This post takes up from two previous posts (part 1; part 2), asking just what do we (we economists) really know about how interest rates affect inflation. Today, what does contemporary economic theory say?

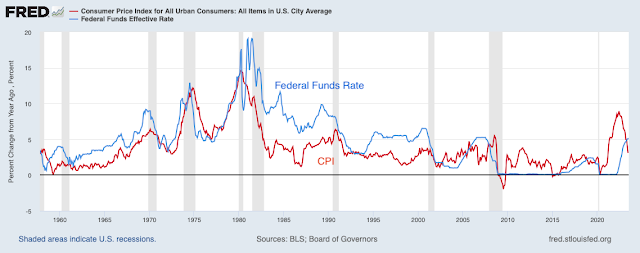

As you may recall, the standard story says that the Fed raises interest rates; inflation (and expected inflation) don't immediately jump up, so real interest rates rise; with some lag, higher real interest rates push down employment and output (IS); with some more lag, the softer economy leads to lower prices and wages (Phillips curve). So higher interest rates lower future inflation, albeit with "long and variable lags."

Higher interest rates -> (lag) lower output, employment -> (lag) lower inflation.

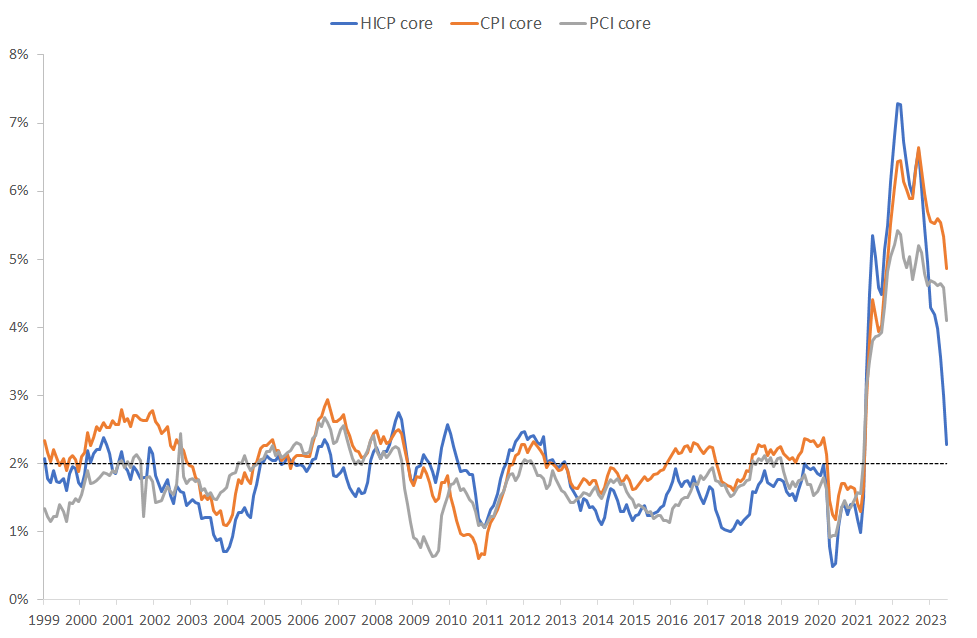

In part 1, we saw that it's not easy to see that story in the data. In part 2, we saw that half a century of formal empirical work also leaves that conclusion on very shaky ground.

As they say at the University of Chicago, "Well, so much for the real world, how does it work in theory?" That is an important question. We never really believe things we don't have a theory for, and for good reason. So, today, let's look at what modern theory has to say about this question. And they are not unrelated questions. Theory has been trying to replicate this story for decades.

The answer: Modern (anything post 1972) theory really does not support this idea. The standard new-Keynesian model does not produce anything like the standard story. Models that modify that simple model to achieve something like result of the standard story do so with a long list of complex ingredients. The new ingredients are not just sufficient, they are (apparently) necessary to produce the desired dynamic pattern. Even these models do not implement the verbal logic above. If the pattern that high interest rates lower inflation over a few years is true, it is by a completely different mechanism than the story tells.

I conclude that we don't have a simple economic model that produces the standard belief. ("Simple" and "economic" are important qualifiers.)

The simple new-Keynesian model