I'm working madly to finish The Fiscal Theory of the Price Level. This is a draft of Chapter 21, on how to think about today's emerging inflation and what lies ahead, through the lens of fiscal theory. (Also available as pdf). I post it here as it may be interesting, but also to solicit input on a very speculative chapter. Help me not to say silly things, in a book that hopefully will last longer than a blog post! Feel free to send comments by email too.

Chapter 21. The Covid inflation

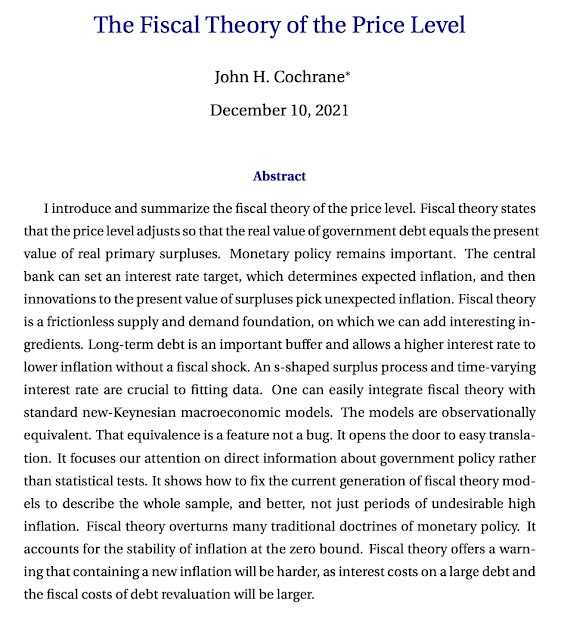

As I finish this book's manuscript in Fall 2021, inflation has suddenly revived. You will know more about this event by the time you read this book, in particular whether inflation turned out to be ``transitory,'' as the Fed and Administration currently insist, or longer lasting. This section must be speculative, and I hope rigorous analysis will follow once the facts are known. Still, fiscal theory is supposed to be a framework for thinking about monetary policy, so I would be remiss not to try.

|

| Figure 1. CPI through the Covid-19 recession. |

Figure 1 presents the CPI through the covid recession. Everything looks normal until February 2021. From that point to October 2021 the CPI rose 5.15% (263.161 to 276.724), a 7.8% annual rate.

What happened, at least through the lens of the simple fiscal theory models in this book? Well, from March 2020 through early 2021, the U.S. government -- Treasury and Fed acting together -- created about $3 trillion new money and sent people checks. The Treasury borrowed an additional $2 trillion, and sent people more checks. M2, including checking and savings accounts, went up $5.5 trillion dollars. $5 trillion is a nearly 30% increase in the $17 trillion of debt outstanding at the beginning of the Covid recession. Table 21.1 and Figure 2 summarize. ($3 trillion is the amount of Treasury debt purchased by the Fed, and also the sum of larger reserves and currency. Federal debt held by the public includes debt held by the Federal Reserve.)

|

| M2, debt, and monetary base (currency + reserves) through the Covid-19 recession. |

|

Some examples: In March 2020, December 2020, and again in March 2021, in response to the deep recession induced by the Covid-19 pandemic, the government sent ``stimulus'' checks, totaling $3,200 to each adult and $2,500 per child. The government added a refundable child tax credit, now up to $3,600per child, and started sending checks immediately. Unemployment compensation, rental assistance, food stamps and so forth sent checks to people. The ``paycheck protection program'' authorized $659 billion to small businesses. And more. The payments were partly designed as economic insurance, transfers from people doing well during covid to those who had lost jobs or businesses, and efforts to keep businesses from failing. But they were also in large part, intentionally, designed as fiscal-monetary stimulus to boost aggregate demand and keep the economy going. The massive ``infrastructure'' and ``reconciliation'' spending plans occupied the Congress through 2021, adding expectations of more deficits to come.

From a fiscal-theory perspective, the episode looks like a classic fiscal helicopter drop. There is a large increase in government debt, transferred to people, who do not expect that debt to be repaid. It is a``fiscal shock,'' a decline in surpluses s_t, with no expectation of larger subsequent surpluses. Of course it led to inflation!