A Wall Street Journal Oped, From July 29 2018. Now that 30 days have passed, I can post the whole thing.

The Tax-and-Spend Health-Care Solution

Honest subsidies beat cross-subsidies. They’d encourage competition and innovation.

By John H. Cochrane

Why is paying for health care such a mess in America? Why is it so hard to fix? Cross-subsidies are the original sin. The government wants to subsidize health care for poor people, chronically sick people, and people who have money but choose to spend less of it on health care than officials find sufficient. These are worthy goals, easily achieved in a completely free-market system by raising taxes and then subsidizing health care or insurance, at market prices, for people the government wishes to help.

But lawmakers do not want to be seen taxing and spending, so they hide transfers in cross-subsidies. They require emergency rooms to treat everyone who comes along, and then hospitals must overcharge everybody else. Medicare and Medicaid do not pay the full amount their services cost. Hospitals then overcharge private insurance and the few remaining cash customers.

Overcharging paying customers and providing free care in an emergency room is economically equivalent to a tax on emergency-room services that funds subsidies for others. But the effective tax and expenditure of a forced cross-subsidy do not show up on the federal budget.

Over the long term, cross-subsidies are far more inefficient than forthright taxing and spending. If the hospital is going to overcharge private insurance and paying customers to cross-subsidize the poor, the uninsured, Medicare, Medicaid and, increasingly, victims of limited exchange policies, then the hospital must be protected from competition. If competitors can come in and offer services to the paying customers, the scheme unravels.

No competition means no pressure to innovate for better service and lower costs. Soon everybody pays more than they would in a competitive free market. The damage takes time, though. Cross-subsidies are a tempting way to hide tax and spend in the short run, but they are harmful over years and decades.

We have seen this pattern over and over. Until telephone deregulation in the 1970s, the government wanted to provide telephone landlines below cost. It forced a cross-subsidy from overpriced long distance and a telephone monopoly to keep entrants out and prices up. The government wanted to subsidize small-town air service. It forced airlines to cross-subsidize from overpriced big-city services and enforced an oligopoly to keep entrants from undercutting the profitable segments. But protection bred inefficiency. After deregulation, everyone’s phone bills and airfares were lower and service was better and more innovative.

Lack of competition, especially from new entrants, is the screaming problem in health-care delivery today. In no competitive business will they not tell you the cost before providing service. In a competitive business you are bombarded with ads from new companies offering a better deal.

The situation is becoming ridiculous. Emergency rooms are staffed with out-of-network anesthesiologists. Air ambulances take everyone without question, and Medicare, Medicaid and exchange policies underpay. You wake up with immense bills, which you negotiate afterward based on ability to pay. The cash market is dead. Even if you have plenty of money, you will be massively overcharged unless you have health insurance to negotiate a lower rate.

Taxing and spending is not good for the economy. But it’s better than cross-subsidization. Taxing and spending can allow an unfettered competitive free market. Cross-subsidies must stop competition and entry at the cost of efficiency and innovation. Taxing and spending, on budget and appropriated, is also visible and transparent. Voters can see what’s going on. Finally, broad-based taxes, as damaging as they are, are better than massive implied taxes on very few people.

This is why continued tinkering with the U.S. health-care system will not work. The system will be cured only by the competition that brought far better and cheaper telephone and airline services. But there is a reason for the protections that make the system so inefficient: Allowing competition would immediately undermine cross-subsidies. Unless legislators swallow hard and put the subsidies on the budget where they belong, we can never have a competitive, innovative and efficient health-care market.

But take heart—when that market arrives, it will make the subsidies much cheaper. Yes, the government should help those in need. But there is no fundamental reason that your and my health care and insurance must be so screwed up to achieve that goal.

Mr. Cochrane is a senior fellow of the Hoover Institution at Stanford University and an adjunct scholar of the Cato Institute

Wednesday, August 29, 2018

Monday, August 27, 2018

Post-Apocalyptic Health Care

Post-apocalyptic life in American health care is a fantastic blog post on the state of American health care and insurance. (HT Marginal Revolution)

Bottom line:

This isn't about technology -- for centuries large organizations worked well using the technology of paper, writing, forms, and files. Electronic records just make those structures work more efficiently.

But when the rules and formal systems grow immense, vague, contradictory, and unworkable, human networks form in their place. Then things happen only by networks of personal connections, informal structures working around the dead elephant in the room to get anything accomplished. The latter, at great inefficiency, of course. Large bureaucratic organizations, allowing people to cooperate anonymously, are vital to an advanced society.

Later in the post,

Bottom line:

American health care organizations can no longer operate systematically, so participants are forced to act in the communal mode, as if in the pre-modern world.The formal systems of health care are broken under [my interpretation, to follow] the weight of regulation. By "formal systems" I mean the normal bureaucratic procedures by which large organizations run and interact: a set of rules, forms, records, and so forth. "Bureaucratic" here is not a pejorative. Bureaucracy is what allows large organizations to work.

This isn't about technology -- for centuries large organizations worked well using the technology of paper, writing, forms, and files. Electronic records just make those structures work more efficiently.

But when the rules and formal systems grow immense, vague, contradictory, and unworkable, human networks form in their place. Then things happen only by networks of personal connections, informal structures working around the dead elephant in the room to get anything accomplished. The latter, at great inefficiency, of course. Large bureaucratic organizations, allowing people to cooperate anonymously, are vital to an advanced society.

Later in the post,

It’s like one those post-apocalyptic science fiction novels whose characters hunt wild boars with spears in the ruins of a modern city. Surrounded by machines no one understands any longer, they have reverted to primitive technology.

Except it’s in reverse. Hospitals can still operate modern material technologies (like an MRI) just fine. It’s social technologies that have broken down and reverted to a medieval level.

Systematic social relationships involve formally-defined roles and responsibilities. That is, “professionalism.” But across medical organizations, there are none. Who do you call at Anthem to find out if they’ll cover an out-of-state SNF stay? No one knows.To be specific, follow the author through a detailed personal story. The story takes a while, and it's one story, but the granularity of a story makes the case vivid.

Thursday, August 23, 2018

Modigliani-Miller theorem repealed, reports PBS

Link here.

In case you don't get it, see previous posts on buybacks here and here, that explain how buybacks do not affect share prices, and certainly cannot cause the rise since 2008.

Thanks to a correspondent for the pointer.

Thursday, August 16, 2018

Options on health insurance

Alex M. Azar, U.S. secretary of health and human services, published an interesting OpEd in the Washington Post, describing a clever health insurance innovation. HHS will allow "temporary" health insurance, including a guaranteed renewability provision. The HHS announcement is here and the official rule on the Federal Register here.

The last sentence is the most intriguing. Long ago, before the ACA made all of this sort of innovation illegal, United Health started offering the option to buy health insurance. Pay money now, and any time you get sick you can still get health insurance, at the pre-stated rate. (Under the ACA that option is now called a cell phone, but the insurance is a lot more expensive and many doctors and hospitals don't take it.)

It sounds like HHS is allowing this again. But I couldn't figure out from a quick read whether the guarantee only lasts 36 months, or if they can sell that option for a longer date. It sounds like the plain guaranteed renewability is only 36 months, the length of the contract.

For newcomers to this blog, guaranteed renewability and the option to buy health insurance is the key to escaping the preexisting conditions problem in a free market for health insurance. I'm delighted to see the idea take hold, if at the edges. Great trees grow from saplings.

The trouble is, that most of the things you worry about happen in a time frame more than 36 months. I want guaranteed renewability for life! If I get cancer in 22 months, knowing I can keep health insurance for another 14 is not that helpful. (Much more here, especially "health status insurance.")

You may ask, then, why only 36 months? As I piece it together, the ACA, which is still law, has a little carve out for temporary insurance, defined as a contract that last 12 months. Anything longer must meet the list of mandates. It sounds like HHS was pretty clever within the constraints of the law, allowing them to be renewed, so 12 months can turn in to 36. I presume you can sign up with another company after 36 months? But you lose the guaranteed renewability so the new company may charge you a lot.

Unless, perhaps, they really are letting insurance companies offer the right to buy health insurance as a separate product, and that can have as long a horizon as you want? If they haven't done that, I suggest they do so! I don't think the ACA forbids the selling of options on health insurance of arbitrary duration.

Americans will once again be able to buy what is known as short-term, limited-duration insurance for up to a year, assuming their state allows it. These plans are free from most Obamacare regulations, allowing them to cost between 50 and 80 percent less.

Insurers will also be able to sell renewable plans, allowing consumers to stay on their affordable coverage for up to 36 months. Consumers can also buy separate renewability protection, which will allow them to lock in low rates in their renewable plans even if they get sick.The big news to me is guaranteed renewability. You sign up now, and you are guaranteed rates don't go up if you get sick.

The last sentence is the most intriguing. Long ago, before the ACA made all of this sort of innovation illegal, United Health started offering the option to buy health insurance. Pay money now, and any time you get sick you can still get health insurance, at the pre-stated rate. (Under the ACA that option is now called a cell phone, but the insurance is a lot more expensive and many doctors and hospitals don't take it.)

It sounds like HHS is allowing this again. But I couldn't figure out from a quick read whether the guarantee only lasts 36 months, or if they can sell that option for a longer date. It sounds like the plain guaranteed renewability is only 36 months, the length of the contract.

For newcomers to this blog, guaranteed renewability and the option to buy health insurance is the key to escaping the preexisting conditions problem in a free market for health insurance. I'm delighted to see the idea take hold, if at the edges. Great trees grow from saplings.

The trouble is, that most of the things you worry about happen in a time frame more than 36 months. I want guaranteed renewability for life! If I get cancer in 22 months, knowing I can keep health insurance for another 14 is not that helpful. (Much more here, especially "health status insurance.")

You may ask, then, why only 36 months? As I piece it together, the ACA, which is still law, has a little carve out for temporary insurance, defined as a contract that last 12 months. Anything longer must meet the list of mandates. It sounds like HHS was pretty clever within the constraints of the law, allowing them to be renewed, so 12 months can turn in to 36. I presume you can sign up with another company after 36 months? But you lose the guaranteed renewability so the new company may charge you a lot.

Unless, perhaps, they really are letting insurance companies offer the right to buy health insurance as a separate product, and that can have as long a horizon as you want? If they haven't done that, I suggest they do so! I don't think the ACA forbids the selling of options on health insurance of arbitrary duration.

Monday, August 13, 2018

Trade uncertainty and investment

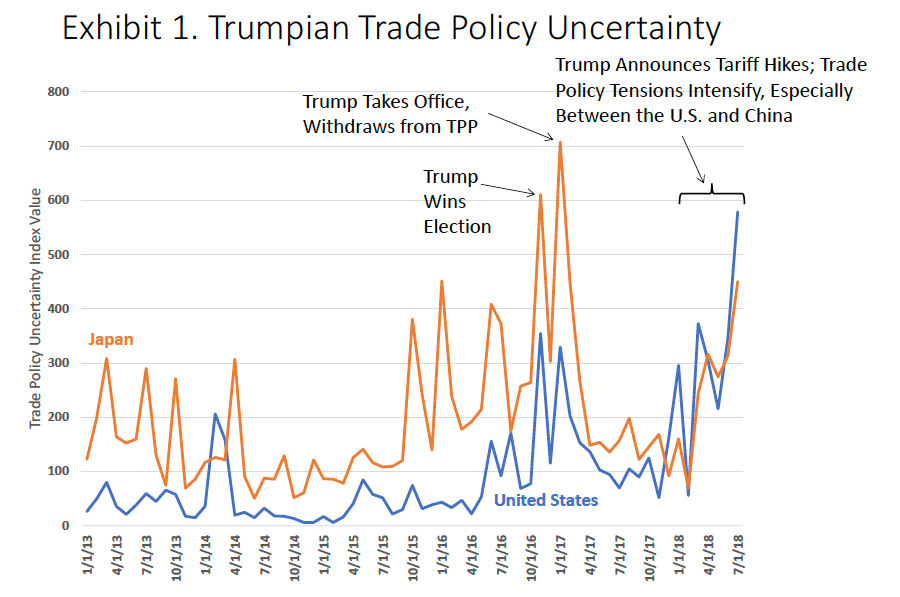

My colleague Steve Davis has a nice post quantifying economic uncertainty due to the trade war, and its emerging impact on investment.

Steve (and Nick Bloom) have done a great job quantifying policy uncertainty over time. To be clear, policies can have two effects -- there is the certainty of damaging policy, but there is also the damaging uncertainty of what policy will be. If a trade war seems to be looming, and you don't know if you will get tariff protection (raw steel) or be hurt by the tariff (steel users, competing with tariff-free steel products from abroad), that's uncertainty. Businesses hold off investing when they know things will be bad. But they also hold off when they're not sure what will happen. That's uncertainty.

Our little (so far) trade war is full of uncertainty

As of July, this uncertainty is only having a small effect on investment, and the economy is still booming -- in my view from the corporate tax rate cuts and deregulation efforts. It is true that the US is so big that most of the economy does not live on exports or directly compete with imports.

Steve (and Nick Bloom) have done a great job quantifying policy uncertainty over time. To be clear, policies can have two effects -- there is the certainty of damaging policy, but there is also the damaging uncertainty of what policy will be. If a trade war seems to be looming, and you don't know if you will get tariff protection (raw steel) or be hurt by the tariff (steel users, competing with tariff-free steel products from abroad), that's uncertainty. Businesses hold off investing when they know things will be bad. But they also hold off when they're not sure what will happen. That's uncertainty.

Our little (so far) trade war is full of uncertainty

Trade policy under the Trump administration also has a capricious, back-and-forth character... Less than three months after withdrawing from the TPP, the President said he would consider rejoining for a substantially better deal, only to throw cold water on the idea a few days later. Initially, the administration justified steel tariffs on the laughable grounds that Canada, for example, presents a national security threat. Later, President Trump tweeted that tariffs on Canadian steel were a response to its tariffs on dairy products. Some countries get tariff exemptions, some don’t. Exemptions vary in duration, and they come and go in a head-spinning manner. Two days ago (August 10), the President tweeted that he “just authorized a doubling of Tariffs on Steel and Aluminum with respect to Turkey” for reasons unclear. For a fuller account of tariff to-ing and fro-ing under the Trump administration, see the Peterson Institute’s “Trump Trade War Timeline.”The arbitrariness, including the waivers, means

Crony capitalism, political favoritism, and extra sand in the gears of commerce – here we come!But to the point, what's the Davis-Bloom quantitative measure of uncertainty doing? Answer: it is higher than even around the election -- whose outcome, and the nature of the Trump presidency certainly led to a vast amount of uncertainty.

As of July, this uncertainty is only having a small effect on investment, and the economy is still booming -- in my view from the corporate tax rate cuts and deregulation efforts. It is true that the US is so big that most of the economy does not live on exports or directly compete with imports.

Let’s sum up the U.S. survey evidence: About one-fifth of firms in the July 2018 SBU say they are reassessing capital expenditure plans in light of tariff worries. Among this one-fifth, firms have reassessed an average 60 percent of capital expenditures previously planned for 2018–19. ..Only 6 percent of the firms in our full sample report cutting or deferring previously planned capital expenditures in reaction to tariff worries. These findings suggest that tariff worries have had only a small negative effect on U.S. business investment to date.But it could get worse. Steve closes with a nice list of recent trade outbursts from our part of the economics blog world:

In closing, I should note that the harmful consequences of tariff hikes and trade policy uncertainty extend well beyond short-term investment effects. For other critiques of the Trumpian approach to trade policy, see the worthy commentaries by Robert Barro, Alan Blinder, John Cochrane, Doug Irwin, Mary Lovely and Yang Liang, Greg Mankiw and Adam Posen, among others.

Intellectual property and China

Let's transfer more technology to China, writes Scott Sumner, with approving comments from Don Boudreaux. They're exactly right, skewering one of the common backstop defenses of protectionists on both left and right.

The question is whether China can buy US technology, or require technology transfer to Chinese partners as a condition of the US firm entering China. Scott and Don have sophisticated versions of my reaction: If Chinese access isn't worth it to you, don't do the deal.

It stands to reason that stealing technology and IP is bad, and should be stopped. Whether imposing tariffs is the smart way to do that, we will discuss another day. But on an economic basis, even that is questionable!

A key point: Selling technology is not like selling a car. If you sell a car, you can't use it. If someone steals your car, you can't use it. But everyone can use knowledge. Scott:

The question is whether China can buy US technology, or require technology transfer to Chinese partners as a condition of the US firm entering China. Scott and Don have sophisticated versions of my reaction: If Chinese access isn't worth it to you, don't do the deal.

It stands to reason that stealing technology and IP is bad, and should be stopped. Whether imposing tariffs is the smart way to do that, we will discuss another day. But on an economic basis, even that is questionable!

A key point: Selling technology is not like selling a car. If you sell a car, you can't use it. If someone steals your car, you can't use it. But everyone can use knowledge. Scott:

The beauty of information is that use by one person does not preclude use by othersIf I know how to wax my car in half the time it takes you, and you sneak in to my house to learn my secret, you wax your car in half the time too. But so do I.

Sunday, August 12, 2018

Lira Crash

No, a currency board won't save the Lira, contra Steve Hanke's oped in the Wall Street Journal. Steve:

Government debt is the problem. Turkey may still have the resources to back its currency 100% with dollar assets. But what about the looming debt? Turkey does not have the resources to back all its government debt with dollar assets! If it did, it would not have borrowed in the first place.

So what happens when the debt comes due? If the government cannot raise enough in taxes to pay it off, or convince investors it can raise future taxes enough to borrow new money to roll it over, it must either default on the debt or print unbacked Lira.

I.e. a currency board run by an insolvent government will fail. The government will eventually grab the foreign reserves.

The Argentinian currency board did fail, and this is basically why.

Turkey should adopt a currency board. A currency board issues notes and coins convertible on demand into a foreign anchor currency at a fixed rate of exchange. It is required to hold anchor-currency reserves equal to 100% of its monetary liabilities,...Well, that sounds reasonable no? If 100% of the country's currency and bank reserves are backed by US dollars, and the currency is pegged to the dollar, what could go wrong? Don't want Lira? The central bank promises to exchange 1 Lira for 1 dollar and always has enough dollars to make good on the promise. It sounds like an ironclad peg.

Government debt is the problem. Turkey may still have the resources to back its currency 100% with dollar assets. But what about the looming debt? Turkey does not have the resources to back all its government debt with dollar assets! If it did, it would not have borrowed in the first place.

So what happens when the debt comes due? If the government cannot raise enough in taxes to pay it off, or convince investors it can raise future taxes enough to borrow new money to roll it over, it must either default on the debt or print unbacked Lira.

I.e. a currency board run by an insolvent government will fail. The government will eventually grab the foreign reserves.

The Argentinian currency board did fail, and this is basically why.

Saturday, August 11, 2018

Links: trade, housing, taxes

Three interesting links caught my attention today:

1) Prefab housing in Berkeley and Alex Tabarrok Commentary on Marginal Revolution.

Housing should be manufactured. As Tabarrok points out, it is one place where productivity has not improved much. I gather Ikea is now moving in to manufacture housing (I lost the link). Economies of scale should make a big difference. Once Ikea does to housing what they did to the Poang chair, steadily refining it, they can bringing the price down a lot.

But, manufactured houses have to obey local building codes too, and planning review and design review, and inspections, and all the other little local obstacles. Getting a uniform code will be a big fight, but strikes me as necessary to reap those economies of scale.

The prefab houses are made in China, using steel. A bunch of obvious meditations follow.

As I understand it, we now have import taxes (tariffs) on raw steel from China, but not taxes on products made out of steel. Why does the Trump administration so obviously provide an incentive for manufacturing to move to China? I've read a lot of stories about keg manufacturers, steel locker manufacturers, and so on going out of business over this difference. Is there some part of trade law that I don't know about that forces this outcome, and forbids them to also tax steel content of imports?

It nicely illustrates the point, that if you don't let people come to the US, the capital can go there. Even homebuilding.

2) Greg Mankiw makes an excellent point about marginal tax rates.

Phil Gramm and Robert B. Eklund wrote a great WSJ oped pointing out that inequality in the US really is not as large as it seems, because most measures left out government transfers, even cash transfers. (They cite the CATO study by John F. Early.) Once you add transfers back in again, the US has a much flatter income distribution. We have a more progressive tax system than Europe, with no VAT and lower payroll tax rates, and we do a lot of income transfers.

Greg points out a clever implication of this fact. From the pre- and post-tax and transfer income distribution, we can measure the average marginal tax rate, including the loss of benefits due to program phase out with income:

Greg says something about heterogeneity that I did not understand, but it strikes me that heterogeneity makes matters worse. Hetereogeneity means people are different. Some people are at a cliff: make one more dollar, lose medicaid or another service. Some people are not.

But if 76 percent on average means half the people face a 100% marginal tax rate and half face a 50% marginal tax rate, I think this means the overall disincentive effects are worse than if everyone faces 75% tax rate. In that circumstance half the people will not work at all. Sometimes in economics heterogeneity makes things worse, sometimes better. I think this is a case of worse, but I would be curious to know if there is a standard answer.

While we're on income transfers and disincentives, back to Berkeley

3) Back to trade, Tim Taylor the conversable economist has an excellent post on the Jones act. The Jones act is the law that requires all shipping between US ports to be on US made ships staffed by US merchant marines. (Tim builds on another Cato report by Colin Grabow, Inu Manak, and Daniel Ikenson.)

If you want evidence on whether protection makes an industry thrive, this is it

I hear even from formerly sensible correspondents now mad for tariffs that we need steel tariffs for national security, so we can fight WWII again, I guess. Well, the Jones act is a nice test case since much of its rationale is to keep a merchant marine going to staff all those liberty ships. Tim (and, really, Colin, Inu and Daniel) demolishes even the national security argument.

1) Prefab housing in Berkeley and Alex Tabarrok Commentary on Marginal Revolution.

Imagine a four-story apartment building going up in four days, and from steel. It happened in Berkeley, a city known for its glacial progress in building housing.Four days? Well, not really

The modules were stacked on a conventional foundation. Electricity, plumbing, the roof, landscaping and other infrastructure were added.That didn't take 4 days. And

The project, initially approved by the city in 2010 as a hotel, then re-approved in 2015 as studio apartments,So, really, 10+ years! (In my personal one data point, getting permits can take as long as building.)

Housing should be manufactured. As Tabarrok points out, it is one place where productivity has not improved much. I gather Ikea is now moving in to manufacture housing (I lost the link). Economies of scale should make a big difference. Once Ikea does to housing what they did to the Poang chair, steadily refining it, they can bringing the price down a lot.

But, manufactured houses have to obey local building codes too, and planning review and design review, and inspections, and all the other little local obstacles. Getting a uniform code will be a big fight, but strikes me as necessary to reap those economies of scale.

The prefab houses are made in China, using steel. A bunch of obvious meditations follow.

As I understand it, we now have import taxes (tariffs) on raw steel from China, but not taxes on products made out of steel. Why does the Trump administration so obviously provide an incentive for manufacturing to move to China? I've read a lot of stories about keg manufacturers, steel locker manufacturers, and so on going out of business over this difference. Is there some part of trade law that I don't know about that forces this outcome, and forbids them to also tax steel content of imports?

It nicely illustrates the point, that if you don't let people come to the US, the capital can go there. Even homebuilding.

2) Greg Mankiw makes an excellent point about marginal tax rates.

Phil Gramm and Robert B. Eklund wrote a great WSJ oped pointing out that inequality in the US really is not as large as it seems, because most measures left out government transfers, even cash transfers. (They cite the CATO study by John F. Early.) Once you add transfers back in again, the US has a much flatter income distribution. We have a more progressive tax system than Europe, with no VAT and lower payroll tax rates, and we do a lot of income transfers.

Greg points out a clever implication of this fact. From the pre- and post-tax and transfer income distribution, we can measure the average marginal tax rate, including the loss of benefits due to program phase out with income:

The bottom quintile earned 2.2% of all earned income in 2013, but after adjusting for taxes and transfer payments, its share of spendable income rose to 12.9%... The second quintile’s share more than doubled, rising from 7% of earned income to 13.9% of spendable income. For the third quintile, middle-income Americans, the increase was much smaller, from 12.6% to 15.4%.Thus

.. the effective marginal tax rate when a person moves from the bottom to the middle quintile is 1 - (15.4-12.9)/(12.6-2.2), or 76 percent.76 percent! The average person in the lowest quintile of the income distribution who earns an extra dollar, gets to keep only 24 cents. Can you spot the disincentive to work, or get an education?

Greg says something about heterogeneity that I did not understand, but it strikes me that heterogeneity makes matters worse. Hetereogeneity means people are different. Some people are at a cliff: make one more dollar, lose medicaid or another service. Some people are not.

But if 76 percent on average means half the people face a 100% marginal tax rate and half face a 50% marginal tax rate, I think this means the overall disincentive effects are worse than if everyone faces 75% tax rate. In that circumstance half the people will not work at all. Sometimes in economics heterogeneity makes things worse, sometimes better. I think this is a case of worse, but I would be curious to know if there is a standard answer.

While we're on income transfers and disincentives, back to Berkeley

In lieu of providing affordable units on site, Kennedy will pay a fee to the city of Berkeley’s Affordable Housing Trust Fund, as required under the city’s affordable housing laws. The amount is around $500,000, he said.Someone needs to write an expose of "affordable housing" programs. Who gets them and how? And once in, disincentives to earn more money, or take a better job in another city must be immense. It's also another hidden cross-subsidy driving up prices.

3) Back to trade, Tim Taylor the conversable economist has an excellent post on the Jones act. The Jones act is the law that requires all shipping between US ports to be on US made ships staffed by US merchant marines. (Tim builds on another Cato report by Colin Grabow, Inu Manak, and Daniel Ikenson.)

If you want evidence on whether protection makes an industry thrive, this is it

If susttained protection from foreign competition was a useful path to the highest levels of efficiency and cost-effectiveness, then US ship-building and shipping should be elite industries. But in fact, US ship-building and shipping--safely protected from competition-- have fallen far behind foreign competition, with negative costs and consequences that echo through the rest of the US economy--and probably diminish US national security, too.

...After nearly a century of protection from foreign competition, costs of ship-building in the US are far above the international competition.

"American-built coastal and feeder ships cost between $190 and $250 million, whereas the cost to build a similar vessel in a foreign shipyard is about $30 million.High shipping costs induce substitution

This shift away from water-based transportation to overland road and rail has a variety of costs, like greater congestion and wear-and-tear on the roads. It also has environmental costs like higher carbon emissions:

Unsurprisingly, the high cost of shipping by water means that in the US, freight is instead shipped overland. Consider, for example, all the trucks and trains that run up and down the east coast or the west coast.A long time ago when I was a CEA junior staffer, I got to see a bright idea die. The idea: Let's allow the US to export oil from Alaska to Japan. (There was an oil export ban, part of the legacy of 1970s energy policies.) Then use the money to buy oil from Saudi Arabia to send to the east coast. It's the same thing as sending Alaskan oil to the east coast but much cheaper. Everyone said great idea until the congressional liason said those ships from Alaska to the east coast are Jones act ships, and here is their list of threats if you do it. End of idea.

I hear even from formerly sensible correspondents now mad for tariffs that we need steel tariffs for national security, so we can fight WWII again, I guess. Well, the Jones act is a nice test case since much of its rationale is to keep a merchant marine going to staff all those liberty ships. Tim (and, really, Colin, Inu and Daniel) demolishes even the national security argument.

if that [national defense] is the goal, the Jones Act is sorely failing to accomplish it. Instead, the Navy can't afford the extra ships it wants, the number of available US civilian ships and the knowledgeable workers to run them is shrinking, and military operations have had to find ways to make use of foreign ships. Some anecdotes drive home the point:

"When U.S. forces were deployed to Saudi Arabia during Operations Desert Shield and Desert Storm, a much larger share of their equipment and supplies was carried by foreign-flagged vessels (26.6 percent) than U.S.-flagged commercial vessels (12.7 percent). Only one U.S.-flagged ship was Jones Act compliant. In fact, the shipping situation was so desperate that on two occasions the United States requested transport ships from the Soviet Union and was rejected both times. ... At the time, Vice Admiral Paul Butcher, who was then deputy commander of the U.S. Transportation Command, remarked that without the availability of foreign-flag sealift, `It would have taken us three more months to complete the sealift ourselves.' ...As with steel, if the goal is national defense, let the defense department ask for appropriations to staff a mothball merchant marine, don't force a hidden cross subsidy into the price of everything else.

Wednesday, August 8, 2018

Free Trade or Managed Mercantilism

Mary Anastasia O'Grady's WSJ coverage of Nafta talks included the following tidbit

Of course, they are far better than the alternative, in which everything is tariffed, protected, managed, and individually negotiated.

auto-sector “rules of origin,” which dictate how much of a vehicle must be made in North America to qualify as duty-free when it crosses continental borders.

In May, Team Trump proposed a new North American content requirement of 75%, up from the current 62.5%. It also wanted a new requirement that 70% of the steel and aluminum in Nafta vehicles be North American and new wage regulations that would require 40% of the value of North American cars and sport-utility vehicles—and 45% of Nafta trucks—be produced by workers making between $16 and $19 an hour.

Mexico countered with 70% North American content, a 30% regional steel requirement and 20% regional aluminum. Market-based labor rates are important for Mexican competitiveness, but Mexico showed flexibility by proposing $16 an hour for 20% of the value of vehicles it makes. The U.S. rejected that offer. Now the two sides are trying to find middle ground.Nafta and the like are often called "free trade agreements." Economists like me wonder, why does that take tens of thousands of pages? "We do not charge border taxes (tariffs), nor restrict quantities, nor will government purchases favor American companies." "We do the same." Done. That's free trade. This little snippet reminds us what trade pacts really are.

Of course, they are far better than the alternative, in which everything is tariffed, protected, managed, and individually negotiated.

Monday, August 6, 2018

Who will pay unfunded state pensions?

Homeowners. So says a nice WSJ op-ed by Rob Arnott and Lisa Meulbroek, and a proposal by Chicago Fed Economists Thomas Haasl, Rick Matton, and Thomas Walstrum.

The latter was a modest proposal, in the Jonathan Swift tradition. Despite Crain's Chicago Business instantly labeling it "foolish," "inhumane," and "the dumbest solution yet, the first article points out its inevitability. If indeed courts will insist that benefits may not be cut, then state governments must raise taxes, and this is the only one that can do the trick.

States can try to raise income taxes. And people will move. States can try to raise business taxes. And businesses will move. What can states tax that can't move? Only real estate. If the state drastically raises the property tax, there is no choice but to pay it. You can sell, but the new buyer will be willing to pay much less. Pay the tax slowly over time, or lose the value of the property right away in a lower price. Either way, the owner of the property on the day the tax is announced bears the burden of paying off the pensions.

There is a an economic principle here, the "capital levy." A government in trouble has an incentive to grab existing capital, once, and promise never to do it again. The promise is important, because if people know that a capital levy is coming they won't invest (build houses). If the government can pull it off, it is a tax that does not distort decisions going forward. Of course, getting people to believe the promise and invest again after the capital levy is... well, let's say a tricky business. Governments that do it once have a tendency to do it again.

In sum, a property tax is essentially the same thing as the government grabbing half the houses and selling them off to make pension obligations. And unless a miracle happens, it is the only way out.

Update: We're there already, say Orphe Divounguy, Bryce Hill, and Joe Tabor at Illinois Policy. The bulk of recent increases in property taxes have gone to pay for pensions, not more teachers, police, etc.

Update 2: I should clarify, that I found this an interesting piece of economics more than anything else. I do not think this is the right solution, nor is it the only one. Most other countries around the world, having made unsustainable pension promises, find some way around them and reduce pensions. It happens. Some sort of federal bailout is not unthinkable either. Moreover, the suddenly announced surprise once and for all property tax increase is unlikely, see update 1. So the states are likely to reap many disincentive effects of expected increases in property and other taxes.

Finally, most importantly property tax payers vote! They are unlikely to sit still for such a mass expropriation of their wealth.

The latter was a modest proposal, in the Jonathan Swift tradition. Despite Crain's Chicago Business instantly labeling it "foolish," "inhumane," and "the dumbest solution yet, the first article points out its inevitability. If indeed courts will insist that benefits may not be cut, then state governments must raise taxes, and this is the only one that can do the trick.

States can try to raise income taxes. And people will move. States can try to raise business taxes. And businesses will move. What can states tax that can't move? Only real estate. If the state drastically raises the property tax, there is no choice but to pay it. You can sell, but the new buyer will be willing to pay much less. Pay the tax slowly over time, or lose the value of the property right away in a lower price. Either way, the owner of the property on the day the tax is announced bears the burden of paying off the pensions.

There is a an economic principle here, the "capital levy." A government in trouble has an incentive to grab existing capital, once, and promise never to do it again. The promise is important, because if people know that a capital levy is coming they won't invest (build houses). If the government can pull it off, it is a tax that does not distort decisions going forward. Of course, getting people to believe the promise and invest again after the capital levy is... well, let's say a tricky business. Governments that do it once have a tendency to do it again.

In sum, a property tax is essentially the same thing as the government grabbing half the houses and selling them off to make pension obligations. And unless a miracle happens, it is the only way out.

Update: We're there already, say Orphe Divounguy, Bryce Hill, and Joe Tabor at Illinois Policy. The bulk of recent increases in property taxes have gone to pay for pensions, not more teachers, police, etc.

Update 2: I should clarify, that I found this an interesting piece of economics more than anything else. I do not think this is the right solution, nor is it the only one. Most other countries around the world, having made unsustainable pension promises, find some way around them and reduce pensions. It happens. Some sort of federal bailout is not unthinkable either. Moreover, the suddenly announced surprise once and for all property tax increase is unlikely, see update 1. So the states are likely to reap many disincentive effects of expected increases in property and other taxes.

Finally, most importantly property tax payers vote! They are unlikely to sit still for such a mass expropriation of their wealth.

Friday, August 3, 2018

Saving rate doubles

The BEA just revised the personal saving rate, and doubled it.

To commenters bemoaning the low and declining personal saving rate

I found the graph in Greg Ip's column in the Wall Street Journal, but updates seem not to show it. Greg ties it to the business cycle:

|

| Source: Wall Street Journal |

To commenters bemoaning the low and declining personal saving rate

I found the graph in Greg Ip's column in the Wall Street Journal, but updates seem not to show it. Greg ties it to the business cycle:

Previously, it looked like much of last year’s acceleration in consumer spending came by dipping deeper into savings, a sign of an expansion in its later stages. The Bureau of Economic Analysis has since found wages and self-employed income were much higher than it first estimated, so the saving rate, instead of sliding to around 3%, stands at 6.8%—in line with its average since 2012. The expansion now looks middle-aged (albeit late middle-age) rather than old.

Personal saving is one of the less well defined and measured concepts in economics. Is housing equity included? Is the value of employer pension plans included? (What if those pensions are massively underfunded?) If you own stock, but the company invests out of retained earnings, giving you a capital gain, is that included? (Economically it's the same as paying profits as income, then issuing new stock to finance investment, which would show up as your saving. But we'd pay a lot of taxes, which is why most corporate investment is financed out of retained earnings.)

The definition should conform to the question. If you want to know whether Americans are prepared for retirement, then the average saving rate doesn't really matter, and you should include social security and medicare. If you're worried about debt buildup, then you're worried about some households saving too little and others saving too much, not the average. If you want to think about the trade balance and capital formation, then you want the national saving rate and don't include social security. And so forth.

Economic policy is also schizophrenic about saving. Half of the time hands are wrung that Americans don't save enough. The other half -- or really all the time -- policy pundits want Americans to consume more in the name of stimulus, meaning save less, or worry about "savings gluts" driving asset price "bubbles" or "secular stagnation."

I couldn't find the BEA's explanation of what changed. It's something to do with finding more income among self-employed people, and I guess more income - the same consumption = more saving. But where was that income before? If blog readers know where the BEA explains the change in methodology or can comment directly, send a comment or an email.

Update:

A correspondent sends this, which I have not had a chance to check out

Here are some links that might interest you, one by Seeking Alpha and one by Barron’s:

https://seekingalpha.com/article/4192911-changed-savings-rate-least?page=1

https://www.barrons.com/articles/americans-are-saving-more-than-we-thought-1533034800?tesla=y

The upshot is this (from the Seeking Alpha article):

“Last week, in tandem with benchmark GDP revisions, the Bureau of Economic Analysis (BEA) forewarned us of another wholesale recomputing of the savings rate. Based on new data made available by the IRS' National Research Program, the BEA has raised its income estimates to "correct for the effects of taxpayer underreporting." How the IRS has decided taxpayers are "underreporting" isn't clear (audits?), regardless there is more income than previously believed and reported in the national accounts.”

Thus, the saving rate changed because the IRS made an adjustment, and thus the BEA made an adjustment.

Update:

A correspondent sends this, which I have not had a chance to check out

Here are some links that might interest you, one by Seeking Alpha and one by Barron’s:

https://seekingalpha.com/article/4192911-changed-savings-rate-least?page=1

https://www.barrons.com/articles/americans-are-saving-more-than-we-thought-1533034800?tesla=y

The upshot is this (from the Seeking Alpha article):

“Last week, in tandem with benchmark GDP revisions, the Bureau of Economic Analysis (BEA) forewarned us of another wholesale recomputing of the savings rate. Based on new data made available by the IRS' National Research Program, the BEA has raised its income estimates to "correct for the effects of taxpayer underreporting." How the IRS has decided taxpayers are "underreporting" isn't clear (audits?), regardless there is more income than previously believed and reported in the national accounts.”

Thus, the saving rate changed because the IRS made an adjustment, and thus the BEA made an adjustment.

Wednesday, August 1, 2018

The conversation

A few pieces I read over the last few days juxtapose nicely on the state of America today.

On Saturday, Orrin Hatch, writing in the Wall Street Journal,

On Saturday, Orrin Hatch, writing in the Wall Street Journal,

"America’s culture war has reached a tipping point. While our politics have always been divisive, an underlying commitment to civility has usually held citizens on both sides together...

To be clear, I am not calling for an end to the culture war. Indeed, it can and must be fought. Intense disputes over social issues are a feature, not a flaw, of a functioning democracy.

Subscribe to:

Posts (Atom)