Note: These are remarks I gave in a concluding panel at the Conference on Inequality in Memory of Gary Becker, Hoover Institution, September 26 2014. The conference program here, and John Taylor's summary here, where you can see the great papers I allude to. I'll probably rework this to a more general essay, so I reserve the right to recycle some points later.

Why and How We Care About Inequality

Wrapping up a wonderful conference about facts, our panel is supposed to talk about “solutions” to the “problem” of inequality.

We have before us one “solution,” the demand from the left for confiscatory income and wealth taxation, and a substantial enlargement of the control of economic activity by the State.

Note I don’t say “redistribution” though some academics dream about it. We all know there isn’t enough money, especially to address real global poverty, and the sad fact is that government checks don’t cure poverty. President Obama was refreshingly clear, calling for confiscatory taxation even if it raised no income. “Off with their heads” solves inequality, in a French-Revolution sort of way, and not by using the hair to make wigs for the poor. The agenda includes a big expansion of spending on government programs, minimum wages, “living wages,” government control of wages, especially by minutely divided groups, CEO pay regulation, unions, “regulation” of banks, central direction of all finance, and so on. The logic is inescapable. To “solve inequality,” don’t just take money from the rich. Stop people, and especially the “wrong” people, from getting rich in the first place.

In this context, I think it is a mistake to accept the premise that inequality, per se, is a “problem” needing to be “solved,” and to craft “alternative solutions.”

Just why is inequality, per se, a problem?

Suppose a sack of money blows in the room. Some of you get $100, some get $10. Are we collectively better off? If you think “inequality” is a problem, no. We should decline the gift. We should, in fact, take something from people who got nothing, to keep the lucky ones from their $100. This is a hard case to make.

One sensible response is to acknowledge that inequality, by itself, is not a problem. Inequality is a symptom of other problems. I think this is exactly the constructive tone that this conference has taken.

But there are lots of different kinds of inequality, and an enormous variety of different mechanisms at work. Lumping them all together, and attacking the symptom, “inequality,” without attacking the problems is a mistake. It’s like saying “fever is a problem. So medicine shall consist of reducing fevers.”

Monday, September 29, 2014

Monday, September 22, 2014

A few things the Fed has done right -- the oped

Now that 30 days have passed, I can post the whole oped from the Wall Street Journal. See previous post for additional commentary

A Few Things the Fed Has Done Right

The Fed's plan to maintain a large balance sheet and pay interest on bank reserves is good for financial stability.

As Federal Reserve officials lay the groundwork for raising interest rates, they are doing a few things right. They need a little cheering, and a bit more courage of their convictions.

The Fed now has a huge balance sheet. It owns about $4 trillion of Treasury bonds and mortgage-backed securities. It owes about $2.7 trillion of reserves (accounts banks have at the Fed), and $1.3 trillion of currency. When it is time to raise interest rates, the Fed will simply raise the interest it pays on reserves. It does not need to soak up those trillions of dollars of reserves by selling trillions of dollars of assets.

The Fed's plan to maintain a large balance sheet and pay interest on bank reserves, begun under former Chairman Ben Bernanke and continued under current Chair Janet Yellen, is highly desirable for a number of reasons—the most important of which is financial stability. Short version: Banks holding lots of reserves don't go under.

This policy is new and controversial. However, many arguments against it are based on fallacies.

A Few Things the Fed Has Done Right

The Fed's plan to maintain a large balance sheet and pay interest on bank reserves is good for financial stability.

As Federal Reserve officials lay the groundwork for raising interest rates, they are doing a few things right. They need a little cheering, and a bit more courage of their convictions.

The Fed now has a huge balance sheet. It owns about $4 trillion of Treasury bonds and mortgage-backed securities. It owes about $2.7 trillion of reserves (accounts banks have at the Fed), and $1.3 trillion of currency. When it is time to raise interest rates, the Fed will simply raise the interest it pays on reserves. It does not need to soak up those trillions of dollars of reserves by selling trillions of dollars of assets.

The Fed's plan to maintain a large balance sheet and pay interest on bank reserves, begun under former Chairman Ben Bernanke and continued under current Chair Janet Yellen, is highly desirable for a number of reasons—the most important of which is financial stability. Short version: Banks holding lots of reserves don't go under.

This policy is new and controversial. However, many arguments against it are based on fallacies.

Saturday, September 20, 2014

Yellen on the poverty of the poor.

I ran across this interesting speech by Fed Chair Janet Yellen, "The importance of asset building for low and middle income households."

This all brings to mind several thoughts.

The median net worth reported by the bottom fifth of households by income was only $6,400 in 2013. Among this group, representing about 25 million American households, many families had no wealth or had negative net worth. The next fifth of households by income had median net worth of just $27,900.But even these numbers are in a sense overstated, since much of the "net worth" is in home equity, thus not easily available

Home equity accounts for the lion's share of wealth... for lower and middle income families, financial assets, including 401 (k) plans and pensions, are still a very small share of their assets.This matters because,

for many lower-income families without assets, the definition of a financial crisis is a month or two without a paycheck, or the advent of a sudden illness or some other unexpected expense. .... According to the Board's recent Survey of Household Economics and Decisionmaking, an unexpected expense of just $400 would prompt the majority [!] of households to borrow money, sell something, or simply not pay at all.["Majority" meaning 51% of all households seems like a lot, if the bottom 2/5 has $27,500. But I didn't look it up.]

This all brings to mind several thoughts.

Friday, September 19, 2014

Capital Language

Sometimes the press deserves a little applause. Peter Coy at Business Week and Pat Regnier at Time both wrote articles very nicely explaining bank capital and many fallacies around it.

Both articles also have nice graphics, but I give Coy and BusinessWeek the A+, because it also explains that banks can build capital without cutting lending.

A few select quotes. From Coy at Business Week, two fallacies skewered:

HT to Anat Admati who sent me the links.

Both articles also have nice graphics, but I give Coy and BusinessWeek the A+, because it also explains that banks can build capital without cutting lending.

A few select quotes. From Coy at Business Week, two fallacies skewered:

So what exactly is capital? Sometimes it’s described as a rainy-day fund, which is wrong. More often it’s characterized as something banks “hold,” which can make it sound like a pile of money that has to be set aside so it can’t be lent out for a profit. That’s not right either.

The American Bankers Association says that higher capital requirements for big banks “reduce economic and job growth.” But banks can meet capital requirements without cutting back lending. They just have to sell more shares (cutting down on buybacks also works) or reduce cash-draining dividends (refraining from raising them also helps).Regnier at Time too, and passes on the useful housing analogy.

...As Admati frequently points out, banks have benefited from the misconception that higher capital requirements means banks would have to keep 20% or 30% of their money locked up in a vault, instead of lending it out to businesses or homeowners.

In fact, making banks “hold more capital” actually means they have to borrow less. In their book, Admati and Hellwig show that this is almost exactly like a homeowner making sure to build up equity in her house.

To raise more capital, banks wouldn’t hold back lending. Rather, they’d tap their shareholders, either by issuing new stock or just by cutting the dividends they pay out of earnings, letting profits build up on the balance sheet.It's refreshing when professional writers explain things a lot more clearly and succinctly than us academics seem to do, and get the economics spot on. Yes, words, stories, and ideas do matter, and the change in attitude about bank capital is a great example.

HT to Anat Admati who sent me the links.

Thursday, September 18, 2014

The case for open borders

Alex Tabarrok has a splendid post "the case for open borders" on Marginal Revolution.

Along the way he points to "Economics and Immigration: Trillion Dollar Bills on the Sidewalk?" by Michael Clemens and forthcoming Journal of Economic Perspectives, "The Domestic Economic Impacts of Immigration" by David Roodman and "The case for Open Borders" by Dylan Matthews, a Bryan Caplan interview and story on vox. All are worth reading.

1) Women

Anecdotes and analogies are important for how we understand events, beyond equations and tables. Bryan makes this point, with a lovely "elevator pitch" metaphor. Bryan comes up with a good story as well, that I hadn't thought of:

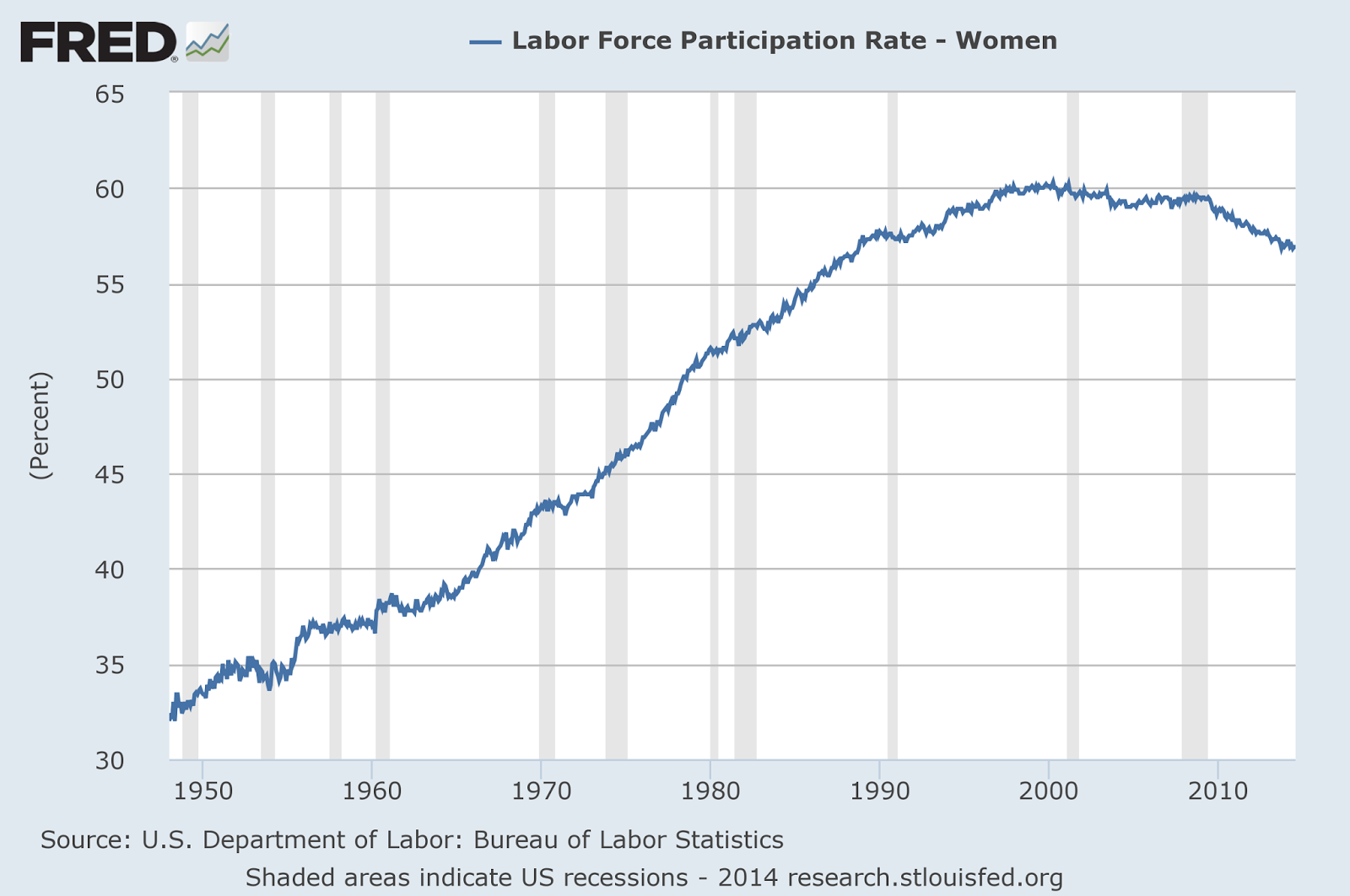

How much has the entry of women to the labor force lowered men's jobs and wages? (I was tempted to write "access to jobs," but someone might take it seriously!) Should the US government have prohibited women from entering the labor force, in order to shore up the wages of men?

The increase in women's labor force participation was huge -- from 32% to 60%, resulting in an increase in overall labor force participation from 59% to 67% of the population from 1960 to 2000. 8% of 320 million is 26 million, so we're talking about a lot of extra people working.

The answer to the first question is surely yes, but not a lot. 26 million men did not lose their jobs so women could work. And the answer to the second question is surely no.

Along the way he points to "Economics and Immigration: Trillion Dollar Bills on the Sidewalk?" by Michael Clemens and forthcoming Journal of Economic Perspectives, "The Domestic Economic Impacts of Immigration" by David Roodman and "The case for Open Borders" by Dylan Matthews, a Bryan Caplan interview and story on vox. All are worth reading.

1) Women

Anecdotes and analogies are important for how we understand events, beyond equations and tables. Bryan makes this point, with a lovely "elevator pitch" metaphor. Bryan comes up with a good story as well, that I hadn't thought of:

How much has the entry of women to the labor force lowered men's jobs and wages? (I was tempted to write "access to jobs," but someone might take it seriously!) Should the US government have prohibited women from entering the labor force, in order to shore up the wages of men?

The increase in women's labor force participation was huge -- from 32% to 60%, resulting in an increase in overall labor force participation from 59% to 67% of the population from 1960 to 2000. 8% of 320 million is 26 million, so we're talking about a lot of extra people working.

The answer to the first question is surely yes, but not a lot. 26 million men did not lose their jobs so women could work. And the answer to the second question is surely no.

Wednesday, September 17, 2014

FOMC statement and the new normal.

The Sept 17 FOMC statement made the usual waves in the when-will-they-raise-rates commentary. But the separate "policy normalization principles and plans" document is, I think, more interesting. And since the Wall Street Journal called it "a new technical plan for how it will raise short-term interest rates" and then moved on, it is I think worth a bit of examination.

It confirms the previous plan:

It confirms the previous plan:

During normalization, the Federal Reserve intends to move the federal funds rate into the target range set by the FOMC primarily by adjusting the interest rate it pays on excess reserve balances.What does this mean? The Fed has about $3 trillion of reserves outstanding, and required reserves are about $80 billion. The old way of raising rates would require that they sell off $2.9 trillion of assets, soaking up $2.9 trillion of reserves, so that interest rates will go up without paying interest on reserves. I illustrated this in the graph on the left.

Wednesday, September 10, 2014

Optimal quantity of money, achieved?

Here are three graphs, presenting inflation, long-term interest rates and short-term interest rates in the US, Germany and Japan.

Capital and Language

| The Fed Scrutinizes Bank Capital, in the Popular Imagination |

The good news. The Fed wants more capital. Banks should absorb their own risks, rather than all of us to count on the Fed to stand over their shoulders and make sure they never lose money again.

Confusing language has long been a roadblock in this effort, along with red herrings passed along thoughtlessly.

"Costly"

The WSJ writes

The Federal Reserve plans to hit the biggest U.S. banks with a costly new requirementMr. Tarullo's testimony does not contain any mention of the idea that higher capital requirements will be "costly." My view, expressed nicely by Admanti and Hellwig's book, is that there is zero social cost to lots more bank equity. Disagree if you will, but source it please, don't just pass it on as if the source said it or as if this is a fact like the sun coming up tomorrow.

"Hold"

Friday, September 5, 2014

The $20,000 bruise

The $20,000 bruise story in the Wall Street Journal makes good reading. All of these health care disasters make good reading.

A question for any experts who read this blog. Surely there is a business opportunity here, no? "We negotiate your medical bill." It is a huge waste of resources for Mr. David a "co-founder and chief strategy officer of Organovo Inc., a biotech company in California" to spend hours on the phone and more hours on the internet learning about medicare coding procedures. And all his acquired knowledge is now wasted. Surely such a business could operate, like many lawyers, on a contingency fee basis, and take a fraction of money saved.

Yes, as Mr. David points out, this is what insurance companies are supposed to do. But copays are going up, and more people are gong to be paying out of pocket anyway.

Are there businesses like this that I, and Mr. David, simply don't know about?

Update: I knew that were there is demand there must be supply! A correspondent sends me a link to copatient.com, which looks like this:

I let the billing supervisor speak for a moment, and then cut him off using the ammo I had acquired from billing-coders' blogs. "You billed a G0390 for trauma-team activation. But chapters 4 and 25 of the MCPM require there be EMS or outside hospital activation if you are billing a G0390. There was no such activation here. So here is what I need you to do: Remove that $10,000 charge and reissue the bill."

He was silent for a moment. And then he said, " Let me talk to my supervisor."

...To the hospital's immense credit, they sent a refund to our insurance company and reissued the bill without the $10,000 trauma activation. They could have refused. What would my recourse have been? To hire a lawyer? Try to interest my insurer in fighting over a measly $10,000 charge? That is a tiny line item in their book of business.All of us have experienced or know people who have experienced similar nightmares.

A question for any experts who read this blog. Surely there is a business opportunity here, no? "We negotiate your medical bill." It is a huge waste of resources for Mr. David a "co-founder and chief strategy officer of Organovo Inc., a biotech company in California" to spend hours on the phone and more hours on the internet learning about medicare coding procedures. And all his acquired knowledge is now wasted. Surely such a business could operate, like many lawyers, on a contingency fee basis, and take a fraction of money saved.

Yes, as Mr. David points out, this is what insurance companies are supposed to do. But copays are going up, and more people are gong to be paying out of pocket anyway.

Are there businesses like this that I, and Mr. David, simply don't know about?

Update: I knew that were there is demand there must be supply! A correspondent sends me a link to copatient.com, which looks like this:

Promotion

Once upon a time, in the Krugman pantheon, I was only "stupid." Then I made it to "mendacious idiot." I've been promoted again, to "Evil!" And, better, corrupt, since "vested interests can buy the ideas they want to hear," and I am listed a seller.

All under the once-authoritative imprimatur of that impressive logo, reproduced above. All the news that's fit to print. And then some.

Break out the champagne. I wonder what I can aspire to next. I do have a Ph.D. Perhaps, dare I hope,...

Actually, I am flattered to be listed in the company of Alesina, Ardagna, Reinhart, Rogoff, and Lucas. In other contexts, Fama, Prescott, Ferguson.

OK, enough Krugman blogging. It's just gotten to the point of humorous, in a pathetic sort of way.

Wednesday, September 3, 2014

Cool video

Nightingale and Canary from Andy Thomas on Vimeo.

Using 3D visualization software and other programs, Thomas breaks down photos of insects, orchids, and birds into their composite parts. He then reassembles the images in a sort of collage and builds trippy animations that react, based on rules he's set, to sound – in this case, archival bird song.Source: This is Your Bird on Drugs, post by Julia Lowrie Henderson. Video by Andy Thomas

This has absolutely nothing to do with economics, or grumpiness. I just thought it was cool.

Krugman on the attack

In the New York Times, rehashing ancient calumnies. It must be a slow day.

Dear Paul, let me introduce you to parts of the distribution other than the mean. Inflation risk is a tail event. I am in California now. There is a danger of big earthquakes. That the big one has not happened in the last 5 years does not mean the ground will be still forever, nor that geologists are mendacious idiots ignorant of Bayes' theorem.

My worries about inflation do not come from monetary policy. I've been as outspoken on the view that monetary policy is ineffective at the zero bound as the most solid Keynesian. In the WSJ, "Reserves that pay market interest are not inflationary. Period." If you bothered to read anything before venting, you'd know that.

My worries stem from the western world at 100% debt to GDP ratio, larger unfunded commitments to ageing populations, slow growth, and no solid plan to pay it back. I've been pretty clear that this is a self inflicted wound -- our governments can let economies grow and pay it back, but may choose not to. If bond investors decide they don't want to be the ones holding the bag, inflation will come no matter what central banks do about it.

This mechanism remains a proper fault sitting underneath us. But one that can sit a long time. Just like, I hope, the San Andreas. But the fact that sovereign debt must eventually be repaid, defaulted on, or inflated away, remains an accounting identity valid even in the most rabid Keynesian worldview.

For fun, I spent a few minutes googling Krugman and deflation (sometimes "spiral", sometimes "vortex"), which also did not happen, and in my view cannot happen. But I will resist. It's just too easy to play this game. Economics is not soothsaying, and descending further into the pit dignifies it unneccessarily.

Dear Paul, let me introduce you to parts of the distribution other than the mean. Inflation risk is a tail event. I am in California now. There is a danger of big earthquakes. That the big one has not happened in the last 5 years does not mean the ground will be still forever, nor that geologists are mendacious idiots ignorant of Bayes' theorem.

My worries about inflation do not come from monetary policy. I've been as outspoken on the view that monetary policy is ineffective at the zero bound as the most solid Keynesian. In the WSJ, "Reserves that pay market interest are not inflationary. Period." If you bothered to read anything before venting, you'd know that.

My worries stem from the western world at 100% debt to GDP ratio, larger unfunded commitments to ageing populations, slow growth, and no solid plan to pay it back. I've been pretty clear that this is a self inflicted wound -- our governments can let economies grow and pay it back, but may choose not to. If bond investors decide they don't want to be the ones holding the bag, inflation will come no matter what central banks do about it.

This mechanism remains a proper fault sitting underneath us. But one that can sit a long time. Just like, I hope, the San Andreas. But the fact that sovereign debt must eventually be repaid, defaulted on, or inflated away, remains an accounting identity valid even in the most rabid Keynesian worldview.

For fun, I spent a few minutes googling Krugman and deflation (sometimes "spiral", sometimes "vortex"), which also did not happen, and in my view cannot happen. But I will resist. It's just too easy to play this game. Economics is not soothsaying, and descending further into the pit dignifies it unneccessarily.

Monday, September 1, 2014

Italian deflation?

Giulio Zanella has a nice post on noisefromamerika, dissecting the sources of Italian deflation. (In Italian, but Google translate does a pretty good job.) Deflation can come from lack of "demand," or from technical innovation and increases in supply. What do the data suggest?

Subscribe to:

Comments (Atom)