|

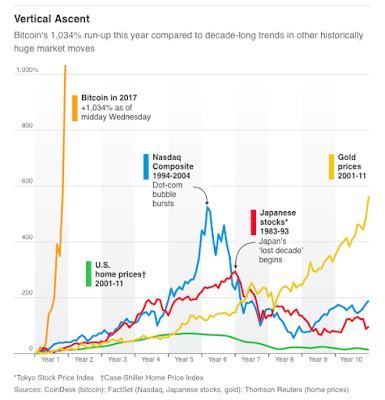

| Source: Wall Street Journal |

So, what's up with Bitcoin? Is it a "bubble?'' A mania of irrational crowds?

It strikes me as a fairly pure instance of a regularly occurring phenomenon in financial markets, one that encompasses some "excess valuations" in stock markets, gold and commodities, and money itself.

Let's put the pieces together. The first equation of asset pricing is that price = expected present value of dividends. Bitcoin has no cash dividends, and never will. So right off the bat we have a problem -- and a case that suggests how other assets might have value above and beyond their cash dividends.

Well, if the price is greater than zero, either people see some "dividend," some value in holding the asset, beyond its cash payments; equivalently they are willing to hold the asset despite a lower expected return going forward, or they think the price will keep going up forever, so that price appreciation alone provides a competitive return. The first two are called "convenience yield," the latter is a "rational bubble."

"Rational bubbles" are intriguing, but I think fundamentally flawed. If a price goes up forever, eventually the value of bitcoin must exceed all of US wealth, then all of world wealth, then all of interplanetary wealth, then all of the atoms in the universe. The "greater fool" or Ponzi scheme theory must break down at some point, or rely on an irrational belief in the next fool. The rational bubbles theory also does not account for the association of price surges with high volatility and high trading volume.

So, let's think about "convenience yield." Why might someone be willing to hold bitcoins even though their price is above "fundamental value" -- equivalently even though their expected return over a decently long horizon is lower than that of stocks and bonds? Even though we know pretty much for sure that within our lifetimes bitcoin will become worthless? (If you're not sure on that, more later)