I was having a bit of fun making graphs for a talk. Are we all fine

and debt is no longer a problem? I went back for a closer look at the CBO's long term budget outlook and The budget and economic outlook 2013 to 2023. All numbers from these sources.

Above, I plot the CBO's long term outlook, in the alternative fiscal scenario (i.e. the one that is even faintly plausible). As you can see, though they think the deficit gets better for a bit, then the entitlements disaster is still with us.

Of course, this will not happen, the only question is what adjusts. If bond markets get a whiff that we actually will try these paths, we have a crisis on our hands.

So what can adjust? Revenue is historically about 20% of GDP no matter what tax rates are. Doubling Federal revenue, while of course states, cities and counties keep taxing us, seems like an unlikely prospect. I'm all for cutting spending, but really, cutting spending in half, and by more than 20 percentage points of GDP? Well, it's in the Ryan budget, but it's a lot. So, what else can we do?

Answer: Growth. Tax revenue equals tax rate times income, and income equals todays income times growth. Greater growth makes all the difference.

To illustrate this point, I made a simple calculation. Suppose growth is 1% and then 2% greater than the CBO projects. What effect does that have? To keep it very simple, I assume that spending stays the same, and revenue stays the same fraction of GDP. Thus, I just divide spending/GDP by a 1% and then 2% growth rate (e^(0.01 t)) and we have the new spending as a fraction of the larger GDP.

This is pretty amazing, no? If we just had two percentage points GDP growth greater than the CBO's forecast (which is a bit above 2% in the out years) the whole budget would be solved without fixing anything.

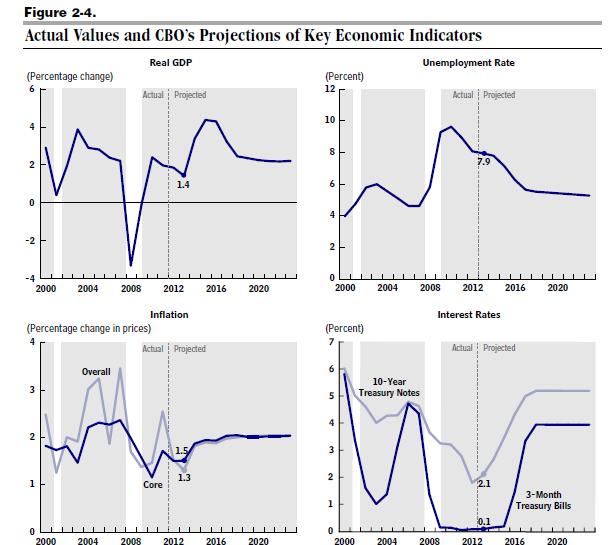

This thought sent me back to look at the CBO's economic assumptions,

Uh-oh. The CBO thinks we are going to quickly enter a period of 4% growth, go back to trend, and then start growing smartly. Tax revenue = tax rate x income, that's a lot of revenue. The CBO, the Fed, and everyone else (me too for a few years) has been forecasting this bounce back growth just around the corner for a while now. What if it doesn't happen, and 1.5% growth without catching up to trend is the new normal?

To keep it simple, I redid the above chart now just assuming 1% and 2% less growth than the CBO.

Is that Greece, or Cyprus?

So, the real budget news that could matter has little to do with tax rates or spending. What matters most of all is whether we break out of this sclerotic growth trap.

I found this graph pretty chilling as well:

Really, what chance do you think there is that defense, nondefense discretionary and other mandatory spending will decrease form 4% of GDP to 2.5-3% of GDP in 10 years?

The net interest line is interesting. That's a huge rise. Why? Here are the other economic assumptions

You see the strong GDP growth, 4% for several years, in the top left panel. Inflation, bottom left, apparently has nothing to do with deficits, the Phillips Curve is alive and well.

But, the CBO is projecting interest rates to rise sharply in 2016, back to a low-normal 4% 3 month and 5% 5 year rate. This causes the $850 billion a year in interest costs highlighted in the previous graph, about the same numbers I was bandying about in "Monetary Policy with Large Debts" when worrying whether the Fed could actually do that to deficits.

From the deficit view, a Japanese lost decade of low interest rates would keep this from happening (or postpone it). Of course any financial event leading to higher interest rates would increase these interest payments a lot.

From a bloomberg article

ReplyDeleteDean Baker, co-director of the Center for Economic and Policy Research, called the idea of debt limiting growth “very silly,” saying the U.S. retains vast assets, including technically recoverable oil and gas reserves estimated by the Institute for Energy Research at $128 trillion.

shouldn't the US Govt fiscal position calculation take this 128 trillion into account ?

Obama is against the development of oil and gas reserves on Federal lands, although he takes credit for the increase in oil and gas production from shales on private and state lands as if he had anything to do with it. Actually under his Administration production of hydrocarbons on Federal land and in the Gulf of Mexico has declined.

DeleteRenewable energy is not ready for prime time. We have been subsidizing wind energy for 20 years and it's still too expensive.

"including technically recoverable oil and gas reserves"

DeleteWhich they will fight like hell to keep anybody from using.

"the U.S. retains vast assets"

DeleteIt is like a bunch of guys throwing a house party. They are out of money and out of booze. Somebodys says: "If we rip the copper pipes out of the basement, we can get enough money to buy a couple more kegs".

Yeah, that'll work out pretty well, won't it?

"Revenue is historically about 20% of GDP no matter what tax rates are."

ReplyDeleteFederal Revenue has been as low a 15.5% of GDP and has broached 20% of GDP only twice in recent history - 1980-81 and 1999-2000.

http://research.stlouisfed.org/fred2/graph/fredgraph.pdf?&chart_type=line&graph_id=&category_id=&recession_bars=On&width=630&height=378&bgcolor=%23b3cde7&graph_bgcolor=%23ffffff&txtcolor=%23000000&ts=8&preserve_ratio=true&fo=ve&id=FGRECPT_GDP&transformation=lin_lin&scale=Left&range=Custom&cosd=1950-01-01&coed=2012-10-01&line_color=%230000ff&link_values=&mark_type=NONE&mw=4&line_style=Solid&lw=1&vintage_date=2013-03-22_2013-03-22&revision_date=2013-03-22_2013-03-22&mma=0&nd=_&ost=&oet=&fml=a%2Fb&fq=Quarterly&fam=avg&fgst=lin

"But, the CBO is projecting interest rates to rise sharply in 2016, back to a low-normal 4% 3 month and 5% 5 year rate. This causes the $850 billion a year in interest costs highlighted in the previous graph, about the same numbers I was bandying about in "Monetary Policy with Large Debts" when worrying whether the Fed could actually do that to deficits."

And if all of the debt was held internally by the US this would not be a problem. Those interest payments become some American's income.

"So, the real budget news that could matter has little to do with tax rates or spending. What matters most of all is whether we break out of this sclerotic growth trap."

GDP = Personal Consumption Expenditures + Business Investment + Government Expenditures + (Exports - Imports).

Courtesy of the federal reserve, income has shrank leaving out PCE. Courtesy of the federal government selling debt abroad, forgot about NET EX.

Courtesy of the federal government addressing the deficit as a spending problem, forget about GE.

That just leaves you business investment and tax policy. And as shown from the above chart, tax revenue as a percentage of GDP is at the low end of the scale.

Dear proffesor Cochrane,

ReplyDeleteYou are arguing the growth is a solution to the U.S deficit problem, as far as I understand You. However, it seems to me that You are treating the GDP growth to be exogenous. In other words, it is not the spending that is high, but rather the growth that is low. But, maybe, the growth is low, because spending is high. I have found this paper by Alesina et al. (2002) that investigates the impact of fiscal policy on profits and investments in OECD countries. The authors argue that public spending, especially its wage component, has sizeable negative effect on profits and business investment. http://www.economics.harvard.edu/faculty/alesina/files/Fiscal%20Policy,%20Profits%20and%20Investment.pdf

How refreshing. Most of my other commenters seem to be Keynesians who think more spending = more growth. I agree, substantially less spending in the right places could increase growth. But the point was a very simple calculation, not a detailed dynamic simulation. And putting that effect in would seem to be cooking the books.

DeleteProfessor,

Deleteyou argue:

"[...] substantially less spending in the right places could increase growth."

I am not saying I disagree, but I would say, that the very few that espouse a position like yours above [either in the policy world or in academia, there are not that many] have not articulated well of *WHY* such statement could be true.

In the meantime, Keynesian are ploughing along and pounding the "spend,spend, spend" mantra, while the very few that do not agree cannot articulate it well for the populace at large.

That's my 2 cents.

"Most of my other commenters seem to be Keynesians"

DeleteMy perception is that the biggest cluster of commenters on your blog are libertarians who want to advance a social agenda under the pretext of economic policy.

"Most of my other commenters seem to be Keynesians who think more spending = more growth. I agree, substantially less spending in the right places could increase growth."

DeleteGovernment expenditures are part of nominal GDP, you can argue all you want, that is how nominal GDP is calculated.

Do government expenditures contribute to real GDP? I think what you mean to say is that substantially less spending in the right places could shift the balance of real and nominal growth.

Frank,

DeleteGDP is something made up and doesn't exactly reflect a quality of living. If the Govt spend another 40 trillion next year "GDP" would go up, but our quality of life certainly wouldn't.

Anonymous,

DeleteI don't disagree. A government can't "make" you happier than you currently are. The best it can do is provide equal protection under the law and equal opportunity to succeed.

Regarding your statement that, "Most of my other commenters seem to be Keynesians who think more spending = more growth, some of us are true Keynesians and not of that POV at all."

DeleteKeynes thought, correctly, that deficit spending would do no good for a country with a current account deficit. If you have been reading carefully, you will note that even Brad DeLong recently blogged that the deficits ought to be in China and Germany.

Unless we end our current account deficits we will continue, as in the past, to merely tread water.

As for the cut spending crowd, the problem remains simple, How to you cut spending and increase aggregate demand? Has never happened and will never happen. See WWII.

WWII?? See 1949-1953. Spending was gutted and the economy flourished.

DeleteDear proffesor Cochrane,

ReplyDeleteThank You for the clarification. It is remarkable how this issue has stucked within traditional "Keynesian-NonKeynesian" debate, especially if one considers the overwhelming body of empirical evidence against the Keynesian fiscal multiplier.

Would you be so kind as to give me a few of your favorite examples from that body of evidence? (Because this is the internet, I'll add that this is a 100% good faith request, I'm not going to turn around and say something stupid like "haha, you cited the same thing as all anti-keynsians, you must be dumb.")

DeleteBen, I give you my favorite examples: John Taylor's papers on the effect of the stimulus. He has a couple of papers with co-authors on its effect (or non-effect...), look them up on his website at Stanford. My second favorite example is Robert Barro's work on stimulus.

DeleteDear Ben,

DeleteSome interesting papers:

1. Economic Growth in a Cross Section of Countries-Barro(1991);

2. Large Changes in Fiscal Policy: Taxes vs Spending-Alesina, Ardagna (2009);

3. Are Government Activities Productive? Evidence from a Panel of U.S States-Evans, Karras (1994);

4. Public Sector Capital and the Productivity Puzzle-Holtz-Eakin (1994);

5. Government Spending in a Simple Model of Endogenous Growth- Barro (1990);

Ben,

DeleteYou ask for "a few examples from that body of evidence" that government spending is not the panacea to low GDP that Keynesians believe it is?

How about you look at the orgy of government spending since 2008.

To make it apolitical, for these purposes you can include all the obscene government spending during W's terms as well.

Where's the ginormous multiplier return on all those trillions, Ben?

The whole reason we're having this conversation is that GDP growth has stalled out.

But, in the Keynesian view, how on earth did that happen in the face of massive, sustained, government spending ?

And please, let's not have the deus-ex-machina of "well, you don't how much abysmally worse the counter factual would have been".

That's not a substantive, honest argument.

It's just a shifty dodge.

Anon

DeleteSince Keynes said deficit spending will not work much at all when you are running a large current account deficit, it just bleeds out, creating no jobs, here, Why are you cursing the wrong deficit?

We have just spent 6 years proving Keynes knew what he was talking about.

Growth is not a panacea.

ReplyDeleteGrowth simpliciter would be easy - throw open the borders to sharply increased immigration. The burden of old white folks could be put on young brown ones. Not a politically feasible solution in Europe or America(although it looks like Canada and Australia are trying to do it).

Growth per capita is not a complete solution either - with higher gdp per capita we can expect that the "wages" (particularly the incomes of health care and military personnel) paid, directly or indirectly, by the government to keep pace with that growth in per capita income.

Not really the way I would think of it. Growth is always a good thing if you are an unemployed guy. Immigration by the way is not really a good promoter of growth. That is putting the cart bwfore the horse. Immigrants are drawn to economies which are already growing and have jobs that need filling.

Delete"Growth is always a good thing if you are an unemployed guy."

DeleteI'm not sure that is right. It seems that some of the policies being espoused by the right would have the effect of growing total GDP but could wind up putting all the growth PLUS a larger share of the existing GDP in the hands of the wealthy - to the detriment of the midde class and working poor.

It will depend on your utility function. It seems that Professor Cochrane's utility function is something like Total Utility equals Total GDP while mine would be closer to Total Utility equals sum over all Americans ln(individual consumption). (A more sophisticated version would include future consumption with some discount to current value.)

Let's get Tetlock's forecasters on these economic assumptions...

ReplyDeleteThe growth beats austerity argument, nicely charted by Prof Cochrane, is laid out with many specifics in my recent e book, "The Politics of Abundance." Easy to download from various web sites. Blair Levin co author. Reed Hundt

ReplyDeleteHi Professor Cochrane, do you think slowing population growth will make it difficult for us to achieve historical GDP growth rates?

ReplyDeleteTHIS!! What is even worse is going to be the fact that the population is aging! Old people don't work! Our long term trend of 3% growth seems wildly unrealistic going forward as our country gets older and older.

DeleteThe CBO's assumptions are rubbish. And John, I think you are a fantasic economist, but I don't think growth is plausible.

Growth comes from 2 places, population growth and innovation.

ReplyDeleteThe first domestically is slowing, but immigration is a GREAT way to boost growth (hopefully in a manner that aids the second).

Then innovation. Where does innovation come from? 1) government funded research (it's important, if liberals want to spend, why not suggest more graduate students rather than transfers / construction). 2) Old companies doing R&D, innovating processes, trying new products - in general this seems healthyish. We have great advances in mobile, oil and gas to name a few. The stock market is healthy, firms have a lot of cash ...

3) New companies displacing old companies. 3 is clearly where we are failing. Have we done anything positive over the past X (pick your favorite window) to aid new young companies? Navigating government whether it be licensing, litigation, insurance, discrimination issues, healthcare continues to get harder and harder. Who does that help and hurt? A young buck with an idea or an established firm with a giant legal / gov relations / HR staff. Everyone knows someone (or is someone) who is frustrated with their current job because of the bureaucracy, inefficiency, nepotism, lack of innovation (list goes on and on) and thinks they could do better if they ran the firm. Can we please try to create a society where it's easier for them to try?

For a much better written growth related story, see my 2nd favorite Booth finance profs column from a few months ago.

http://blogs.chicagobooth.edu/n/blogs/blog.aspx?nav=main&webtag=faultlines&entry=60

Actually most growth comes from business investment. So anything you do that spooks investment will be a negative pressure on the economy.

DeleteGrowth is driven by population, technological advances and social investments (roads, education, administrative structures etc. ) - business investment is important but it will generally follow opportunities created by the other three factors.

DeleteI simply disagree with this and our recent experience seems to bear out my views. population by itself does not create wealth or growth, otherwise China and India would not have been backward for so long. Infrastructure does play an important role but after a basic transportation structure has been built the returns for further builds are diminishing.

DeleteNo, it is business investment far more than anything else which does the trick. Or to put into Keynesian terms, it represents those animal spirits.

KyleN - India and China had sufficient wealth. What they lacked were the institutional structures that made business investment profitable. They have adopted a few of the simpler western institutions and grew rapidly. What was holding them back was not lack of private capital - it was poor "social" capital.

DeleteThe Right just does not comprehend how important the water is to the fish.

KyleN - Just on the importance of social "institutions": In the twelfth century Bishop Absalon imposed law and order by force in Eastern Denmark and the surrounding areas. The King of Denmark gave Absalon a land grant and Absalon built a fortification. Trade flourished in the area that Absalon controlled and a city that became known as "Merchants' Harbor" grew on Absalon's land grant. That city still exists and its name is little changed ...

DeleteRight, and once the social institutions stopped being negative, it was then investment which created economic growth.

DeleteI have read that 'true' Keynes theory advocates generating enough surplus during growth years in order to fund a slightly larger G during recessions (to moderate against a falling C). It seems a reasonable theory, but in practice, governments don't have the discipline to save during good years. Plus, the G tends to be spend extremely inefficiently and most of it is wasted on beaurocracy and hand-outs. The political system is the weak point, not so much the economic theory. As Milton Friedman said, the way to solve things is by making it politically profitable for the wrong people to do the right things.

ReplyDeleteWith Rob Yoe’s comment in mind:

ReplyDeleteFor me Keynes unravels the minute you realize that the system might work great if humans were not human and were instead something else. However, if that was so, the reason to invoke such Keynesian practices for purposes of the cycle, would be unnecessary for such perfect people would not have booms and busts for other perfect people to adjust to.

So perhaps those so enamored by it do not realize its not really a solution its an almost solution, for its design fits another kind of people than the people who love the design.

It’s exactly what they asked for, but it isn’t what they want…

Of course, tabula rasa sounds great until you realize that such a thing cant be, for if it was, then any kind of economic planning would be moot given shifting norms created by fads of self programming.

So in the absence of that, a system or solution that would seek to work well and with complimentary ease to what humans are would be one that accepts and adapts to the concepts of imperfect but natural beings with commonalities of behaviors and choices that transcend their educations over the long term.

[If you question the last part. You can teach people not to panic in a financial crisis, and to stay calm and not act in certain ways. But on the day it happens, I expect to see a whole bunch of them lined up at the bank regardless of what they have been taught]

I think people who want men to change to meet their plans have plans forever doomed by the requirement that men change their natures, while people who want their plans to compliment man as a natural being, work much better.

With man as a natural being we all have a commonality for all plans to apply to and evolve from, with man as something malleable, we make great plans then demand man to be something – then wonder when he is what he has been for at least the past 12,000 years.

Just thinking out loud I guess…

I think our chances of seeing robust growth with our current configuration of institutions are far smaller than our chance of seeing a hyperinflation and collapse.

ReplyDeleteI look around and I see sclerotic institutions that consume far more resources than they should (e.g. medical establishment 18% of GDP vs OECD average 12%) and produce mediocre results for most Americans. Yet, all they can do is whine "feed me, feed me".

A Japan 1989-2012 scenario would be a best case. We wouldn't have hyperinflation and we would take all of the bad news calmly without freaking out. I don't think Americans have the social discipline to do it.

Similar issues are studied by Ayse Imrohoroglu in a nice quantitative paper: here is the link:

ReplyDeletehttp://www-bcf.usc.edu/~aimrohor/USDebt.pdf

Have a look!

Iraq, Afghan wars will cost to $4 trillion to $6 trillion, Harvard study says

ReplyDeleteBy Ernesto Londoño, Washington Post

The U.S. wars in Afghanistan and Iraq will cost taxpayers $4 trillion to $6 trillion, taking into account the medical care of wounded veterans and expensive repairs to a force depleted by more than a decade of fighting, according to a new study by a Harvard researcher.

--30--

And we spend $1 trillion a year on the Defense Department, VA and Homeland Security.

I think I have some clues how we could cut spending.

I haven't taken time to look through this entry yet (I've read your other posts on the topic before), but on general topic of "fun debt graphs", there is a new page up which has an interactive graph of future government finances based on the GAO long term forecast (which fixes some things from the CBO version). It lets you do things like use the SSA's lower estimate of GDP, use different interest rate projections, and plugs in some of the work from papers that project increased national debt will slow GDP growth, which leads to lower revenue which then leads to more debt..

ReplyDeletehttp://www.politicsdebunked.com/article-list/budget-lottery

The numbers don't beging to curve upward until 2017. That means that there won't be a political solution put forward until then. Who ever wins in 2016 will have their work cut out for them....

ReplyDeleteMedicare and social security will be an increasing percentage of goverment expenditures. Contrary to popular belief, social security is not guaranteed. I expect, beginning in 2020 that we begin rolling back the quality of the benefits from these programs....

But, as Prof. Cochrane points out, the numbers are sensitive to several changing variables that we cannot accurately forecast. We should not be debating 10 year budgets. Congress should write 2 year budgets, with the goal of keeping spending and deficit on target every 2 year period. If there is a crisis and congress needs do go out of bounds they may need to do that, and for that reason I am against a balanced budget ammendment. However, it should be a big deal for them to do so.

You want to talk debt most Americans max out all their credit cards. It's scary.

ReplyDelete

ReplyDeleteGreat article! We will be linking to this great article on our website. Keep up the good writing

بهترین جراح بینی

عمل بینی

جراحی بینی

بینی گوشتی

بینی استخوانی

بینی