I'm still digesting New-Keynesian models. As part of that effort, today I offer some thoughts on how economists come to such different views of the current situation and desirable policies. It's a nice story, in the end. Real economists, unlike much of the commentary and blogging world, come to different conclusions by using much the same model, but making different assumptions and simplifications, each of which we can look at and evaluate, and hopefully come to some consensus.

The economy is not doing well. The black line in the graph shows log consumption. (The units are percent increase in consumption since 2002.) After trending up steadily at close to 3% per year through the previous decade, consumption -- along with output and everything else -- took a dive, totaling 10% loss relative to the red trendline. And consumption has been stuck there ever since.

So, the big questions: why, and what might be done about it?

All current macroeconomic theories start with the same basic story: when interest rates are higher, people consume less today, save, and then consume more in the future. Higher real interest rates mean higher consumption growth. In equations,

(c represents log consumption, i is the interest rate, pi is inflation, rho and gamma are parameters. Rho is a "discount rate" capturing how much people prefer the present to the future, and gamma captures how strongly people react to interest rate changes. I simplified, leaving out uncertainty.)

We build on this insight in different ways.

I. New Keynesians

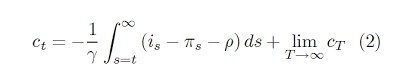

Integrating forward, today's consumption reflects all expected future

interest rates, and where we think consumption will be in the far-off

future

This is the central equation of the new-Keynesian model and world-view. (For example, this is Johannes Wieland's equation 2, see my last post. I have taken out growth or trend, so these represent deviations from a steady growth path.)

The green line in the graph presents the New-Keynesian diagnosis of the current situation. New-Keynesians assume consumption will return to trend, so the last term in the equation is zero. In the graph, they anchor future consumption at the green dot. Then, a too-high interest rate means too-high consumption growth, which drives the level of today's consumption down. (For example, Ivan Werning's figure 3, discussed in an earlier post here.)

Why is the interest rate too high? The "zero lower bound" is to blame. The Fed cannot lower nominal interest rates (i) below zero. So if the inflation and discount rate terms (pi and rho) require a strongly negative nominal rate, the real rate will be stuck at a big positive number.

From this one equation and graph, you can make sense of lots and lots of new-Keynesian analysis and policy advice.

The level of today's consumption depends on the whole string of future interest rates, not just today's interest rate. So, if people expect the interest rate in 2014 to be lower, that is every bit as effective in raising today's consumption as would be lowering today's rate. Hence, "open mouth operations," "forward guidance," and "managing expectations." If the Fed by just talking can persuade people it will hold interest rates low for a longer periods, when they are expecting rates to rise above zero, that expectation will "stimulate" today's consumption. If promises don't help, perhaps announcing a new "rule" which if followed would lead to lower rates for longer will help to change expectations.

In this equation, more inflation lowers the real interest rate too. So, anything that boosts inflation is a good thing. Boosting inflation isn't primarily about a Phillips curve, direct "monetary stimulus," encouraging investment, and so on. It's a way to lower real interest rates inside the integral and shift consumption from the future to the present.

Once again, increasing expected future inflation would be just as effective as increasing current inflation. Hence, calls for the Fed to announce a higher inflation target, or at least announce that it will tolerate more inflation before beginning to raise rates, as it has.

Fiscal stimulus, and many of the other seemingly magical properties of new-Keynesian models (see last post) follow from the idea that inflation is good. Fiscal stimulus raises inflation. Broken windows, hurricanes, pointless public works projects, temporarily lowering the economy's productive capacity, all raise inflation (how is in other equations of the model), which lowers interest rates.

I'm not sold on this story, as you probably guessed, for a variety of reasons.

New Keynesian models are a bit fuzzy on just why interest rates have to be so low -- why the "natural rate" is sharply negative and why zero interest rates aren't enough. Many of the formal models assume that consumer's discount rate (rho) has declined sharply, beyond the capacity of the interest rate to follow it. If rho goes to, say -5%, with our 2% inflation, then even a zero nominal interest rate is like a 3% real interest rate. (These are deviations from trend, so one might not need actually negative discount rates to hit the zero bound. But even adding growth, it's hard to avoid the need for a negative natural rate to cause a problem of this size.)

Now, a spontaneous outbreak of thrift, to the point of valuing the future a lot more than the present, seems a bit of a strained diagnosis for the fundamental trouble of the US economy. That a bit more thrift is a great danger to the economy, rather than the long awaited return to normal after decades of debt-financed consumption, seems strained as well.

To be fair, all the papers I've read say clearly that they regard the decline in the discount rate rho as a stand-in for some more complex process involving the financial crisis. For example, a more precise version of my first equation adds a "precautionary saving" term. When people are very uncertain about the future, they save more, just as if they had become much more patient. In equations,

This story seems possible for 2008 and 2009, in the depths of the financial crisis and recession. But I'm less convinced that it describes our current moment. Just look at the graph. Our state is one of steady but sclerotic growth, not one of great consumption volatility.

New-Keynesian introductions have something more complex in mind, involving the "frictions" of the financial crisis, and lots of models in this spirit add explicit financial frictions. That too seems to me a useful line to pursue to understand the onset of the recession and the financial crisis. But that too is really not our question. The "frictions" of the financial crisis -- capital constraints at banks and financial intermediaries, or the run in the shadow banking system -- passed quite a while ago, and the models with frictions are by and large not being used to address the current moment.

The question before us is not really why consumption fell so drastically in 2008 and 2009. The question is, why did consumption get stuck at so low a level starting in 2010? For this question, it's much harder for me to understand what a strongly negative discount rate means.

This question and controversy is much like those surrounding the Great Depression. The controversy there has not been about why the stock market crash and recession happened in the first place. (Though perhaps it should, as we really don't know much about that process.) The controversy is, why did the US get stuck so low for so long? Was it bad monetary policy (Friedman and Schwartz), bad microeconomic policy, war on capital, and high marginal tax rates (Cole, Ohanian, Prescott, etc.), or inadequate fiscal stimulus (Keynesians)?

Many new-Keynesian models (such as Ivan Werning's) generate the high real interest rate by predicting strong deflation. Yes, if inflation (pi) were negative 10% in (2), then a zero interest rate would be a 10% positive real rate. But our inflation has been positive throughout. Our zero interest rate has meant a negative 1.5% to 2.5% real rate all along. Deflation simply did not happen. Moreover, the other ingredient in new-Keynesian modeling -- the Phillips curve -- says that a big output gap should be accompanied by some action on inflation, not a steady 2%. The Phillips curve part of the model suggests that "potential" dropped, not that current output is far below that potential.

I graphed the green line to 2010, a good date for supposing the crisis is over and we entered the period of sclerotic growth rather than swift return to trend. We've had some time since 2010. Again, the new-Keynesian model generates a low consumption level by saying that we have too-strong consumption growth. But we don't have strong consumption growth. Equation (2) does not produce a steadily depressed level of consumption, with (if anything) weaker than normal growth. I guess you could argue for a constant sequence of unexpected negative shocks, so that each quarter, people are expecting the big consumption growth which just ends up not happening. But you can see how strained that argument is. It would be much more appealing to refer to a model and analysis that describes slumponomics directly. (Update: I just found Kathryn Dominguez and Matt Shaprio on a sequence of negative shocks.)

And, you might be exploding a bit at the economic logic of it all. How can it be that all we need to do is to decide how much to consume, and the output just magically appears? Doesn't consumption have to be limited a bit by income?

Well, the new-Keynesian models are coherent on this subject. The simple models have no capital; output is produced by more or less labor each period. The logical structure of the models, is, roughly, that you first decide how much you want to consume, then you'll work hard enough to make the required income. (This isn't a behavioral assumption, it's the equilibrium outcome of sticky prices and monopolistic competition.)

That's why fiscal stimulus works at all. You might think that if you have to pay taxes to the goverment, which buys output to throw it away, you'll have to consume less. (Again, stimulus in these models is Ricardian so the same whether from taxed or borrowed money, and stimulus does not depend on the government doing anything useful with the output.) But if consumption is determined first by the above equation, then you just work harder to pay taxes and make the stuff the government wants to throw away. That gives us a multiplier of one, not zero, and then inflation kicks in to raise desired consumption and give us a larger multiplier. (Roughly! Again, I'm trying to explain the core simplest idea, not to fairly describe all the complexities of the models.)

The very simple new-Keynesian model also does not have investment or capital stock. Output is produced as you need it. That's why consumption "demand" immediately means changes in output. I've always wondered why buying a car is good (consumption) but buying a forklift is bad (investment) in new-Keynesian models. You just can't ask that question in the very simplified model here -- there is no investment. Now, real quantitative new-Keynesian models do have investment and capital (with adjustment costs and other wedges). But as far as I can tell, the same basic conclusions emerge from models with capital, so the intuition must be as here, in which consumption is everything.

II Permanent income

An alternative view asks, what about the second term on the right hand side of the basic equation (2)? What if nothing's terribly wrong with the intertemporal allocation of consumption, but the long-run productive capacity of the economy has declined?

There is certainly an abundant litany of such complaints. What if all the over regulation (Obamacare, Dodd-Frank, EPA "crucifixions," etc.), sand in the gears, disincentives of social programs, crony capitalism, policy uncertainty, high and prospectively much higher marginal tax rates, and other litany of complaints, have permanently reduced the productive capacity of the US economy, or, worse, its long run growth rate? Then we are not returning to trend. The trend has shifted down.

If so, the trouble is in the second term on the right hand side of the basic equation (2). And this basic equation has a dramatic and important lesson for us: Long-run ("supply") will depress today's consumption every bit as much as expected future interest rates ("demand") effects do. And improving the long-run "supply" effects can have a direct "stimulative" effect on consumption today.

I italicized, because I think this is an underappreciated consequence of the common world-view of all modern macroeconomics, both new-Keynesian and not, embodied in (2). The old-Keynesian view was, take care of the short run now, because helping the long run only helps in the long run. You hear this over and over in policy circles. More stimulus now, and then talk about "structural reform" once the economy has recovered. Equation (2) denies that separation: Improving the long run improves the present.

I drew the blue line to reflect this view of matters. For an equation, we can turn to our old friend the permanent

income model

Here W represents wealth (capital stock), r is the real rate r = i - pi, and y represents the stream of expected future income. This is an extremely oversimplified version of the standard stochastic growth model at the heart of... well, I don't know what to call us anymore. "Neoclassical?" "Anybody left who is a bit suspicous of the new-Keynesian juggernaut?"

The difference is really one of emphasis, not deep economics. (3) also derives from (1), but with a different set of auxiliary assumptions. The real interest rate is constant at r. There is capital W, and investment freely adds or subtracts from capital. Labor's product y is fixed rather than produced.

Again, this model is, like (2), extremely simplified. Yes, interest rates do vary, and it's easy enough to add that to the model. Similarly, new-Keynesians know there is capital and investment. We're outlining basic stories today, not constructing completely realistic, but often obscure and complex, models.

In this equation, the level of consumption shifts up and down along with expectations of permanent income. So, if you get news that the productive efficiency of the economy is permanently 10% lower, consumption drops 10%, and then goes on at the previous growth rate. As, by picking 2010 as the decision date, my graph suggests.

Like the new-Keynesians, I won't be that specific here about

just why consumption fell so drastically in the financial crisis. The permanent income model does suggest that we look for changes in permanent income to explain the fall, rather than (only) a rise in discount rates or real interest rates, i.e. the desired intertemporal allocation of consumption. From this perspective, consumers realized in fall 2008, that this recession was going to last forever rather than bounce back quickly, and they adjusted consumption downward accordingly. They were right. Just how they knew, when all the Government's forecasters thought we would quickly bounce back, is an interesting question. Surely, my litany of free-marketer's complaints did not obvioulsy get suddenly worse in October 2008, just coincident with a run in the shadow banking system. Well, maybe not so surely. Maybe consumers thought, we're in a horrible banking crisis, and our government is likely to prolong this one with ham-handed policies just like they did in the 1930s. But that's pretty speculative. And I do think (just as speculatively) there was a run in the shadow banking system, effective risk aversion spiked, and the financial crisis was more than just a signal of bad policy to come.

But all that is a topic for another day. The

question is why consumption (and output) remain so low for so long after

the crisis, when whatever outside-the-model chaos is over. The permanent income view suggests the problem is a poor long-term level, poor long-term prospects for the productive capacity of the economy, not too high growth, to an unchanged long-term level.

In this view, the Fed largely wasting its time with all its QEs and promises about future interest rates. The right policy answer is to forget about stimulating and fine tuning. Fix the long-run growth problem and the short run will take care of itself, much faster than you might have thought. This isn't the Fed's job. For Europe, do the "structural reforms" now and you'll start growing now in anticipation of their effect.

Moreover, in the underlying stochastic growth model, a rise in real interest rates is a good thing. Yes, we can get on the new-Keynesian green trajectory. What does that is a rise in the marginal product of capital, which raises interest rates, attracts investment, and leads to greater output. In that model, consumption is (very roughly) anchored at its position today, and increased interest rates raise future consumption, not the other way around. Of course, in the stochastic growth model, the Fed can't raise interest rates all on its own -- a higher marginal product of capital comes from greater efficiency or better technology. Still, it encapsulates the comments you read here and there that maybe the conventional sign is wrong -- maybe higher interest rates are desirable, as a sign of a good thing, not as a cause of a bad thing. There is always supply and demand in economics, and two sides to every question.

Which view is right? To my eyes, consumption seems stuck on a lower trend line, not growing sharply. Real interest rates are already negative -- we do not have deflation -- and I find it hard to believe that the discount rate and marginal product of capital are negative 5% or worse. The very large discount rate shock needed for the new-Keynesian story is pretty nebulous. The shocks to long-run productivity are staring us in the face.

I wish, of course, for more serious structural investigation to separate the two stories. I haven't seen a serious attempt to look at the structure of the US economy and measure a sharp negative "natural rate." (I welcome pointers from commenters.) I would welcome a quantitative assessment of how much the level of GDP is depressed from my litany of free-market complaints. With trillions of dollars of GDP, and potentially trillions of wasted stimulus at stake, you'd think we could do better.

I want to emphasize, this is not a fight between models. This is the same model, with different emphasis, and different simplifications. There is nothing in the new-Keynesian modeling paradigm that forbids one to ask the question, what if the long-run productivity of the economy has sunk and high real rates are not the problem? The models were developed to talk about other things, to talk about historical "cycles" defined as deviations from "trend." Nothing but old habits prohibits one from asking the opposite questions.

III. Old Keynesians

A traditional view of consumption has been conspicuously absent so far, the textbook old-Keynesian consumption function

Consumption depends on today's income through the "marginal propensity to consume" mpc.

Modern new-Keynesian models are utterly different from this traditional view. Lots of people, especially in policy, commentary, and blogging circles, like to wave their hands over the equations of new Keynesian models and claim they provide formal cover for traditional old-Keynesian intuition, with all the optimization, budget constraints, and market clearing conditions that the old-Keynesian analysis never really got right taken care of. A quick look at our equations and the underlying logic shows that this is absolutely not the case.

Consider how lowering interest rates is supposed to help. In the old Keynesian model, investment I = I(r) responds to lower interest rates, output and income Y = C + I + G, so rising investment raises income, which raises consumption in (4), which raises income some more, and so on. By contrast, the simple new-Keynesian model needs no investment, and interest rates simply rearrange consumption demand over time.

Similarly, consider how raising government spending is supposed to help. In the old Keynesian model, raising G in Y = C + I + G raises Y, which raises consumption C by (4), which raises Y some more, and so on. In the new-Keynesian model, the big multiplier comes because raising government spending raises inflation, which lowers interest rates, and once again brings consumption forward in time.

Old-Keynesians spent two generations fighting against the intertemporal view of consumption embodied in my first two equations, and now at the heart of the new-Keynesian model, in favor of the last equation. They said consumers were "liquidity constrained," or "rule of thumb," their expectations (if they had any) "adaptive," either too stupid to look forward in time or unable to do so.

I must confess a little sympathy to some of these views. A long long time ago I wrote a paper on "near-rationality" criticizing excessive zeal in the application of equation (1). Really, if the Fed today raises interest rates to 12% (annual rate) for a month, would everybody's consumption fall one percent today, so that it could rise one percentage point over the next month? Or is the relation between consumption and interest rates one of those looser relations that yes, applies roughly, for large sustained changes, and over long time periods, but not necessarily instantly?

In any case, a look at (1) and its application in (2) tells us that Friedman won more than he could possibly have imagined. Intertemporal optimization is now not the heretical pariah suggesting a low marginal propensity to consume and low multiplier, but it is the heart of the model. The Lucas-Sargent-Prescott revolution pervades new-Keynesian

models as

much as their more classical counterparts. Consumers are

forward-looking. Expectations matter. No self-respecting mid 1970s Keynesian would have said that Fed pronouncements about what interest rates

were going to be in 2016 -- or how the future unemployment rate would

condtion that choice -- would have the slightest effect at all on today's consumption.

Consumers are myopic, he would say. Expectations are adaptive.

But as a result, the new-Keynesian model really has nothing to do with the old-Keynesian intuition.

IV. Bottom line

Enough history of thought, though. The relevant choice today is between the first two alternatives. Are we in a situation where the long run is just fine, but the zero bound is forcing us to have too high interest rates, so consumption growth is too high and the level is depressed? Or are we in a situation that consumers doubt the long-run productive capacity of the economy, and are consuming little today because they expect to consume little tomorrow and little 10 years from now?

The answer matters: whether the economy can be stimulated merely by more solemn promises from the Fed about future interest rates and inflation, by broken-window interventions that reduce supply today to engender some inflation, or whether the economy must be stimulated today by ignoring short-run stimulus, fixing the long run, and counting on the permanent income model to increase consumption, and the present value model (q theory) to increase investment today.

---------------------------------------

P.S. It's 2013. Why is displaying math in html so hard?! The people who developed the internet are all nerd engineers who took calculus! I'm back to pasting in png files to show equations. I tried mathjax, but it only seems to work on traditional screens, not in mobile, rss, etc. Suggestions welcome.

P.P.S. Martin Boulanger and Absalon below asked if maybe consumption wasn't growing unsustainably before the crash. Here's a longer view of the first graph, with my 2000-2007 trend line.

Or, even go back to 1945.

A big boom in the 2000's does not stick out from the consumption data. If anything, it was a little weaker than usual.

Also, yes, this is total consumption. Nondurable and services does not look much different. I started to break out the components but the post was getting too long.

Sunday, February 3, 2013

71 comments:

Comments are welcome. Keep it short, polite, and on topic.

Thanks to a few abusers I am now moderating comments. I welcome thoughtful disagreement. I will block comments with insulting or abusive language. I'm also blocking totally inane comments. Try to make some sense. I am much more likely to allow critical comments if you have the honesty and courage to use your real name.

Subscribe to:

Post Comments (Atom)

FYI: http://www.intmath.com/blog/wp-content/math-rendering-comparison.php P.

ReplyDeleteThanks for that - very helpful!

DeleteProfessor,

ReplyDeleteGreat post.

Might I put forward an alternative view - that the red trend line in consumption growth was itself unsustainable. Not necessarely that a 3% level of growth cannot be sustained in principle, but that in this case it was brought about by unsustainable, artificial, 'stimulants':

1. fiscal deficit spending

2. easy monetary policy (though not relative to today's) and

3. excessive credit growth.

These factors will necessarely lead to an increase in GDP (I, C and G increase, without any offset). But is this a good thing? Note that GDP does not measure the long-term economic value or viability of expenditures. With factors 1-3 in effect, business & household expenditures at the margin which would ordinarily not make the budget are made. Growth seems like it will be fast enough, the cost of borrowing is low enough etc. However, when factors 1, 2 or 3 inevitably end (credit growth at this point in time), the music slows and the marginal projects that seemed profitable fail and need to be unwound. This can be painful, but resources need to be freed first so they can be put to better use later.

The issue comes when governments seem intent on preventing these misallocations from correcting, stopping any real turnaround in growth from occuring.

No doubt you've recognised the hallmarks here of an alternative school of thought. I'd appreciate your thoughts on this.

Yet, output is output. The amount that the U.S. was producing per year, was rising at 3% annually. If this was pushing the economy beyond capacity (due to fiscal or monetary stimulus), then why didn't we see inflation? Perhaps structural changes need to be made (less private and public borrowing, for example) and that may dampen output for some time, but that doesn't mean that the potential productive power of the U.S. can't continue to grow at 3% annually. It's hard to set up a model in which an unsustainable rate of GDP growth is achieved for such a long time.

DeleteIncredible.

ReplyDeleteIn your alternative model, consumption falls, but as households save because of lower expected future income, investment rises. Aggregate demand does not fall at all. The allocation of labor between consumer goods and capital goods shifts to more capital goods. Total production remains equal to capacity.

The added capital goods now increases future income. This raises permanent income and consumption now.

If people have lower expectations about future productivity, it will almost certainly require a lower interest rate to coordinate saving and investment.

The lower interest rate provides an incentive to increase consumption now relative to the assumed lower consumption in the future. (Lower future income results in less future consumption, and so less consumption now. The lower interset rate offsets that.) The lower interest rate provides an incentive to invest more, produce more capital goods, raise future output and income and so future consumption, which also motives more consumption now.

If the real interest rate needed to coordinate saving and investment is less than the negative of the inflation rate, then there is a problem.

If you believe in constant real interest rates because investmnet is freely turned into capital, so demand for investment is perfectly elastic at a positive real interest rate, then this cannot be a problem. As explained above, the decrease in consumption would be matched by an investment boom.

If the shift in future productivity also reduces the expected marginal product of capital, perhaps driving it below zero, then the problem returns.

If, on the hand, the problem is current and expected low demand is creating the expectation of low future income and low productivity of investment, then increased spending and sales now would rapidly clear up the problem, with expected future production, income, and consumption all rising, along with the expected productivity of current investment. If the problem is demand is low realative to current productive capacity, more demand now fixed the problem.

Of course, your real assumption must be (but you never want to say it) is that if the problem is too little demand, all prices and wages would drop.

And your real business cycle business must come down in the end to a claim that people are working to save, and so if the future output they can get from saving is less, they will work less now. Employment is low because people don't want to work because real wages are low. (This breaks down with your fixed interest rate story, I think. It comes down to low productivity of capital causes low real interest rates, which results in people saving and investing less, and instead enjoying more leisure.)

To me, the story you told where lower future income results in lower consumption and that this results in production and work now looks like a fallacy of composition.

"From this perspective, consumers realized in fall 2008, that this recession was going to last forever rather than bounce back quickly, and they adjusted consumption downward accordingly. They were right. Just how they knew, when all the Government's forecasters thought we would quickly bounce back, is an interesting question. Surely, my litany of free-marketer's complaints did not obvioulsy get suddenly worse in October 2008,"

ReplyDeleteIf I may suggest another answer: The problem was not the regulations introduced post 2008. In 2008 the public discovered that they were a lot poorer than they thought they were - their houses were seriously overvalued and their stock portfolios were both worth a lot less than had been thought and even the new, lower, stock valuations might turn out to be based on fraudulent financial statements. Cut W in the permanent income model by half and you should expect to see consumption fall. Certainly in my household the drop in our investment portfolio has held back consumption.

It is worth noting that the government has been pumping up consumption through deficit spending so the real performance of the economy might be a lot worse than your chart suggests.

You left out uncertainty but uncertainty (and fear) is extremely important. The easiest thing the government could do to restore confidence in the future would be to take aggressive steps to ensure that corporate financial statements can be trusted. The fiascos around MF Global and Libor, and Lanny Breuer effectively admitting that some banks were simply too big to prosecute all support the general view that the public cannot rely on information supplied by Wall Street.

Sorry for the double post - there is also the factor that pre-crash a portion of the public were treating the increases in the values of their homes as part of their incomes and spending it through the use of home equity loans. Those increases are gone and so is the consumption based on that "income".

ReplyDeleteThese are good thoughts -- I'm glad I said we're not here to talk about why the crash happened! (for another day).

DeleteThe problem with house values is that in many ways house prices represent a transfer. Yes, for you and me who own houses and will some day sell them for something smaller, we lose lifetime wealth when prices decline. Same with stocks. But these are great times for an employed 29 year old. He or she gets to buy houses and stocks much cheaper, or can "afford" to buy more other stuff and the same houses or stocks.

The decline in house prices is not the same as three states worth of housing washing in to the ocean. The houses are still there.

People who are not planning to sell live in them as before, with no change. The price is essentially irrelevant.

Once again, though, for this post, let's focus on why we're stuck in low gear and not what happened in 2008 -- unless we have good reasons that the two are connected.

"let's focus on why we're stuck in low gear"

DeleteBut ... we are only "stuck in low gear" if we assume that the height of the bubble represented a sustainable baseline. The height of the bubble appears to have involved serious mispricing of housing and certain financial assets which would have operated to distort the statistics.

"The decline in house prices is not the same as three states worth of housing washing in to the ocean."

For the people with underwater mortgages and for the investors who hold those mortgages - it might well be as though the houses had washed into the ocean.

I don't think you can figure out how to get out of low gear until you understand why you got there in the first place. I think Absalon is on to something. Here's how I see it.

DeleteThe 2008 crisis was a financial crisis, which, I think, means that a "bubble" burst. Absalon notes how the real estate and stock markets were overvalued, i.e., the nominal values did not correspond to real values. The bubble burst, a correction happened, and people recomputed their wealth position, current and future. But there was no change in real wealth at all, because the housing stock and the productive capacity of the economy was unchanged. There was only a change in nominal values -- and yet the economy tanked. This was not just a case of redistribution of valued from old buyers to new buyers, it was a reevaluation of total wealth. And there's the problem for any Keynesian model: it seems that total consumption does not depend just on real values, but on nominal values as well. This is something that Axel Leijonhufvud found and remarked on in his studies of the Argentine hyperinflation. Bubbles matter because nominal values matter. Take that, macroeconomists -- you need to rewrite your consumption functions and realize that financial losses/gains matter, independent of real wealth. Changes in the nominal values of stocks of wealth are not always purely redistributive, as Prof. Cochrane suggests -- rather, they can clearly have real consequences.

It seems that you are throwing stones from glass house. You complain that Keynesians can't really explain why consumption growth has yet to pick up: "I guess you could argue for a constant sequence of unexpected negative shocks, so that each quarter, people are expecting the big consumption growth which just ends up not happening. But you can see how strained that argument is. It would be much more appealing to refer to a model and analysis that describes slumponomics directly."

ReplyDeleteBut, isn't the argument that all the supply-side troubles (over-regulation, healthcare, etc.) seamlessly took over for financial crisis troubles without causing a lot of consumption volatility equally strained? I can begin to believe an argument along the lines of hysteresis or something else that claims that the U.S. has supply-side problems that prevented us from recovering from a recession. But, I find it less believable that 1) the supply-side troubles came just as we were recovering from a recession and 2) they aren't preventing a recovery but are actually depressing permanent income to the exact level that keeps our unemployment rate at a steadily high number.

John,

ReplyDeleteSome thoughts on this part of your post:

"[A] more precise version of my first equation adds a "precautionary saving" term. When people are very uncertain about the future, they save more...This story seems possible for 2008 and 2009, in the depths of the financial crisis and recession. But I'm less convinced that it describes our current moment."

I know it seems very long, but households actually are still holding elevated amounts of liquid assets as a share of total household assets. Alternatively, this ongoing elevated demand for liquidity can be seen in risk premium which remains inordinately high.

So I think it is reasonable to say "precautionary savings" remains an important part of the story. And we don't need to look far to see why: the Euro crisis of 2010-2012, the debt-ceiling talks of 2011, the fiscal cliff of 2012, and concerns about a China slowdown. All of these were developments after the 2007-2008 crisis that have kept liquidity demand elevated. In short, what I see is a world still plagued by excess liquidity demand.

Try MathJax for the LaTeX.

ReplyDeleteI did. It worked great for the blog on a browser, but didn't work for rss feeds, email, mobile and all the other places blog posts seem to go. And then when I tried to write "$20" in a subsequent post, it set everything after that in math mode and I couldn't figure out how to get a text model $. Ideas, mostly on the former?

DeleteTo print a dollar sign in LaTeX, use \$

DeleteYes, but not with mathjax. Then you get \ and enter math mode. I guess $\$$ would work.

DeleteDo you think there is a relationship between what happens in the US and in the UK (more people employed but no increase in GDP)?

ReplyDelete"The controversy there has not been about why the stock market crash and recession happened in the first place."

ReplyDeleteI have always thought that the Stock Market crash was the least surprising and least causal thing about the Great Depression of the 1930s. The stock market is supposed to predict the future and in 1929 the future was very grim. A rational investor who in early 1929, actually knew that WWII was coming at us like a freight train, that FDR would steal the people's money, and the US would default on its bonds, and who did not shoot himself would have sold everything, put it in Double Eagles, and buried it deep under the Oak Tree.

“[A]re we in a situation that consumers doubt the long-run productive capacity of the economy, and are consuming little today because they expect to consume little tomorrow and little 10 years from now?”

ReplyDeleteIntuitively, it seems that the answer is obviously YES.

In addition to the many good reason that you noted, consumers face few (if any) opportunities to increase their future incomes. They have suffered a one-time shock to their net worth when the housing bubble burst and cannot rationally expect housing to re-inflate. They cannot earn adequate income on savings due to ZIRP and are still afraid that the risk/return of equities is negative. Long-term employment and job security are things of the past, so they cannot count on future earned income. And they have begun to doubt the reliability of government income transfer programs.

So what's a rational consumer to do but hunker down?

Note that this is not directly the same thing as consumers “doubting the long run productive capacity of the economy” — however, the cause is the same. And it points to the same solution: get the long-term right, and the short-term will fix itself.

Thank you for one of the best attempts I've seen at explaining the intuition behind the basic NK model. Here is where I still need help:

ReplyDeleteThe logical structure of the models, is, roughly, that you first decide how much you want to consume, then you'll work hard enough to make the required income. (This isn't a behavioral assumption, it's the equilibrium outcome of sticky prices and monopolistic competition.)

I don't understand the intuition for how NK gets to a lower-output equilibrium from its sticky price and monopolistic competition assumptions, and I don't understand why it centers on consumption rather than investment even when its models have capital. It pretty clearly is not anything like a simplistic intuition like this which focuses on a generic sticky-price story but without reference to any particular verison like Calvo: Too-low prices for safe future consumption naturally lead to increased demand for the medium of account which demand cannot clear because some prices like wages are sticky downward, leading to growing unemployment until some new temporary equilibrium hits at the new distorted prices with some labor and whatever else on the sideline. Slumponomics is then getting stuck in this new equilibrium with some game-gone-wrong stalemate as perpetual possible-but-then-unactualized reflation keeps the stickier prices from adjusting more quickly (only slightly different than the constant shock story you mentioned). I can't even tell if the NK model expects involuntary unemployment in particular or rather just output below potential like an RBC model.

We are stuck in low gear because unemployment is high. Why is unemployment high? some of it is due to lack of well trained workers, but most of it is due to the fact that states have laid off or haven't hired lots of state workers because they can't easily run a counter cyclical fiscal policy in a crisis.

ReplyDeleteI understand your argument that sand in the gears is the cause of both low consumption and unemployment. But this is a feedback system. Sand was in the gears in 2007 too.

Consider this: Soviet Union was all sand and no gears. Yet it grew at around 2.5-3% per year even after adjusting for faulty statistics.

This is a great exposition of New Keynesian models.

ReplyDeleteBut I feel like the "New Classical" case here - the idea that forward-looking expectations of more-or-less permanent maladaptive government policy changes - is really overstated. This "downshift" in consumption - the seemingly long-term downward shift in the trend - is evident in many, many rich countries, including West, Central, South, and East Europe, and also Japan. Is it possible that policy (and expectations of long-term future policy!) responded essentially the same in all those countries? I guess it is possible.

But plausible??

Good point. But it is a global world, and it's hard to find any free market nirvanas any more. Is there a country anywhere that is deregulating, lowering marginal tax rates, and liberalizing?

DeleteAlso, I offer the PIH as a very oversimplified alternative view, focusing on consumption. There are models 3, 4, and 5 out there, adding many very important effects.

In fact, once you start thinking about long-run productivity, the whole consumption business becomes a side show. What matters is detailed understanding of long-run productivity. Once you don't care about "demand," the time path of consumption is not really that interesting.

http://theredbanker.blogspot.com/2013/02/mummy-when-will-we-grow.html

DeleteThe time path to consumption remains actually quite interesting even if we had a detailed understanding of long run productivity.

Productivity gains got hoovered up. The middle class is in the ropes (Glen's comment).

Consumption sucks because the consumer is fucked and he knows it. Businesses know the consumer is fucked.

After all, they are firing employees-consumers as fast as they can and/or paying him as little as they can. Somehow they must know what it means at the aggregated level. In a Game Theory sense, the first company who decided to stop paying living wages was the first to ‘default’. It won. Now that all companies have ‘defaulted’ , what does Game Theory say about the outcome? Stable sub-optimum or some-such?

I mean, why would any sane business invest? S&P500 revenue growth is bound to suck for a long long time...

Recently, even Japan slipped into a current account deficit.

DeleteAccordingly, what is common in all of the countries mentioned are current account deficits. Since on this blog correlation always equals causation, this poses a very hard question, especially when one considers the actions of Switzerland to keep its accounts positive and the actions of GB, showing that the gov't there now realizes it that, at all cost, it must turn the balance positive.

Look at all of Southern Europe. The answer for everyone is "raise exports," because no model (from Marx to Cochrane) will produce internal demand sufficient to return to work.

Pettis argues, and I believe correctly based on my reading, that Keynes was opposed to fiscal deficits in countries with a current account deficit. To be specific, Pettis asserts that Keynes wanted the US (today China) to run fiscal deficits during the Greater Depression (not GB and Europe).

Where do either of you place yourself on this fundamental?

Regarding expectations, you omit those of entrepreneurs, like myself. Where in your model is the expectation of every current entrepreneur who knows that any factory built to manufacture his or her product will be in China and hence, contrary to the lessons of Ford, he or she will not be creating demand for his or her product even among the workers making the same?

And, with robots, the future is worse. Everyone knows that robots will be deployed faster than new jobs are created, for there is no law or economics that a new job will be created to replace an old one destroyed by technology. This is also known as the iron rule of the Ozarks: Supply does not create its own demand, for we have an unlimited supply of rocks, for which there is no demand. The corollary is that Scarcity creates Demand.

Yes, long run productivity is the key. And that is due to improve because we have technological progress. But if we really wanted to give it a kick, we need to improve education and fix situations such as Chicago gang and murder problem, or at least mitigate them - we have a whole lot of unproductive workers who are that way because they grow up in catch-22 conditions

DeleteI'll have to return to this post to really understand it, but I'll comment now anyway to ask about a third possible view, which we could call the Blame-It-on-Obama View or, more simply, the Short-Run Supply View, which in a sense combines the other two. In this view, the problem is current bad policy, not expected future bad policy. Lavish unemployment insurance, housing aid conditional on being unemployed, Solyndra projects, uncertainty over Obamacare and the tax system, and even uncertainty over government spending growth combine to make people hesitate to put their labor and capital to immediate use, which reduces GDP. Get rid of all those things though, and output will spring back. That doesn't explain why people reduce their consumption, since permanent income hasn't fallen much, but it would if a lot of people are liquidity-constrained. Anyway, the implication is that once we get rid of the bad policy, the economy will spring back, as in the neo-Keynesian green line.

ReplyDelete"Lavish unemployment insurance" - LOL.

Delete"But these are great times for an employed 29 year old. He or she gets to buy houses and stocks much cheaper, or can "afford" to buy more other stuff and the same houses or stocks."

ReplyDeleteUnfortunately there's a dearth of employed 29 year olds, and of those many are college grads working at high school grad jobs, and those who have decent jobs might not feel secure enough to make the commitment. I agree with the commenters above that there's a lot of insecurity leading to - dare I say it? - a paradox of thrift.

Having payroll taxes go back up didn't help, nor did all the uncertainties of ObamaCare and the deferred fiscal cliff cage match, nor did the work week cutbacks that nobody in Congress seems to have foreseen.

However, Senator Feinstein has given us a Krugman-style alien invasion scenario for the private sector; she has pulled forward about 5 years' worth of demand for guns and ammo and there's no sign that it's easing up. We are about to do the experiment in real time. Let's see how the boost in aggregate demand works out. /sarc off.

The unemployment rate for college grads is 3.7%. And the wage premium for college is still quite high.

DeleteTo Cochrane, I would say look at market reactions to see if "open mouth operations" have an effect. Sumner has me convinced that they do.

And what kind of jobs do they have?

DeleteAnother reason there might be lower future productivity growth might be fundamental long-run technological stagnation such as Gordon and Cowen argue is happening. This looks to be a much more likely source than Obamacare or Dodd-Frank, which barely do anything, despite a lot of loud whining about them in some quarters.

ReplyDeleteOTOH, there is abundant technology growth for robots, which have the potential to blast productivity through the roof. Unfortunately, that will destroy unskilled labor jobs. Quite honestly, I don't see the need for human managers of these robots keeping up with the number of jobs destroyed by the robots. If you needed one human for each robot, why replace the human with the robot?

DeleteEven flipping burgers isn't safe: http://momentummachines.com/

Then we have the farmbots: http://www.newscientist.com/gallery/farm-robots

There are automated cow-milking systems: http://www.businessweek.com/articles/2012-10-05/the-210-000-cow-milking-robot

It's a good time to be a robot, but not an unskilled or blue collar worker.

And I like the irony of the captcha challenge on Blogspot that says "Please prove you're not a robot".

Thanks for such an interesting post. I have been one of the consumption economists at the Board since the summer of 2007 so I have spent many hours thinking about this topic. A few quick reactions to your post (and purely my views).

ReplyDelete1. I think that models which rely on significant interest rate sensitivity by households are going to have a hard time explaining actual consumption. From both working with macro times series in a reduced form way and more structured micro data analyses, inter-temporal smoothing looks weak. Now interest rates are likely important for durable expenditures (not flow consumption) but that's more likely a user cost or maybe an expectations channel.

2. I think the permanent income explanation is more plausible, though I would not take such as dismal view of policy effectiveness. The resources available to households took a big hit in the recession, lower net worth, little income gains, high unemployment AND households appear to have projected those conditions forward. The income expectations series in the Michigan survey fell like a rock in the recession. (See the link for some charts: https://docs.google.com/file/d/0B3Xcr11DtXJ-OTE1ODRhYTktYzQ3NS00NGYwLWExYzEtNjlmNmJiNTI1NGEz/edit?pli=1). Some additional analysis I have done with that data suggests that household might have overshot...become too pessimistic following the recession about their income prospects. That excess pessimism has been pretty persistent, but that doesn't necessarily mean its impervious to policy. One could imagine it being an extra kick if the recovery got going.

3. One last thing to ponder: two areas of spending that have been particularly weak in the recovery are housing services and financial services. Of course, the first order problem is that everything has been weak in recovering, but it might tell us something about particular channels, such as from the housing market.

"I think that models which rely on significant interest rate sensitivity by households are going to have a hard time explaining actual consumption."

DeleteI agree completely. It seems that most models have a tendency to overstate how observant (you didn't claim this explicitly, but I feel it's noteworthy) and sensitive they are to changes.

Good post, and thanks for the link.

I do not think it will be possible to return to the 3% growth trend line under current policies. Rather our growth will be the anemic variety which has long characterized Europe. And rightly so since we are following similar polices that Europe followed in the past.

DeleteThe only way that would change is if we were the recipient of some major breakthrough such as a slashing of energy prices.

The focus on demand is the problem. Get the basics right, get productivity and investment up, and demand will take care of itself.

Claudia great comment. Thanks.

DeleteFinancial services might appear low now because they were over stated per crash.

"But as a result, the new-Keynesian model really has nothing to do with the old-Keynesian intuition." - and therein lies the Achilles Heel. Try doing your analysis with the "old" Keynesian model and see what happens. I bet it works better. Money illusion is real, for the same reason PT Barnes is quoted for saying: "There's a sucker born every minute".

ReplyDeleteIf you look at the last graph, it seems to me that this graph is not linear. The growth rate is slowly slowing over time. As the low hanging productivity fruit is taken, it becomes harder and harder to maintain X growth in consumption. Furthermore, going forward, fewer and fewer people working, able or not, will lead to less and less consumption.

ReplyDeleteI do not buy into the Low Hanging fruit theory. Simply because it would have appeared the same way at any time in history. We are not capable of predicting the new technologies, methods, or circumstances which will produce future economic growth.

DeleteConsider the following three very large macro variables: 1) increasing female labor force participation from the end of WWII to about 1990, 2) increasing total credit market debt/GDP from the early 1980s until about 2007, and 3) increasingly favorable demographics, including dependency ratios and the relative size of the highest-consuming age groups during roughly the same period as the credit expansion. The increase in female labor force participation significantly more than offset the decrease in male labor force participation for 40+ years, allowing for a sustained rise in consumption offsetting (or masking) secular declines in underlying labor force productivity. The increase in total credit market debt (from about 150% of GDP for the 1960s and 1970s to a peak of about 350% when the bubble burst) allowed for more consumption offsetting (or masking) secular declines in productivity. The favorable demographics over roughly this same period, which are now unfavorable and will become increasingly so for many years, further accelerated this trend of consumption in excess of productivity. Basically, we've taken on debts we cannot repay and made promises (especially Federal entitlements) we cannot honor (in real terms) and used this to sustain consumption we could not otherwise sustain (with the help of a 30-year decline in long-term interest rates. All of this is now over or in the process of ending. These are extremely large macro factors. How do any of them figure into any of the models described here relating consumption trends or consumption levels?

ReplyDeleteThere is more to the consumption analsysis. My work develops an equation for total available capacity for factor utilization (labor and capital). The equation also has a zero lower bound which is affecting the dynamics of the economy.

ReplyDeletehere is the link...

https://docs.google.com/file/d/0BzqyF_-6xLVELWVQUkpPa1pEN1k/edit?usp=sharing

Very illuminating post, thank you.

ReplyDeleteSimplifying further the simplified models, it seems that all boils down to different long run expectations. Dot. Model 1: households’ beliefs didn’t change after the crisis, bad economic policy today is delaying the recovery, that will happen anyway. Model 2: households figured out during the crisis that the long-term prospects actually changed, there is nothing you can today but fixing the long run.

But as long as I understand the models have nothing to say about the long-run, that is driving the results (our own judgments have a lot to say, of course). Let the households (and all other economic agents) change beliefs and you’re done. Pick your preferred equilibrium!

I know I’m being unfair, as this ones are business-cycle models, but as we start talking about long-run and structural breaks, I strongly feel something missing here, and the short-long term separation looks more unrealistic than usual.

Real-interest-rates are just reflections of risk aversion. So why are high rates good?

ReplyDeleteKarl Smith has a good graph-filled response which says that there really was a measurable outbreak of thrift.

ReplyDeleteC is the wrong variable. We should be looking at I.

ReplyDeleteBut Consumtion is 70% of GDP!

Consuption is fairly stable of over time and ususally stable through recessions. Investment, while only 15% or so of GDP is dynamic.

Building from the "tail wagging the dog" metphor. C is the body of the dog. I is the nose of the dog. Where I goes, the rest follows.

Anonymous,

DeleteConsumption is not stable at all.

US personal consumption expenditures as a percentage of GDP:

http://research.stlouisfed.org/fred2/graph/fredgraph.pdf?&chart_type=line&graph_id=&category_id=&recession_bars=On&width=630&height=378&bgcolor=%23b3cde7&graph_bgcolor=%23ffffff&txtcolor=%23000000&ts=8&preserve_ratio=true&fo=ve&id=PCE_GDP&transformation=lin_lin&scale=Left&range=Custom&cosd=1950-01-01&coed=2012-12-01&line_color=%230000ff&link_values=&mark_type=NONE&mw=4&line_style=Solid&lw=1&vintage_date=2013-02-05_2013-02-05&revision_date=2013-02-05_2013-02-05&mma=0&nd=_&ost=&oet=&fml=a%2Fb&fq=Quarterly&fam=avg&fgst=lin

In 1960, PCE about 63% of GDP and swung between 61% and 63% from 1960 to 1970.

Frank,

DeleteThank you, your graph helps to illustrate my point. The graph which you link to shows that PCE/GDP is grew in every recession. This is because PCE is relatively stable and GDP is fluctuating, causing the ratio increase.

"The graph which you link to shows that PCE/GDP grew in every recession."

DeleteBut consumption did not fall back after the recession was over and GDP growth returned to trend. And so I don't know how you can argue that consumption is stable over time when it has in fact become a larger and larger portion of GDP over time.

"I started to break out the components but the post was getting too long."

ReplyDeleteWas getting? Just kidding. And I'm probably not your target audience anyway...I'm just trying to learn economics on my own by immersing myself in several blogs and books.

The demographic shift has started, and at the same time as the other things

ReplyDeleteI hate writing math over the internet too! Maybe the engineers (who were and are indeed nerds) may have simply been lazy nerds who were uninterested in turning math syntax into beautifully rendered equations. Unfortunately I couldn't find a Tex plugin but I did find something from Chapman, hope this helps.

ReplyDeletehttp://www1.chapman.edu/~jipsen/mathml/asciimath.html

For math in HTML, a good overview is: http://www.cs.tut.fi/~jkorpela/math/

ReplyDeleteI like jqmath: http://mathscribe.com/author/jqmath.html

This is a great, great post.

ReplyDeleteUnder the PIH view, why is the nominal rate zero and the real rate negative 2 percent? The marginal product of capital is negative? Preference shifts lead to value future consumption more than the present? Bad regulation today is just a portent of worse regulation to come?

It sure *looks* like we are at the ZLB. When inflation expectations rise, short term nominal rates don't move and short term real rates become more negative.

I'd love to here how PIH/neoclassical/neo-Cochrane? view explains that.

It doesn't. We are at the ZLB, and the real interest rate on government bonds is negative. (Private parties borrow at higher rates, and risk premia are much more important than most macro says.)

DeleteThe question is, how relevant is this fact for understanding the level of consumption. The PIH is not "the" model. As I wrote to the point of ridiculous repetition, it is a grossly oversimplified model, useful (maybe) for digesting one part of what's going on. It does not say WHY income fell, and in the big picture it alludes to, understanding the wedges in the economy's prodcutive capacity is key.

So, at this level of abstraction, the question is, does it really matter that we are at the ZLB and real interest rates on government bonds are -2%, not the usual +1%? Is that the key most important fact and distortion causing our doldrums? Or is that a fact, an interesting, fact, but a secondary epicycle, that we don't really need for reducing the big picture down to one equation in a blog post?

The art of economic modeling includes a lot of throwing out "realism" so you can get the important big picture.

it seems like it does really matter, because it is a telltale sign of the fact that private actors are suffering from excess of risk aversion, i.e. underinvesting in profitable projects

Delete"So, at this level of abstraction, the question is, does it really matter that we are at the ZLB and real interest rates on government bonds are -2%, not the usual +1%? Is that the key most important fact and distortion causing our doldrums?"

DeleteNo it is not. The key most important fact and distortion causing our doldrums is a failure to realize:

1. The federal government should sell equity instead of debt

2. On an after tax basis, the private cost of servicing debt can be BELOW THE ZERO BOUND, totally eliminating the "need" for Keynesian inflation or pump priming or whatever else you would like to call it.

Here is personal consumption expenditures dating back to 1960 compared with nominal ten year interest rates:

Deletehttp://research.stlouisfed.org/fred2/graph/fredgraph.pdf?&chart_type=line&graph_id=&category_id=&recession_bars=On&width=630&height=378&bgcolor=%23b3cde7&graph_bgcolor=%23ffffff&txtcolor=%23000000&ts=8&preserve_ratio=true&fo=ve&id=PCE,DGS10&transformation=pc1,lin&scale=Left,Left&range=Custom,Max&cosd=1960-01-01,1962-01-02&coed=2012-12-01,2013-02-04&line_color=%230000ff,%23ff0000&link_values=,&mark_type=NONE,NONE&mw=4,4&line_style=Solid,Solid&lw=1,1&vintage_date=2013-02-05,2013-02-05&revision_date=2013-02-05,2013-02-05&mma=0,0&nd=,&ost=,&oet=,&fml=a,a&fq=Monthly,Daily&fam=avg,avg&fgst=lin,lin

"All current macroeconomic theories start with the same basic story: when interest rates are higher, people consume less today, save, and then consume more in the future."

Nice theory. The numbers say otherwise.

This comment has been removed by the author.

DeleteI don't see much disagreement from those numbers, but the idea would be to detrend first...

DeleteThanks, that's a really interesting read.

ReplyDeleteAre the graphs total consumption or consumption per capita?

ReplyDeleteWe knew that during the boom, consumer grew as a share of GDP - that was clearly unsustainable.

Looking at the chart longer term - it looks like the rate of increase in consumption dropped around 1975. It also looks like consumption bulged above a 1992-1998 trend line during the period 1998 to 2006 - perhaps fueled by the "Greenspan put".

Yes, of course there was a big rise in consumption as we rode a classic debt fueled bubble. But growth has been slow not because of a lack of demand, but because of a lack of investment.

DeleteCapital is going into other nations, mostly to Asia.

Interesting write-up.

ReplyDeleteIf recessions occur because some portion of the capital base looses it's economic value (say via over-investment, but could be an earthquake), then a period of above average investment would be required to return consumption to trend: i.e. to replace or reallocate the lost capital in addition to expanding at the trend rate.

With this view, continue to invest at pre-recession rates would put consumption on a lower but parallel path following the end of the recession, while a drop in the investment rate would put one on a lower slope following the recession's end.

This view seems in conflict with conventional wisdom but consistent with actual behavior.

If you explore the last graph, it looks to ME that this graph isn't linear. the expansion rate is slowly fastness over time. because the low hanging productivity fruit is taken, it becomes tougher and tougher to take care of X growth in consumption.The Equation

ReplyDelete"If so, the trouble is in the second term on the right hand side of the basic equation (2). And this basic equation has a dramatic and important lesson for us: Long-run ("supply") will depress today's consumption every bit as much as expected future interest rates ("demand") effects do. And improving the long-run "supply" effects can have a direct "stimulative" effect on consumption today."

ReplyDeleteUsually, I think, the second term is discounted, such as:

lim(T to infinity)C_T*{(discount factor)^(T-t)}

where discount factor is affected by the paths of i_t and pi_t, as well as rho. In that case, "the improving the long-run "supply" effects" are limited. And if today's austerity leads to higher discount rate than otherwise, the effect will be reduced furthermore.

It seems that the Bank of England is also New Keynesian...

ReplyDeletehttp://uk.reuters.com/article/2013/02/13/uk-inflation-forecast-idUKBRE91C0JE20130213

Once I read the most stupid reason why Keynesian is the "most successful" modelling approach: "Just look at how many people is employed to work with these models! All central banks, several investment banks, etc."

Not difficult to reach this conclusion if the only reasons for an (active) central bank to exist are keynesian models! And then, of course, you need to employ people to forecast what these central banks will do to the economy.

Maybe here we have: a reason why the financial sector is so inflated (and we can clearly argue that this is *not* optimal as the press likes to say). But this only happens because of the distortion that the government imposes in the market!

What about that as a research topic?

Regards,

Thiago

This isn't related to the model issue per se but I think Harry is on to something. We may want to spend less time on economic models and more time on demographic models. I'm a financial economist, not a macro- or development economist, but it seems like there should be work out there that let's us strip out demographic effects from the long time-series of consumption growth. Obviously, there wasn't a sudden shift in 2007-2009 (except young Mexicans returning home), but there could be important aspects of changes that tell us what to expect over the next 10 years. A couple anecdotes: my baby-boomer sisters both retired in the last few years and I bet their consumption has each declined by 10%. My parents have gone from an active retirement of traveling, shopping, etc. to inactive retirement where their only consumption growth is in healthcare services. It just seems to me that if we want to really understand and compare the implications of macro models we need to adjust for any first-order demographic effects.

ReplyDeleteTheir basic facts seem to scream: The demand for financial services shifted out. People with scarce skills supplying such services made a lot of money. The investor should analysis before investing where they are going to invest.

ReplyDeletefarmland investment funds

"I've always wondered why buying a car is good (consumption) but buying a forklift is bad (investment) in new-Keynesian models."

ReplyDeleteIf a business owner in a depressed economy buys a forklift, she will park it next to the other forklifts in the warehouse that have nothing to do. She already can't move her inventory because of lack of consumption demand. If, on the other hand, consumption rises substantially she will have hope that she will sell a good part of her inventory. She will not only put her mothballed forklifts and their operators back to work, but she may place an order with the factory to renew her depleted inventory.

I observe a tendency amongst economists who are skeptical of keynesian models to think investment and consumption should be just as stimulative and see this as a tradeoff between C and I. But the forklift is the wrong tradeoff to consider. The basic methodology of the BEA shows us why.

The BEA maintains the NIPA as a double entry bookkeeping system. This is critical to making sure that you don't violate accounting identities like S = I. When I go down to the dealership and buy a car for $30,000 the BEA enters the transaction in PCE as I will be driving for personal consumption. But, by doing this I just eliminated $30,000 from savings. Therefore, investment must fall by $30,000, too. Fortunately, there is an obvious counterpart to my consumption. When I bought the vehicle, it no longer belongs to the dealership. The BEA must remove $30,000 from the Inventory Investment account as the second part of the transaction. It is easy to see from this analysis that the tradeoff to consumption is not forklift vs car. It is car being used for personal consumption vs car sitting unused in dealership inventory. The forklift may sound as if it is as good an option as the car (even though it isn't), but the car sitting unused on the lot for years is far worse than the car being used as a consumption good.

This article on Effects of Public Expenditure on Production and Distribution is also helpful. Thanks for this.

ReplyDelete