[Uber's] exponential growth confirms what every New Yorker and cab riders in many other cities have long suspected: Taxi service is woefully inefficient. It also raises a question of broader relevance: Why stop here?This is an all too often overlooked effect of so much government-induced cartelization. The costs of higher prices are paid by middle and lower income people. And many job opportunities are denied to lower income people.

Just as limited taxi medallions [and ban on surge pricing, and the mandated shift change -JC] can lead to a chronic undersupply of cabs at 4 p.m., the state licensing regulations for many occupations are creating bottlenecks across the economy, raising the prices of many goods and services and putting good jobs out of reach of too many Americans.

... like taxi medallions, state licenses required to practice all sorts of jobs often serve merely to cordon off occupations for the benefit of licensed workers and their lobbying groups, protecting them from legitimate competition.

...“Lower-income people suffer from licensing,” Professor Krueger told me. “It raises the costs of many services and prevents low-income people from getting into some professions.

Thursday, January 29, 2015

Uber and Occupational Licenses

I enjoy moments of agreement, and common sense in publications where it's usually absent. Eduardo Porter writing in the New York Times on the lessons of Uber vs. Taxis for occupational licensing is a nice such moment.

Wednesday, January 28, 2015

Unemployment insurance and unemployment

"The Impact of Unemployment Benefit Extensions on Employment: The 2014 Employment Miracle" by Marcus Hagedorn, Iourii Manovskii and Kurt Mitman is making waves. NBER working paper here. Kurt Mitman's webpage has an ungated version of the paper, and a summary of some of the controversy. It's part of a pair, with "Unemployment Benefits and Unemployment in the Great

Recession: The Role of Macro Effects" also including Fatih Karahan.

A critical review by Mike Konczal at the Roosevelt Institute blog, and a more positive review by Patrick Brennan at National Review Online are both interesting. Both are thoughtful reviews that get at facts and methods. Maybe the tone of the economics blogoshpere is improving too. Bob Hall's comments and response on the earlier paper are also worth reading. This is a bit deja-vu from the observation that North Carolina experienced a large drop in unemployment when it cut benefits. My post here, WSJ coverage, and I think there are some papers which google isn't finding fast enough at the moment.

The basic issue: I think it's widely accepted, if sometimes grudgingly, that unemployment insurance increases unemployment. If you pay for anything, you get more of it. People with unemployment insurance can hold out for better jobs, put off moving or other painful adjustments, and so on. The earlier paper points out that there are important general equilibrium effects as well. We should talk about how UI affects labor markets, not just job search.

Quick disclaimer. Let's not jump to "good" and "bad." Searching too hard and taking awful jobs in the middle of a depression might not be optimal. Pareto-optimal risk sharing with moral hazard looks a lot like unemployment insurance. Perhaps that disclaimer can settle down the tone of the debate.

But the question remains. How much? How much does unemployment insurance increase unemployment? And the related macro question, just why did unemployment in the US suddenly drop coincident with sequester and the end of 99 week unemployment benefits?

Recession: The Role of Macro Effects" also including Fatih Karahan.

A critical review by Mike Konczal at the Roosevelt Institute blog, and a more positive review by Patrick Brennan at National Review Online are both interesting. Both are thoughtful reviews that get at facts and methods. Maybe the tone of the economics blogoshpere is improving too. Bob Hall's comments and response on the earlier paper are also worth reading. This is a bit deja-vu from the observation that North Carolina experienced a large drop in unemployment when it cut benefits. My post here, WSJ coverage, and I think there are some papers which google isn't finding fast enough at the moment.

The basic issue: I think it's widely accepted, if sometimes grudgingly, that unemployment insurance increases unemployment. If you pay for anything, you get more of it. People with unemployment insurance can hold out for better jobs, put off moving or other painful adjustments, and so on. The earlier paper points out that there are important general equilibrium effects as well. We should talk about how UI affects labor markets, not just job search.

Quick disclaimer. Let's not jump to "good" and "bad." Searching too hard and taking awful jobs in the middle of a depression might not be optimal. Pareto-optimal risk sharing with moral hazard looks a lot like unemployment insurance. Perhaps that disclaimer can settle down the tone of the debate.

But the question remains. How much? How much does unemployment insurance increase unemployment? And the related macro question, just why did unemployment in the US suddenly drop coincident with sequester and the end of 99 week unemployment benefits?

Tuesday, January 27, 2015

SNB, CHF, ECB, and QE

The last two weeks have been full of monetary news with the Swiss Franc peg, and the ECB's announcement of Quantitative Easing (QE). A few thoughts.

As you have probably heard by now, the Swiss Central Bank removed the 1.20 cap vs. the euro, and the franc promptly shot up 20%.

To defend the peg, the Swiss central bank had bought close to a year's Swiss GDP of euros (short-term euro debt really) to issue similar amounts of Swiss Franc denominated debt.

This is a QE -- a big QE. Buy assets, print money (again, really interest-paying reserves). So to some extent the news items are related. And, it's pretty clear why the SNB abandoned the peg. If the ECB started essentially the opposite transaction -- buying debt and selling euros -- the SNB would soon be awash.

A few lessons:

As you have probably heard by now, the Swiss Central Bank removed the 1.20 cap vs. the euro, and the franc promptly shot up 20%.

To defend the peg, the Swiss central bank had bought close to a year's Swiss GDP of euros (short-term euro debt really) to issue similar amounts of Swiss Franc denominated debt.

This is a QE -- a big QE. Buy assets, print money (again, really interest-paying reserves). So to some extent the news items are related. And, it's pretty clear why the SNB abandoned the peg. If the ECB started essentially the opposite transaction -- buying debt and selling euros -- the SNB would soon be awash.

A few lessons:

Thursday, January 22, 2015

Autopsy -- the Op-Ed

This was an Op-Ed in the Wall Street Journal December 22 2014. WSJ asks me not to post them for a month, so here it is now. I was trying for something upbeat, and to counter a recent spate of opeds on how ISLM is a great success and winning the war of ideas.

An Autopsy for the Keynesians

This year the tide changed in the economy. Growth seems finally to be returning. The tide also changed in economic ideas. The brief resurgence of traditional Keynesian ideas is washing away from the world of economic policy.

No government is remotely likely to spend trillions of dollars or euros in the name of “stimulus,” financed by blowout borrowing. The euro is intact: Even the Greeks and Italians, after six years of advice that their problems can be solved with one more devaluation and inflation, are sticking with the euro and addressing—however slowly—structural “supply” problems instead.

U.K. Chancellor of the Exchequer George Osborne wrote in these pages Dec. 14 that Keynesians wanting more spending and more borrowing “were wrong in the recovery, and they are wrong now.” The land of John Maynard Keynes and Adam Smith is going with Smith.

Why? In part, because even in economics, you can’t be wrong too many times in a row.

An Autopsy for the Keynesians

| Source: Wall Street Journal |

No government is remotely likely to spend trillions of dollars or euros in the name of “stimulus,” financed by blowout borrowing. The euro is intact: Even the Greeks and Italians, after six years of advice that their problems can be solved with one more devaluation and inflation, are sticking with the euro and addressing—however slowly—structural “supply” problems instead.

U.K. Chancellor of the Exchequer George Osborne wrote in these pages Dec. 14 that Keynesians wanting more spending and more borrowing “were wrong in the recovery, and they are wrong now.” The land of John Maynard Keynes and Adam Smith is going with Smith.

Why? In part, because even in economics, you can’t be wrong too many times in a row.

Tuesday, January 13, 2015

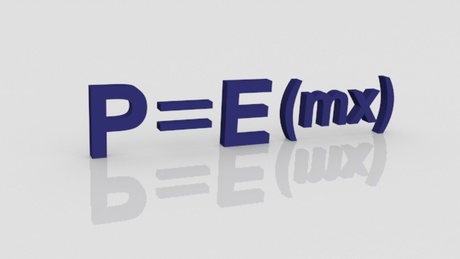

Asset Pricing Mooc

The new and improved online version of my PhD class "Asset Pricing Part 1" will open for business January 18.

You can learn more about the class and sign up for it on the Coursera website here. (Part 2, which follows this spring is here. Part 1 and 2 will be completely separate Coursera classes, so take what you want.)

The videos and quizzes have been useful for people who are not "taking" the class, or as supplementary materials for people teaching regular classes. I taught my PhD class by asking the students to watch the videos before coming to class, which allowed a higher level discussion. Feel free to use these resources any way you wish!

While we're at it, I maintain a section of my research website with extra materials for people using the Asset Pricing book in classes, here, and my teaching materials from MBA and PhD classes are here

To whet your appetite, here is the syllabus from the two classes.

Part 1 syllabus:

You can learn more about the class and sign up for it on the Coursera website here. (Part 2, which follows this spring is here. Part 1 and 2 will be completely separate Coursera classes, so take what you want.)

The videos and quizzes have been useful for people who are not "taking" the class, or as supplementary materials for people teaching regular classes. I taught my PhD class by asking the students to watch the videos before coming to class, which allowed a higher level discussion. Feel free to use these resources any way you wish!

While we're at it, I maintain a section of my research website with extra materials for people using the Asset Pricing book in classes, here, and my teaching materials from MBA and PhD classes are here

To whet your appetite, here is the syllabus from the two classes.

Part 1 syllabus:

- Week 1: Stochastic Calculus Introduction and Review. dz, dt and all that.

- Week 2: Introduction and Overview. Challenging Facts and Basic Consumption-Based Model.

- Week 3:

- Classic issues in Finance

- Equilibrium, Contingent Claims, Risk-Neutral Probabilities.

- Week 4: State-Space Representation, Risk Sharing, Aggregation, Existence of a Discount Factor.

- Week 5: Mean-Variance Frontier, Beta Representations, Conditioning Information.

- Week 6: Factor Pricing Models -- CAPM, ICAPM and APT.

- Week 7: Econometrics of Asset Pricing and GMM.

- Final Exam

- Week 1: Factor pricing models in action

- The Fama and French model

- Fund and performance evaluation.

- Week 2: Time series predictability, volatilty and bubbles.

- Week 3: Equity premium, macroeconomics and asset pricing.

- Week 4: Option Pricing.

- Week 5: Term structure models and facts.

- Week 6: Portfolio Theory.

- Final Exam

Thursday, January 8, 2015

Deflating Deflationary Fears

|

| Source: Charles Plosser |

Wednesday, January 7, 2015

Piketty Facts

Most Piketty commentary (like the Deridre McCloskey review I blogged earlier) focuses on the theory, r>g, and so on. After all, that's easy and you don't have to read hundreds of pages.

"Challenging the Empirical Contribution of Thomas Piketty's Capital in the 21st Century" by Phillip W. Magness and Robert P. Murphy is one of the first deep reviews of the facts that I have seen. I haven't read it yet, but the abstract looks promising:

"Challenging the Empirical Contribution of Thomas Piketty's Capital in the 21st Century" by Phillip W. Magness and Robert P. Murphy is one of the first deep reviews of the facts that I have seen. I haven't read it yet, but the abstract looks promising:

Thomas Piketty's Capital in the 21st Century has been widely debated on theoretical grounds, yet continues to attract acclaim for its historically-infused data analysis. In this study we conduct a closer scrutiny of Piketty's empirics than has appeared thus far, focusing upon his treatment of the United States. We find evidence of pervasive errors of historical fact, opaque methodological choices, and the cherry-picking of sources to construct favorable patterns from ambiguous data. Additional evidence suggests that Piketty used a highly distortive data assumption from the Soviet Union to accentuate one of his main historical claims about global “capitalism” in the 20th century. Taken together, these problems suggest that Piketty’s highly praised and historically-driven empirical work may actually be the book’s greatest weakness.Comments on the paper welcome. If I get a chance to read it I'll post some.

Time use of the non-employed

|

| Source: New York Times |

What do they do all day? The New York Times has a lovely article answering that question.

I took a screenshot at left to advertise the post, but go to the Times where the graph is interactive.

Next question, where does the money come from?

Understanding the lives of people in this predicament seems to me a useful step to understanding the big decline in participation.

Tuesday, January 6, 2015

Strange Bedfellows

Jeff Sachs has written a very interesting Project Syndicate piece on Keynesian economics. It's phrased as a critique of Paul Krugman, but his message applies much more broadly. Krugman was mostly articulating fairly standard views on stimulus, "austerity'' and so forth. (We need a better word than "Keynesian'' for what Jeff calls "crude aggregate-demand management.'' But I don't have one handy.)

This is a good example for people outside economics (and quite a few inside) who think all economists line up on an easy right-left divide. If you expected Sachs to support the standard Keynesian consensus because he's "liberal," or to use his words, in favor of "progressive economics," you would be wrong. He looks at the facts, the forecasts, and the Krugman's curious rewriting of history in a "victory lap," and comes to his own conclusions.

Needless to say, I'm happy to find someone else making many of the basic points in my

Autopsy for Keynesian Economics (ungated version). I'm even more happy that someone of a "progressive" political orientation comes to the same conclusions that I do from a more libertarian orientation. I'll be curious to see if Sachs comes in for the same sort of venomous personal attacks -- with essentially no attempt to argue the content -- as my piece attracted from the politicized lefty economics blogosphere. Do they treat "friends" more nicely, or "traitors" more harshly? We'll see.

On infrastructure, Sachs writes

This is a good example for people outside economics (and quite a few inside) who think all economists line up on an easy right-left divide. If you expected Sachs to support the standard Keynesian consensus because he's "liberal," or to use his words, in favor of "progressive economics," you would be wrong. He looks at the facts, the forecasts, and the Krugman's curious rewriting of history in a "victory lap," and comes to his own conclusions.

Needless to say, I'm happy to find someone else making many of the basic points in my

Autopsy for Keynesian Economics (ungated version). I'm even more happy that someone of a "progressive" political orientation comes to the same conclusions that I do from a more libertarian orientation. I'll be curious to see if Sachs comes in for the same sort of venomous personal attacks -- with essentially no attempt to argue the content -- as my piece attracted from the politicized lefty economics blogosphere. Do they treat "friends" more nicely, or "traitors" more harshly? We'll see.

On infrastructure, Sachs writes

To be clear, I believe that we do need more government spending as a share of GDP – for education, infrastructure, low-carbon energy, research and development, and family benefits for low-income families. But we should pay for this through higher taxes on high incomes and high net worth, a carbon tax, and future tolls collected on new infrastructure. We need the liberal conscience, but without the chronic budget deficits.Here too, we can almost agree. We can agree on the principle that infrastructure spending is important, and should be evaluated on the basis whether its benefits exceed its costs, not on the "stimulative" powers of its spending. Then we can go back to evaluating whether all of these particular investments have benefits greater than costs, and whether those particular taxes merit their distortions.

Monday, January 5, 2015

Carbon Tax or Carbon Rights?

Larry Summers has a very nice Financial Times oped, "Let this be the year when we put a proper price on carbon" Greg Mankiw has also written extensively and eloquently in favor of a carbon tax, for example here. Jeff Miron has some interesting skeptical thoughts, recently here.

I agree in principle. But I have some important qualifications, and some suggestions for framing to broaden the appeal of the proposal substantially. I also think that individual rights may be better than a tax. What matters, really, is a carbon price, and there are different ways to bring that about.

Saturday, January 3, 2015

Interest-paying money is not inflationary

(With credible fiscal policy, of course.) Another interesting case, from JP Koning's Blog "Moneyness"

Koning describes the lack of inflation as a result of the perceived "permanence" of the increased reserves. I think it comes from the fact that reserves pay interest -- as they do in New Zealand. Either way, the point is that banks and people are happy to sit on interest-paying money, in enormous quantities, just as they are on bonds.

RBNZ decided to 'flood' the system with balances to make things more fluid. This involved conducting open market purchases that bloated the monetary base (comprised of currency plus deposits) from around NZ$6 billion in mid-2006 to just under NZ$14 billion by December of that year. See chart below.

(Note that the RBNZ's problems began far before the credit crisis and were due entirely to the peculiar structure of the clearing system, not New Zealand's economy.)

Koning describes the lack of inflation as a result of the perceived "permanence" of the increased reserves. I think it comes from the fact that reserves pay interest -- as they do in New Zealand. Either way, the point is that banks and people are happy to sit on interest-paying money, in enormous quantities, just as they are on bonds.

More Cash and Zero Bound

In my last post I started thinking about how options other than currency enforce a zero bound. Imagine there is no more currency, and the Fed tries to impose -5% interest rates. You put in a dollar, you get out 95 cents. What other ways are there to guarantee that if you put in a dollar you get back a dollar? (In my last post, I also pointed out that in each case rules or laws could be changed, but that the magintude of the required changes was pretty big.)

From Kenneth Garbade and Jamie McAndrews in a nice Liberty Street Economics blog post

So, the project will mean changing the rules and laws governing checks, going back hundreds of years.

An earlier post by Todd Keister:

From Kenneth Garbade and Jamie McAndrews in a nice Liberty Street Economics blog post

- Certified check. Go to the bank, tell the bank to write you a $10,000 certified check. Put it in your sock drawer. (More: "Certified checks, which are liabilities of the certifying banks rather than individual depositors, might become a popular means of payment, as well as an attractive store of value, because they can be made payable to order and can be endorsed to subsequent payees.")

Or, inspired by that:

- Don't cash checks. Every 90 days, call up, say you lost the check, ask them to reissue it.

So, the project will mean changing the rules and laws governing checks, going back hundreds of years.

An earlier post by Todd Keister:

- Money market mutual funds.

Currently money market funds promise fixed value, and pay positive interest. They are not set up to charge negative interest, or to allow capital losses. Maybe they should -- I've argued for floating NAV -- but they don't. The Fed kept the 0.25% rate on reserves precisely so banks and money market funds didn't have to reinvent themselves in ways that allow capital losses or negative rates.

Miles Kimball has also been writing in favor of negative nominal rates and thinking about the zero bound. One post is here.

Subscribe to:

Comments (Atom)