interest bearing-electronic money. Let’s do it.

How do we get there

We’ve defined and limited the problem, outlined a better world, but we’re still not ready to write regulations. We should check for failures and unintended consequences of current regulations before we go adding new ones.

Our government subsidizes debt, in numerous ways. Let’s start by not simultaneously subsidizing something and also regulating against its use! We can leave that to energy policy.

The tax deductibility of interest payments is an obvious distortion. It’s not the whole story, as nonfinancial corporations don’t all lever this much, but it’s a part of it. I’d rather just get rid of the whole corporate tax, which eliminates demand for a hundred other tax distortions. But treating dividends and interest equally, or better yet reversing the treatment — deduct dividends, not interest — would help.

Implicit and explicit debt guarantees are a bigger part of the distortion in favor of debt. But, while it’s easy to say “end debt guarantees,” I fear the government will always bail out ex-post, and that inability to precommit is an important justification for limiting debt debt. ( V. V. Chari and Patrick Kehoe have elegantly made this case, in “A Proposal to Eliminate the Distortions Caused by Bailouts” Minneapolis Fed Working Paper.)

A lot of law, regulation and accounting subsidizes debt as a liability by privileging it as an asset. Liquidity regulations encourage institutions to hold very short-term debt, with a run option to save themselves individually in times of trouble. Well, that incentivizes someone else to issue that debt, and encourages the fallacy of “sell if things go bad” risk management. Accounting regulations also treat run-prone short-term debt as safe as cash.

Using floating-value funds for transactions purposes would trigger short-term capital gains taxes and an accounting nightmare. That needs to be fixed if we want free liquidity.

In sum, throughout the regulatory system, we should treat non-government short-term debt as poison in the well, both as an asset and as a liability, and we should remove the impediments to the use of liquid floating-value assets. Will this take some effort? Sure. But just carrying the tens of thousands of pages of regulations over to the Dodd-Frank bonfire will take some effort.

Regulatory relief would be a potent carrot and it is my strongest suggestion. We could say, any institution that is financed by more than (say) 75% equity and long term debt is exempt from asset risk regulation, systemic designation, bank regulation and so forth; it will be treated like a non-financial company. I suspect they would come running. MetLife’s suit and other companies’ efforts to downsize suggests that banks really do not like regulation and will do a lot to rearrange their operations to avoid it.

This suggestion reflects a deeper problem: Where is the safe harbor in Dodd-Frank? Where does it say “this is how we want you to set up a systemically safe financial institution. If you do this, you’re doing a good job, and we’ll leave you alone.” Nowhere. Not even an equity ETF, about the most run-proof structure in creation, is exempt.

Adding a safe harbor is an especially attractive way to move to better policy. If we need to repeal Dodd-Frank, we’re asking a lot. Too many people have too much invested in it. If we just add to Dodd-Frank its missing definition of “systemic,” and thus a definition of “not systemic,” a specification of how an institution can be exempt from detailed regulation, they will run for it, and the rest can die on the vine.

At last a bit of regulation

Finally, if after removing all the subsidies and inducements for debt, and a regulatory safe harbor, banks are still using too much run-prone financing, ok, we get to add a bit of stick.

The usual approach to boosting capital combines complex regulation, taking the form of a limit on a ratio of complex numbers, with extensive discretion and regulatory remediation. The ratios don’t work for all sorts of reasons. The denominator is the big problem. Simple leverage — debt to assets ratios — is silly. We require equity on holding reserves, and a stock vs a call option have much different risk for the same asset value. Risk weights violate the fundamental principle of finance, that a portfolio is less risky than the sum of its parts. Risk weights are deeply distorting investing decisions – loans carry large risk weights, while securities formed of the same loans carry small risk weights. Greek debt is still 0 risk weight.

And what level of capital is “safe?”17.437%? 35.272%? Really, the answer is “so much that it doesn’t matter,” and “more is always better.” Since costs and benefits do not suggest a hard and fast number, why regulate one – and then endlessly argue about it?

We need something simple, transparent, and that avoids these pathologies. The best I can think of is a Pigouvian tax, say 5 cents for each dollar of short-term debt (less than a year) and 2 cents for longer term debt. By taxing the amount of debt, arguments about the denominator vanish. So we don’t have to get in to riskweights, leverage, book values market values, and so forth.

Everywhere in economics, charging a price is better than a quantitative limit.

You will ask, just what is the right tax? I don’t know. I suspect however, that the benefits of short-term financing are much less than banks claim when they are trying to convince regulators to lower a quantitative limit. If they faced even a quite low tax, I suspect we would see a swift rediscovery of the Modigliani-Miller theorem. In any case, we don’t have to decide that ahead of time. Adjust the tax rate as needed until you get the capital you want.

As it is sensible to demand more capital of more “dangerous” firms, so the tax could rise on some simple measures of danger. I distrust any accounting measures, so following Chari and Kehoe’s recent suggestion, the tax could be a rising function of the ratio of short-term debt to the market – not book -- value of equity. The market value of equity is easily measurable. Let the firm figure out whether to issue more equity, retain more earnings, find a buyer, restructure debt, pay the tax for a while, or whatever they want to do.

Most importantly though, we are not trying to carefully craft a way for banks to get by on the minimal amount of capital. The point is that capital is not expensive, socially if not privately. We don’t want to jigger the absolute minimum amount of the tax, we want to induce banks to shift overwhelmingly to floating-value run-proof liabilities.

The current path

This all may seem a bit radical, so I think it’s worth emphasizing just how broken the current system is.

Since the 1930s, we have tried a fundamentally different approach to stopping runs and financial crises, emphasizing minimal equity and lots of debt. When depositors run, really the only way to stop it is for the government to guarantee debts. But, once people expect debt guarantees, banks to take too much risk, and their creditors lend without regard to that risk.

So, we tried to substitute regulatory supervision of asset risk for both ends of market information processing and discipline. It’s not enough, we have another crisis, guarantee more debt, and so on. The little old lady swallowed a fly, a spider to catch the fly, as the song goes, and now she is trying to digest the horse.

That we are having a conference on “ending too big to fail” reflects he widespread perception that we have not ended this cycle, the “resolution authority” will not work, and it will institutionalize creditor bailouts rather than precommit against them—which might be impossible and unwise anyway.

Regulation quickly failed its first test after the 2008 subprime crisis. Europe’s bank regulators, with that crisis fresh in the rear view mirror, still allowed Greek debt at zero risk weights, and promptly bailed out the French and German banks who were over exposed. Will the same regulators artfully prick asset bubbles, diagnose imbalances, macro-prudentially raise capital standards, promptly resolve nearing failures, and sternly haircut debt holders… next time?

We are devoting enormous resources and suffering large economic distortions to regulate the risk of bank assets. But bank assets aren’t risky! A diversified, mostly marketable portfolio of loans and mortgage backed securities is far safer than the profit stream of any company.

So why are we, as a society, investing so much in regulating some of the safest corporate assets on the planet? Well, because they’re leveraged to the hilt, and we’re holding the bag. We don’t have to.

And asset risk regulation is now spilling over into efforts to regulate asset prices themselves. For example, the OFR proposed to regulate equity asset managers, even though they just trade equity on customer’s behalf. Why? Because the managers might sell, drive asset prices down; and someone might have borrowed money on those assets that asset risk regulators didn’t notice. The Fed is discussing “macroprudential” policy to allocate credit to target house prices, and raising interest rates to manage stock prices.

The result is an increasingly uncompetitive and sclerotic financial system. We are the financial system of zero interest rates where nobody who actually needs one can get a loan.

Already, financial innovators are springing up around the banking system, in peer to peer lending, finance tech, and so on. These give me hope. Maybe equity-financed banking will spring up like weeds around the ruins of the big banks. But those don’t have to be ruins.

If it really does cost 25 bp more for a mortgage in my world, and if we really want to subsidize home mortgages, we can do so by writing checks to homeowners, on budget, rather than set up a dangerous and sclerotic financial system.

Discussion

I got great comments at the conference from panelists Michael Hasenstab, Michael Keen, Donald Marron, and Thomas Phillips. A few points that come out of the discussion:

100% Equity is not necessary. I focus on this option because it is, in fact, cleanest, and I want to make the case that 100% equity is possible and reasonable. Once you accept that, then 75% equity can work too. It would be just about bulletproof: the institutions would have to be at risk of losing 75% of its value before a run could start.

To emphasize, not all debt or fixed value debt is equally dangerous. Your gas bill is a fixed value claim, but the gas company can’t bankrupt you tomorrow if they call and say “we want our money” and you don’t pay up.

The transition sounds hard. Issuing gobs of equity sounds costly. But again, look at structure (3). No new money is needed. We are simply replacing debt with equity. In fact, we could do it in a day. The Bank’s current liabilities are transferred to the fund, in return for newly issued equity. Nobody has to go to the market! That’s not necessary, but I think it makes clear that we don’t need more money or a lot of discombobulation. In fact, I think banks would slowly redeem debt for equity without much trouble.

Michael, as a manager of a bond fund, emphasized the necessity of large banks with global reach to be reliable counterparties and market makers on all sorts of assets. But equity-financing helps them! If equity financed, banks can be as “big” as anyone wants, without causing risks. We don’t need to break up the banks or fear size.

Michael Keen gave a great introduction to tax issues. The tax code is also a bunch of patches applied to cure the consequences of other taxes. He pointed out that the total tax wedge includes the taxes paid by the bank, and the taxes on interest paid by investors. My head hurts, and I can’t help but never to the fact that Eliminating corporate and rate of return taxes, leaving a simple consumption tax, solves all these problems!

Michael also thought in some detail about how to make equity deductible, and even with debt. This has troubled me: allowing a deduction for dividends like interest sounds nice, but we want to encourage banks to keep dividends, which builds capital. He outlined “ACE” rules that allow banks to deduct a “notional cost of equity,” usually a risk free rate plus a few percent. I asked later, why not deduct the actual return.

Donald Marron gave quite a few examples in which the government simultaneously taxes and subsidizes, including carbon, tobacco, and sugar.

Donald pointed out that it’s not always best to regulate via a price rather than a quantity. This is a good question, but I think run-prone securities are a good case for price regulation. Like pollution, the regulator doesn’t really know what the costs of compliance are, and there are lots of creative ways for the business to rearrange things to reduce the pollution.

Donald pointed out that the word “tax” is pollution in our politics. Also “tax” rates have to be voted by congress. Agencies can impose “fees.” Economists understand “taxes” in terms of incentives, politics understands “taxes” as income transfers and ignores incentives. He’s spot on. Forever more, let us call it a “Pigouvian fee” on debt!

Thomas Phillipon questioned whether mutual funds are truly run-free. He has a point, there is a small incentive to run with big losses given the option to redeem at NAV. Answer: exchange tried funds, or an exchange traded backstop, in which you can or must sell your shares to another investor rather than demand money from the fund solves the problem. ETFs are really run free!

Thomas also gave a long and detailed explanation of why leverage ratios or leverage charges don’t work. That’s exactly why I propose to tax debt itself, not a leverage ratio.

In a later section, David Skeel pointed out that Lehman when it failed, had 25,000 employees — fewer than the current compliance staff at citigroup.

I closed with a warning: my vision of a monetary system based on short-term government debt depends on government solvency. If Greece comes to the US, and banks are deeply involved in government debt, considered risk free, we’re in really deep trouble. Insulating a financial system from sovereign debt problems is a separate, and important, question.

Update: A correspondent sent a thoughtful email advocating floating-value equity-like securities for many cases on the asset side as well. Then, from twitter, "a few more steps and whole world for sharia compliant financing ie 100% equity both on asset and liability side." I'm not sure if that is praise or criticism.