Expectations and the Neutrality of Interest Rates is a new paper. It's an essay, really, expanding on a lunch talk I was privileged to give at the Minneapolis Fed "Foundations of Monetary Policy" conference in honor of the 50th anniversary of Bob Lucas' 1972 "Expectations and the Neutrality of Money."

Abstract:

Lucas (1972) is the pathbreaking analysis of the neutrality and temporary non-neutrality of money. But our central banks set interest rate targets, and do not even pretend to control money supplies. How is inflation determined under an interest rate target?

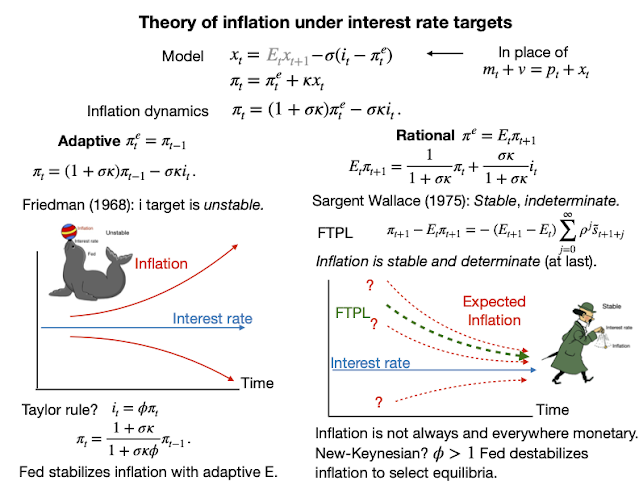

We finally have a complete theory of inflation under interest rate targets, that mirrors the long-run neutrality and frictionless limit of monetary theory: Inflation can be stable and determinate under interest rate targets, including a k percent rule, i. e. a peg. The zero bound era is confirmatory evidence. Uncomfortably, long-run neutrality means that higher interest rates eventually produce higher inflation, other things (and fiscal policy in particular) constant.

With a Phillips curve, we have some non-neutrality as well: Higher nominal interest rates raise real rates and lower output. A good model in which higher interest rates temporarily lower inflation is a harder task. I exhibit one such model. It has the Lucas property that only unexpected interest rate rises can lower inflation. A better model, and empirical understanding, is as crucial to today's agenda as Lucas (1972) was in its day.

Much of this is contentious. The issues are crucial for policy: Can the Fed contain inflation without dramatically raising interest rates? Given the state of knowledge, a bit of humility is in order.

The link also has slides, if you like those. In one slide, I managed to put together the 54 year project to (finally) produce a full theory of inflation under interest rate targets:

re: "Can the Fed contain inflation without dramatically raising interest rates?"

ReplyDeleteYes, the 1966 Interest Rate Adjustment Act is prima facie evidence. So is QE3, where the FDIC reduced deposit insurance from unlimited to $250,000.

Banks don't lend deposits. Deposits are the result of lending. Ergo, all bank-held savings are frozen. The DIDMCA of March 31st, 1980, proves this. It turned the nonbanks into banks destroying money velocity.

ReplyDeleteThe E.U. and the U.K. are both experiencing unprecedented inflation, driven in part by energy prices that are not volatile in the normal sense but in the supply-demand mismatch sense. Joseph C. Sternberg of The Wall Street Journal in an article titled "The Coming Global Crisis of Climate Policy" (WSJ, p. A17, 2022-09-09) ascribes this development to the climate-change policies adopted by the E.U. and the U.K. He warns that "[t]he U.K. may be facing a wave of business bankruptcies exceeding anything witnessed during the post-2008 panic and recession. Some100,000 firms could be forced into insolvency in coming months, bankruptcy consultancy Red Flag Alert warned this week.These are otherwise healthy firms with at least £1 million in annual revenue. Business failures on this scale would dwarf the roughly 65,000 firms of any size that went under from 2008-10."

ReplyDeleteThe excessive price increases facing U.K. and E.U. consumers and firms are the direct result of government policies adopted to "fight climate change" and assuage the demands from environmentalist and international bodies such as the U.N., I.E.A., I.P.C.C., and international money managers such as Blackrock and Vanguard, amongst others.

Not all inflation is caused by or responsive to government fiscal policies or interest rate hikes. Central banks have yet to prove that they can manage the money supply through interest rate policy alone.

If J. C. Sternberg is correct, moderate inflation of 5%-6% will prove to be the least of worries, and central banks will soon be contending with larger problems relating to deep recessions and financial sector crises.

re: "manage the money supply through interest rate policy alone"

DeleteExactly. The effect of the FED’s operations on interest rates is indirect, varies widely over time, and in magnitude. What the net expansion of money will be, as a consequence of a given injection of additional reserves, nobody knows until long after the fact.

The consequence is a delayed, remote, and approximate control over the lending and money-creating capacity of the payment’s system.

What caused secular stagnation was the deregulation of interest rates. This was predicted in: “Should Commercial banks accept savings deposits?” Conference on Savings and Residential Financing 1961 Proceedings, United States Savings and Loan League, Chicago, 1961, 42, 43.

DeleteWe got stagflation – as predicted

We got secular strangulation – as predicted

Errata:

ReplyDeleteEquation (14) appearing on page 9 of the paper “Expectations and the Neutrality of Interest Rates”, 2022-09-08, JCH, reads

Eₜπₜ₊₁ = – ( πₜ – Eₜπₜ₋₁ )/(σ∙κ) - iₜ (14)

If equation (14) is derived from substitution of the right-hand side of equation (12) for the term xₜ in equation (13), then the correct form for equation (14) is given by

Eₜπₜ₊₁ = ( πₜ – Eₜπₜ₋₁ )/(σ∙κ) + iₜ (14, corrected)

This can be verified by substituting the right-hand side of equation (14, corrected) for the term Eₜπₜ₊₁ in equation (12) and then simplifying the resulting expression. Thus,

(12) xₜ = – σ∙( iₜ – Eₜπₜ₊₁ )

becomes

(12´) xₜ = – σ∙( iₜ – ( πₜ – Eₜπₜ₋₁ )/(σ∙κ) – iₜ).

Cancelling like terms in (12´) gives

(12´´) xₜ = ( πₜ – Eₜπₜ₋₁ )/ κ .

Re-arranging the order of equation (12´´) gives equation (13), i.e.,

(12´´´) κ∙xₜ + Eₜπₜ₋₁ = πₜ .

It then follows that equation (14) appearing on p. 9 has the wrong sign on both terms standing to the right of the equality sign.

If the error is carried through the rest of the paper, then it is likely that the solution has the wrong sign as well; unless, of course, equation (14) is taken to an even power wherever it appears subsequently in the paper. I admit that I haven’t taken the trouble to discover to what extent the error leads to erroneous subsequent conclusions.

[You might consider not publishing this remark, insofar as it only pertains to the paper itself and not the weblog post about the paper. /s/ O.E.E.]

Thanks so much! As typos, especially in equations are the bane of my life, I always appreciate them being pointed out. They pass by like the gorilla in the basketball game. Fixed now.

DeleteThe equation Eₜ{πₜ₊₂} = Eₜ{iₜ₊₁} (un-numbered) that follows eqn. (14) is derived from the corrected eqn. (14) without error, interestingly enough. The uncorrected eqn. (14) is a standalone “typo”. One has to invoke the iterated expectations principle to get the result, of as a matter of course. [/s/ O.E.E.]

DeleteIn the Appendix to the paper, the remark is made that "rational expectations" in continuous time takes the time derivative of x going "forwards", while "adaptive expectations" takes the time derivative of x going "backwards". This raises the question of the notion of the derivative in differential calculus. Convention states that the arrow of time points only in one direction--i.e., forward. Convention gives the definition of the derivative of x(t), where x(t) is any real-valued variable that is piece-wise continuous C² with a limited number of discontinuities, as

ReplyDeletedx(t)/dt = lim Δt →0₊ {[x(t + Δt) – x(t)] / Δt} = lim Δt →0₊ {[x(t) – x(t – Δt)] / Δt}.

Curiosity compels me to inquire as to the meaning of the expression you use to distinguish between the derivatives under rational expectations and adaptive expectations. To the best of my knowledge, the lag operator, L , is not used in continuous time problems with the exception of a transportation lag, such as u(t – τ) with u(t)=0 for t <0.

With jumps or diffusions, the "forward" and "backward" differences are not the same. The process is not differentiable. You can actually use all the linear operator tricks in continuous time as well. Strangely, this is not part of the usual continuous time literature. I wrote up the translation in "continuous time linear models," here. https://www.johnhcochrane.com/research-all/continuous-time-linear-models.

DeleteThe link "https://www.johnhcochrane.com/research-all/continuous-time-linear-models" is not accessible to me. :{

DeleteIs it the period that's causing problems? If not, johnhcochrane.com, then articles, then time series should get you there.

DeleteMany thanks. The "Read more." link brings up the paper (57 pp.)

DeleteOne thing that happened during the pandemic was places would tighten rules until cases started falling and then loosen them until cases started rising. It gave the illusion of control, because rules were tightest before cases fell and loosest when they started rising. But the same would be true if we burned a witch when cases started rising, then two if they kept rising etc.. You'd burn the most witches the week cases peaked and the fewest when cases troughed. In 2022 they stopped bothering, but the waves still looked the same.

ReplyDeleteI wonder if something similar didn't happen with interest rate/inflation targeting. CBs have tons of groupthink and the great moderation started when inflation/interest rate targeting was in vogue, so it was logical to think policy was the reason. I still mostly think that. But would we be able to tell if it was some random other thing? It kind of happened everywhere at once, no? If some third cause were responsible, ATMs, globalization, financialization the nature of interest rate targeting would still give the illusion of being responsible, irates would go up until inflation came down and go down until inflation went up.

Errata:

ReplyDeleteThe sign of third term of the RHS of Equation (9) should be negative.

9/21/22 Did anyone notice when questioned today about the hurdles he is faced with, Powell gave no mention or hint today to the fiscal money supply tsunami he is facing. Any opinions why?

ReplyDelete