I have been emphasizing the Fed's dilemma: If it raises interest rates, that raises the U.S. debt-service costs. 100% debt to GDP means that 5% interest rates translate to 5% of GDP extra deficit, $1 trillion for every year of high interest rates. If the government does not tighten by that amount, either immediately or credibly in the future, then the higher interest rates must ultimately raise, rather than lower, inflation.

Jesper Rangvid points out that the problem is worse for the ECB. Recall there was a euro crisis in which Italy appeared that it might not be able to roll over its debt and default. Mario Draghi pledged to do "whatever it takes" including buying Italian debt to stop it and did so. But Italian debt is now 160% of GDP, and the ECB is still buying Italian bonds. What happens if the ECB raises interest rates to try to slow down inflation? Well, Italian debt service skyrockets. 5% interest rates mean 8% of GDP to debt service.

Central banks first stop bond buying and then raise interest rates. Whether U.S. bond buying programs actually lower treasury yields is debatable. But there is no question that the ECB's bond buying keeps down Italy's interest rate, by keeping down the risk/default premium in that rate. If the ECB stops buying, or removes the commitment to "whatever it takes" purchases, debt service costs will rise again precipitating the doom loop.

Jesper:

The ECB is caught in a dilemma.

The ECB knows that very expansionary monetary policy, combined with already high inflation and strong economic growth, creates a serious risk that inflation and inflation expectations run wild.

The ECB also knows, however, that if it tightens monetary policy, i.e. stop asset purchases and raise rates, debt-burdened Eurozone countries will face severe challenges.

Take Italy as an example. At the end of last year, Italian public debt corresponded to 160% of Italian GDP. This is a lot of debt. ...

Low interest rates have been kind:

... in spite of a 50% higher debt burden, debt-servicing costs for Italy has been cut by a third from 2007 to 2020. The reason is of course low interest rates.

...In addition to the global fall in rates, though, the ECB has been buying Eurozone government debt in massive amounts, significantly reducing rates even further. ...

|

| Figure 11. ECB holdings of Italian debt securities. Millions of euros. Source: Datastream via Refinitiv. |

The ECB has bought a lot of debt. First, in relation to the Public Sector Purchase Program (PSPP), launched after the Eurozone debt crisis, and, second, in relation to the Pandemic Emergency Purchases Program (PEPP), the program launched to battle the corona crisis. Under the PSPP, ECB amassed Italian debt worth EUR 400bn. Under the PEPP, it amassed EUR 300bn. In total, the ECB holds Italian debt worth EUR 700bn, see Figure 11. The ECB owns close to 25% of all outstanding Italian public debt....

|

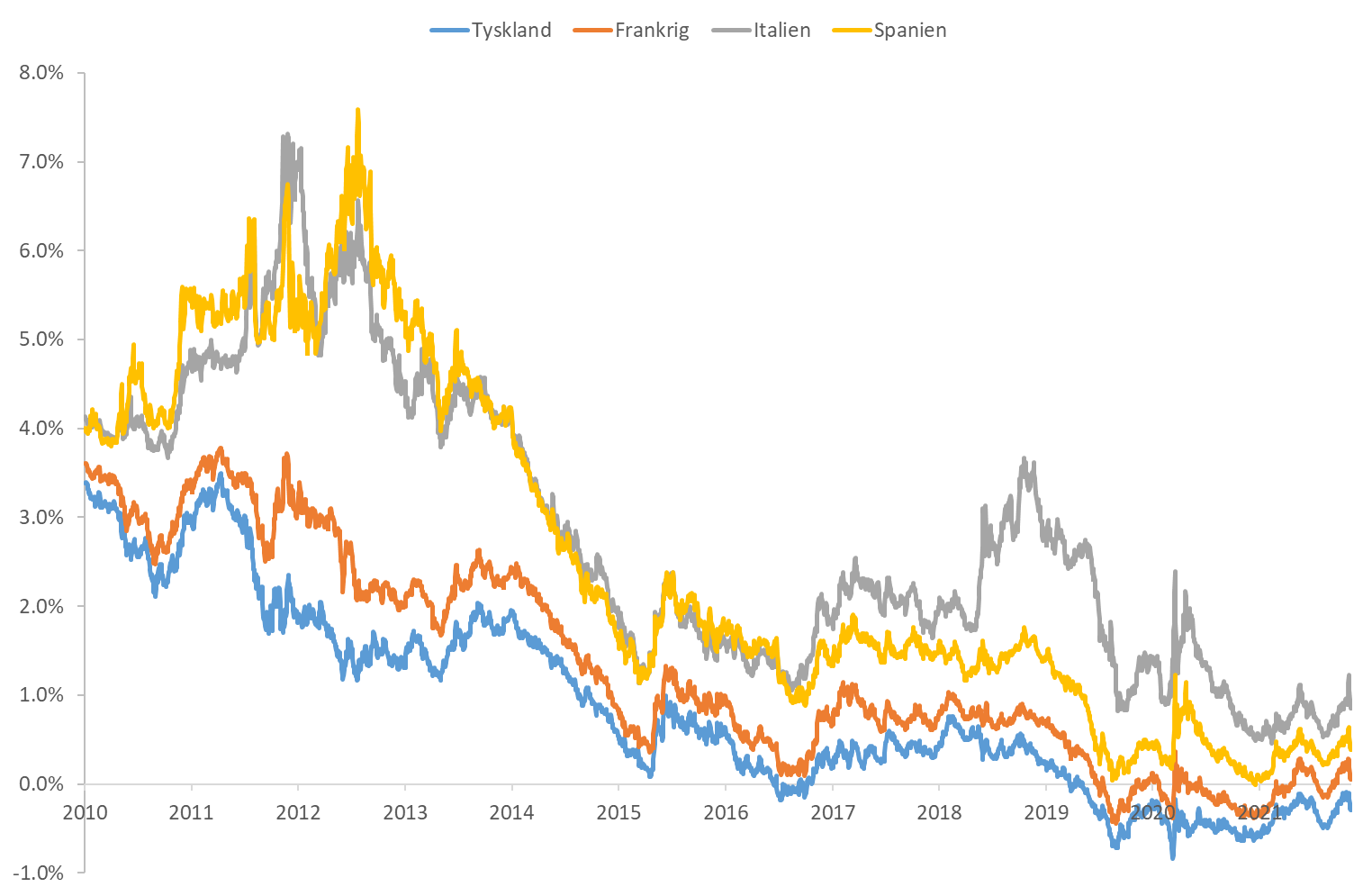

| Figure 12. Yields on long-dated Eurozone government bonds. Source: Datastream via Refinitiv |

Many of us remember the Eurozone crisis in 2010-2013. Italian yields reached more than seven percent in 2012, see Figure 12. Yields only came down after Mario Draghi’s famous “we will do whatever it takes” speech in 2012 (link). ECB saved Italy, thereby saving the Eurozone.

This is an important reminder that it can happen. For the U.S. a large default/inflation premium to real interest rates is a theoretical possibility, and perhaps a memory of the early 1980s if one interprets that episode as a fear of return to inflation, or otherwise a memory of the 1790s. For Europe this happened, and only 10 years ago.

Jesper does not mention the interesting question, what happens to all these bonds on the ECB balance sheet, or the bonds it will surely acquire if Italian spreads widen again, in the event of default.

Jesper also does not mention one small piece of good news. I gather Italian debt is somewhat longer-term than U.S. debt, though I don't have a good number handy. That fact means that higher real interest rates (including default premium) only spread into interest costs slowly.

In sum,

the ECB is stuck in a corner. Whether one fears this round of inflation will persist or not, the fact that the ECB is constrained by fiscal considerations is problematic. If the ECB one day needs to raise rates, it will face the dilemma described above.

What to do?

What is the solution? This will take us too far in this blog, but it lies in the old discussion of macroeconomic reforms in certain European member states, directing fiscal policy to a healthy path, improving productivity and competitiveness, and in the end generate higher growth. This is easier said than done.

Draghi was quite clear, that "do whatever it takes" was a temporary expedient, to give Italy room for structural and fiscal reforms. Those (predictably?) did not happen so here we are again. Is it too late? Italy will surely not reform before a crisis looms, so the case has to be that a crisis is severe enough to finally provoke growth-oriented economics.

The ECB, however, remains stuck between a rock and a hard place. As the Fed will be if it tries to substantially raise interest rates.

To move from the general to the specific here. Remember that thing about Greek bonds issued under London law? That were redeemed in full while Greek law bonds got crammed down? There appears to be a small issue of Italian govt bonds under NY law. At least there was 8 years back.

ReplyDeleteA prediction therefore. If - if - the interest rate rise comes to pass, Italian govt finances come under that significant strain, the NY law bonds will rise in value relative to the domestic law.

Whatever the solution, don't do a Greece. The Greek GDP declined by 25% in response to austerity programs, and never recovered.

ReplyDeletehttps://fred.stlouisfed.org/series/CLVMNACSCAB1GQEL

I wish I knew the answer. The Treaty of Versailles and the Greek austerity programs suggest what not to do.

There is one bright spot in Europe and it's in Germany:

ReplyDeletehttps://m.youtube.com/watch?v=u8j51XZegsk

If you skip to about 38:00, there is a great explanation how banks in Germany fuel investment in innovation so that firms are competitive. Germany has the highest output per capita in the world. Wow.

To me, how lending actually works makes a huge difference with all this Fiscal and Monetary madness.

The whole video is worth watching. But, in the end, Germany is not a Greece or Italy...

your analysis of the fiscal effects of inflation are incomplete. Because of the non indexation of capital gains and inventory profits real tax revenues rise with inflation - might not this be larger than the interest rate effect?

ReplyDeleteIt seems to me that the ECB/euro would work better if:

ReplyDelete1) Any EU member that wants a seat at the ECB needs to issue two types of debt: senior and junior.

2) Senior debt is safe and backs the euro. Junior debt is risky and can default.

3) Senior debt must be between (say) 30% and 60% of GDP. If a country wants to issue more debt, this must be junior debt, or else it loses its seat (countries can use the euro without being part of the eurosystem).

4) The ECB only buys/sells/holds senior sovereign debt. It no longer participates in private credit markets as it does now.

5) Ideally senior debt is inflation indexed, and of one type (perpetuities perhaps?)

P.S. For a breakdown of Italian Government Debt by maturity, see:

http://www.dt.mef.gov.it/en/debito_pubblico/dati_statistici/bollettino_trimestrale/

A couple of points worth mentioning. (1) Higher interest rates are also a problem for Central Banks. If they raise rates to control inflation, it will increase their IOER costs and my guess is that the average yield on the Fed's portfolio won't match the rates they will have to pay on the excess reserves to control inflation. (2) The Fed needs to retain their profits instead of remitting them back to the Treasury (they should've been retaining them as soon as the began engaging in QE), especially under the new IOER regime

ReplyDeleteI think it was Anil Kashyap who said "Structural Reform" has become a catch-all word. No one wants to say it plainly. It means someone's benefits gets reduced, someone's tax liabilities go up, and someone's loopholes get closed. In other words, political suicide.

ReplyDeleteIsn't the most likely result just more monetization? For example, to pay its higher interest costs, Greece issues 0% notes that the ECB buys at par.

ReplyDeletePresumably this further eroding of limits on what the ECB will do eventually (maybe immediately, who knows?) leads to more inflation, but maybe that's preferable politically to the other reforms.

The current approach of more monetization won't stop until the inflation it is causing becomes less politically palatable than the necessary reforms (both pro-growth deregulation and fiscal austerity) that allow governments to live within their means.

One question is whether that happens before alternative currencies effectively supplant the current ones controlled by governments.

This comment has been removed by the author.

ReplyDeleteHi John,

ReplyDeleteGreat post as always. One small comment (and you obviously don't need to publish this), I know Jesper well, and you are misspelling his name as "Jasper" throughout. It is with an "e" not an "a".

Best,

Morten

This comment has been removed by the author.

ReplyDelete"I gather Italian debt is somewhat longer-term than U.S. debt, though I don't have a good number handy".

ReplyDeleteThe average residual maturity of Italian public debt is 7.6 years.

(https://www.bancaditalia.it/pubblicazioni/economia-italiana-in-breve/2021/eib_December2021_en.pdf?language_id=1)

Thanks. Though beware average maturity is a terrible statistic. 99 euros of overnight debt + 1 euro of a perpetuity (infinite maturity) = infinite average maturity. Weights principal only, and at face not market value. Too bad treasuries apparently don't know how to calculate duration.

DeleteThanks. Actually the Italian Treasuries knows how to calculate duration. The duration of Italian public debt is 6.2 years ante-derivatives and 6.6 post-derivatives http://www.dt.mef.gov.it/export/sites/sitodt/modules/documenti_it/debito_pubblico/dati_statistici/indicatori_rischio/Indicatori_di_rischio_al_III_trimestre_2021_.pdf

DeleteHow to choose between face values and market prices is a relevant issue. Current Treasury minister considered it here, pp. 31-35 https://www.bancaditalia.it/pubblicazioni/altri-atti-convegni/2000-fiscal-sustainability/021-060_balassone_and_franco.pdf?language_id=1

Thank you! I'm interested to learn that the Italian treasury is so far ahead of US here.

DeleteIf the Taylor rule is taken as a way to approximate the measurement of monetary policy, the result is overwhelming. Inflation in the United States at 6.8%, an ouput gap that I calculate at -1.51% of the observed minus the trend that would have followed without Covid19, a natural interest rate of 2%, then we have a federal funds rate above 10%. Compared to the 0.25% figure, the difference is so strong that we should deeply analyze what is going on. A return to the Volcker era in the future? I don't know.

ReplyDeleteIf I were to offer a prophesy, then I would say that the JCB, ECB, or even the Fed will likely just say one day: I refuse to collect on the bonds that they own.

ReplyDeleteThese Central Banks could probably get away with it as a one off event, but what happens when the underlying governments hold their next bond auction?

Interesting post, thanks.

ReplyDeleteAn FT commenter by the name of 'Upton' pithily described the ECB's dilemma as the Euro has "one foot in the fire and one foot in the freezer", i.e. Germany is superbly productive and hard-working, and thus is at risk of inflation, whereas Italy and Greece are corrupt, lazy and sclerotic and their economies are already on life support and couldn't handle an interest rate rise.

Interesting times!