Family formation and crime is the title of a very nice new paper by Maxim Massenkoff and Evan K. Rose. (HT Alex Tabarrok at Marginal Revolution, which also has great commentary.)

The graphs speak for themselves. Go to the paper to look at them all. A few select ones:

Arrests fall by half, starting when mothers know they are pregnant:

(The paper presents more accurate but less interpretable event study coefficients. If you know what that means, go look at the paper.)

Father's crime drops too:

This decline isn't as steep. But first of all note it's all fathers, married or no, and second third and more kids. Then look at the huge difference in vertical scale. Women go from 3 to 2 economic offenses per 10,000. Men go from 20 to12 economic offenses per 10,000. This is a huge reduction in crime rates.

Monday, November 25, 2019

Wednesday, November 20, 2019

Capital market freedom

I gave a presentation on "capital markets" at the Hoover Centennial series on Tuesday. Caroline Hoxby gave a clear presentation on human capital, and George Shultz told some great stories from his time in government. Judging from the questions, Caroline was the star and I put them to sleep. Finance always does that. The video:

Here is the text of my presentation

Hoover stands for freedom: ideas defining a free society is our motto. And economic is a central freedom: You can’t guarantee political freedom, social and lifestyle freedom, freedom of speech and expression, without economic freedom.

Economic freedom applies to capital; to financial freedom, as much as to goods, services, and labor. Freedom to buy and sell, without a government watching every transaction. Freedom to save, and invest your capital with the most promising venture, at home or abroad, or to receive investment from and sell assets to anyone you choose — whether the investments conforms to a government’s plans or not.

But freedom is not anarchy. Economic and financial freedom depend on a public economic infrastructure. They need functioning markets, property rights, an efficient court system, rule of law; They need a stable and efficient money, and a government with sound fiscal affairs that will not inflate, expropriate, or repress finance to its benefit, and freedom from confiscatory taxation.

Here lies our conundrum. The government that can set up and maintain this public architecture can restrict trade and finance. Businesses, workers and other groups can demand protection. The government can control finance for political ends and to steer resources its way. And that ever-present temptation is stronger for finance. Willie Sutton, asked why he robbed banks, responded “that’s where the money is.” Governments have noticed as well.

Ideas matter. People care about prosperity, too. Citizens and voters must understand that their own freedom, and that of their neighbors, is the best guarantor of their and the common prosperity. 250 years after Adam Smith, most of US still really does not trust that fervent competition is their best protection, not extensive regulation. See our rent control and labor laws. That necessary understanding remains even more tenuous in financial affairs

Can a more free financial, payments, monetary, and capital market system work? How? It is our job — ours, the ideas-defining-a free-society people — to put logic and experience together on this question. And the answer is not obvious. Finance paid for our astonishing prosperity. But the history of finance is also full of crashes, panics, and imbroglios. Government finance won wars, but also impoverished nations. Economic freedom does not mean freedom to dump garbage in neighbor’s back yard. Just where this parable applies to financial markets is an important question.

The last 100 years have been a great ebb and flow of freedom in financial and monetary affairs. The immediate future is cloudy, suggesting more ebb, but offering some hope for flow

Hoover scholars have been and are in the midst of it. Milton Friedman spent a quarter century here, advancing free exchange rates, free trade, open capital markets, sound money, and sound fiscal policy. John Taylor took up that baton. Allan Meltzer, author of the magisterial history of the Federal Reserve, was a frequent visiting fellow here. George Shultz spearheaded the transition to floating exchange rates and free capital movement, fought valiantly against price controls, and anchored the Reagan Administration’s effort to eliminate inflation and fix the tax code. Many others contributed, and Hoover is just as alive today.

We could spend an afternoon on the financial history of the last 100 years. I’ll just focus on three pivotal stories.

Bank and financial panics have been central to the ebb and flow of financial freedom for all of the last hundred years. The banking panic of 1933 was surely the single event that made the great depression great. It was centrally a failure of regulators and regulation. The Federal Reserve was set up in 1914, to prevent another panic of 1907. And it promptly failed its first big test. Micro-regulation failed too. Interstate banking and branch banking were illegal. So, when the first bank of Lincoln, Nebraska failed, it could not sell assets to JP Morgan, who could have reopened the bank the next day. The bank could not recapitalize by selling shares. So the people who knew how to make loans were out selling apples.

As usual, the response to a great failure of regulation was... more regulation. Deposit insurance protected depositors. But offering insured deposits to bankers is like sending your brother-in-law to Las Vegas with your credit card. So the government started extensively regulating how banks invested, and forbade banks to compete for deposits. But people in Las Vegas with your credit card, for 20 years, get creative. From Continental Illinois to the savings and loan Crisis, to the Latin American and Southeast Asian crises, to LTCM, and Bear Stearns, and finally the great crisis of 2008, we repeated the same story: bailout larger classes of creditors, add regulations to try to stop more creative risk taking, add power to regulators who really really will see the next one ahead of time, promise it won’t happen again. Dodd Frank, and today’s “macroprudential” policy are not new, they are just the last logical patch on the same leaky ship.

An alternative idea has been around since the 1930s. Financial crises are runs, period. Runs are caused by a certain class of contract, like deposits, which promise a fixed value, first-come first-served payment, and the bank fails if it cannot pay immediately. Then, if I hear of trouble at the bank, I run down to get my money before you do, and the bank fails. The solution is simple — let banks get their money largely by issuing equity and long term debt. Such banks need no asset regulation, and no protection from competition, as they simply cannot fail. Run prone short term debt financing is the garbage in the neighbor’s back yard, and eliminating it is the key to financial freedom — and innovation.

Many of us at Hoover have been advancing this idea, adapted to modern technology, along with reform of the bankruptcy code so that large banks can fail painlessly, a lesson we should have learned from the 1930s. It is slowly gaining traction in the world of ideas, though not yet in the world of policy. A lot of vested interests will lose money in this free world, not the least of which the vast regulatory bureaucracy and economists who serve them more welcome ideas.

Second, let’s talk about international trade and capital flows. Financial freedom includes the right to buy and sell abroad as you see fit, and to invest your money or receive investment from wherever you wish, even if that crosses political boundaries. As always that freedom leads to prosperity.

The world learned a good lesson from the disastrous Smoot-Hawley tariffs of the 1930s. So, the postwar order built an international system aiming for free trade and free capital markets. Now free trade and capital should be easy. They take one-sentence bills, ideally that start “Congress shall make no law…” But each government faces strong pressure and temptations to protect its weak industries, and their employees, and to redirect its citizens’ savings to pet projects, favored sectors, and to government coffers, mixed with frankly xeonophobic fears of “foreign ownership.” So the postwar order was a long hard slog, with international institutions, long international agreements that are more managed mercantilism than free trade, and consistent US leadership. Capital freedom took even longer than trade freedom. As recently as the 1960s, US citizens were not allowed to take money abroad. Many people around the world still fact such restrictions.

This time, a crisis helped. The Bretton Woods system of 1945 envisioned free trade but little net trade, so it wanted fixed exchange rates and allowed capital controls to continue. The US deficits and inflation of the early 1970s blew that apart, leading to floating exchange rates and open capital markets.

By the 1990s, the world entered an era of vastly expanded trade and international investment, strong economic growth. The last 30 years have seen the greatest decline in poverty around the globe in all human history. Now much-maligned “globalization” and “neo-liberalism” was a big part of it. I think we shall remember it nostalgically alongside the free-trade and free-capital pax Britannica of the late 19th century.

But crises often lead to bad policy in international finance as well. The Latin American and Southeast Asian crises of the 1990s, even before the great financial crisis of 2008 unsettled many nerves. To me the stories look familiar: Latin American governments borrowed too much money, again, and US banks found a way to leverage their too-big-to-fail guarantees around the supposedly wise oversight of risk regulators, again. East Asian governments were on the hook for their banks' short term borrowing and big American banks were lending again.

But the policy community, and countries wanting cover for bailouts and expropriations, convinced themselves that dark forces were at work, “hot money” “sudden stops,” and that all foreign capital — not just short-term foreign-currency debt — is dangerous and must be controlled. Now even the IMF, formerly the bastion of free exchange rates, free capital flows, and fiscal probity, advances capital controls, exchange-rate intervention, and government spending on solar cells and consumer subsides, in the name of climate and inequality, even in times of crisis.

Moreover, I think the world of ideas failed really to understand what it had created. For a generation economists scratched their heads that countries seemed to invest mostly out of their own savings rather than borrow from abroad, and called this a puzzle. When the world started to look like our models, and huge trade and capital surpluses and deficits emerged, economists pronounced “savings gluts” and “excessive volatility” needing “policy-makers” to “manage flows,” and lots of clever economists to advise them. Time-tested verities do not get you famous in economics.

Let me close by speculating a bit about the future. It will be an… well an exiting time for those of us who value ideas in defense of a free society and who think about money, finance, and capital.

Sooner or later, if our path does not change, the western world will confront a sovereign debt crisis. Our governments have made promises they cannot keep, buttressed by economists bearing the singularly bad idea that debts do not have to be repaid. Since government debt is the core of the financial system, most of which counts on a bailout of borrowed money, the subsequent financial crisis will be unimaginably awful.

Payments, technology and financial innovation will force some fundamental choices.

We are headed to a world of electronic rather than cash transactions. But cash has one great freedom-enhancing virtue: anonymity. If the government can watch everything you buy and sell, or exclude people from the ability to transact, all sorts of freedoms vanish. Now Governments have good reasons to monitor transactions to better collect taxes, and to make life difficult for criminals, drug smugglers, and terrorists. But governments have many bad reasons: to impose capital controls and trade barriers, to prop up onerous domestic regulations, and to punish political enemies, foreign and domestic.

So a great battle of financial freedom will play out. Will the emerging electronic payments system work on the Chinese social credit model? Or will innovation undermine leviathan — and undermine even basic law enforcement efforts? Can we reestablish a balance between anonymity, freedom, and optimally imperfect enforcement of often ill-conceived financial laws and regulations?

In a larger sense, Silicon Valley is trying to do to finance what Uber did to taxis. Will the Fed and Congress allow narrow banks, electronic banks, payments networks like Libra, and internet lenders to compete and serve us better? Or will they continue to defend by regulation the oligopoly of banks and credit card companies?

Larger questions hang over us. On one political side seems to lie business as usual — unreformed, highly regulated banks, the usual subsidies such as Fannie and Freddy, student loans, and so on, with increasing restrictions on international trade and investment. On the other side lies a large increase in bank regulation, direction of credit to green new deal projects and favored constituencies, and extreme levels of capital taxation. From the Fed, central banks, IMF, OECD, BIS, CFPB, and so on, I hear only projects for ever larger expansion of their role in directing finance.

I do not hear many voices for patient liberalization. Ideas defining a free society will be sorely needed.

********

The Q&A was interesting. John Raisian wisely preempted the usual "what about inequality?" question. My main regret was not answering cogently enough the questioner who asked (paraphrase) "Now that unions are gone, who will speak for the little guy (or gal)?" What I should have said, in addition to what I did say:

The little guy or gal voluntarily dropped out of unions, and voted against pro-union politicians, because they felt unions did not speak for them. If you're a Republican, a Libertarian, a fan of school choice, concerned about pension debt, unions do not speak for you. A lot of formerly union people voted for Trump. Unions became government-supported advocates for one wing of one political party, and their members left in droves. Political parties "speak for" you if you wish someone to do that. Not unions.

Here is the text of my presentation

Hoover stands for freedom: ideas defining a free society is our motto. And economic is a central freedom: You can’t guarantee political freedom, social and lifestyle freedom, freedom of speech and expression, without economic freedom.

Economic freedom applies to capital; to financial freedom, as much as to goods, services, and labor. Freedom to buy and sell, without a government watching every transaction. Freedom to save, and invest your capital with the most promising venture, at home or abroad, or to receive investment from and sell assets to anyone you choose — whether the investments conforms to a government’s plans or not.

But freedom is not anarchy. Economic and financial freedom depend on a public economic infrastructure. They need functioning markets, property rights, an efficient court system, rule of law; They need a stable and efficient money, and a government with sound fiscal affairs that will not inflate, expropriate, or repress finance to its benefit, and freedom from confiscatory taxation.

Here lies our conundrum. The government that can set up and maintain this public architecture can restrict trade and finance. Businesses, workers and other groups can demand protection. The government can control finance for political ends and to steer resources its way. And that ever-present temptation is stronger for finance. Willie Sutton, asked why he robbed banks, responded “that’s where the money is.” Governments have noticed as well.

Ideas matter. People care about prosperity, too. Citizens and voters must understand that their own freedom, and that of their neighbors, is the best guarantor of their and the common prosperity. 250 years after Adam Smith, most of US still really does not trust that fervent competition is their best protection, not extensive regulation. See our rent control and labor laws. That necessary understanding remains even more tenuous in financial affairs

Can a more free financial, payments, monetary, and capital market system work? How? It is our job — ours, the ideas-defining-a free-society people — to put logic and experience together on this question. And the answer is not obvious. Finance paid for our astonishing prosperity. But the history of finance is also full of crashes, panics, and imbroglios. Government finance won wars, but also impoverished nations. Economic freedom does not mean freedom to dump garbage in neighbor’s back yard. Just where this parable applies to financial markets is an important question.

The last 100 years have been a great ebb and flow of freedom in financial and monetary affairs. The immediate future is cloudy, suggesting more ebb, but offering some hope for flow

Hoover scholars have been and are in the midst of it. Milton Friedman spent a quarter century here, advancing free exchange rates, free trade, open capital markets, sound money, and sound fiscal policy. John Taylor took up that baton. Allan Meltzer, author of the magisterial history of the Federal Reserve, was a frequent visiting fellow here. George Shultz spearheaded the transition to floating exchange rates and free capital movement, fought valiantly against price controls, and anchored the Reagan Administration’s effort to eliminate inflation and fix the tax code. Many others contributed, and Hoover is just as alive today.

We could spend an afternoon on the financial history of the last 100 years. I’ll just focus on three pivotal stories.

Bank and financial panics have been central to the ebb and flow of financial freedom for all of the last hundred years. The banking panic of 1933 was surely the single event that made the great depression great. It was centrally a failure of regulators and regulation. The Federal Reserve was set up in 1914, to prevent another panic of 1907. And it promptly failed its first big test. Micro-regulation failed too. Interstate banking and branch banking were illegal. So, when the first bank of Lincoln, Nebraska failed, it could not sell assets to JP Morgan, who could have reopened the bank the next day. The bank could not recapitalize by selling shares. So the people who knew how to make loans were out selling apples.

As usual, the response to a great failure of regulation was... more regulation. Deposit insurance protected depositors. But offering insured deposits to bankers is like sending your brother-in-law to Las Vegas with your credit card. So the government started extensively regulating how banks invested, and forbade banks to compete for deposits. But people in Las Vegas with your credit card, for 20 years, get creative. From Continental Illinois to the savings and loan Crisis, to the Latin American and Southeast Asian crises, to LTCM, and Bear Stearns, and finally the great crisis of 2008, we repeated the same story: bailout larger classes of creditors, add regulations to try to stop more creative risk taking, add power to regulators who really really will see the next one ahead of time, promise it won’t happen again. Dodd Frank, and today’s “macroprudential” policy are not new, they are just the last logical patch on the same leaky ship.

An alternative idea has been around since the 1930s. Financial crises are runs, period. Runs are caused by a certain class of contract, like deposits, which promise a fixed value, first-come first-served payment, and the bank fails if it cannot pay immediately. Then, if I hear of trouble at the bank, I run down to get my money before you do, and the bank fails. The solution is simple — let banks get their money largely by issuing equity and long term debt. Such banks need no asset regulation, and no protection from competition, as they simply cannot fail. Run prone short term debt financing is the garbage in the neighbor’s back yard, and eliminating it is the key to financial freedom — and innovation.

Many of us at Hoover have been advancing this idea, adapted to modern technology, along with reform of the bankruptcy code so that large banks can fail painlessly, a lesson we should have learned from the 1930s. It is slowly gaining traction in the world of ideas, though not yet in the world of policy. A lot of vested interests will lose money in this free world, not the least of which the vast regulatory bureaucracy and economists who serve them more welcome ideas.

Second, let’s talk about international trade and capital flows. Financial freedom includes the right to buy and sell abroad as you see fit, and to invest your money or receive investment from wherever you wish, even if that crosses political boundaries. As always that freedom leads to prosperity.

The world learned a good lesson from the disastrous Smoot-Hawley tariffs of the 1930s. So, the postwar order built an international system aiming for free trade and free capital markets. Now free trade and capital should be easy. They take one-sentence bills, ideally that start “Congress shall make no law…” But each government faces strong pressure and temptations to protect its weak industries, and their employees, and to redirect its citizens’ savings to pet projects, favored sectors, and to government coffers, mixed with frankly xeonophobic fears of “foreign ownership.” So the postwar order was a long hard slog, with international institutions, long international agreements that are more managed mercantilism than free trade, and consistent US leadership. Capital freedom took even longer than trade freedom. As recently as the 1960s, US citizens were not allowed to take money abroad. Many people around the world still fact such restrictions.

This time, a crisis helped. The Bretton Woods system of 1945 envisioned free trade but little net trade, so it wanted fixed exchange rates and allowed capital controls to continue. The US deficits and inflation of the early 1970s blew that apart, leading to floating exchange rates and open capital markets.

By the 1990s, the world entered an era of vastly expanded trade and international investment, strong economic growth. The last 30 years have seen the greatest decline in poverty around the globe in all human history. Now much-maligned “globalization” and “neo-liberalism” was a big part of it. I think we shall remember it nostalgically alongside the free-trade and free-capital pax Britannica of the late 19th century.

But crises often lead to bad policy in international finance as well. The Latin American and Southeast Asian crises of the 1990s, even before the great financial crisis of 2008 unsettled many nerves. To me the stories look familiar: Latin American governments borrowed too much money, again, and US banks found a way to leverage their too-big-to-fail guarantees around the supposedly wise oversight of risk regulators, again. East Asian governments were on the hook for their banks' short term borrowing and big American banks were lending again.

But the policy community, and countries wanting cover for bailouts and expropriations, convinced themselves that dark forces were at work, “hot money” “sudden stops,” and that all foreign capital — not just short-term foreign-currency debt — is dangerous and must be controlled. Now even the IMF, formerly the bastion of free exchange rates, free capital flows, and fiscal probity, advances capital controls, exchange-rate intervention, and government spending on solar cells and consumer subsides, in the name of climate and inequality, even in times of crisis.

Moreover, I think the world of ideas failed really to understand what it had created. For a generation economists scratched their heads that countries seemed to invest mostly out of their own savings rather than borrow from abroad, and called this a puzzle. When the world started to look like our models, and huge trade and capital surpluses and deficits emerged, economists pronounced “savings gluts” and “excessive volatility” needing “policy-makers” to “manage flows,” and lots of clever economists to advise them. Time-tested verities do not get you famous in economics.

Let me close by speculating a bit about the future. It will be an… well an exiting time for those of us who value ideas in defense of a free society and who think about money, finance, and capital.

Sooner or later, if our path does not change, the western world will confront a sovereign debt crisis. Our governments have made promises they cannot keep, buttressed by economists bearing the singularly bad idea that debts do not have to be repaid. Since government debt is the core of the financial system, most of which counts on a bailout of borrowed money, the subsequent financial crisis will be unimaginably awful.

Payments, technology and financial innovation will force some fundamental choices.

We are headed to a world of electronic rather than cash transactions. But cash has one great freedom-enhancing virtue: anonymity. If the government can watch everything you buy and sell, or exclude people from the ability to transact, all sorts of freedoms vanish. Now Governments have good reasons to monitor transactions to better collect taxes, and to make life difficult for criminals, drug smugglers, and terrorists. But governments have many bad reasons: to impose capital controls and trade barriers, to prop up onerous domestic regulations, and to punish political enemies, foreign and domestic.

So a great battle of financial freedom will play out. Will the emerging electronic payments system work on the Chinese social credit model? Or will innovation undermine leviathan — and undermine even basic law enforcement efforts? Can we reestablish a balance between anonymity, freedom, and optimally imperfect enforcement of often ill-conceived financial laws and regulations?

In a larger sense, Silicon Valley is trying to do to finance what Uber did to taxis. Will the Fed and Congress allow narrow banks, electronic banks, payments networks like Libra, and internet lenders to compete and serve us better? Or will they continue to defend by regulation the oligopoly of banks and credit card companies?

Larger questions hang over us. On one political side seems to lie business as usual — unreformed, highly regulated banks, the usual subsidies such as Fannie and Freddy, student loans, and so on, with increasing restrictions on international trade and investment. On the other side lies a large increase in bank regulation, direction of credit to green new deal projects and favored constituencies, and extreme levels of capital taxation. From the Fed, central banks, IMF, OECD, BIS, CFPB, and so on, I hear only projects for ever larger expansion of their role in directing finance.

I do not hear many voices for patient liberalization. Ideas defining a free society will be sorely needed.

********

The Q&A was interesting. John Raisian wisely preempted the usual "what about inequality?" question. My main regret was not answering cogently enough the questioner who asked (paraphrase) "Now that unions are gone, who will speak for the little guy (or gal)?" What I should have said, in addition to what I did say:

The little guy or gal voluntarily dropped out of unions, and voted against pro-union politicians, because they felt unions did not speak for them. If you're a Republican, a Libertarian, a fan of school choice, concerned about pension debt, unions do not speak for you. A lot of formerly union people voted for Trump. Unions became government-supported advocates for one wing of one political party, and their members left in droves. Political parties "speak for" you if you wish someone to do that. Not unions.

Tuesday, November 19, 2019

Free market health care

and transparent pricing are possible.

Russ Roberts has a great econtalk podcast, interviewing Keith Smith of the Surgery Center of Oklahoma Click on that link, roll over the areas of your body that hurt, and find out exactly how much it will cost to fix them.

No insurance. Pay a preset transparent surprisingly low price. Get surgery. A great piece of news is that this is actually possible -- you won't go to jail (yet) for just running a hospital like any other business.

Russ and Keith had one particularly good interchange on why regular hospital pricing is so screwed up. I have made the point several times that our government wants to cross-subsidize indigent care, medicare and medicaid, and the insanity of hospital and insurance billing is mostly a reaction to that. I went on to speculate that the government is also restricting competition to uphold these cross subsidies. The existence of the surgery center of Oklahoma says to some extent I am wrong about hospitals, though it raises the question why the model is so scarce.

Russ: A friend of mine recently had back surgery at an academic institution, a nonprofit regular hospital, a very good one with a good reputation. The surgery... was $101,673.77. Seriously. Now, my listeners know that macroeconomists have a sense of humor. We know they do because they use decimal points. But it turns out hospital finance offices do too. ...That is not--repeat--not--what the hospital collected from the insurance company. But that list price, that weird, enormous list price of $100,000--a little over 100,000--was on the form.

The surgery facility... got $13,000 from the insurer. You charge for that same surgery, I looked it up, a little under [$10,000]. So, they're 30% more than you for what they collect and they're 10 times what you charge on the list price.

My first question is why did they write down that goofy number of $100,000 on the bill, even though the insurance company only pays [$13,000]? ...

Keith Smith: Well, I'll back up in time. I was at a meeting where there was some hospital people and they were very angry with me because we put our prices online.... and this angry hospital administrator lost his cool....he asked me what percentage of my revenue at the Surgery Center of Oklahoma was uncompensated care.... that question haunted me, because that is a very bright, very articulate person. And he does not misspeak. I thought very carefully about what he actually said. What percentage of my revenue is uncompensated care?

[JC, in case you're skimming read the literal words. Normally, uncompensated care might be a big fraction of your costs, but sort of by definition zero percent of your revenue]

...So, I did some checking and indeed hospitals are paid to the extent that they claim that they were not paid. And this is a kickback... Hospitals are paid to the extent that they claim that they were not paid.

Russ Roberts: So, explain.

Keith Smith: So, a $100,000 bill, the hospital collects $13,000. They claim that they lost $87,000.

This $87,000 loss maintains the fiction of their not-for-profit status, but it also provides the basis for a kickback the federal government sends to this hospital in the form of what's called Disproportionate Share Hospital payments.

So, when you hear uncompensated care, that is the $87,000 that your friend saw written off on the difference between hospital insurance and what insurance paid.

So, the fact is, the hospital made money on that case. But they claimed that they lost $87,000.

And then that fictional loss provides the basis for a kickback from the federal government, called--it's uncompensated care or DSH, Disproportionate Share Hospital payments. So, as I thought about this, I began to realize that there's a lot of people in on this scam. Including the insurance companies. I mean, why would an insurance company agree to play along with this hospital? Well, the insurance company actually wants an inflated charge because then, for employers they work with, they can show that the savings that dealing with that particular insurance company generates is very, very large....

Now, what the insurers actually do is ask the hospital administrators, 'Can you do a brother a favor and actually charge $200,000 for that, so that our percentage savings actually looks larger?'It goes on like this. A definite must-listen.

In related news, "the Trump Administration Releases Transparency Rule in Hospital Pricing" reported by Stephanie Armour in the Wall Street Journal. The subhead is "legal challenges are likely!"

The final rule will compel hospitals in 2021 to publicize the rates they negotiate with individual insurers for all services, including drugs, supplies, facility fees and care by doctors who work for the facility.

The administration proposed extending the disclosure requirement to the $670 billion health-insurance industry. Insurance companies and group health plans that cover employees would have to disclose negotiated rates, as well as previously paid rates for out-of-network treatment, in file formats that are computer-searchable, officials said.

...

The requirements are more far-reaching than many industry leaders had expected and could upend commercial health-care markets, which are rife with complex systems of hidden charges and secret discounts. The price-disclosure initiative has become a cornerstone of the president’s 2020 re-election health strategy, despite threats of legal action from the industry.

Hospitals and insurers typically treat specific prices for medical services as closely held secrets, with contracts between the insurers and hospital systems generally bound by confidentiality agreements.All well and good, and a testament to lots of the good regulatory reform work going on under the radar screen in Washington. In some sense the headline chaos is quite useful. And my personal kudos to the market oriented health economists working on this effort.

But... You have to ask, just why do we need another layer of price-transparency regulations? Why are hospitals choosing such devious schemes, while grocery stores don't? Or, a better analogy, tax lawyers, contractors, car repair, pet repair, lasik surgeons, or anyone else performing complex personal services does not do this sort of thing? Are hospital administrators uniquely devious? Of course not. They are good hard-working men and women trying to do the best they can in a screwed-up regulatory and legal system.

So as long as hospitals and insurers want to play these games, as long as the strong incentives are there to play these games, so long as many arms of the government want to play these games to support medicare, medicaid and indigent care that governments don't want to pay for, I'm less than sanguine about their inability to get around a set of transparency rules. It seems about like bank risk regulation, a game of cat and mouse. It would seem more effective to reduce the government-provided incentive to screw things up in the first place. I guess that if transparency is politically hard and headed to legal challenges, reforming a system that so many people have so much vested interest in -- intellectual as well as financial -- might be even harder.

But, as long as the Surgery Center of Oklahoma is not driven out of business -- which its many competitors would surely like -- maybe there is hope. Free market, cash and carry, competitively priced health care might just upend the ossified current system.

Imagine if there were two Surgery Centers of Oklahoma, competing on price and quality...

Saturday, November 16, 2019

Wednesday, October 23, 2019

Economics and cognitive dissonance

What is the value of economics? "Have you economists ever proved anything that isn't obvious?" is a common complaint.

Tyler Cowen has an insightful post on Marginal Revolution, that provides a lovely insight into the power of economic thinking.

Often, multiple policy questions come down to a single issue. We may not know the answers to any of the questions, but we can at least say that the single issue drives the answer to all of them. So once you decide one issue goes one way, you can't (rationally) believe another issue goes another way, no matter how politically convenient that might be.

The issue here is the "elasticity of labor demand." If wages go down 10%, how many more workers will employers hire? If wages go up 10%, how many fewer will they hire? Already, note, that's one number, and it makes little sense to believe a higher number in one direction than another except for some likely quite transitory adjustment costs.

Tyler

This is a bit of economic-ese, so let me translate just a bit. The argument for a minimum wage is that labor demand is inelastic -- employers will hire the same number of workers. They will just absorb the higher wages or pass along the costs to customers. Workers get all the benefit. If labor demand is elastic, employers cut back on the number of employees. Most people lose their jobs and only a lucky (or productive, or willing to tolerate harsher working conditions) few get the higher wage.

The argument for wage subsidies requires the opposite assumption. If we subsidize wages, do employers respond by just paying people less? (Or, of we pay the subsidy to the worker, are the same number now willing to work for lower wages from employers? An often forgotten core result of economics is, it doesn't matter who pays the tax or gets the subsidy.) That is the case if labor demand is inelastic. Or do employers respond by paying the same amount, and expanding the workforce? That is the result if labor demand is elastic. You need elastic labor demand for wage subsidies to work as intended.

Thus, you can't simultaneously be for higher minimum wages and for wage subsidies. That is cognitive dissonance. Or, inconsistency. Or wishful thinking. And very common.

Likewise, just about 99% of macroeconomics is centered on the proposition that wages are "sticky." (1%, consisting of basically me, still has doubts.) If deflation breaks out, wages do not fall. Wages are too high. Employers cut back on workers, and people are unemployed. For this argument to work, (among other things) labor demand must be elastic. And then inducing exactly the same situation by minimum wages must have exactly the same result -- fewer jobs.

The point on immigration is good. The labor demand curve unites a price and a quantity. Thus, if pushing on a price has little effect on quantity, we know that pushing on a quantity has a large effect on price. Or, you have a hard time believing one thing about pushing on a price, and another thing about pushing on a quantity.

If you don't like minimum wage hikes, you can't believe that immigrants are pushing down wages. If you like higher minimum wages, you must believe that immigrants are terrible for labor markets. This proposition should be equally uncomfortable on the left and the right.

(Supply demand graphs are great here. I leave them as an exercise for the reader. If you know how to read them, this was all obvious already.)

Yes, one can complicate the analysis in each case to get a desired result -- add adjustment costs, asymmetries, or whatever. But it is striking that most discussions don't do that -- they don't reconcile that what is good for the goose ought to be good for the gander, and defend why not in a specific case.

Tyler:

Update: Casey Mulligan complains that Tyler and I both left out the many margins of adjustment that happen in response to minimum wages, such as making hours less convenient, reducing benefits, making work less pleasant, and so forth. Casey's right, but Casey needs to relax! This isn't an extensive minimum wage post. I've blogged about those effects many times before. They're real and important. And the other side may want to complicate things as well. Before we come up for excuses why (say) minimum wages and immigration are different, let us at least acknowledge the simple model in which they are the same, and that to the extent labor demand elasticity bears in the analysis of each, one should use a consistent assumption on that ingredient.

Tyler Cowen has an insightful post on Marginal Revolution, that provides a lovely insight into the power of economic thinking.

Often, multiple policy questions come down to a single issue. We may not know the answers to any of the questions, but we can at least say that the single issue drives the answer to all of them. So once you decide one issue goes one way, you can't (rationally) believe another issue goes another way, no matter how politically convenient that might be.

The issue here is the "elasticity of labor demand." If wages go down 10%, how many more workers will employers hire? If wages go up 10%, how many fewer will they hire? Already, note, that's one number, and it makes little sense to believe a higher number in one direction than another except for some likely quite transitory adjustment costs.

Tyler

There is a longer history of minimum wage assumptions not really being consistent with other economic views.

Have you ever heard someone argue for wage subsidies and minimum wage hikes? No go! The demand for labor is either elastic or it is not.

Have you ever heard someone argue for minimum wage hikes and inelastic labor demand, yet claim that immigrants do not lower wages? Well, the latter claim about immigration implies elastic labor demand.

Have you ever heard someone argue that “sticky wages” reduce employment in hard times but government-imposed sticky minimum wages do not? Uh-oh. [The link is good too - JC]

It would seem we can now add to that list. Maybe we will see a new view come along:

“Labor demand is elastic when licensing restrictions are imposed, but labor demand is inelastic when minimum wages are imposed.”

This is a bit of economic-ese, so let me translate just a bit. The argument for a minimum wage is that labor demand is inelastic -- employers will hire the same number of workers. They will just absorb the higher wages or pass along the costs to customers. Workers get all the benefit. If labor demand is elastic, employers cut back on the number of employees. Most people lose their jobs and only a lucky (or productive, or willing to tolerate harsher working conditions) few get the higher wage.

The argument for wage subsidies requires the opposite assumption. If we subsidize wages, do employers respond by just paying people less? (Or, of we pay the subsidy to the worker, are the same number now willing to work for lower wages from employers? An often forgotten core result of economics is, it doesn't matter who pays the tax or gets the subsidy.) That is the case if labor demand is inelastic. Or do employers respond by paying the same amount, and expanding the workforce? That is the result if labor demand is elastic. You need elastic labor demand for wage subsidies to work as intended.

Thus, you can't simultaneously be for higher minimum wages and for wage subsidies. That is cognitive dissonance. Or, inconsistency. Or wishful thinking. And very common.

Likewise, just about 99% of macroeconomics is centered on the proposition that wages are "sticky." (1%, consisting of basically me, still has doubts.) If deflation breaks out, wages do not fall. Wages are too high. Employers cut back on workers, and people are unemployed. For this argument to work, (among other things) labor demand must be elastic. And then inducing exactly the same situation by minimum wages must have exactly the same result -- fewer jobs.

The point on immigration is good. The labor demand curve unites a price and a quantity. Thus, if pushing on a price has little effect on quantity, we know that pushing on a quantity has a large effect on price. Or, you have a hard time believing one thing about pushing on a price, and another thing about pushing on a quantity.

If you don't like minimum wage hikes, you can't believe that immigrants are pushing down wages. If you like higher minimum wages, you must believe that immigrants are terrible for labor markets. This proposition should be equally uncomfortable on the left and the right.

(Supply demand graphs are great here. I leave them as an exercise for the reader. If you know how to read them, this was all obvious already.)

Yes, one can complicate the analysis in each case to get a desired result -- add adjustment costs, asymmetries, or whatever. But it is striking that most discussions don't do that -- they don't reconcile that what is good for the goose ought to be good for the gander, and defend why not in a specific case.

Tyler:

Third addendum: Of course there are numerous other ways this analysis could run. What is striking to me is that people don’t seem to undertake it at all.It is interesting in policy debates how people debating each issue seem not to connect with other issues. Clear thinking is hard. "Wait, this comes down to the elasticity of labor demand, and we made the opposite assumption last Tuesday discussing immigration" is not the sort of thought that occurs naturally. It is also a sign that policy-oriented economics is all too often searching for justification of pre-determined answers.

Update: Casey Mulligan complains that Tyler and I both left out the many margins of adjustment that happen in response to minimum wages, such as making hours less convenient, reducing benefits, making work less pleasant, and so forth. Casey's right, but Casey needs to relax! This isn't an extensive minimum wage post. I've blogged about those effects many times before. They're real and important. And the other side may want to complicate things as well. Before we come up for excuses why (say) minimum wages and immigration are different, let us at least acknowledge the simple model in which they are the same, and that to the extent labor demand elasticity bears in the analysis of each, one should use a consistent assumption on that ingredient.

Friday, October 18, 2019

Who pays more taxes

A retired guy and a carpenter walk in to a bar, and they each order a beer. When they pay, the fashionable progressive economist asks them, "how much tax did you pay today on the money you got to buy that beer?" The carpenter answers, "Well, I just got my paycheck today. So, that's 30% federal income tax, 5% state income tax, 15% social security and other payroll taxes." The retiree says, "I took the money out of my bank account at the ATM on the way over. There isn't a tax on taking money out of banks so I didn't pay any taxes today."

"The shame, the horror, the inequality!," proclaims the progressive economist, sending the preprint of his study in the New York Times. "Retirees, who have a lot more in their bank accounts than working folks, aren't paying any taxes! All the taxes are being shouldered by poor workers! We need to tax money people take out of banks!"

"Wait a darn-tootin' minute," says the retiree, having spilled half his beer. (Old people talk like that.) "I worked my whole life. I paid Federal income taxes, state income taxes, city income taxes, and payroll taxes on that money. My company paid sales taxes, corporate income taxes, property taxes, mitigation fees and so on out of every dollar I billed made for them. I paid vastly overinflated health insurance to cross subsidize medicaid, medicare, and indigent care. I saved for my retirement, rather than blowing it all when I was young. Then every year I paid taxes on interest and dividends, and capital gains when I rebalanced my portfolio. It's a miracle I still have this lousy $5 left to buy a beer. No, thank goodness there is not a take-it-out-of-the-bank tax. But I paid a heck of a lot of taxes on this money!"

I think this little story captures the essence of one of the many little -- well, Phillip Magness in in the AEIER, reflecting a little traditional conservative politeness, calls them "fibs" -- in the latest Saez-Zucman effort to prove that rich people pay less taxes than you and I, an equally ardent effort to prove that despite everyone else's numbers the rich really did pay a lot more taxes in the golden 1950s, reinforcing the trope cited even in the Democratic debates* with lightning speed.

Others have torn the numbers apart, including Magness, David Splinter at the Joint Committee on Taxation, Larry Kotlikoff in the Wall Street Journal, Robert Verbuggen in the National Review, Michael R. Strain at Bloomberg and many others. To usually sleep-inducing results. Hand it to Saez and Zucman to know how to tell the big fib and get your name in the headlights. So let me focus on two very simple problems that my little story highlights.

"The shame, the horror, the inequality!," proclaims the progressive economist, sending the preprint of his study in the New York Times. "Retirees, who have a lot more in their bank accounts than working folks, aren't paying any taxes! All the taxes are being shouldered by poor workers! We need to tax money people take out of banks!"

"Wait a darn-tootin' minute," says the retiree, having spilled half his beer. (Old people talk like that.) "I worked my whole life. I paid Federal income taxes, state income taxes, city income taxes, and payroll taxes on that money. My company paid sales taxes, corporate income taxes, property taxes, mitigation fees and so on out of every dollar I billed made for them. I paid vastly overinflated health insurance to cross subsidize medicaid, medicare, and indigent care. I saved for my retirement, rather than blowing it all when I was young. Then every year I paid taxes on interest and dividends, and capital gains when I rebalanced my portfolio. It's a miracle I still have this lousy $5 left to buy a beer. No, thank goodness there is not a take-it-out-of-the-bank tax. But I paid a heck of a lot of taxes on this money!"

I think this little story captures the essence of one of the many little -- well, Phillip Magness in in the AEIER, reflecting a little traditional conservative politeness, calls them "fibs" -- in the latest Saez-Zucman effort to prove that rich people pay less taxes than you and I, an equally ardent effort to prove that despite everyone else's numbers the rich really did pay a lot more taxes in the golden 1950s, reinforcing the trope cited even in the Democratic debates* with lightning speed.

Others have torn the numbers apart, including Magness, David Splinter at the Joint Committee on Taxation, Larry Kotlikoff in the Wall Street Journal, Robert Verbuggen in the National Review, Michael R. Strain at Bloomberg and many others. To usually sleep-inducing results. Hand it to Saez and Zucman to know how to tell the big fib and get your name in the headlights. So let me focus on two very simple problems that my little story highlights.

Friday, September 13, 2019

Bans on fracking and nuclear power

If you want evidence that climate policy has become unhinged from science and quantification, becoming more like a religious cult, look no further than the recent Democratic presidential candidates' proposals to ban fracking immediately and nuclear power soon.

From Michael Cembalest at JP Morgan

I'm not a denier. Yes, carbon is a problem, warming is a problem, and a uniform carbon tax, vast expansion of nuclear energy, more renewables, lots of R&D on them, GMO foods, and geoenginnering are solutions. (If indeed warmer weather is an existential crisis, and if indeed $2 billion of soot in the upper atmosphere solves it, that should at least be on the table.) Actual, quantitative, scientific solutions. They don't atone for our carbon sins.

A ban on fracking and nuclear are not solutions, and will raise carbon emissions. The US is doing better on carbon reduction than other countries, because of fracking and natural gas. Unlike Germany, who has followed these policies, we cannot rely on Eastern European coal and Russian gas.

I am delighted to see that despite my fears of how extensive discretionary regulation will silence dissent, Mr Cembalest can still write such a note, with the JP Morgan imprimatur. We'll see how long such heresy survives more intense financial regulation and "stakeholder" control of corporate boards. "Eco-authoriarianism" and a "coercive green new deal" are already openly advocated, here for example.

From Michael Cembalest at JP Morgan

I'm not a denier. Yes, carbon is a problem, warming is a problem, and a uniform carbon tax, vast expansion of nuclear energy, more renewables, lots of R&D on them, GMO foods, and geoenginnering are solutions. (If indeed warmer weather is an existential crisis, and if indeed $2 billion of soot in the upper atmosphere solves it, that should at least be on the table.) Actual, quantitative, scientific solutions. They don't atone for our carbon sins.

A ban on fracking and nuclear are not solutions, and will raise carbon emissions. The US is doing better on carbon reduction than other countries, because of fracking and natural gas. Unlike Germany, who has followed these policies, we cannot rely on Eastern European coal and Russian gas.

I am delighted to see that despite my fears of how extensive discretionary regulation will silence dissent, Mr Cembalest can still write such a note, with the JP Morgan imprimatur. We'll see how long such heresy survives more intense financial regulation and "stakeholder" control of corporate boards. "Eco-authoriarianism" and a "coercive green new deal" are already openly advocated, here for example.

Monday, September 9, 2019

More on low long-term interest rates

In an environment with stable inflation, the yield curve should typically be inverted.

Long term investors care about money when they retire, not next month. Most investors are long-term.

If inflation is steady, long-term bonds are a safer way to save money for the long run. If you roll over short-term bonds, then you do better when interest rates rise, and do worse when interest rates fall, adding risk to your eventual wealth. The long-term bond has more mark-to-market gains and losses, but you don't care about that. You care about the long term payout, which is less risky. (Throw out the statements and stop worrying.) So, in an environment with varying real rates and steady inflation, we expect long rates to be less than short rates, because short rates have to compensate investors for extra risk.

If, by contrast, inflation is volatile and real rates are steady, then long-term bonds are riskier. When inflation goes up, the short term rate will go up too, and preserve the real value of the investment, and vice versa. The long-term bond just suffers the cumulative inflation uncertainty. In that environment we expect a rising yield curve, to compensate long bond holders for the risk of inflation.

So, another possible reason for the emergence of a downward sloping yield curve is that the 1970s and early 1980s were a period of large inflation volatility. Now we are in a period of much less inflation volatility, so most interest rate variation is variation in real rates. Markets are figuring that out.

Most of the late 19th century had an inverted yield curve. UK perpetuities were the "safe asset," and short term lending was risky. It also lived under the gold standard which gave very long-run price stability.

(Yes, this argument is about portfolio variance, not beta, and assumes that the bond portfolio is a substantial part of the investor's wealth, or that inflation happens in bad times, at least over the investor's long horizon.)

***

This is a follow-up to low bond yields. That post has several good comments with links to the literature.

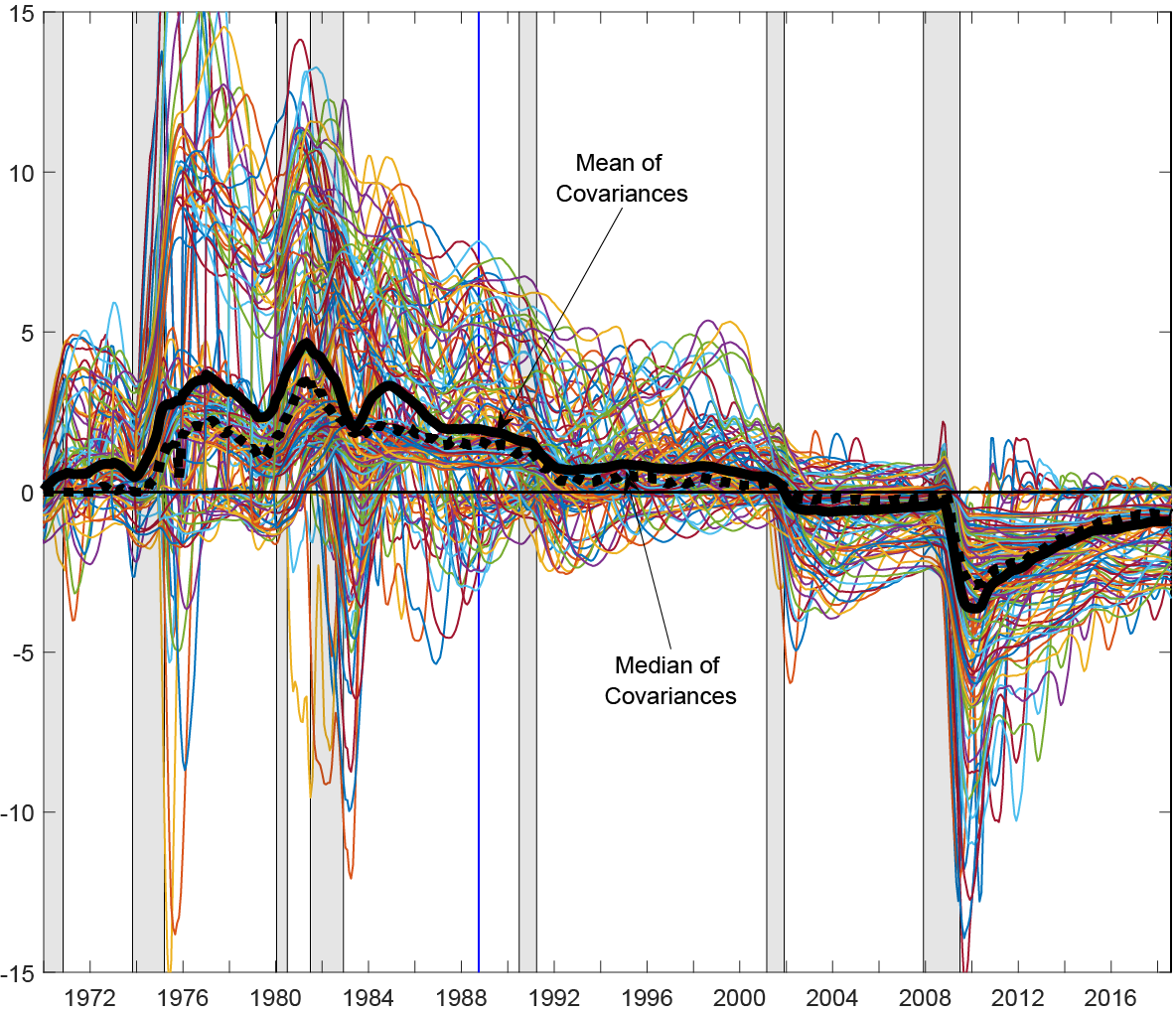

On that point, Uri Carl and Anthony Dierks send along this lovely graph from their note which makes the same point as my earlier blog post. The plot is different measures of the time-varying "covariance between Real Activity and Nominal Measures." The covariance changes sign, as I suspected.

Long term investors care about money when they retire, not next month. Most investors are long-term.

If inflation is steady, long-term bonds are a safer way to save money for the long run. If you roll over short-term bonds, then you do better when interest rates rise, and do worse when interest rates fall, adding risk to your eventual wealth. The long-term bond has more mark-to-market gains and losses, but you don't care about that. You care about the long term payout, which is less risky. (Throw out the statements and stop worrying.) So, in an environment with varying real rates and steady inflation, we expect long rates to be less than short rates, because short rates have to compensate investors for extra risk.

If, by contrast, inflation is volatile and real rates are steady, then long-term bonds are riskier. When inflation goes up, the short term rate will go up too, and preserve the real value of the investment, and vice versa. The long-term bond just suffers the cumulative inflation uncertainty. In that environment we expect a rising yield curve, to compensate long bond holders for the risk of inflation.

So, another possible reason for the emergence of a downward sloping yield curve is that the 1970s and early 1980s were a period of large inflation volatility. Now we are in a period of much less inflation volatility, so most interest rate variation is variation in real rates. Markets are figuring that out.

Most of the late 19th century had an inverted yield curve. UK perpetuities were the "safe asset," and short term lending was risky. It also lived under the gold standard which gave very long-run price stability.

(Yes, this argument is about portfolio variance, not beta, and assumes that the bond portfolio is a substantial part of the investor's wealth, or that inflation happens in bad times, at least over the investor's long horizon.)

***

This is a follow-up to low bond yields. That post has several good comments with links to the literature.

On that point, Uri Carl and Anthony Dierks send along this lovely graph from their note which makes the same point as my earlier blog post. The plot is different measures of the time-varying "covariance between Real Activity and Nominal Measures." The covariance changes sign, as I suspected.

Intellectual property and the trade deficit

"The IP Commission estimates that between $200 billion and $500 billion a year of intellectual property is stolen from the U.S." I found this interesting tidbit in The Atlantic interview of Kevin Hassett, ex CEA chair. (HT Marginal Revolution)

Well, suppose China were to pay up, and pay the $200 to $500 billion a year in royalty payments. Where would it get the money from? Hmm. It would have to sell us an additional $200 to $500 billion worth of exports, that's how. The trade deficit would have to increase.

China could sell us $200 to $500 billion a year of assets instead. Maybe we would like to hold lots of Chinese stocks, bonds, or government bonds rather than buy more boatloads of goods? But if we bought worthwhile Chinese assets, those are only claims on future Chinese profits. And the only use we have for lots and lots of Chinese currency profits is to... buy things in China and send them here. If we bought worthless assets, bonds that default, or stocks whose legal rights evaporate, then, well, we're back where we started.

Or maybe we don't want to license IP, we just think US owned firms operating in China could make an additional $200 to $500 billion per year profits operating in China without Chinese competition. And what do US owners want to do with $200 to $500 billion of Chinese profits per year? Go on a shopping trip, and put it on boats, sooner or later.

One way or another, the only way that China can properly pay for intellectual property, is to put more stuff on boats and send it to us. Paying for intellectual property must increase the trade deficit.

Being a free trader, I think this is great. The point of trade is to get the imports. The point of intellectual property is to force China to send us boatloads of stuff.

Somehow I don't think the Administration sees it that way. But you can't escape addition.

Well, suppose China were to pay up, and pay the $200 to $500 billion a year in royalty payments. Where would it get the money from? Hmm. It would have to sell us an additional $200 to $500 billion worth of exports, that's how. The trade deficit would have to increase.

China could sell us $200 to $500 billion a year of assets instead. Maybe we would like to hold lots of Chinese stocks, bonds, or government bonds rather than buy more boatloads of goods? But if we bought worthwhile Chinese assets, those are only claims on future Chinese profits. And the only use we have for lots and lots of Chinese currency profits is to... buy things in China and send them here. If we bought worthless assets, bonds that default, or stocks whose legal rights evaporate, then, well, we're back where we started.

Or maybe we don't want to license IP, we just think US owned firms operating in China could make an additional $200 to $500 billion per year profits operating in China without Chinese competition. And what do US owners want to do with $200 to $500 billion of Chinese profits per year? Go on a shopping trip, and put it on boats, sooner or later.

One way or another, the only way that China can properly pay for intellectual property, is to put more stuff on boats and send it to us. Paying for intellectual property must increase the trade deficit.

Being a free trader, I think this is great. The point of trade is to get the imports. The point of intellectual property is to force China to send us boatloads of stuff.

Somehow I don't think the Administration sees it that way. But you can't escape addition.

Sunday, September 8, 2019

Low bond yields

Why are interest rates so low?

Here is the 10 year bond yield, by itself and subtracting the previous year's inflation (CPI less food and energy). The 10 year yield has basically been on a downward trend since 1987. One should subtract expected 10 year future inflation, not past inflation, and you can see the extra volatility that past inflation induces. But you can also see that real yields have fallen with the same pattern.

There is lots of discussion. A falling marginal product of capital, due to falling innovation, less need for new capital, a "savings glut," and so forth are common ideas. The use of government bonds in finance, the money-like nature of government debt among other institutional investors and liquidity stories are strong too. And most of the press is consumed with QE and central bank purchases holding down long term rates. I hope the steadiness of the trend cures that promptly.

Along the way in another project, though, I made the following graph:

The blue line is 10 times the growth rate of nondurable + services per capita (quarterly data, growth from a year ago). The red line is the negative of an approximate measure of the real return on 10 year government bonds. I took 10 x (yield - yield a year ago), and subtracted off the CPI.

Look at the last recession. Consumption fell like a rock, while the real return on long-term bonds was great. That real return came from a double whammy: long term bonds had great nominal returns as interest rates fell, and there was a big decline in inflation. No shock, there is a "flight to quality" in recessions, along with a sharp decline in nominal rates. From a foreign perspective, the rise in the dollar added to the return of long-term bonds. The graph suggests this is a regular pattern going back to the almost-recession of 1987. In every recession, consumption falls, interest rates fall, inflation falls, so the real ex post return on government bonds rises.

Government bonds are negative beta securities. At least measured by consumption or recession betas. Negative beta securities should have low expected returns. They should be less even than real risk free rates. I haven't seen that simple thought anywhere in the discussion of low long-term interest rates.

Making the graph, I noticed it was not always thus. 1975, 1980, and 1982 have precisely the opposite sign. These were stagflations, times when bad economic times coincided with higher inflation and higher interest rates. Likewise, countries such as Argentina which go through periodic currency crises, devaluations, and inflations, flights to the dollar, all associated with bad economic times, should have the opposite sign. There is a hint that 1970 was of the current variety.

One could easily make a story for the sign flip, involving recessions caused by monetary policy and attempts to control inflation, vs. recessions involving financial problems in which people run to, rather than from, money in the recession.

In any case, the period of high yields was associated with government bonds that do worse in recessions, and the period of low yields is associated with government bonds that do better in recessions and have a negative beta. I haven't really seen that point made, though I am not fully up on the literature on time-varying betas in bond markets.

In any case, if we want to understand risk premiums in bond markets, this sort of simple macro story might be a good starting point before layering on institutional complexities.

Here is the 10 year bond yield, by itself and subtracting the previous year's inflation (CPI less food and energy). The 10 year yield has basically been on a downward trend since 1987. One should subtract expected 10 year future inflation, not past inflation, and you can see the extra volatility that past inflation induces. But you can also see that real yields have fallen with the same pattern.

There is lots of discussion. A falling marginal product of capital, due to falling innovation, less need for new capital, a "savings glut," and so forth are common ideas. The use of government bonds in finance, the money-like nature of government debt among other institutional investors and liquidity stories are strong too. And most of the press is consumed with QE and central bank purchases holding down long term rates. I hope the steadiness of the trend cures that promptly.

Along the way in another project, though, I made the following graph:

The blue line is 10 times the growth rate of nondurable + services per capita (quarterly data, growth from a year ago). The red line is the negative of an approximate measure of the real return on 10 year government bonds. I took 10 x (yield - yield a year ago), and subtracted off the CPI.

Look at the last recession. Consumption fell like a rock, while the real return on long-term bonds was great. That real return came from a double whammy: long term bonds had great nominal returns as interest rates fell, and there was a big decline in inflation. No shock, there is a "flight to quality" in recessions, along with a sharp decline in nominal rates. From a foreign perspective, the rise in the dollar added to the return of long-term bonds. The graph suggests this is a regular pattern going back to the almost-recession of 1987. In every recession, consumption falls, interest rates fall, inflation falls, so the real ex post return on government bonds rises.

Government bonds are negative beta securities. At least measured by consumption or recession betas. Negative beta securities should have low expected returns. They should be less even than real risk free rates. I haven't seen that simple thought anywhere in the discussion of low long-term interest rates.

Making the graph, I noticed it was not always thus. 1975, 1980, and 1982 have precisely the opposite sign. These were stagflations, times when bad economic times coincided with higher inflation and higher interest rates. Likewise, countries such as Argentina which go through periodic currency crises, devaluations, and inflations, flights to the dollar, all associated with bad economic times, should have the opposite sign. There is a hint that 1970 was of the current variety.

One could easily make a story for the sign flip, involving recessions caused by monetary policy and attempts to control inflation, vs. recessions involving financial problems in which people run to, rather than from, money in the recession.

In any case, the period of high yields was associated with government bonds that do worse in recessions, and the period of low yields is associated with government bonds that do better in recessions and have a negative beta. I haven't really seen that point made, though I am not fully up on the literature on time-varying betas in bond markets.

In any case, if we want to understand risk premiums in bond markets, this sort of simple macro story might be a good starting point before layering on institutional complexities.

Saturday, August 24, 2019

Why stop at 100? The case for perpetuities

Issue 100-year Treasurys, advocates the Wall Street Journal. It mentions a short note deep on the Treasury website that

(I wrote a whole paper on this a while ago, if you want lots of detail and answers to practical questions. Unfortunately the Treasury website does not say how to send in suggestions, and nobody outreached to me, so this blog post is it.)

Perpetuities are bonds with no principal payment. Each perpetuity pays $1 forever. If interest rates are 3%, to borrow $100, the government would sell three perpetuities, and then pay investors $3 each year. When the government wants to pay back the debt, it simply buys back the perpetuities on the open market.

A 100 year bond is almost a perpetuity. If the government issues a $100 100 year bond at 3%, only 100/(1.03)^100 = $5.20 of that value comes from the $100 principal payment. 95% of the value of a 100 year bond is already in the stream of coupons. For the investor, they are practically the same security. In particular they have nearly the same sensitivity to interest rate changes.

But perpetuities are better. Most of all: Perpetuities would be much more liquid -- easy to buy, sell, and use as collateral. The reason is simple. Once 100 year bonds get going, there would be 100 separate and distinct issues outstanding. The 2123 2.6% 100 year bond is a different bond from the 2124 2.7% 100 year bond. If a dealer has an order for the first and an offer for the second, he or she cannot make the trade. If you borrow and sell short the first, you cannot deliver the second in return. This segmentation would make the markets for each bond thinner, and the bid ask spread larger. It would keep a lot of dealers and traders and market makers needlessly in business, which may be one good reason the financial industry seems largely against the idea.

Perpetuities, by contrast, are a single security. When the government borrows more next year, it is borrowing more of the same security. There is one, thick, transparent, low-spread market.

A more liquid market would pay lower rates. Much of the point is for the government to borrow at low rates. Much of the reason government debt has such low interest rates is that it is very liquid -- easy to buy and sell, the "safe haven" in bad times and so forth. Government debt is somewhat like money, and like money pays less interest in return for its liquidity. Well, then, the more liquid the better!

A 100 year bond would make sense if there were a group of investors sitting around who really wanted to have $3 coupons for 100 years, and then $100 exactly in 100 years, not 101 years, and they were not planning to buy or sell in the meantime. That is not remotely the case. Long term bonds are actively traded. Perpetuities match the varied investment horizons of ultimate investors, and by being more liquid are more flexible.

There is plenty of historical precedent. Perpetuities actually came before long-term bonds. They were the cornerstone of UK finance for the entire 19th century.

One can raise a bunch of practical objections, and if you have them go check out the paper.

Lower costs? The WSJ only advocates 100 year debt on the notion it would give the Treasury a lower borrowing cost when yield curves are inverted. This is a good argument, but more difficult and subtle than the WSJ lets on. The current yield is not the lifetime cost. The 100 year cost of borrowing with short term bonds depends on what short term interest rates do in the future. If rates go up, it costs eventually more to borrow short. If rates go down it costs less, even if the current yield curve is inverted. In the benchmark "expectations model" yields have already adjusted so the expected cost is the same. The issue is the same to a household deciding between an ARM and a fixed rate mortgage. Even if the current ARM rate is higher than the fixed, if ARM rates go down in the future, the ARM could end up being better.

My paper was part of a conference at Treasury, published by Brookings. I had a good debate with Robin Greenwood, Sam Hanson, Joshua Rudolph, and Larry Summers who wrote The Optimal Maturity of Government Debt (available here). They argued for borrowing short, not long. A the time the yield curve was steeply upward sloping, and in their simulations they opined that the chance of short rates rising and long rates declining to the point that the cost advantage would invert was small. The current reality has changed that conclusion as now it is the short rates that are higher.

Still, I think this is the wrong way to look at it. The Treasury is not in a great position to play bond trader and figure out where small variations in the yield curve reflect profitable opportunities.

Risk management. Like all investors, though, the Treasury's first question should be risk management, not profit. And there is a great risk facing the US Treasury. We are clearly going to run up a lot more debt before sanity sets in. Go look at the just released CBO Long Term Debt Outlook.

Net interest is already large. What happens if interest rates go up? Yes, they are unbelievably low now. But nobody really knows why. Between "secular stagnation" and "r* has declined" and "savings glut" you can see economists making things up right and left. So, you should not have huge confidence that we will not return to historically normal interest rates of the last few centuries, or moreover that we will never suffer the kinds of interest rate spikes that happen to highly indebted countries trying to roll over 100% of GDP or so debt in a recession, financial crisis, or war. If interest rates rise sharply, the US Treasury, having borrowed short, is screwed. We bought the ARM at a teaser rate.

This, to me, is the real argument that the government should issue lots more long-term debt; 100 years if needed (but please, only every 10 years or so!) or, much better, perpetuities. Buy the fixed rate mortgage, and you keep the house no matter what happens to rates. Let's keep the house. In this discussion with Greenwood et al, they argued that the chance of such an interest rate spike is low. Perhaps, but the insurance is cheap -- and with a flat or inverted yield curve it's even cheaper.

Borrow long to buy insurance, not just for a good deal.

Update:

In response to a few comments. In the paper I proposed that the Treasury issue 1) fixed-rate perpetuities -- a security that pays one dollar forever -- 2) floating-rate perpetuities -- just like Fed reserves, the interest rate adjusts daily and the price is always exactly $1.00 3) indexed perpetuities -- it pays one dollar adjusted for the CPI (or one of its improved versions) forever. The first eventually replaces all long term debt, the second eventually replaces all short term debt, and the third replaces TIPS.

The second is really more important, and I'll do a separate post eventually. If the treasury offered a fixed-value floating-rate instantly transferrable security just like reserves, it would do wonders for the financial system.

Treasury’s Office of Debt Management is conducting broad outreach to refresh its understanding of market appetite for a potential Treasury ultra-long bond (50- or 100-year bonds).My 2 cents: Why stop at 100? Issue perpetuities!

(I wrote a whole paper on this a while ago, if you want lots of detail and answers to practical questions. Unfortunately the Treasury website does not say how to send in suggestions, and nobody outreached to me, so this blog post is it.)

Perpetuities are bonds with no principal payment. Each perpetuity pays $1 forever. If interest rates are 3%, to borrow $100, the government would sell three perpetuities, and then pay investors $3 each year. When the government wants to pay back the debt, it simply buys back the perpetuities on the open market.

A 100 year bond is almost a perpetuity. If the government issues a $100 100 year bond at 3%, only 100/(1.03)^100 = $5.20 of that value comes from the $100 principal payment. 95% of the value of a 100 year bond is already in the stream of coupons. For the investor, they are practically the same security. In particular they have nearly the same sensitivity to interest rate changes.

But perpetuities are better. Most of all: Perpetuities would be much more liquid -- easy to buy, sell, and use as collateral. The reason is simple. Once 100 year bonds get going, there would be 100 separate and distinct issues outstanding. The 2123 2.6% 100 year bond is a different bond from the 2124 2.7% 100 year bond. If a dealer has an order for the first and an offer for the second, he or she cannot make the trade. If you borrow and sell short the first, you cannot deliver the second in return. This segmentation would make the markets for each bond thinner, and the bid ask spread larger. It would keep a lot of dealers and traders and market makers needlessly in business, which may be one good reason the financial industry seems largely against the idea.

Perpetuities, by contrast, are a single security. When the government borrows more next year, it is borrowing more of the same security. There is one, thick, transparent, low-spread market.

A more liquid market would pay lower rates. Much of the point is for the government to borrow at low rates. Much of the reason government debt has such low interest rates is that it is very liquid -- easy to buy and sell, the "safe haven" in bad times and so forth. Government debt is somewhat like money, and like money pays less interest in return for its liquidity. Well, then, the more liquid the better!