"Nobody Knows How Interest Rates Affect Inflation" is a new oped in the Wall Street Journal August 25. (Full version will be posted here Sept 25). It's a distillation of two recent essays, Expectations and the Neutrality of Interest Rates and Inflation Past, Present, and Future and some recent talks.

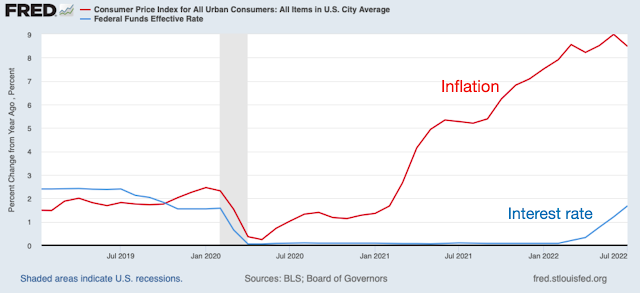

The Fed has only very slowly raised interest rates in response to inflation:

Does the Fed's slow reaction mean that inflation will spiral away, until the Fed raises interest rates above inflation? The traditional theory says yes. In this theory, inflation is unstable when the Fed follows an interest rate target. Unstable:

In this view, the Fed must promptly raise interest rates above inflation to contain inflation, as the seal must move its nose more than one for one to get back under the ball. Until we get interest rates of 9% and more inflation will spiral upward.

The view comes fundamentally from adaptive expectations. Inflation = expected inflation - (effect of high real interest rates, i.e. interest rate - expected inflation). If expected inflation is last year's inflation, you can see inflation spirals up until the real interest rate is positive.

But an alternative view says that inflation is fundamentally stable. Stable:

In this view, a shock to inflation will eventually fade away even if the Fed does nothing. The Fed can help by raising interest rates, but it does not have to exceed inflation. (That is, so long as there is no new shock, like another fiscal blowout.) This view comes from rational expectations. That term has a bad connotation. It only means that people think broadly about the future, and are no worse than, say, Fed economists, at forecasting inflation. Story: If you drive looking in the rear view mirror (expected road = past road), you veer off the road, unstable. If you look forward, even badly, (expected road = future road), the car will eventually get back on the road.

Econometric tests aren't that useful -- inflation and interest rates move together in the long run in both views, and jiggle around each other. Episodes are salient. The unstable view points to the 1970s:

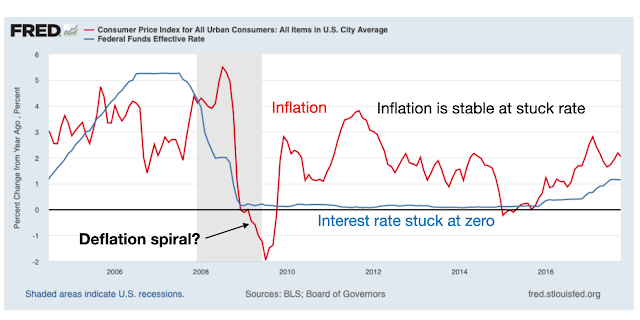

The Fed reacted too slowly to shocks, the story goes, letting inflation spiral up until it finally got its nose under the ball in 1980, driving inflation back down again. But the stable view points to the 2010s:

It's exactly the opposite situation. Deflation broke out. The Fed could not move interest rates below zero. The classic analysis screamed "here comes the deflation spiral." It didn't happen. Wolf. If the deflation spiral did not break out, why will an inflation spiral break out now?

Not elsewhere: As I look at these, I start to have additional doubts about the classic story of the 1970s. The Fed did move interest rates one for one. Inflation did not simply spiral out of control. For example, note in 1975, inflation did come right back down again, even though interest rates never got above inflation. The simple spiral story does not explain why 1975 was briefly successful. Each of the waves of inflation also was sparked by new shocks.

Who is right? I don't pound my fist on the table, but stability, at least in the long run, is looking more and more likely to me. That says inflation will eventually go away, after the price level has risen enough to inflate away the recent debt blowout, even if the Fed never raises rates above inflation. In any case, it looks like we have another really significant episode all set up, to add to the 1970s and 2010s. If inflation spirals, stability is in trouble. If inflation fades away and interest rates never exceed inflation, the classic view is really in trouble. The ingredients are stirred, the test tube is on the table...

But, that's a conditional mean. A new shock could send inflation spiraling up again, just as may have happened in the 1970s. New virus, China invades Taiwan, financial crisis, sovereign debt crisis, another fiscal blowout -- if the US forgives college debt, why not forgive home loans? Credit cards? -- all could send inflation up again, and ruin this beautiful experiment.

As you clearly said the source of the shocks seems to drive the magnitude of how much should the interest rate raise. It clearly depends on whether if is the financial crisis, the war or the fiscal theory of price.

ReplyDeleteSeems to me any discussion of inflation without mentioning the money supply is incomplete, and often misleading. The unstated premise in such discussions seems to be that though interest rate manipulation is accomplished by tweaking (or choking, or goosing) the money supply, it's unnecessary to be explicit about it. But that, IMHO, promotes confusion that's already rife in the media and even among some economists and policy makers. Isn't it relevant added information to say, for example, that inflation is unlikely to recede if the money supply, or alternatively, nominal GDP, is growing rapidly, or alternatively, steady or declining? After all, interest rates could be "high" or "low" under either scenario.

ReplyDeleteGreat point. John misses the ball by excluding this from his discussions on the topic. The only thing the Fed can do is adjust the money supply and let the market determine the rates. The overnight rate is meaningless.

DeleteWell, how could anybody vote against Tintin's Professor Calculus?

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteVolker's first attempt failed. His second attempt succeeded, according to his lights, but wrecked havoc with millions of households in the process. Powell, J., is doing his best imitation of Volker's second attempt.

ReplyDeleteThe natural experiment that you identify in your narrative above is not going to be allowed to proceed, if Powell, J., has his way with the FOMC voting members.

A paper authored by Foley, D. K., K. Shell, and M. Sidrauski, titled "Optimal Fiscal and Monetary Policy and Economic Growth", published in the Journal of Political Economy, v. 77, no. 4, Part 2: Symposium on the Theory of Economic Growth (July - Aug., 1969), pp. 698-719, looks at the deterministic case of "a modern "mixed" economy in which the government can influence investment and saving, but only indirectly, by manipulating certain basic variables like the deficit and the money supply."

In Foley-Shell-Sidrauski's view, "[t]he very term "mixed economy" implies that there are two centers of decision making and that the preferences of the consumers and of the government are distinguishable. It is not at all clear where the preferences of the government come from, or even whether governments have consistent preferences ... ."

The authors observe, about government, "First, its deficit appears as transfer income and influences the demand for consumption goods. Second, the government can change the relative supplies of its own bonds and money to the asset market by making open-market purchases or sales. Changes of this kind will affect the equilibrium price of capital and will, therefore, affect the economy's growth path."

In keeping with the norms of that earlier period, and in keeping with the interests of its intended audience, the paper is presented in a formal way that is at odds with the approach used in this our modern era. Nonetheless, though it is replete with higher mathematics, the paper is accessible and concise in 22 pages (incl. references).

The parallels between the Foley-Shell-Sidrauski paper (1969) and the Fiscal Theory of [Inflation][the Price Level], in terms of the choice of subject matter in both and the early date of publication of the former, drew my interest. The paper, along with other publications that he has authored or co-authored, are available on his homepage (search term: "Karl Shell"). As the Foley-Shell-Sidrauski paper (1969) does not appear in the bibliography or references in the Fiscal Theory of the Price Level (pre-print, 2022), I thought that it might be of interest to you and your readers, given both its provenance and its date of publication.

Karl Shell, Thorne Professor of Economics at Cornell University since 1986, edits the Journal of Economic Theory (est. 1968 - present).

The Volcker demarcation led to a switch in the composition of credit. 1961: Edwards: “It seems to be quite obvious that over time the “demand for money” cannot continue to shift to the left as people buildup their savings deposits; if it did, the time would come when there would be no demand for money at all”

ReplyDeleteSo, we got the Hubris-Curve.

The question of whether the interest rate is co-integrated with the inflation rate, or whether the interest rate raised can cause the rate of inflation to abate, is an academic pursuit. The policy makers believe the latter and it is now the central focus of their monetary policy and open-market operations, along the lines of Paul Volker's intervention during 1980-81.

ReplyDeleteToday's speech given by Chmn. Powell simply confirms the policy assumptions underlying the path that the FOMC will pursue until the committee either (a) finds itself on the brink of inducing a full-blown hard economic recession, or (b) succeeds in curtailing economic growth short of inducing a hard economic downturn.

The rationale espoused is that high rates of inflation impoverish people through rapid change in the level of prices relative to changes in the level of wage rates (broadly defined). Ergo, contingent on the committee 'engineering' a 'soft-landing', pursuing a policy of increasing the short-term interest rate will be worth the risk of lower employment rates (higher unemployment) to "re-balance" the demand for labor (read: risk of cost-push wage rate settlements) and avoid the inculcating expectations of the higher rates of inflation for longer (citing Bernanke and Greenspan).

As in past policy decision-making, recognizing that affecting change in the rate of inflation must be approached circumspectly, the true policy target is the rate of employment (unemployment) and aggregate demand through the effect of interest rates on borrowing and financing and private firm expansion and retrenchment decisions. The rate of change of the aggregate price indices will follow accordingly, in the Committee’s way of thinking. As shown in prior episodes of FOMC policy tightening, everything proceeds smoothly until the economic stresses build up to the point where a break-down occurs, in a manner typical of the non-linear behavior of over-stressed natural and engineered systems. The economic equivalent is a collapse into recession triggered by a financial crisis of confidence, e.g., 2007-09, or 2000-01. The year 2020 might have undergone a similar fall into recession had not the pandemic arrived to change the economy’s course. The next recession to befall us is slated for 2023-24, if nothing new arises.

So would you agree with Modern Monetary Theory that says increasing the money supply and keeping interest rates low will not necessarily cause inflation?

ReplyDeleteHow long until some Republican president orders the forgiveness of the tax debts of a select set of supporters, say payroll taxes of small businesses.

ReplyDeleteThere's a problem with this, in that almost all federal taxes are pay-as-you-go and you therefore can't accumulate a tax debt.

Delete-dk

With it being unclear as to whether inflation is stable or unstable what should Fed policy be? Seems to me the choice should be the one that is least likely to do the most harm; better said, to result in the least bad outcome should that policy choice be incorrect.

ReplyDeleteHi, John. I would be interested in your take on Turkey. Pursuing a low interest rate policy despite ~80 percent inflation and a weak currency. How does it fit into the FTPL/FTI?

ReplyDelete-Craig Pirrong

It's a good question. The natural response is fiscal: The proposition that low rates lead eventually to low inflation needs steady solvent fiscal policy, widespread beleif that the government is good for its debts. Are you buying Turkish government bonds (in Lira)? Turkey isn't terrible on current deficits, but it has a lot of foreign debt, which leads to a doom loop if exchange rates fall. Many comments in FTPL on turkey and the East Asian crashes of the late 1990s apply. But it's a case that needs serious quantitative study.

DeleteWhy do people keep saying money supply still? The money supply theory is dead. It has been dead for decades. Money supply is at best endogenous and anecdotal unless there is a constant monetized fiscal spending.

ReplyDeleteThomas J. Sargent and William L. Silber publish a rebuttal in The Wall Street Journal, "What Jerome Powell Can Learn From Arthur Burns", WSJ, Aug. 28, 2022 12:03 pm ET.

ReplyDeleteSargent & Silber urge Powell to learn from Burns (former Fed. Chmn.) and go aggressively for longer to bring the rate of inflation down, come what may.

First Burns, then Volcker, focused on the money supply (credit). During summer of 1974, I was employed in the mine engineering department of Utah Mines undertaking evaluations of project proposals. At the time, the baseline estimate for cost inflation used in the studies was 12 pct. per annum. Times were good, and employment was not difficult to find, but the unemployment rate was about double what it is today. Thirty-six years later, the local municipality was faced with a decision of whether to proceed with completion of a partially finished replacement recreation facility in the face of cost inflation of 12 pct. per annum. The municipality had turned down a lump sum contract in favor of acting as its own construction general manager and had been letting contracts out on a design-build basis (i.e., piece-meal). The economy had turned around from the 2008-9 recession and the construction industry was becoming busy (money was flowing again). The municipal managers, thinking that they could save money, ended up paying much more than they expected to and brought the municipal government to the brink of insolvency. Rational expectations, or irrational optimism of the green-horns?

Mr. Powell is optimistically pessimistic. Sargent & Silber are pessimistic (or realistic, depending on your point of view). The view of this page is "Qué será, será" , as near as I can tell. Just don't mortgage the farm.

Re 2009 and deflation, doesn't that lend itself to as was mentioned earlier in the comments the money supply's effects on inflation because a lot of paper wealth was eliminated at that point in time with housing prices collapsing and the stock market while not a great indicator of true economic health had contracted in size substantially.

ReplyDeleteThis is a great blog\issue that really sheds light on how little we know as economists. It is humbling. It strikes me as being somewhat akin to a physicists disagreeing over whether gravity pulls up or down. But it is important to recall that physicists do disagree over somewhat basic phenomena such as what keeps airplanes aloft.

ReplyDeleteMy own view is that the traditional view is correct and the new-fangled theories are likely too clever by half. I note that it seems that the Fed has finally capitulated and joined the "we need positive real rates" camp. The WSJ has a short video interview with Williams (found in the online paper) where he looks intently into the camera and explains that getting inflation under control will require positive real rates for some time and "we just aren't there yet". No kidding John! Welcome to the team! Glad to have you onboard - now get to work!

The contemporaneous macroeconomic constraint - the dynamic equation of exchange - cannot be dismissed. Money growth and velocity growth, together, always tell the final tale.

ReplyDeleteSerious question. I want to know: If (a) money is debt as many proclaim, and (b) more money relative to goods causes inflation, then why would debt jubilees (forgiveness of student, credit cards, etc) not be deflationary?

ReplyDeleteThis is definitely correct. Inflation, in the long-run, is a function of money supply and economic health. That is, improvements to the economy are deflationary.

ReplyDeleteIgnoring that for a moment, we can see that, quite obviously, whatever the Fed does with interest rates will be dominated in the long run by the Federal budget deficit. That is constant.

You can see this in the data, that the long-run expansion of money supply corresponds with the long-run budget deficit as well as the long-run inflation rate. The three go together.

Good to see you professor it's been so long.

ReplyDeleteThe elephant in the room is the budget deficit rate. Basically, how much is the government obliging itself to print in the long run? inflation = deficit/money_supply is going to be predictive of the inflation rate in the long run.

ReplyDeleteWe should really edit the cartoon of the guy with the watch, replacing the interest rate with the deficit rate. With a constant deficit rate, expected inflation is just a function of deficit rate + shift_from_saving_to_consuming + economic_health.

Interest rates are a reaction to expected inlfation, not the other way around.

Based on your article, what are your thoughts regarding the affect that the supply concerns over goods or in reality the lack of supply of certain consumables will have on the continued upward pressure on inflation regardless of the interest rate increases by the fed? Interested in examples or historical periods for comparison. With prolonged real interest rates, but governmental pauses in production related to lockdowns overseas, any thoughts on the timing gap between real rates increases and consumer demand decreases enough to create a net positive supply growth of goods that would drive prices down? Love the groups thoughts on this.

ReplyDeleteIf a permanent increase in the deficit causes unsustainable demand and the Fed keeps nominal rates fixed, it seems to me that the resulting inflation would be unabated, eventually causing expected inflation to rise, further lowering real returns and further increasing excess demand. Please explain the mechanism causing the real rate to rise back to its natural level, as you seem to propose as a possibility obviating the need for higher nominal rates in your WSJ article.

ReplyDeleteAll forecasts here condition on the idea that there are no additional fiscal shocks. For some reason people are willing to hold US government debt, so they must believe that sooner or later the US will come to its senses rather than inflate or default. Forecasts are expected values, what if there is no news, what if nothing comes to shake whatever that belief is. If the US goes down a fiscal rathole, yes, inflation breaks out. A trillion in student debts and another 5 trillion in the next crisis/recession/war might do the trick. Real interest rates revert in any case. In the end inflation just changes the units, from feet to inches, not the size of the quantity being measured.

DeleteThanks. I now understand your WSJ analysis to be based upon a one-time increase in the deficit, equivalent to a rightward shift in the IS followed next year by an equal leftward shift. Aside from your dynamics, the comparative statics seem to be the same as I learned in grad school fifty years ago. Pray for “coming to its senses.”

DeleteThanks. I now understand your WSJ analysis to be based upon a one-time increase in the deficit, equivalent to a rightward shift in the IS followed next year by an equal leftward shift. Aside from your dynamics, the comparative statics seem to be the same as I learned in grad school fifty years ago. Pray for “coming to its senses.”

DeleteThe 1998 paper by Burnside, C., et al., is, as you mention above and in the "Fiscal Theory of the Price Level", an important source of insight into the nature of fiscal policy acting on the macro economy. It is particularly salient to me as I was part of investor group involved in foreign direct investment in S. E. Asia between 1992 and 1998, and we saw it all come down in real time. It adversely affected several tens of millions of 1996 constant dollars of bolted-down capital of which our group held about a one-fifth to one-third equity interest.

ReplyDeleteThe paper is: "Prospective Deficits and the Asian Currency Crisis", Burnside C., Eichenbaum, M., Rebelo, S. Working Paper 6758 (http://www.nber.org/papers/w6758), National Bureau of Economic Research, Cambridge, Mass., Oct. 1998.