The greatest financial bailout of all time is underway. It’s 2008 on steroids. Yet where is the outrage? The silence is deafening. Remember the Tea Party and occupy Wall Street? “Never again” they said in 2008. Now everyone just wants the Fed to print more money, faster. (Well, there are

some free market economists left. But we're a small voice!)

Maybe the Fed is right that if any bondholder loses money, if bond prices fall, if companies reorganize in bankruptcy, the financial system and the economy will implode. I am not here today to criticize that judgement. But if so, we must ask ourselves how we got to this situation, again, so soon. Once is an expedient. Twice is a habit. It is clear that going forward any serious shock will be met by bailouts, and the Fed printing reserves to buy vast quantities of any fixed-income asset whose price starts to fall.

Why does the Fed feel the need to jump in? Because once again America is loaded up with debt, because bankruptcy is messy, and because the Fed fears that debt holders losing money will stop the financial system from providing, well, more debt.

This crisis is a huge wealth shock. The income lost during shutdown is simply gone. The question is, who is going to take that loss? Borrowing to keep paying bills, the current solution, posits that future profits will soak up today's losses. We'll see about that. The CARES act puts future taxpayers squarely on the hook to pay today's bills. But where do those bills go? To creditors -- property owners, bond holders, and so forth. If we're looking around for pots of wealth to absorb today's losses, why are bondholders not chipping in? The biggest wealth transfer in history is underway, from tomorrow's taxpayers to today's bondholders, on the theory that if they lose money the economy falls apart?

OK, but why did America load up with debt again, apparently all "systemically important?" Could the expectation of a bailout any time there is an economy wide shock happens have had something to do with it? Will we do anything when this is over to stop companies from once again loading up with debt -- especially short term debt -- and forcing the Fed's hand again?

Meantime, anyone who hoarded some savings in the hope of profiting from fire sales, in the hope of providing liquidity to "distressed markets" has once again been revealed as a chump. Will we do anything to encourage them? Will lots of debt, private gain, taxpayers take the losses, be the perpetual character of our financial system.

"You can't worry about moral hazard in a crisis," they said, and they didn't. At least last time there was some recognition of moral hazard, and a promise to clean up the moral hazard with reform. Will there be any such effort this time? Is anyone even

thinking about the enormous moral hazard we are creating with these precedents? Will the financial system perpetually a four-year-old on a bicycle, a parent running closely behind with one hand on the seat? Will the "Powell put" on fixed income grow ever larger? Or will we, this time, finally cure the financial system so it can survive the next shock?

A bailout

Small but symbolic: The federal government just

bailed out the airlines -- or more precisely airline stockholders, bondholders, unions, airplane leaseholders and other creditors who would lose in bankruptcy.

"big airlines will receive 70% of the money as grants—which won’t be paid back—and 30% as loans. The cash comes with strings attached: Airlines must give the government warrants amounting to 10% of a given loan’s value that can be swapped for stocks; they cannot lay off staff until September; and they face restrictions on dividends, buybacks and executive compensation."

Oh, and as the article makes clear, this only gets us maybe through the summer. Anyone want to take a bet that planes are full again by September?

The big banks got bailed out in 2008 — or more precisely, the stockholders, bondholders and creditors of the big banks got bailed out. Never again, they said. Again.

Now, one can make a case that big banks are “systemic,” that if their bondholders lose money the financial system collapses. Just how are airline bondholders “systemic?” What calamity falls if airline bondholders don’t get paid in full? Just why is a swift pre-packaged bankruptcy not the right answer for airlines? This seems like a great time to renegotiate airplane and gate leases, union contracts (some require the airlines to keep flying empty planes!) fixed-price fuel contracts and more.

If taxpayers have to give airlines

cash grants don't we get some reassurance this doesn't have to happen again? Even I would say, no more debt financing. You can see the instinct in "restrictions on dividends, buybacks and executive compensation." Democrats in Congress wanted "stakeholder" board seats, carbon reporting, and more. Why not go full Dodd-Frank on them? Detailed regulation of their financial affairs, stress tests to make sure they can survive the next time? Like banks, the existing airlines might not end up minding so much a return to the 1970s status as regulated utilities. Or, more likely, like GM, we just forget about it, let them load up on debt again, and pretend there won't be a 2030 bailout?

The Fed's big artillery

The real action is at the Fed. The Fed is buying commercial paper, corporate bonds, municipal bonds. The Fed is explicitly propping up asset prices. The Fed is also lending directly to companies. The current guesstimate is $4 trillion, with $2 trillion already accomplished. More is coming.

It started "small"

On March 17, the Fed bailed out money market fund investors, buying the “illiquid” assets of those funds so that the funds could continue to pay out dollar for dollar. Recall that in 2008, the Fed and Treasury bailed out money market fund investors, buying assets to stop a run on money-market funds' promise that you can always cash out at $1. Never again, they said. Fixed dollar promises must be backed by Treasuries, other funds must let asset values float. Again.

On March 17

the Fed also announced it will buy commercial paper. “Directly from eligible companies.” Yes, the Fed prints reserves to lend directly to companies that can issue A1/P1 commercial paper.

"By eliminating much of the risk that eligible issuers will not be able to repay investors by rolling over their maturing commercial paper obligations, this facility should encourage investors to once again engage in term lending in the commercial paper market. "

Why are companies borrowing long term by rolling over commercial paper? Didn't we learn anything about rolling over short term debt in 2008? Are we going to follow up by putting a stop to that? Why don't companies have more equity financing, on which they can just stop paying dividends?

"Investors" you say, it's not all the Fed. Read carefully. "By eliminating much of the risk..." The Fed props up prices, and removes risk. Then private investors will come in. The markets won't ride that bike without the Fed's hand on the saddle, apparently. Why do we bother to have private markets?

On March 17 the Fed started

to lend again to primary dealers. These are the traders, much maligned by the Volcker rule.

The PDCF will offer overnight and term funding with maturities up to 90 days...Credit extended to primary dealers under this facility may be collateralized by a broad range of investment grade debt securities, including commercial paper and municipal bonds, and a broad range of equity securities.

Let's translate. You're the trading desk at, say Goldman Sachs. You want to buy stocks, as you think people are dumping in a hurry. Great, that's what traders are supposed to do: "provide liquidity." But, sadly, you're in the habit of of funding trading activity by borrowing money, short term. And you can't do that right now. So the Fed will now lend you the money to buy stocks, and will take the stocks as collateral! It's almost as if the Fed is buying stocks -- except you get the gains, and if you go under, the Fed gets the stocks! (A friend in the securities industry say nobody is bothering to investigate and price high grade corporates. The Fed is setting the prices.)

Again, the Fed is between a rock and hard place. Yes "balance sheets are constrained." Trading firms don't have enough equity to take on additional risk. The natural buyers at asset fire sales are constrained out of the market. Bail the Fed feels it must. But this is exactly what happened when the Fed first lent to broker/dealers in 2008! Why in the world are we in this position, 12 years after that crisis?

On March 20,

the Fed expanded into state and municipal markets. The mechanism is the same: Fed lends to a financial institution, which buys the assets, and then gives the Fed the assets as collateral for the loan. Once again the point is "enhance the liquidity and functioning of crucial state and municipal money markets."

On March 23,

the Fed rolled out real artillery. Ominously,

Treasury markets appeared "illiquid," so the Fed has stepped in buying $1.3 trillion in the first month -- more than the Treasury issued. The Fed is funding

Treasury borrowing with newly printed reserves. The Fed now buys mortgage backed securities.

And now..

corporate bonds. This is well past 2008.

the Primary Market Corporate Credit Facility (PMCCF) for new bond and loan issuance and the Secondary Market Corporate Credit Facility (SMCCF) to provide liquidity for outstanding corporate bonds.

Translation: The Fed will buy new corporate bonds, thus directly lending to corporations. And it will buy outstanding bonds.

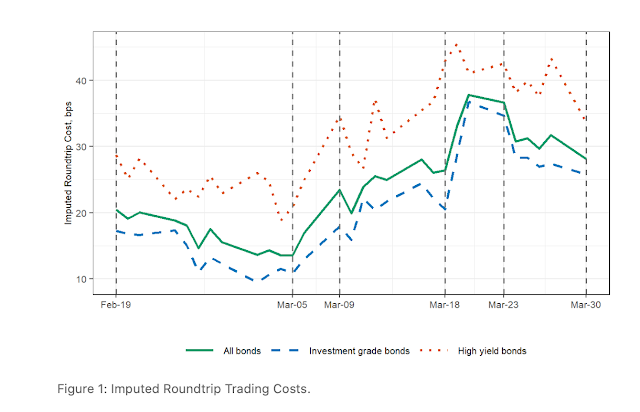

Why would it do that? Well, to "provide liquidity." This is a word that ought to set off BS detectors. Yes, there is such a thing as an "illiquid" market. There is also such a thing as a market whose prices are dropping like a stone. Sell all you want but at 50 cents on the dollar. "I wish I had sold at yesterday's prices" is not illiquidity. You have to pay people a lot to take risk right now. Which is it? Hard to tell. There are ways to tell, of course. For example, illiquid markets have negative price autocorrelation -- a low price today bounces back. I am not aware of the Fed having applied this or any other test. (Research topic suggestion.)

Again, I don't want to criticize, but there sure is a danger of propping up prices under the guise of "illiquidity." The Fed's view that if the Fed takes all risk off the table "liquidity" will reappear is also pretty close to taking risk off the table so prices will rise.

The Fed is already buying new bonds from companies to finance their new expenditures. Propping up prices of

existing bonds is a way to let old bondholders cash out at high prices, now before the deluge. Just why can't old bondholders even take mark-to-market losses?

And, if

corporate bondholders need to be bailed out in this way, are we going to do anything about it going forward? Do you get to buy junk bonds, high interest municipal debt, and the Fed will let you out if anything bad happens?

Wrap up

OK, I haven't even gotten through March and the Fed is just getting going. Let's wrap up.

The Fed has felt the need to take over essentially all new lending in the economy. The Fed is also propping up most fixed-income prices. The Fed is deliberately removing risk from holding these assets.

Once again, I will be told, "this isn't the time to think about moral hazard." But having done this twice, the first time with huge protest, the second time as if it is perfectly normal, this is the pattern, and the moral hazard is there. The economy will load up on debt, especially short term debt. People will not keep stashes of savings around to provide liquidity or jump on buying opportunities. And the need for bailouts will be larger in the next crisis.

"But the Fed made money in 2008" you may retort. And it has a half chance of making money again. If the recession wraps up in September and these "loans" get paid back, it will do nicely. If the recession goes on a year and all these "loans" go sour, it will not look so pretty.

Yes, in 2008 the Fed and treasury successfully operated the world's largest hedge fund, printing money to buy low-price assets. But is this really the function of the Federal Reserve? Do we want it driving private hedge funds out of the liquidity provision business, by its ability to print rather than borrow money, and by the off-balance-sheet put that the US taxpayer will in the end take losses if this massively leveraged portfolio doesn't work out?

Where is the outrage? Where are the financial economists? Where is the reform plan so we don't do this again? At a minimum, can we say tha the government could stop subsidizing debt, via tax deduction and regulatory preference for "safe" (ha!) debt as an asset?

Hello out there? In 2008, everyone was writing financial crisis papers. Now everyone is playing amateur epidemiologist.

Finance colleagues, you have a bigger crisis and intervention to study, and a deeper set of regulatory conundrums. Is everyone just too scared of sounding critical of the Fed? Get to work!

The Fed and Treasury's actions are telling us we are on the verge of financial

apocalypse. Let's wake up and look at what's coming, especially if it doesn't all get better by September.

Some links

This post continues from

Financial Pandemic.

I had planned a longer post on the details of many of these programs, but this is long enough.

A great explanation by Robert McCauley in FT. Section heads include 1) Acting as a lender of last resort to securities firms, 2) acting as a lender of last resort to investment funds, 3) acting as a securities dealer of last resort, 4) acting as a securities underwriter of last resort and finally 5) acting as a securities buyer of last resort.

A simple tweet storm by Victoria Guida

Via the indefatigable Torsten Slok,

Financial Policy During the COVID-19 Crisis MIT opeds on financial affairs

A great list of policy trackers.

Financing Firms in Hibernation During the COVID-19 Pandemic

The Yale

Financial Stability Tracker and especially the

Finance Response Tracker are very useful list of what's going on.

Fed Intervention in the To-Be-Announced Market for Mortgage-Backed Securities

by Bruce Mizrach and Christopher J. Neely is a very nice description of what's going on there

The United States as a Global Financial Intermediary and Insurer by Alexander Monge-Naranjo. More contingent liabilities waiting for Uncle Sam bailouts.

A data set of international fiscal responses