This is an essay, prepared for the CATO 39th annual monetary policy conference. It will appear in a CATO book edited by Jim Dorn. This is a longer and more academic piece underlying "The ghost of Christmas inflation." Video of the conference presentation. This essay in pdf form.

FISCAL INFLATION

John H. Cochrane

From its inflection point in February 2021 to November 2021, the CPI rose 6 percent (278.88/263.161), an 8 percent annualized rate. Why?

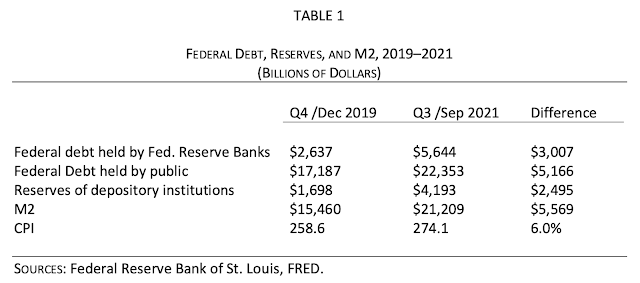

Starting in March 2020, in response to the disruptions of Covid-19, the U.S. government created about $3 trillion of new bank reserves, equivalent to cash, and sent checks to people and businesses. (Mechanically, the Treasury issued $3 trillion of new debt, which the Fed quickly bought in return for $3 trillion of new reserves. The Treasury sent out checks, transferring the reserves to people’s banks. See Table 1.) The Treasury then borrowed another $2 trillion or so, and sent more checks. Overall federal debt rose nearly 30 percent. Is it at all a surprise that a year later inflation breaks out? It is hard to ask for a clearer demonstration of fiscal inflation, an immense fiscal helicopter drop, exhibit A for the fiscal theory of the price level (Cochrane 2022a, 2022b).

What Dropped from the Helicopter?

From December 2019 to September 2021, the M2 money stock also increased by $5.6 trillion. This looks like a monetary, not a fiscal intervention, Milton Friedman’s (1969) classic tale that if you want inflation, drop money from helicopters. But is it monetary or fiscal policy? Ask yourself: Suppose the expansion of M2 had been entirely financed by purchasing Treasury securities. Imagine Treasury debt had declined $5 trillion while M2 and reserves rose $5 trillion. Imagine that there had been no deficit at all, or even a surplus during this period. The monetary theory of inflation, MV=PY, states that we would see the same inflation. Really? Similarly, ask yourself: Suppose that the Federal Reserve had refused to go along. Suppose that the Treasury had sent people Treasury bills directly, accounts at Treasury.gov, along with directions how to sell them if people wished to do so. Better, suppose that the Treasury had created new mutual funds that hold Treasury securities, and sent people mutual fund shares. (I write mutual fund as money market funds are counted in M2.) The monetary theory of inflation says again that this would have had no effect. These would be a debt issue, causing no inflation, not a monetary expansion. Really?

Clearly, overall debt matters, not the split of government debt between interest-paying reserves or monetary base and Treasury securities. The Federal Reserve itself is nothing more than an immense money-market fund, offering shares that are pegged at $1 each, pay interest, and are backed by a portfolio of Treasury and mortgage-backed securities. (Plus, an army of regulators and a huge staff of economists who are supposed to help forecast inflation.)

Milton Friedman’s (1969) helicopter drop is a powerful parable. But a helicopter drop is a fiscal policy, not a monetary policy. The U.S. Federal Reserve may not legally drop money from helicopters; it may not write checks to voters. The Fed may even less vacuum up money; it may not tax people. Helicopter drops and money vacuums are fiscal operations. The Fed may only lend money, or buy and sell assets. To accomplish a helicopter drop in the United States, the Treasury must issue debt, the Fed must buy it with newly printed money, and then the Treasury must drop that money from helicopters, writing it down as a transfer payment. And that is pretty much exactly what happened.

Ask yourself: If, as Friedman’s helicopter is dropping $1,000 on each household, the Fed sends burglars who remove $1,000 of Treasury securities from the same households, would we still see inflation? That’s monetary policy. If Friedman’s helicopter were followed by the Treasury secretary with a bullhorn, shouting “Enjoy your $1,000 in helicopter money. Taxes are going up $1,000 tomorrow,” would we still see inflation?

Friedman’s helicopters are not a monetary change, a substitution of money for debt, an increase in the liquidity of a given set of household assets. They are a “wealth effect” of government debt. Dropping debt from helicopters is a brilliant psychological device for convincing people that the government debt raining down on them will not be repaid by future taxes or spending restraint. It will be left outstanding, so they had better spend it now.

Indeed, we just witnessed a “helicopter drop.” But a helicopter drop is fiscal policy.

Why did fiscal inflation not happen sooner? The government has been borrowing money like the proverbial drunken sailor, for decades. The Fed has been buying Treasury securities and turning the debt into reserves for a decade. Why now?

Inflation comes when government debt increases, relative to people’s expectations of what the government will repay. If the Treasury borrows, but everyone understands it will later raise tax revenues or cut spending to repay the debt, that debt does not cause inflation. It is a good investment, and people are happy to hold on to it. If the Fed prints up a lot of money, buys Treasury debt, and the Treasury hands out the money, as happened, but everyone understands the Treasury will pay back the debt with future surpluses, the extra money causes no inflation. The Fed can always soak up the money by selling its Treasury securities, and the Treasury repays those securities with surpluses (i.e., taxes less spending).

The 2020–2021 borrowing and money episode was distinctive because, evidently, it came without a corresponding increase in expectations that the government would, someday, raise surpluses by $5 trillion in present value to repay the debt. Looking in to people’s heads is hard, but why? We can at least find some plausible speculations.

One may look to politicians’ statements. Even in the Obama-era “stimulus” spending, the administration emphasized promises of eventual debt reduction. One may chuckle and sneer at promises to repay debts decades after an administration leaves office, but at least they went through the motions to make that promise! Nobody went through any motions about long-run fiscal planning, long-run deficit reduction, and entitlement and tax reform, in 2020–2021. It was the era of modern monetary theory (MMT), of costless “fiscal expansion” made possible, or so it was claimed, by the manna-from-heaven that interest rates would stay low forever.

The manner of fiscal expansion matters too. When the Treasury borrows in the usual manner, it borrows from established long-term investors, who view Treasury debt as debt that will be repaid and not defaulted or inflated. They view it as a savings or investment vehicle, not as cash to be spent. They save, or invest, based on long and so-far mostly successful experience. This time, following canary-in-the-coal mine disruptions in Treasury markets during March 2020, the Federal Reserve immediately bought new Treasury debt with newly created money, before it even touched these investor’s portfolios. The effect of the operation was to print new money and send people checks, so the debt issue is now held as bank deposits flowing into reserves, rather than as Treasury securities. People holding this new money are likely to spend it rather than regard it as a long-term investment. In our simplest economic models, it does not matter who holds the debt. But in just a little more nuanced view, who holds the debt matters.

In our simplest economic models, interest-paying reserves and Treasuries are equivalent securities. But people likely do see a difference between reserves and short-run Treasuries. Treasuries may well carry a reputation that they will be repaid, while people assume reserves will not be repaid by larger surpluses. Then issuing lots of reserves rather than Treasuries is inflationary, but not because the reserves are ``money,’’ but rather because they convey a different set of fiscal expectations, just as dropping money or debt from helicopters sends a different signal about repayment than issuing debt at a Treasury auction.

Most of the previous operations financed government spending or government worker salaries, counting on higher incomes to slowly filter through the economy. This one sent checks directly to people.

Finally, this fiscal stimulus was enormous, and carried out on a deep misdiagnosis of the state of the economy. Even in simplistic hydraulic Keynesian terms, $5 trillion times any multiplier is much larger than any plausible GDP gap. And the Covid recession was not due to a demand deficiency in the first place. A pandemic is, to the economy, like a huge snowstorm. Sending people money will not get them to go out to closed bars, restaurants, airlines, and businesses.

“Stimulus,” “accommodation,” “easing” was the point. This method finally worked, where previous stimulus efforts failed. One can see several suggestive differences, which amount to important economic lessons.

What about “supply shocks?” What about a shift of demand from services to durables? Much analysis misses the difference between relative prices and inflation, in which all prices and wages rise together. A supply shock makes one good more expensive than others. Only demand makes all goods rise together. There wouldn’t be “supply chain” problems if people were not trying to buy things like mad! A shift in demand from services to durables can make durable prices go up. But it would make services prices go down. And let us not even go down the ridiculous path of blaming inflation on a sudden contagious outbreak of “greed” and “collusion” by businesses from oil companies to turkey farmers, needing the administration to send the FTC out to investigate.

It is telling that inflation was a complete surprise to the Federal Reserve. The Federal Reserve’s job is supposed to be to monitor the supply capacity of the economy and to make sure demand does not outstrip it. The Fed failed twice. First, the economy did not need demand-side stimulus. Insurance was wise, and forestalling a financial crisis was necessary. But sending money to every citizen to stoke demand was not. Second, the Fed being surprised by supply shocks is as excusable as the Army losing a battle because its leaders are surprised that the enemy might attack. As we see by the outcome, the Fed’s understanding of supply, largely based on statistical analysis of labor markets, is rudimentary.

WilI Inflation Continue?

If the government borrows or prints $5 trillion, with no change in its plan to repay debt, on top of $17 trillion outstanding debt, then the price level will rise a cumulative 30 percent, so that the $22 trillion of debt is worth in real terms what the $17 trillion was before. In essence, absent a credible increase in future surpluses, the deficit is financed by defaulting on $5 trillion of outstanding debt, via inflation. By this calculation, the 6 percent or so cumulative inflation we have seen so far leaves a way to go. But people may think some of the debt will be repaid. If they think half will eventually be repaid, then the price level need only rise 15 percent overall.

But then it stops. A one-time unbacked debt increase leads to a one-time price-level increase, not continuing inflation. Whether inflation continues or not depends on future monetary policy, future fiscal policy, and whether people change their minds about overall debt repayment.

Fiscal policy may not be done with us yet. If unbacked fiscal expansions continue—that is, borrowing when people do not expect additional repayment—then additional bouts of fiscal inflation will occur. Untold trillions of spending, including new entitlements, with no realistic hope of raising tax revenues commensurately to cover them are certainly high on the Biden administration’s agenda. (Higher tax rates do not necessarily mean higher revenues, if economic growth falters; and even so the proposed taxes do not cover the proposed spending increases even with static scoring.) The mentality that borrowed money need never be repaid, because the MMT fairy or r<g magic makes debt free, remains strong in Washington. But the failure of the so-called “Build Back Better” plan may augur well for budget seriousness and a limit to ill-constructed social policies with strong supply disincentives.

The most troublesome question remains: Do people, having decided that at least some of our government’s new debt will not be repaid, so they should spend it now and inflate it away, now think that the government is less likely to repay its existing debts, or less likely to repay future borrowing? If so, even more inflation can break out, seemingly (as always) out of nowhere.

Fiscal Constraints on Monetary Policy

Fiscal and monetary policies are always intertwined in causing or curing inflation. Even in a pure fiscal theory of the price level, monetary policy (setting interest rates) can control the path of expected future inflation. Thus, whether inflation continues or not also depends on how monetary policy reacts to this fiscal shock and its consequences.

Whether the Fed will do something about it is an obvious concern. The Fed’s habits and new operating procedures, formed before 2019 in a Maginot Line against perpetual below-target inflation, look remarkably like the Fed of about 1971: Let inflation blow hot to march down the Phillips curve to greater employment, wait for inflation to exceed target for a while before doing anything about it, talk about “transitory” and “supply” shocks to excuse each error. The Fed understands “expectations” now, unlike in 1971, but seems to view them as a third force amenable to management by “forward guidance” speeches rather than formed by a hardy and skeptical experience with the Fed’s concrete actions. The Fed likes to say it has “the tools” to contain inflation, but never dares to say just what those tools are. In recent U.S. historical experience, the Fed’s tool is to replay 1980: 20 percent interest rates, a bruising recession hurting the disadvantaged especially, and the medicine applied for as long as it takes. Will our Fed really do that? Will our Congress let our Fed do that? Can you deter an enemy without revealing what’s in your arsenal and whether you will use it?

If the Fed needs to fight inflation, fiscal constraints on monetary policy will play a large and unexpected role. In 1980, the debt-to-GDP ratio was 25 percent. Today it is 100 percent, and rising swiftly. Fiscal constraints on monetary policy are four times larger today, and counting.

For a rise in interest rates to lower inflation, fiscal policy must tighten as well. Without that fiscal cooperation, monetary policy cannot lower inflation. There are two important channels of this interconnection.

First, the rise in interest rates raises interest costs on the debt. The government must pay those higher interest costs, by raising tax revenues and cutting spending, or by credibly promising to do so in the future. At 100 percent debt to GDP, 5 percentage points higher interest rates mean an additional deficit of 5 percent of GDP or $1 trillion, for every year that high interest rates continue.

This consideration is especially relevant if the underlying cause of the inflation is fiscal policy. If we are having inflation because people don’t believe that the government can pay off the deficits it is running to send people checks, and it will not reform the looming larger entitlement promises, then people will not believe that the government can pay off an additional $1 trillion deficit to pay interest costs on the debt. In a fiscally driven inflation, it can happen that the central bank raises rates to fight inflation, which raises the deficit via interest costs, and thereby only makes inflation worse. This has, for example, been an analysis of several episodes in Brazil.

Second, if monetary policy lowers inflation, then bondholders earn a real windfall. Fiscal policy must tighten to pay this windfall. People who bought 10-year Treasury bonds in September of 1981 got a 15.84 percent yield, as markets expected inflation to continue. From September 1981 to September 1991, the CPI grew at a 3.9 percent average rate. By this back of the envelope calculation, those bondholders got an amazing 12 percent annual real return. That return came completely and entirely courtesy of U.S. taxpayers. The 1986 tax reform and deregulation, which allowed the United States to grow strongly for 20 years, eventually did produce fiscal surpluses that nearly repaid U.S. federal debt. At 100 percent debt-to-GDP ratio, each 5 percentage point reduction in the price level requires another 5 percent of GDP fiscal surplus.

Ask yourself, if inflation gets built into bond yields, and the Fed tries to lower inflation, will our Congress really raise tax revenues or cut spending in order to finance an unexpected (by definition) and undeserved (it will surely be argued) windfall profit to wealthy investors, foreign central bankers, and fat-cats on Wall Street? If it does not do so, the monetary attempt at disinflation fails.

We state too casually that that the United States will always repay its debts, and prioritize that repayment over all else. We should not take such probity for granted. For example, in the 2021 debt ceiling discussion, it stated as fact by all concerned, from the Treasury to Congress to the White House, that hitting the debt ceiling must trigger a formal default. That is untrue. The United States could easily prioritize its tax revenues to repaying interest and principal on outstanding debt, by cutting other spending instead. Painful, yes. Impossible, no. That the U.S. contingency plan for a binding debt ceiling is formal default tells you that the spirit of Alexander Hamilton, preaching the sanctity of debt repayment to build reputation so we can borrow in the future, is truly dead. And with inflation, we are not even talking about formal default. The question is, will the United States undertake a sharp fiscal austerity to support monetary policy in the fight against inflation, by paying higher interest costs on the debt and by repaying bondholders in more valuable money? Or will the government just repay as promised, but in dollars that are worth more than expected? If the government does the latter, monetary policy fails.

There is a third troublesome requirement for higher nominal interest rates to produce lower inflation. One needs an economic model in which this is true, that model needs to be correct, and its preconditions need to be met. It’s not as easy as it sounds, because in the long run, when real interest rates settle down, higher nominal interest rates must come with higher, not lower inflation. So you need an understanding of how and when things work the other direction in the short run.

In standard new-Keynesian models, used by all central banks, for example, higher interest rates only produce lower inflation if the higher interest rate is unexpected—that is, a “shock” to the economy—and if there is a sharp contemporaneous fiscal contraction, for the above reasons. A widely expected rise in nominal interest rates raises inflation. A rise in interest rates without the corresponding ``austerity’’ raises inflation. Both preconditions are questionable today. More complex ingredients, such as long-term debt or financial frictions, can allow a higher nominal rate to temporarily lower inflation. But reliance on more complex ingredients and frictions is also dangerous.

The Future

The future is not hopeless. Inflation control simply requires our government, including the central bank, to understand classic lessons of history. Forestalling inflation is a joint task of fiscal, monetary, and micro-economic policy. Stabilizing inflation once it gets out of control is a joint task of fiscal, monetary, and micro-economic policy. Expectations are “anchored” if people believe such policy is in place, and politicians and Fed officials are ready to act if needed.

I add “micro-economic,” as it is perhaps the most frequently overlooked adjective. Fiscal surpluses do not result from sharply higher tax rates, especially of a tax system so riven with economic distortions as ours. Fiscal surpluses can come from spending restraint, but that too is difficult. The best road to fiscal surpluses is strong economic growth, which increases the tax base and lowers the need for social spending.

In the conundrum between taxes and spending, there is a way out: raise long-term economic growth. And there is only one way to do that: to increase the supply-side capacity of the economy. That is, however, just as politically controversial as the first two options. Most of the job is to get out of the way. Most economic regulation is designed to transfer incomes, to protect various interests, or to push on the scales of bilateral negotiation, to undo the harsh siren of economic incentives, in a way that stifles economic growth. Many interests hate pro-growth legislation and regulation just as much as they hate taxes and spending cuts. The r<g crowd has a point, but increasing g is the answer.

Much of the “supply shocks” of 2021 come down to the “great resignation”—that is, the puzzling decline in labor force participation despite a labor shortage. The work disincentives of social programs—paying people not to work, bluntly—are laid bare.

All successful inflation stabilizations have combined monetary, fiscal, and micro-economic reforms. I emphasize reforms. In most cases the tax system is reformed to provide more revenue with less distortion. The structure of spending programs is reformed to help people in need more efficiently without work disincentives. Regulations are reformed, though they hurt the profits of incumbents, to increase entry, competition and innovation. The policy regime is changed, durably. Reversible decisions and pie-crust promises do not do much to change the present value of surpluses, to raise the government’s ability to pledge a long stream of surpluses to support debt.

1980 did not succeed in the United States from monetary toughness only. 1980 included supply-side deregulation, and was quickly followed by the 1982 and 1986 tax reforms. The economy took off, so by the late 1990s economists were seriously writing papers about what to do when the federal debt had all been repaid. Many monetary stabilizations have been tried without fiscal and microeconomic reform. They typically fail after a year or two. The history of Latin America is littered with them (Kehoe and Nicolini 2021). The high interest rates of the early 1980s likely represented a fear that the United States would suffer the same fate. The 1970s were not just a failure of monetary policy. The deficits of the great society and Vietnam War contributed, while the supply “shocks” and productivity slowdown did their part.

These points are especially important if the 2021 inflation turns in to a sustained 2020s inflation, as the 1971 inflation turned in to a sustained 1970s inflation. For this time, the roots of inflation will most likely be fiscal, a broad change of view that our government really will not eventually reform and repay its debt. The only fundamental answer to that question will be, to reform and set in place a durable structure that will repay debt. Monetary machination will be pointless.

A small bout of inflation may be useful to our body politic. Inflation is where dreams of costless fiscal expansion, flooding the country with borrowed money to address every perceived problem, hit a hard brick wall of reality. A small bout of inflation and debt problems may reteach our politicians, officials, and commentariat the classic lessons that there are fiscal limits, fiscal and monetary policy are intertwined, and that a country with solid long-term institutions can borrow, but a country without them is in trouble, and one must allow the golden goose to thrive if one wants to tax her eggs. A small bout of inflation may reteach the same classes that supply matters, incentives matter, and sand in the gears matter. The 1980s reforms only happened because the 1970s were so painful.

In the meantime, however, there is one technical thing the Fed and Treasury can do to forestall a larger crisis: borrow long. Interest costs feed into the budget as debt rolls over. U.S. debt is shockingly short maturity, rolled over on average about every two years. If the United States borrows long-term, then higher interest rates do not raise interest costs on existing debt at all. Shifting to long-term debt would remove one of the main fiscal constraints on monetary policy. The Federal Reserve has not helped this fiscal constraint, by transforming a fifth of the federal debt to overnight, floating-rate debt. The 30-year Treasury rate is, as I write 2 percent, about negative 1 percent in real terms. Okay, the 1-year rate is 0.13 percent. As long as this lasts, the government seems to pay lower interest costs. But a 1.87 percent insurance premium to wipe out the danger of a sovereign debt crisis and to buy huge fiscal space to fight inflation seems like a pretty cheap insurance policy. The window of opportunity will not last long, however, as interest rates are already creeping up.

References

Cochrane, J. H. (2022a) “The Fiscal Theory of the Price Level: An Introduction and Overview.” Manuscript, in preparation for Journal of Economic Perspectives. Available at www.johnhcochrane.com/research-all/fiscal-theory-jep-article.

____________ (2022b) The Fiscal Theory of the Price Level. Princeton, N.J.: Princeton University Press. Manuscript available until publication at www.johnhcochrane.com/research-all/the-fiscal-theory-of-the-price-level-1.

Friedman, M. (1969) “The Optimum Quantity of Money.” In M. Friedman, The Optimum Quantity of Money and Other Essays, 1–50. Chicago: Aldine.

Kehoe, T. J., and Nicolini, J. P. (2021) A Monetary and Fiscal History of Latin America, 1960–2017. Minneapolis: University of Minnesota Press.

Issue 30, 50 and 100 year bonds,

ReplyDeleteThis comment has been removed by the author.

DeleteIncrease the duration of the debt is the answer. I thought Greenspan was wrong when he went focused on lowering duration and concentrating on 10 year notes rather than 30 yr bonds. Issue 30, 50, and 100 year bonds. America might be the only country that could get that done at low interest rates.

ReplyDeleteGreenspan wasn't Treasury Secretary at that time.

DeleteYou can lay the responsibility for that choice at the feet of Treasury Secretary Robert Rubin and his deputy Larry Summers.

No, issue perpetuities! And fixed-for-floating swaps!

ReplyDelete"Clearly, overall debt matters, not the split of government debt between interest-paying reserves or monetary base and Treasury securities."

DeleteApparently not since perpetuities would count toward the overall debt level.

"To accomplish a helicopter drop in the United States, the Treasury must issue debt, the Fed must buy it with newly printed money, and then the Treasury must drop that money from helicopters, writing it down as a transfer payment. And that is pretty much exactly what happened."

And how do perpetuities or 100 year bonds prevent the Fed from buying them with newly printed money? Perhaps Treasury should sell something (for instance equity) that the Fed can't legally purchase?

"One may look to politicians’ statements. Even in the Obama-era stimulus spending, the administration emphasized promises of eventual debt reduction."

No it didn't. The Obama administration's "stimulus" was primarily a debt swap (private banking debt for public Treasury debt). You can see it in TCMDO here:

Change units to year over year percentage growth. Total debt (public and private) grew at 10.5% y/y in fourth quarter of 2007 and then stayed between 2% and 4% for all of Obama's administration (2008-2016).

This comment has been removed by the author.

DeleteThat's what the government is already doing: issuing perpetuities. Since, as you said in your post, nobody is expecting the government paying back the debt ever, it is issuing perpetuities.

DeleteTrue, the perpetuities the government is issuing now include a "feature": they have "liquidity windows" on which the government will attempt, on a best effort basis, to find other investors that provide the liquidity the bonds you hold today. Since the risk is all on the hands of the present investors (they have no collateral to claim and no assets will be seized if the government fails to find new suckers in those liquidity windows) this feature is, mostly, irrelevant and does not make a big difference with actual perpetuities.

El Emperador,

DeleteTrue perpetuities have no roll over or redemption date.

The petpetuities that the central bank is issuing are the FRN's that they use to purchase the Treasury bonds.

I think that if the US tries to place perpetuities right now it would fail. No one will take that duration risk in a new thin market (well maybe Goldman would stuff it into their customer's portfolios). It may be seen as a sign that an adult is in charge at Treasury, or seen as a sign that the Government is finally seeing the problems above and preparing for a crisis.

ReplyDelete"JC - The 1980s reforms only happened because the 1970s were so painful."

ReplyDeleteThe other "reform" that happened in the 1990's was that Bob Rubin and Larry Summers while at the Treasury decided to shorten the term structure of the Federal debt to help reduce interest expenditures and bring federal expenditures (including interest payments) in line with federal receipts.

"JC - In the meantime, however, there is one technical thing the Fed and Treasury can do to forestall a larger crisis: borrow long."

So the plan is for the Treasury to borrow long until the necessary "reforms" are enacted by a future Congress and Treasury and one of those "reforms" is for a future Treasury to reduce the term structure of the federal debt?

"The 1986 tax reform and deregulation, which allowed the United States to grow strongly for 20 years, eventually did produce fiscal surpluses that nearly repaid U.S. federal debt."

ReplyDeletehttps://en.wikipedia.org/wiki/Tax_Reform_Act_of_1986

"The act lowered federal income tax rates, decreasing the number of tax brackets and reducing the top tax rate from 50 percent to 28 percent."

https://en.wikipedia.org/wiki/Omnibus_Budget_Reconciliation_Act_of_1993

"The act increased the top federal income tax rate from 31% to 39.6%, increased the corporate income tax rate, raised fuel taxes, and raised various other taxes."

If by eventually, you mean that the top marginal tax rate was "eventually" raised from 28% up to 39.6%, after being lowered from 50% to 28%, then yes the 1986 tax reform "led" to eventual surpluses.

Much of the “supply shocks” of 2021 come down to the “great resignation”—that is, the puzzling decline in labor force participation despite a labor shortage. The work disincentives of social programs—paying people not to work, bluntly—are laid bare.

ReplyDeleteWell...

The CIVRATE has dropped for a few reasons;

1. The pandemic accelerated retirement for a large chunk of baby boomers.

2. Women leaving the workforce to take care of children because schools and daycares being unavailable. Women still have the highest demand for temporal flexibility.

3. Fear of returning to work for fear of getting infected. Not an unreasonable fear. Guilting and shaming people back to work is rarely useful.

4. A game of chicken between employers and employees. The demand for temporal flexibility is increasing amongst both genders. Non-pecuniary benefits are becoming more important. Who will flinch first?

The fiscal helicopter drops weren't just for saving consumption. It was used to pay rent and also to pay down debt. As the blizzard is largely over, yes, those with cash in hand need an asbestos wallet so it doesn't burn a hole in their pockets. But the labor shortages are creating cost push inflation on top of demand pull.

But let's not lay the blame for the dysfunctional labor market at the feet of the fiscal side for plugging a huge hole due to lockdowns.

"From December 2019 to September 2021, the M2 money stock also increased by $5.6 trillion. This looks like a monetary, not a fiscal intervention, Milton Friedman’s (1969) classic tale that if you want inflation, drop money from helicopters. But is it monetary or fiscal policy? Ask yourself: Suppose the expansion of M2 had been entirely financed by purchasing Treasury securities. Imagine Treasury debt had declined $5 trillion while M2 and reserves rose $5 trillion. Imagine that there had been no deficit at all, or even a surplus during this period. The monetary theory of inflation, MV=PY, states that we would see the same inflation. Really? Similarly, ask yourself: Suppose that the Federal Reserve had refused to go along. Suppose that the Treasury had sent people Treasury bills directly, accounts at Treasury.gov, along with directions how to sell them if people wished to do so. Better, suppose that the Treasury had created new mutual funds that hold Treasury securities, and sent people mutual fund shares. (I write mutual fund as money market funds are counted in M2.) The monetary theory of inflation says again that this would have had no effect. These would be a debt issue, causing no inflation, not a monetary expansion. Really?"

ReplyDeleteI feel like this is a really important paragraph of the article. All else equal, I would prefer more in depth discussion on how the fiscal theory and monetary theory differ. The "Really?"s in it make me a bit suspicious that I am not getting the full story. I worry that someone who believes the monetary theory might argue that this does not represent their views.

The truth is that borrowing activities in general have inflationary effects. In the past when most borrowings are in the form of bank loans, monetary aggregates are a good proxy of borrowing activities (since loans create deposits which go into M2). Nowadays that bonds player a much greater role, bond issuances (including by the government which is fiscal policy) are also inflationary, even when they just involve transfer of money between non-bank sectors (and hence do not affect M2).

DeleteFor example, if I have $100 deposit at a bank. I borrow $100 from the bank, and use it to buy a sandwich from a shop, who deposits the $100 at the same bank. So sandwich price goes up, and M2 goes up by $100.

Now if I buy $100 of bills issued by the government, who pays $100 to the sandwich shop, and the shop then deposits the money at the same bank. So sandwich price goes up while total deposits (M2) say the same.

"dollars that are worth more than expected" -> "dollars that are worth less than expected"?

ReplyDeleteFor once that's not a typo. In 1980, 10 year rates rose to 15%, as people expected inflation to stay that high. When inflation fell to 3%, the bondholders got paid back in dollars worth more than they had expected. I could have phrased that more clearly.

DeleteYou had me at... "Ask yourself: If, as Friedman’s helicopter is dropping $1,000 on each household, the Fed sends burglars who remove $1,000 of Treasury securities from the same household". Pure gold (no pun intended).

ReplyDeleteas I have kids I find this immensely depressing!

ReplyDeleteI see people thinking this is the Best of Times...like Wall Street bankers, bitcoiners, Billionaires, Democrats....

This is WORST OF TIMES!

Anyone thinking person knows this will end REALLY REALLY BAD

MMT stand for Modern Monetary Theory? I thought it stood for Magical Monetary Theory. My mistake, I guess.

ReplyDeleteOr Nagical Money Tree. It's a structural shift away from Monetary policy to the Fiscal side. Problem is that assuming taxes will take out excess supply and then redistribute all over again? I have doubts about that mechanism but maybe I got it wrong. There will still be tax avoidance and evasion. At least with NY's OMO office, supply can be adjusted with mechanisms that generally "work."

DeleteThe one upside to at least trying out MMT is that if it doesn't work, the stake can be put in the vampire relatively easily. The effectiveness lag of Fiscal is immediate compared to that of the Fed. But the Fed wins on the implementation side.

Raising taxes or reducing spending strikes me as being two sides of the same coin. Either way, somebody's ox is going to get gored. More importantly, politicians are loath to take anything away from their voters that might affect their reelection chances. While many voices will decry inflation, in all likelihood, politicians will do what they have always done - nothing - pass the buck (literally) and hope that we can somehow inflate our way out of this problem. And, if the GOP is successful in retaking Congress and the White House, it seems unlikely that will do anything more than keep spending.

ReplyDeleteAs a New Year's sentiment let me say how much I have enjoyed these blogs by John Cochrane over the years.

ReplyDeleteAs a layman, I find myself swayed but not convinced by the last arguments I read by any prominent macroeconomist.

I wish you guys would come up with a common perspective.

John reminds me of a gentlemen I met in the grocery store.

DeleteEach day he would ask the cashier in the produce section if they have fresh pomegranates. The cashier would kindly respond to the gentleman that they have bottled pomegranate juice (POM Wonderful or some other variety) but do not carry fresh pomegranates.

One day the same gentleman asks the same question again. To my surprise the cashier points to a section of the produce department and indicates that yes they now carry fresh pomegranates. The gentleman walks back to that section, looks over the selection of pomegranates and then walks away.

My curiousity peaked, I walk over to the gentleman and ask him why he didn't purchase any. He replies that he doesn't care for pomegranates at all.

Let's do a test.

ReplyDelete(1) Inflation was rising in 1965-66, and the Fed tightened. Meanwhile, the budget deficit got larger from LBJ guns-and-butter budget. Inflation fell. Sounds like Fed tightening mattered, not the deficit.

LBJ literally slammed Fed Chair Martin against the wall at his ranch. Talk about fiscal dominance!

Martin eased, and inflation rose.

(2) Reagan cut taxes and increased defense spending, and the deficit surged. Meanwhile, Volcker tightened to the max, and we had a recession and inflation plunged. Fed tightening mattered. The deficit did not.

(3) We had a gigantic deficit in 2009 with no promise to pay it off. That is how we got TEA Party protests. But inflation turned in deflation. A negative shock to aggregate demand could be the explanation. Fiscal theory doesn't cut it.

FTPL seems to depend on expectations of future austerity. But we have no way to measure such expectations. It becomes a non-testable conjecture.

The confusion of monetary and fiscal policies seem to happen when the overnight rate is zero, which blurs the distinction between money and Tbills.

I am being pedantic, but here goes.

ReplyDeleteYou talk about a five percent increase in interest rates.

Are you really thinking about a five percentage point rise in interest rates?

Those two sentences are not the same thing.

You are correct, and I should write percentage points. That's accuracy not pedantry!

DeleteYour support for accuracy is commendable. Thanks

DeleteThe economy runs on energy not the various intermediate goods. Debt is a IOU on future energy. It would appear that continued growth in future energy is questionable. Some seem to be saying that the off book government debt will also be a problem. The Fed is using Ducktape to hold things together in the face of energy depletion. Growth proponents need an appendix to detail where the required resources will come from.

ReplyDeleteTwo other notes re perpetuities: if the Treasury were to issue perpetuities it would have to come up with an iron-clad guarantee that it would not borrow more than say x % of total debt (50%?) in short term instruments ever again, else what would be the point (aside for paradoxically enabling even more reckless borrowing). TY will also have to swap in or retire existing short term debt subject to this rule as well to get to this operating point. A proposal would have to have teeth too, though, as everyone would know that when the next Build Back Better is proposed and congress starts looking in the couch cushions for coins to pretend to cover spending, they will borrow again at the front of the curve to shave a couple of basis points on the projected interest.

ReplyDeleteAs to credibility- Yellen would have been the ideal candidate to show a TY sec with spine managing the term structure of the GOVT debt, but I must admit I am very disappointed in Yellen so far: seems she not only drinks the Kool-Aid, she is now pouring it.

Second, can you issue perpetuities when interest rates are so incredibly low? Say they are issued at 2.5% coupon, it is definitely in the realm of possibility to have yields go to 5%, in which case there will be a massive capital loss for holders. And who will scoop up the perpetuities -- as it is govt debt, most likely it will be sucked in as a 'safe asset' in insurance companies and retirement portfolios. Basel will probably encourage it, too.

Does anyone have a link that explains this in more detail? I vaguely remember this from my economics courses, but I couldn't find anything after more than an hour of Googling. Thanks!

ReplyDeleteIn standard new-Keynesian models, used by all central banks, for example, higher interest rates only produce lower inflation if the higher interest rate is unexpected—that is, a “shock” to the economy . . .A widely expected rise in nominal interest rates raises inflation."

An earlier blog post explains this,

Deletehttps://johnhcochrane.blogspot.com/2021/09/inflation-in-shadow-of-debt.html

This comment has been removed by the author.

DeleteThank you! However, I believe that post explains why the interest rate increase must be accompanied by fiscal tightening. I'm trying to understand why the interest rate increase must be unexpected rather than widely expected. Does anyone have a link? Thank you very much!

DeleteAn expected interest rate increase is already priced in to bonds. And an expected fiscal tightening can't unexpectedly devalue bonds.

Delete"If the government borrows or prints $5 trillion, with no change in its plan to repay debt, on top of $17 trillion outstanding debt, then the price level will rise a cumulative 30 percent, so that the $22 trillion of debt is worth in real terms what the $17 trillion was before. In essence, absent a credible increase in future surpluses, the deficit is financed by defaulting on $5 trillion of outstanding debt, via inflation."

ReplyDeleteIt seems that recent reality has had the trillions going directly into the price levels.

The share price levels of the FAANG market capitalization increases.

Apple is now a $3 trillion company, and there are a few other $ trillion companies.

The gov't spends $5 trillion, paying off donors and "doing good", and the 5 largest companies all increase their market cap by $1 trillion.

This looks like what has been happening for the last decade, with the new Biden choices to reduce energy supply (higher prices! feeding thru all prices) and enforce vax mandates to fire millions of workers and to supply helicopter money to help folks have more to spend.

If the Treasury started trading out its short term debt for long term debt, wouldn’t that immediately spook markets and signal that the Treasury doesn’t think it can repay its debts? I’m just wondering whether the chosen maturity of Treasury debt has effects on market expectations and beliefs.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteOne of my favourite blof

ReplyDelete