A few Stanford colleagues got together to talk about inflation, and that gave me an incentive to summarize recent writings as compactly as possible. Here goes, and thanks to everyone for a great discussion.

The big question

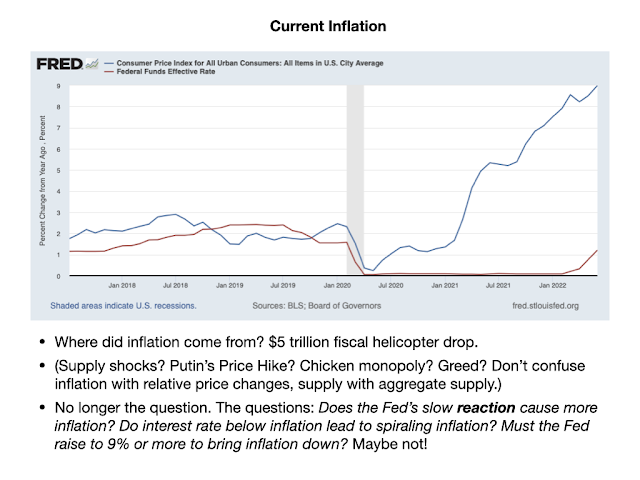

Here we are, 9% inflation. Yes, I think it came from the big fiscal helicopter drop. Others have other theories.Don't confuse inflation with relative prices. An oil price shock can make oil more expensive than other things. But it does not determine whether oil goes up 10% and wages go up 5%, or oil goes down 5% and wages go down 10%. The central phenomenon is a decline in the value of money, that prices and wages all go up together. The clearest indication that is the phenomenon is that wages are going up. Of course people and politicians care most about prices relative to wages. But don't let that confuse us about the economic issue.

|

| Slide courtesy Arvind Krishnamurthy |

The important question right now is, will the Fed's slow reaction lead to spiraling inflation? Conventional economic wisdom says that it takes interest rates above inflation to bring inflation down. As long as interest rates are below inflation, inflation will spiral up. That needs 10% or more interest rates, now. But the Fed thinks that interest rates are already "neutral," meaning that a 2.25-2.5% interest rate and 9% inflation does not push inflation up any more. How can they believe this?

Markets also believe that inflation will largely go away on its own, with no period of interest rates substantially above inflation:

Right now (right side of graph), markets think that inflation 5 years from now (lower blue line) will be 2.5%, and average inflation in the next 5 years will be about 3.4%. And these numbers have come down recently! Of course these markets like the Fed completely missed the emergence of inflation: both numbers were 2.5% in January 2021 on the day that inflation broke out. But that's their current forecast.

And here is the market forecast of interest rates. Markets think rates will rise briefly to 3.5%, but then go quickly back down to 2.5%. Inflation goes away on its own. How can that be?

So much for the real world, how does it work in theory?

This slide boils down 50 years of macroeconomics. i is interest rate, pi is inflation, x is output, the rest are parameters. There are two basic ingredients. First in "IS", higher real interest rates -- nominal interest rate i less expected inflation -- lowers output x. (The correct equation has the grayed out term, but that doesn't turn out to matter for these points.) Second, in "Phillips," inflation is higher if people expect more inflation in the future -- in that case, raise prices now -- and if the economy is booming.

Now, put those ingredients together, and we have the dynamic relationship between interest rates and inflation shown in the third equation.

But what is expected inflation? Starting with Milton Friedman in 1968, and proceeding through the Keynesian tradition since then, conventional wisdom says expected inflation is driven by whatever happened last year, "adaptive" expectations. Substitute that in, and you have the dynamics just above the left hand graph.

Inflation = (number bigger than one) x last year's inflation minus (number) times interest rate.

(Number bigger than one) means that inflation is unstable. If the Fed leaves interest rates alone, any small inflation will get bigger and bigger over time. This is the conventional wisdom that until the Fed raises rates above existing inflation, inflation will keep getting worse and worse.

What if people are smarter than that? What if their expectations for next year are "rational," including all information, or at least "consistent," a model should write that the people in the model have the same expectations as those of the model, we economists are not so much smarter than everyone else. Now we have the right hand group, and inflation dynamics are.

Next year's expected inflation = (number less than one) x this year's inflation plus (number) times interest rate

Now inflation is stable. Even if the Fed does nothing inflation will eventually -- accent on eventually, a lot may happen along the way -- come back down again.

Rational (or at least consistent) expectations, the idea that people think about the future when making decisions today, has been the cornerstone of macroeconomics since about 1972. It is part of the "new-Keynesian" tradition marked NK. There too, inflation is stable. The NK models can't tell you which of the dashed paths will happen, so they predict inflation will bat around between them. But they are all stable. Fiscal theory of the price level picks one of the dashed paths. Inflation is now stable and determinate.

Now you see the central economic question. Another way to put it, it's really about the sign of output in the Phillips curve. Does higher output, and lower real interest rates, cause inflation to grow, or to decline--to raise today's inflation above future inflation?

The Fed, and the markets, are taking the stability view, which the model produces by rational expectations. It's not completely crazy.

The Facts

What does history tell us about this momentous question? Well, that depends.

The conventional stylized history of inflation comes from the 1970s, top graph. The Fed didn't do as bad a job as most people say. In each of the four waves of inflation, the did, promptly, raise interest rates at least one for one, and usually more so, with inflation. The Fed never waited a whole year to do anything. And yet it was not enough, with inflation steadily ramping up, until in 1980 the Fed finally put interest rates decidedly above inflation, and left them there for years, despite a bruising recession.

With that standard interpretation of history, and the adaptive unstable model in mind, the conventional view economists are exactly right to be screaming from the rooftops that the Fed needs to raise interest rates, now.

But now there is another history. In the zero bound era, bottom graph, deflation threatened. (I plot core cpi. Actual CPI got to 2% deflation.) The same unstable/spiral view said, here we go. The Fed can't lower interest rates anymore, so we'll have a deflation spiral. It never happened. Inflation was quieter at the zero bound than before when the Fed was moving interest rates around!

Europe's zero bound lasted longer, until now. And Japan's longer still, starting in the early 1990s. You can't ask for a clearer test that inflation can be stable (and quiet) while central banks do nothing with interest rates. In theory, that needs a lot of preconditions, in particular that no other "shocks" come along -- we just saw a big one, more are coming. But the "stable" theory at least has one episode to counter the standard story of the 1970s.

In short, ye who say inflation will spiral upward if the Fed does not raise interest rates to 10% or more tomorrow, did ye not also say that inflation would spiral downward at the zero bound?

It's not completely crazy.

A fuller simple model

My last slide shows a simulation from a real but still very simple model. It has sticky prices, the full IS curve, rational expectations, and long-term debt. In the top panel, there is a 1% fiscal shock -- the government hands out 1% more debt and people do not think this will be repaid -- and the Fed does nothing. Again, in my view, we just did this times 30. The graph shows a lot of interesting things. First, a one-time fiscal shock leads to persistent inflation. Over several years of inflation higher than interest rates, inflation eats away at the value of government bonds. It does not lead to a one-time price level jump. We're living that period. But the inflation of a one-time fiscal shock eventually fades away on its own. (Don't take steadily declining inflation too seriously. It's pretty easy to spiff up the model to a hump-shaped response that rises smoothly for a while before turning around.)

Monetary policy is not helpless. What happens if the Fed raises rates, as it is starting to do, but there is no unexpected change in fiscal policy (i.e. continue to spend like drunken sailor, as before covid). In this simple model the Fed can lower inflation in the short run. Notice output fall. Yes, the Fed's tool is to cause a bit of recession (IS), and that pushes down inflation (Phillips). The Fed hopes to add just enough of the bottom curve on to the top curve to keep inflation somewhat moderated. But the Fed cannot eliminate inflation. Notice inflation goes up in the long run. The Fed bought lower initial inflation at the cost of prolonging the inflationary period. Eventually, in this model, inflation goes to wherever the Fed sets interest rates. I plotted interest rates that stay high forever so you can see how it works, but if the Fed eventually brings those rates down, so does inflation come down.

The ideal end to inflation would have the Fed do a little bit of this, and then Congress wakes up and gets fiscal policy in order -- passes the negative of the top graph.

Bottom line, both fiscal and monetary policy matter for inflation. Add the two graphs as you please to think about scenarios.

It's not so crazy.

Is this how the world works? I don't have pound fist on table certainty. I have spent so much of my life thinking the Fed has to raise interest rates promptly to avoid inflation, and so many economists think that's true, that fully digesting the rational expectations view is very hard. Yet theory, the Fed, markets, and the zero bound experience speak loudly.

In any case, if nothing terrible happens (these simulations assumptions no additional shocks), we will soon have another great test of macroeconomic theories, adding to the zero bound episode. Inflation will either fade away back down towards the Fed's interest rates, or inflation will continue to spiral upward until the Fed raises rates dramatically.

Yes, economics really doesn't fully know the answer to the most basic question, is inflation stable or unstable around an interest rate target, and does the Fed need to raise interest rates more than observed inflation to bring inflation under control. You now know as much as just about anyone.

The IS and Phillips curves (especially the latter) are awfully weak building blocks as well.

In the zero bound era, have you considered the effects of globalization and digitiazion on US inflation? For example, oursourcing manufacturing to countries with cheaper labor costs put a lid on US local labor costs. And the advent of computers and the internet increased productivity a lot.

ReplyDeleteI'm trying a new format here:

ReplyDeleteWhere does inflation come from? Can we blame some of it on oil?

*Yes: it's a factor input into many types of critical production (food as an example).

*Cost-push inflation is real.

*Proxy evidence: staggering oil market profits, not just revenues.

*Food costs are higher.

How do people use information?

*Perfect information isn't a reality. It's a theoretical possibility.

*People only use what information is useful to them at the time. Price information encoded as relative scarcity is a factor input into economic decision making.

*Plans can change as conditions change.

*Few critical goods have reasonable substitutes, assuming one is aware of them.

So, that's my attempt to economize. Sometimes I believe economics suffers from overcomplication, which can lead to critical decision making mistakes. I'm in the camp of simplification for the purpose of fixing critical problems right now. Otherwise it can crumble under its own weight, and decisiveness is traded away for complexity that causes harm.

A lot of times obvious things are ignored because they don't have the aire of technical profundity. But, I can tell you the obvious and little things matter in business. Unicorns are dying out or are morphing into zombies because they tried to be too clever and forgot basic business fundamentals in the attempt to reform business philosophy 101.

Mykel, if a rising oil price is partially responsible for inflation, how much then, is rising electricity prices responsible?

DeleteDear Mr Cochrane, thank you for intresting analysis! 70th is interesting example but I think CPI jump in 1947 with later soft recession of 49 is closer to current situation. According to Caplan article (1956) the reaction of government and FED to inflation burst came with lag and was rather limited. What do you think about that case?

ReplyDeleteBank Credit, All Commercial Banks (TOTBKCR) is on a tear.

ReplyDeletehttps://fred.stlouisfed.org/series/TOTBKCR

The FED has lost control

Bank credit as a fraction of M2 is lower than the peak value attained in Oct. 2008 (1.153:1) and it is comparable to the level it had in Aug. 1974 (0.782:1). (Bank credit)/(M2) = 0.7897:1 in June 2022. Cf., Sept. 2021 (0.756:1).

DeleteSee -- https://fred.stlouisfed.org/graph/?g=Sk97 .

The ratio of bank credit to M2 is the more informative measure, and it doesn't look especially out of wack at this point in the credit cycle. Of course, that can change, as it did following the 2001 recession when the ratio of bank credit to M2 went in a steady upward progression from a local minimum in July 2002 (0.919:1) to a local maximum in Dec. 2007 (1.145:1) just a year ahead of the melt-down in the 3rd quarter of 2008. Those were the days... .

The FOMC's proviso "bank credit proxy" used to be included in the FOMC’s directive during the Sept 66 - Sept 69 period.

Delete"1966 A new measure, the bank credit proxy, was developed during the year in order to get current information about the operating guide more frequently. This measure infers changes in member bank loans and investments (assets) from changes in member hank deposits (liabilities). Deposit data are available weekly on a daily average basis, whereas bank credit data are available less frequently."

Your ratio is more of a reflection in the "demand for money".

The ratio used in the FRED Chart at https://fred.stlouisfed.org/graph/?g=Sk97 (referenced in my earlier remark) is (TOTBKCR)/(M2SL).

DeleteThe time series M2 is discontinued (2017), but the time series M2SL is identical and the ratio is indistinguishable from (TOTBKCR)/(M2SL) plotted previously.

If you only consider the TOTBKCR measure, you will draw the wrong inference. The measure will always look either too high or too low, but only in relation to "trend" (or, extrapolation of prior period values). The economy grows or shrinks over time, the amount of money in the banking system increases or declines depending on the phase in the business cycle the economy is in--waxing or waning. If M2SL is not to your liking, suggest another measure to use as the denominator.

You're referencing the change in currency.

DeleteThis was a terrific summary. I think it distills down a lot of the complex theories into nice, bite sized pieces.

ReplyDeleteThrow the theories away. Compare the rate of change in M2 from the value of M2 a year earlier, and consider the magnitude of the percentage-change. The 2020-2022 period is far and away larger than any comparable period prior to 2020. Cf., https://fred.stlouisfed.org/graph/?g=SkaA

ReplyDeleteLocal maximum bi-weekly average %-change from year earlier M2 illustrate the phenomenon.

Date %-change from year earlier period M2

7/18/1983 12.9%

10/1/2001 10.2%

1/12/2009 10.5%

1/23/2012 10.26%

11/21/2016 7.42%

5/18/2020 21.84%

2/22/2021 27.2%

7/12/2021 12.0%

8/13/2021 13.5%

12/27/2021 12.7%

5/30/2022 6.48%

6/27/2022 5.97%

The simplified New Keynesian 2-equation model without the tacked on fiscal theory of the price level, and the simplified New Keynesian 2-equation model with the tacked on fiscal theory of the price level, fail when the fundamental assumption on which the model is based is violated. The fundamental assumption is that the model measures small perturbations from the assumed stationary steady-state. The simplified 2-eqn NK model, with or without, the tacked on fiscal theory of the price level equations doesn't fit the 2020-2022 circumstances. The year-over-year %-change in M2 points that out, in no uncertain terms.

re: "The 2020-2022 period is far and away larger than any comparable period prior to 2020"

DeleteThat's an understatement. But M2 is overstated by O/N RRP volumes. Just because its overnight, “The bond underlying the repo transaction is still recorded on the Fed balance sheet”.

see: June 03, 2022 “Understanding Bank Deposit Growth during the COVID-19 Pandemic”

https://www.federalreserve.gov/econres/notes/feds-notes/understanding-bank-deposit-growth-during-the-covid-19-pandemic-20220603.htm

“the deposits may leave the banking system if the holder of the deposits exchanges them”… “in the Federal Reserve’s Overnight Reverse Repurchase (ON RRP) facility.”

What proportion of the year-over-year increase in M2 is attributable to O/N RRP volumes in 2020-22 and in earlier periods, e.g., 1983-2016?

DeleteNothing significant in older periods. And M2 is both empirically and theoretically discredited. Dan Thornton is correct. “Money Supply and Inflation: Where’s the Proof?” WSJ July 21, 2022

DeleteThe problem is that the reporting error impacts my "means-of-payment" time series.

https://fred.stlouisfed.org/series/RRPONTSYD/

Since the FED discontinued legal reserves, and thus "total checkable deposits", I use DDs. The distributed lag effect of money flows, the volume and transactions' velocity of money, are mathematical constants. But the correlation has for the first time broken down.

Apart from a scale factor effect, the ratio RRPONTSYD:M2SL and the ratio RRPONTSYD:WDDNS are essentially identical series.

Deletecf.: https://fred.stlouisfed.org/graph/?g=SxK6

The scaling factor is approximately 1-in-4, M2SL being roughly 4 times larger than WDDNS.

I did look carefully at https://fred.stlouisfed.org/series/RRPONTSYD/ , earlier, and compared it to M2. The ratio RRPONTSYD:M2SL ranged from 0.00633:100 (Feb. 2021) to 9.979:100 (June 2022) versus an earlier period (8/13 to 3/18) when it ranged from a low of 0.0293:100 (Aug. 2013) to a high of 1.8377:100 (Dec. 2016). There is a clear difference in the scale of activity from 2/21-6/22 versus the earlier period of significant activity, 8/13-12/16.

My impression (uninformed, except for what I can take away from the FRED graph) is that FOMC has been attempting to keep the Federal Funds rate under control since 2021 through the NY FRB's open market activity.

Using WDDNS in the denominator, in lieu of M2SL, doesn't alter that impression.

Independently, in 2021, I worked out the estimate of future inflation using the quantity theory (velocity = 1) and arrived at an estimate of 5% for the future inflation rate (2021-2022) on an admittedly thin premise of rate of change in supply of money arising from the stimulus of 2020-21. This was a 'back-of-the-envelope' type of calculation, not a formal analysis.

Last month I undertook a simple OLS regression on the rate of inflation against M2 growth rate (year-over-year) lagged by six calendar quarters and four calendar quarters together of the form Y = b0 + b1 X1 + b2 X2 + w'. Y = current period rate of inflation, X1 = M2 growth (yr-yr) lagged 4 quarters, X2 = M2 growth (yr-yr) lagged 6 quarters, for the period 2018:Q4 thru 2022:Q1, out of curiosity.

The t-values were significant at 5%; the coeff. of determination was fair at 80%; and the F-statistic was significant, but more so because of the use of two independent variables than for any other reason.

The result was satisfactory insofar as it conformed to the general rule of thumb that monetary policy acts with a lag of at least a year and often with a longer lag period. However, I couldn't recommend wagering serious money on the model's predictive power. The result is valid for the period examined but not generally so, as a cursory examination of the longer time series of CPI core inflation rate and M2 growth will amply demonstrate.

This post-pandemic period is probably unique for any number of reasons, including (but not limited to) monetary policy and its knock-on effects.

In the zero interest scenario is it not true that other/related dramatic interventions were at play such as QE that countered deflation despite fixed interest rate ?

ReplyDeleteIt is true that the Fed did massive QE. Just enough hyperinflation to exactly offset the deflation spiral, so we saw nothing? As I joked in seminars, you sleep quietly through the night. The captain comes down to tell you of his huge adventure--the hurricane of hyperinflation on the port bow, the whirlpool of deflation on the starboard, and he just nailed it down the middle. Maybe. Or maybe QE is just changing 2 $5 and a $10 for each 20, and inflation is stable at a zero interest rate. This is a much much shortened version of a long argument here https://www.johnhcochrane.com/research-all/michelson-morley-fisher-and-occam-the-radical-implications-of-stable-inflation-at-the-zero-bound which takes up that and many other epicycles to account for the zero bound era.

DeleteJohn, in the “zero bound era”, the Fed and BoJ couldn’t lower rates any lower. But they were doing “unlimited” QE to try and reinflate the economy and asset prices. Isn’t this the explanation for why we didn’t observe a deflation spiral? Btw, I’m a former student of yours - GSB ‘96.

ReplyDeleteSee response to last comment. Great to see ex students here!

DeleteThe BOJ's QE is a monetary offset. Banks don't lend deposits, deposits are the result of lending. Ergo, all bank-held savings are frozen, lost to both consumption and investment, indeed to any type of payment or expenditure.

Delete“Japanese households have 52% of their money in currency & deposits, vs 35% for people in the Eurozone and 14% for the US.”

The impoundment of monetary savings, and all monetary savings originate in the payment's system, is responsible for the deceleration in the velocity of circulation (secular stagnation).

Retrospective contemplation often proves useful. Here is Robert Lucas, Jr., summing up the lessons of the 1970s:

ReplyDelete'In his Nobel lecture, one of the most readable Nobel economics lectures of the last twenty years, Lucas summed up his and others’ contributions in the 1970s:

"The main finding that emerged from the research of the 1970s is that anticipated changes in money growth have very different effects from unanticipated changes. Anticipated monetary expansions have inflation tax effects and induce an inflation premium on nominal interest rates, but they are not associated with the kind of stimulus to employment and production that Hume described. Unanticipated monetary expansions, on the other hand, can stimulate production as, symmetrically, unanticipated contractions can induce depression." ' -- See http://nobelprize.org/economics/laureates/1995/lucas-lecture.pdf, p. 262.

David R. Henderson, https://www.econlib.org/library/Enc/bios/Lucas.html .

John, it would be helpful to have high resolution charts posted (especially the ones courtesy of Arvind Krishnamurthy

ReplyDeleteEconomists should have taken their lead from Dr. Milton Friedman: “The Lag from Monetary Policy Actions to Inflation: Friedman Revisited” 2002

ReplyDelete“We reaffirm Friedman’s result that it takes over a year before monetary policy actions have their peak effect on inflation… Similarly, advances in information processing and in financial market sophistication do not appear to have substantially shortened the lag”

John, especially appreciate your last sentence. There are still some of us around (like yourself) that think that a IS + Phillips Curve (even in much fancier presentations of it) is a poor foundation for understanding macro outcomes. The Fed's perspective (both explicitly in the FRB model and implicitly) isn't independent of this foundation (along with a RE or consistent expectations view) so hard to take these as truly different "data points". The market's view, as you note, is both independent and interesting. Like you, I don't just disregard it but am concerned about a "Peso Problem" kind of event where market's views change rapidly.

ReplyDeleteGreat post. One question: you stress that we don't know whether inflation is stable or not. Yet the stability/instability comes from the expectations formation process. Are you saying that fundamentally we don't know how expectations are formed and hence we don't know the implications for inflation dynamics? What about the implications in a hybrid PC? Secondly, what about other less parsimonious expectations formation processes, like diagnostic expectations? Can anything be extrapolated from those as far as inflation dynamics are concerned? thanks

ReplyDeleteVery clear and interesting synthesis that even a non-macro person like myself can follow. Doesn't exactly give me the greatest confidence in macro though...

ReplyDeleteIs inflation not simply demand and supply shocks? Supply shocks cause temporary deflation or inflation, or permanent inflation or deflation if the shock is permanent (eg minimum wages above market rates or technological improvements that increase productivity). Demand shocks typically stem from government intervention, like price controls from ww1 and ww2, which caused massive inflation after they were released. If the fiscal policy or monetary policy stimulate more demand than there is supply, we get inflation as we see now (the government can also reduce supply as with price controls, causing inflation). The pandemic shut down the economy and lockdowns made people save more money, thats a supply shock (supply of goods and supply of money). Then there's the demand shock from monetary and fiscal policy, resulting in an explosion of demand post pandemic.

ReplyDeleteWhy did inflation not occur in Europe and Japan in the years you mentioned? Is it not possible that the demand doesn't necessarily stay within the country? In essence, could a country not offload its inflation to other countries through investments or purchases? Could it be that demand pull inflation results when the demand is constrained within a country, yet kept low when the demand can be met in other countries?

Perhaps I'm horribly mistaken. It just seems to me that inflation is the result of people adapting to their circumstances, which can't be explained by any one theory. To me, inflation is the necessary result of attempting to mastermind the economy, and being mistaken. Nature reasserts itself and shows the folly in our hubris.

In econ 101; i was told economics is always a picture of the past. While some things hold true others change.

ReplyDeleteTime is the important unknown factor in two dimensional economics. A few years of adjustment may be needed as large shifts in demand occur. Ie highest housing inflation in southern and no tax states and deflation in northern states. Flat here in chicago for 20 years, 200% in florida or texas.

So making time dependent decisions on shifts in the supply demand pricing curve on a notion wide basis is fraught with short term term poor decision making.

When invoking "rational expectations", take a minute to consider the chart provided by Torsten Slok, chief economist at Apollo Global Management. The latest rendition is found by navigating to https://johnhcochrane.blogspot.com/2022/01/interest-rate-surveys.html

ReplyDeleteAlthough Mr. Slok is tuned into the interest-rate surveys, the surveys include other measures of importance to economists and financiers, such as the unemployment rate forecast and the inflation rate forecast. The forecasts in the periodic surveys of economic forecasters (cf., The Wall Street Journal survey of economic forecasters) are illustrative of the inputs--the conditional expectations of the "output gap", x(t+1), and the "rate of inflation", pi(t+1). These are inputs that we should be using in the new Keynesian IS and PC equations that appear in John's current blog post (see above). To assume, as he does in the 5th slide (chart) in the blog post, that the IS and PC equations can be turned into dynamic discrete-time difference equations (analog of the continuous time first order differential state equations) is a misapprehension. In both the IS curve (eqn.) and the PC curve (eqn.) the equals sign should be replaced by a horizontal arrow pointing towards the left, e.g., xₜ = Eₜ{xₜ₊₁} – σ∙( iₜⁿᵒ ͫ – Eₜ{π ₜ₊₁} – ρ ) is replaced by xₜ ← [ Eₜ{xₜ₊₁} – σ∙( iₜⁿᵒ ͫ – Eₜ{π ₜ₊₁} – ρ )], and so on for the PC curve.

The discrete-time state difference equations have a different form, e.g.,

xₜ₊₁ - xₜ = g(xₜ , πₜ , iₜⁿᵒ ͫ , iₜ₊₁ⁿᵒ ͫ , Eₜ{xₜ₊₁}, Eₜ₊₂{xₜ₊₁} , Eₜ{πₜ₊₁}, Eₜ₊₂{πₜ₊₁}, ε̃ₚ ₜ , ε̃ₚ ₜ₊₁ , ε̃ₓ ₜ , ε̃ₓ ₜ₊₁ ) where the last four variable are forecast error terms having non-zero means and positive variances and covariances of the error terms with one another and with the state variables are not all zero. Does this make the model intractable? Possibly; but, it makes it more interesting than a simple first-order (or, second-order) lag response function. Why more interesting? Because, it forces the analyst to consider more than just the mathematics of mechanical or physical control systems. Or, stated, in Mr. Torsten Slok's vernacular -- (paraphrasing) how could economists get it wrong (the forecast) so consistently? And, we shouldn't take the FOMC "dot plots" as the input to the conditional expectations of the one-period ahead output gap and rate of inflation, but put those aside and look to the outside indicators ('leading' indicators in the old vernacular, and others).

The 5th slide is comforting, but misleading. C'est la vie.

Monetarism has never been tried. Monetarism involves controlling total reserves, not non-borrowed reserves as Paul Volcker found out. Volcker targeted non-borrowed reserves (@$18.174b 4/1/1980) when total reserves were (@$44.88b).

ReplyDeleteInflation was derived from a 24mo rate-of-change in required reserves (unbeknownst to the FEDs' technical staff). Now the FED is without a rudder or an anchor.

John, thank you for explaining to the ecoomicly illiterate public the difference between price levels and the rate of change in prices caused by fiscal and monetary policy. That’s lesson one for our economically illiterate public.

ReplyDelete