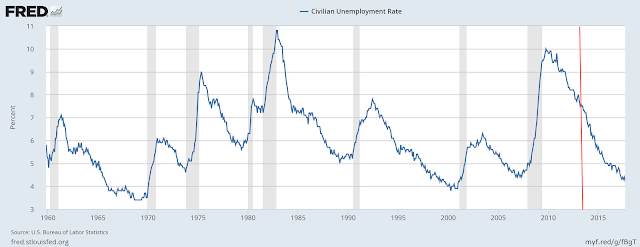

The Federal Reserve's mandate is to "promote maximum employment, stable prices, and moderate long- term interest rates." Ms. Yellen can look back with pride on these outcomes during her term:

One could complain that Ms. Yellen didn't face any particular challenges. As presidents are tested in wartime, so Fed chairs are tested by events. Ms. Yellen didn't face a recession or financial crisis. In this quiet late summer of the business cycle, her job was largely to do nothing, and resist calls from people who wanted her to take big steps. The Fed's major tool is the federal funds rate, has barely moved.

True, but she did not screw up either. So much of monetary history consists of unforced errors, that not making one is an accomplishment. The late summer of business cycles has historically been a time when central bankers over or under react. And there has been no lack of loud voices calling for drastic action one way or another. In particular, the siren song of "macro prudential policy" that the Federal Reserve should manipulate stock and housing prices has been strong. Her predecessor, Ben Bernanke, will be much more written about for the Fed's management of the 2008 crisis and recession, as well for its failure to see it coming in 2007. Not screwing up doesn't earn you as big a place in history, but perhaps it should.

No matter how one feels about monetary policy, and the more important (in my view) question of Fed financial regulation, President Trump is breaking with tradition by not reappointing her. The tradition that if the Fed chair has done a reasonable job, he or she is reappointed is a good one for maintaining the independence of the Fed. Let us hope that it is not gone for good.

Good luck to Ms. Yellen in her next endeavor. And to Mr. Powell in this one.

This comment joins the good lucks in this post!

ReplyDeleteI agree with you. Ms. Yellen did good job in terms of the Fed's dual mandate. The challenge for the next chair, Mr. Powell, would be "normalization." I have no idea about which - managing the financial crisis (Bernanke) or possibly raising the interest rate (to, say, 1% or 2%) above the effective lower bound, and possibly changing the direction of future research of economists, i.e. the last 10 years of macroeconomists' efforts to understand the implications of ZLB (Powell) - is harder job.

ReplyDeleteThe counterpoint is that, by the same logic, Alan Greenspan looked outstanding on Jan. 31 2006.

ReplyDeleteAlso, in addition to not yet knowing the longer-term effects of Yellen's policies, it's not at all clear what one of the Fed's major policies, QE, did or did not accomplish, leaving both Bernanke's and Yellen's legacies uncertain. The chart at the link below offers an interesting look (to me, anyway).

If you're curious, though, I'd suggest asking yourself a question before opening it: How do you think net lending by banks and broker-dealers changed as the Fed moved from QE1 to QE-pause to QE2 to QE-pause to QE3 to QE-stop? Come up with your answer first, maybe even write it down, and then look. That way you won't look at the answer and assume you knew it all along (unless, of course, you did know it - then I'm sorry to have taken your time).

http://nevinsresearch.com/blog/qes-untold-story-a-chart-that-fed-correspondents-should-investigate/

I hope Powell decides to "normalize" the rate the Fed pays on IOR. It was 0% from 1913 to 2008.

ReplyDeleteI hope he does not. A large supply of interest-bearing reserves is a fantastic innovation in monetary policy. Sometimes there is progress even in this, and the old ways are not the best ways. We can live the Friedman rule with no fear of inflation. 1913 to 2008 was not all in all the happiest period for monetary economics.

DeleteUnknown,

DeleteThe interest that the Fed pays as IOR is simply the interest that it receives on it's bond holdings. To pay 0% interest on reserves either the FOMC would need to sell off / fail to rollover it's bond portfolio or the federal government would need to buy back the bonds.

Very nice post.

ReplyDeleteNot to make much of it, but is your preference for the CPI over the deflator part of being Grumpy? Seems like the sort of choice a grumpy guy might make.

No strong preference. It seems to be what the Fed uses. More to the point, how did "price stability" turn in to perpetual 2% inflation?

Delete"how did "price stability" turn in to perpetual 2% inflation?"

DeletePersonally I would prefer zero inflation and don't believe the idea that inflation stimulates the economy. I reject the idea that we need some inflation so the Fed can take real interest rates negative in a recession. Whatever the Taylor curve represents it is not a causal relationship running from inflation to employment.

That said, this article is interesting on the history of the 2% target: https://www.nytimes.com/2014/12/21/upshot/of-kiwis-and-currencies-how-a-2-inflation-target-became-global-economic-gospel.html

I rationalize 2% on the basis that:

1) we cannot agree on a definition of inflation for the purposes of monetary policy;

2) if we could agree, we could not accurately measure inflation;

3) we want to avoid widespread wage deflation;

so we compromise on an inadequate definition of inflation, inadequately measured, and then try to err slightly on the high side - and that takes us to 2%.

I think I have seen a quote from Greenspan that pretty much justifies the 2% on the same basis as I do.

John / Gerard,

Deletehttp://www.businessinsider.com/pce-vs-cpi-weight-comparisons-2014-6

"The official switch from CPI to PCE occurred in 2000 when the FOMC stopped publishing CPI forecasts and began to frame its inflation projections in terms of the PCE price index. This shift, announced by Alan Greenspan during his testimony to Congress, came after extensive analysis done by the Fed."

Inflation is a tax on the existing stock of currency, and on fixed price contracts. No body other than Congress may authorize such a tax. And Congress may not delegate its power to tax. Any inflation target other than 0 is unconstitutional.

DeleteDoing nothing is good, very good.

ReplyDeleteThe Fed Mandate, though, ought to be abolished. It presumes an underlying Keynesian economics that does not conform to reality; if you put this much money into the system, this inflation rate will happen and this many people will be put to work. In my observations, what has happened in the last couple of years is that banks had access to lots of money which they sat on and received lots of interest income, all without having to take risks on loans.

I wonder Fed is giving up a percent or two of growth every year, to hold down inflation by a percent or two.

ReplyDeleteBTW, Q3 unit labor costs were down YOY. And flat since Q4 2015.

I prefer a growth-oriented Fed, and I wonder how many trillions of dollars in output, wages and profits have been lost to "fight inflation"

Why is the low bar of "avoiding disaster" seen as being good enough? Yellen has done a horrible job. Wages were stagnant, growth anemic, and inflation was below target. Has systemic risk been reduced? Or has it been concentrated in fewer mega banks? And interest on excess reserves is scandalous subsidy that is project to cost $50B in 2019. I give Yellen failing grades in aspects of her job: growth, price control, risk mitigation, regulation.

ReplyDeleteThe concentration of power among U.S. commercial banks is inimical to a free capitalistic society and to democratic forms of government. When banks buy their liquidity instead of following the old fashioned practice of storing their liquidity, they impound savings (as DFIs always create new money when making loans/investments with the non-bank public). See Philip George. The impoundment of savings is responsible for both stagflation and secular strangulation.

Delete"Ms. Yellen can look back with pride on these outcomes during her term"

ReplyDeleteDuring 2017 she was extraordinarily prescient. Inflation was set to take off. Raising the remuneration rate initially destroyed money velocity. But money velocity began to rise in the 2nd qtr and has continued to rise for the rest of the year.

An alternative explanation of Yellen's tenure is that after the Fed ballooned its balance sheet during the Panic of 2008 it lost its power to affect the monetary economy, and that Yellen has been the guy with the broom and the can following the parade to clean up what the marchers left.

ReplyDeleteI agree with the post, just adding another crucial fact: Yellen presided over a much-anticipated lift-off of interest rates. Those following the banking system these last years will recall the underlying anxiety with the new level of interest rates due to potential impacting effects on emerging markets (more levered after the crisis) and on the global financial system, accostumed to years and years of 0% interest rate.

ReplyDelete