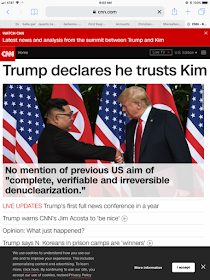

A friend, who reads an unusually diverse set of sources, passed on some interesting pictures suggesting that our media live on different planets.

On the Trump-Kim summit

On the investigations:

Thursday, June 14, 2018

Tuesday, June 12, 2018

Cross-subsidies

Cross-subsidies are an under-appreciated original sin of economic stagnation. To transfer money from A to B, it would usually be better to raise taxes on A and to provide vouchers or otherwise pay competitive suppliers on behalf of B. But our political system doesn't like to admit the size of government-induced transfers, so instead we force businesses to undercharge B. Since they have to cover cost, they must overcharge A. It starts as the same thing as a tax on A to subsidize B. But a cross-subsidy cannot withstand competition. Someone else can give A a better price. So our government protects A from that competition. That ruins the underlying markets, and next thing you know everyone is paying more for less.

This was the story of airlines and telephones: The government wanted to subsidize airline service to small cities, and residential landlines, especially rural. It forced companies to provide those at a loss and to cross-subsidize those losses from other customers, big city connections and long distance. But then the government had to stop competitors from undercutting the overpriced services. And as those deregulations showed, the result was inefficiency and high prices for everyone.

Health care and insurance are the screaming example today. The government wants to provide health care to poor, old, and other groups. It does not want to forthrightly raise taxes and pay for their health care in competitive markets. So it forces providers to pay less to those groups, and make it up by overcharging the rest of us. But overcharging cannot stand competition, so gradually the whole system became bloated and inefficient.

A Bloomberg article "Air Ambulances Are Flying More Patients Than Ever, and Leaving Massive Bills Behind" by John Tozzi offers a striking illustration of the phenomenon, and much of the mindset that keeps our country from fixing it.

The story starts with the usual human-interest tale, a $45,930 bill for a 70 mile flight for a kid with a 107 degree fever.

OK, put your economics hats on. How can it persist that people are double and triple charged what it costs to provide any service? Why, when an emergency room puts out a call, "air ambulance needed, paying customer alert" are there not swarms of helicopters battling it out -- and in the process driving the price down to cost?

This was the story of airlines and telephones: The government wanted to subsidize airline service to small cities, and residential landlines, especially rural. It forced companies to provide those at a loss and to cross-subsidize those losses from other customers, big city connections and long distance. But then the government had to stop competitors from undercutting the overpriced services. And as those deregulations showed, the result was inefficiency and high prices for everyone.

Health care and insurance are the screaming example today. The government wants to provide health care to poor, old, and other groups. It does not want to forthrightly raise taxes and pay for their health care in competitive markets. So it forces providers to pay less to those groups, and make it up by overcharging the rest of us. But overcharging cannot stand competition, so gradually the whole system became bloated and inefficient.

A Bloomberg article "Air Ambulances Are Flying More Patients Than Ever, and Leaving Massive Bills Behind" by John Tozzi offers a striking illustration of the phenomenon, and much of the mindset that keeps our country from fixing it.

The story starts with the usual human-interest tale, a $45,930 bill for a 70 mile flight for a kid with a 107 degree fever.

At the heart of the dispute is a gap between what insurance will pay for the flight and what Air Methods says it must charge to keep flying. Michael Cox ... had health coverage through a plan for public employees. It paid $6,704—the amount, it says, Medicare would have paid for the trip.

The air-ambulance industry says reimbursements from U.S. government health programs, including Medicare and Medicaid, don’t cover their expenses. Operators say they thus must ask others to pay more—and when health plans balk, patients get stuck with the tab.

Seth Myers, president of Air Evac, said that his company loses money on patients covered by Medicaid and Medicare, as well as those with no insurance. That's about 75 percent of the people it flies.

|

| Source: Bloomberg.com |

According to a 2017 report commissioned by the Association of Air Medical Services, an industry trade group, the typical cost per flight was $10,199 in 2015, and Medicare paid only 59 percent that.So, I knew about cross-subsidies, but $45,950 vs. $6,704 is a lot!

OK, put your economics hats on. How can it persist that people are double and triple charged what it costs to provide any service? Why, when an emergency room puts out a call, "air ambulance needed, paying customer alert" are there not swarms of helicopters battling it out -- and in the process driving the price down to cost?

Monday, June 11, 2018

Summer School Suggestion

The Asset Pricing online class is back, now hosted on Canvas. This is a first-year PhD level course in asset pricing. Advanced undergraduates and MBAs with some economics and basic calculus can take it too. I mention it again as it is well suited as a summer school project, and I realized in talking to colleagues that not everyone who knew about the original class knows it's alive again. Go here to sign up.

Faculty can also assign it or parts of it, and using the canvas system find out if students have taken the quizzes. This makes it a useful summer school prerequisite for fall classses, or you can use it or parts of it in a flipped classrom -- have the students do an online unit, take the quiz, and then show up to class prepared for more advanced discussion.

More information here on my webpage, along with all the videos and notes, and lots of extra material. If you don't want to take the quizzes, you can see the videos and notes without taking the course.

Faculty can also assign it or parts of it, and using the canvas system find out if students have taken the quizzes. This makes it a useful summer school prerequisite for fall classses, or you can use it or parts of it in a flipped classrom -- have the students do an online unit, take the quiz, and then show up to class prepared for more advanced discussion.

More information here on my webpage, along with all the videos and notes, and lots of extra material. If you don't want to take the quizzes, you can see the videos and notes without taking the course.

Monday, June 4, 2018

ACA dropouts

Half of the people who sign up for Obamacare (ACA) get a flurry of medical care, then drop out before a year is over. They can always sign up again if they need to. People who stay on insurance tend to be those who have ongoing chronic and expensive conditions that need continual care. The implications for the viability of such insurance are not good.

This is the interesting conclusion of a new paper, "Take-Up, Drop-Out, and Spending in ACA Marketplaces" by Rebecca Diamond, Michael Dickstein, Tim McQuade, and Petra Persson. One good summary graph:

This is the interesting conclusion of a new paper, "Take-Up, Drop-Out, and Spending in ACA Marketplaces" by Rebecca Diamond, Michael Dickstein, Tim McQuade, and Petra Persson. One good summary graph: