Stuart Kirk of HSBC (head of worldwide responsible investing!) gave an eloquent short speech on climate financial risk. Youtube link in case the above embed doesn't work.

Most of the points are familiar to readers of this blog, but they are so artfully put and in such a high visibility place, that you should watch anyway.

Why the catastrophism?

"I completely get that at the end of your central bank career there are many many years to fill in. You've got to say something, you've got to fly around the world to conferences. You've got to out-hyperboae the next guy [or gal]"

A fun bit of hypocrisy:

"Sharon said, `we are not going to survive'..[ but] no-one ran from the room. In fact most of you barely looked up from your mobile phones at the prospect of non-survival."

Regulatory bother

"what bothers me about this one is the amount of work these people make me do"

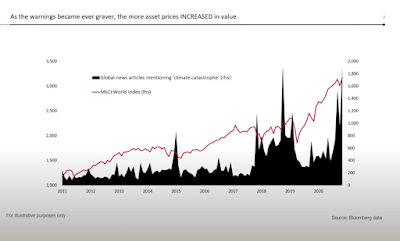

A good point: Markets are not pricing in end of the world.

"Markets agree with me. Despite the hyperbolae, the more people say the world is going to end... the more the word "climate catastrophe" is used around the world, the higher and higher risk assets go. "

Even the worst-case scenarios of 5% of GDP in 2100 are a flyspeck compared to economic growth. Just think back to 1922. "The world is going to be between 500 and 1000 percent richer" Nobody will notice 5% less. "Europe has a GDP per capita 40% less than the US. It's ok" [Well, it's not, but it's a good comparison. The climate "catastrophe" is one eighth the eurosclerosis catastrophe.]

Floods and fires?

"Anything where you put a denominator on those statistics tend to look like that. Human beings have been fantastic at adapting to change.. and we will continue to do so. Who cares if Miami is 6 meters [actually 1 meter] under water in 100 years. Amsterdam has been 6 meters [ actually 6 feet, 2 meters] underwater for ages and that's a really nice place."

California's fire budget is 1% of their state budget and 0.1% of their GDP.

"One of the tragedies of this whole debate, and one we obsess about at HSBC is, we spend way too much on mitigation financing [high speed train to save carbon] and not enough on adaption financing [fire prevention] and I'm sure most of you agree [I'm sure most of the audience did not agree!] "

A good point: Declining size of fossil fuels does not mean loss of profits or financial losses to investors.

"The confusion between volume and value. Anyone who has run money or anyone who has been an analyst knows this very well, but the climate community doesn't. There is a big difference between falling volumes and a falling price.... what happens to prices at the end of this process is completely divorced from the transition winners and losers"

As we transition, investment in coal oil etc. stops. The existing companies make money off their "stranded" assets as they slowly become smaller and smaller and solar cells and windmills take over.

"The longest bank loans at HSBC are 6 years out. What happens in year 7 is actually irrelevant. "

Central banks

"Central banks are particularly annoying because they haven't spend enough time worrying about inflation and why it's going out of control and instead they've been spending too much time on climate risk. "

What about policy risk? We kind of agree that the weather won't cause a financial calamity, so discussion has shifted to "transition risk" to the financial system. What if regulators kill the economy in the name of climate? Kirk caught the Dutch Central Bank completely fudging their climate stress test on this issue. First, they assume that a large carbon tax would dramatically lower GDP for several years, a questionable assumption to start with especially if the proceeds lower more distorting taxes. Most of all, by assuming that there would be a large interest rate rise at the same time which of course hurts banks.

"All the Bank of England and central bank scenarios on climate risk to get a nasty number , they have given the financial sector a whopping great interest rate shock...very easy to make a bank look sick if you destroy their fixed income portfolio. ...Even with a carbon tax, even hitting growth, they couldn't make climate risk move the needle, so they had to get their clever little wonks in the back room to put a gigantic interest rate shock through their models in order to make headlines."

He does not add, if there is 5 years of strong negative GDP impact, conventional views of monetary policy say interest rates would fall, not rise. A second fudge.

And, projections of climate damage from 1920 would miss the greatest rise in human prosperity ever.

"The markets are crashing around our ears..having nothing to do with climate... Let's get back to making money out of the transition because we have thousands of opportunities. I agree with the just transition , I agree with teh opportunities that exist with all these facets of technology

*****

What was his reward for pointing out the emperor has no clothes, and that everyone who can't look up from their cellphone when someone says the world is about to end secretly agrees? Does his employer reward the brave analyst who thinks for himself and can avoid the herd into overpriced securities?

No. He was instantly suspended, though having cleared his presentation ahead of time. FT coverage, Daily Mail or just google it. This emperor and his minions and his consultants does not like his lack of clothing to be pointed out.

Why did HSBC cave so quickly? Fear of woke investors or fear of regulatory retaliation? Just how quickly this evidently clear out of the box thinker, willing to buck the trend and go with fundamentals, finds another job will be a good test of whether there is any competition left in the big bank financial arena.

*****

Update:

A response from Robert Vermeulen of the Dutch Central Bank here

Does a carbon tax really destroy the economy?

ReplyDeleteSeems to that a broad based consumption tax like that is what we should have, especially if it can lead to lowering income and capital gains taxes

thanks, I fixed that. - John

DeleteHe was just suspended by HSBC for giving this talk! He was just suspended by HSBC for giving this talk! https://www.dailymail.co.uk/news/article-10844553/HSBC-suspends-banker-joked-cares-Miami-water.html

ReplyDeleteDepressing.

ReplyDeleteIn addition, we now endure the spectacle of political leaders publicly seeking ways to lower gasoline prices... while warning about climate disasters.

And yes, central bankers should limit themselves to the really important occupation of managing, or at least ameliorating, macroeconomic outcomes.

If voters worry about gasoline high prices, political leaders will seek the way to lower them. If voters want to "virtue signaling" their climate change concerns, political leaders will warn about climate disasters and will "sell" climate friendly policies.

DeleteThat what public choice theory correctly predicts they will do. Being surprised by them doing otherwise is an exercise in naivete.

Pretty much what Warren Buffett has been saying for years. But, Buffett is an uber rich uber celebrity. He can only be worshiped. He can't be cancelled. It really stinks when you have to have $100,000,000,000 in your pocket to be able to tell it like you see it.

ReplyDeleteRoger Pielke Jr. has an essay up about the video. He says: "In one sense, Kirk is just the latest person to get crossways with the climate lobby and to suffer career repercussions as a result. In another sense, far more significantly, this episode is indicative of the deep pathologies of a community that often seems to value political fealty over intellectual substance."

https://rogerpielkejr.substack.com/p/why-investors-need-not-worry-about

Pielke protests too much over the incivility of Kirk's argument but nobody would be talking about a polite Kirk slide deck...and likely he would still have been suspended for wrong think. I commend his effort...

DeleteWell, maybe the wrong emperor is sporting these threads.

ReplyDeleteJust because climate risk isn't sexy doesn't mean it shouldn't be taken seriously.

GDP obsession: it just isn't a good measure for the totality of well-being. It may be an important factor in the scheme of things, but it doesn't capture other important factors that are hard to measure objectively. But if numbers are being fudged, trouble usually follows. That GDP graph is what (5:32)? Nominal or Real GDP? No idea but it matters. I'm venturing it's nominal.

His argument about adaptability is flawed. I guess he never read Jared Diamond. People can still do stupid things (cough cough the Fed)

Our habits and preferences matter. What do we really want, hmmm? If GDP takes a hit in exchange for sustainable economies that can survive, so what? Scarcity is still real last time I checked. Lets ignore that, yes? :D It doesn't mean automatically well-being is diluted somehow or the financial world is about to end.

Econometric modeling is partly to blame because of faith in math. If 1 != 1 then the whole of existence falls apart? (I've got a proof 1 = 0.) This is largely a vestige from the deterministic madness that informed the Rational Enlightenment.

Measurement is important yes but how we frame our observations about the world matters, too. Cause and effect is real. All this was was an attempt to keep the madness going. Explain to me how we're going to adapt when countries are suspending food exports? They're adapting draconically.

We don't care in year 7? Wow. Ir I guess all loans should be 6 years and then close up shop after that? Nope. You see them doing that?

This man is smart and says smart things but it's clear he's frustrated. I guess he's not adapting very well himself.

Nature adapts best of all. We could learn a thing or two about how Nature handles and maintains its systems. George Carlin was right nearly 30 years when he quipped Mother Earth will be just fine. The anxiety is about how we as a species will survive, if at all. At that point GDP won't matter. ;)

I'll stop now. ;)

"doesn't mean it shouldn't be taken seriously".

DeleteThat is, precisely, what Stuart Kirk does: taking it seriously. What is not serious at all, is all the hyperbole and the wobbly thinking.

Moving from GDP to "wellbeing" makes the whole debate a "religious" one since basically means that climate change doomers cannot be falsified: "something we cannot measure or forecast is going to be hit hard" is equivalent to say "God exists but cannot be felt or seen or comprehend", it can still be true but we, humans, have no way of having a positive discussions about it.

That's very convenient for the believers.

And yes, people can do stupid things and our adaptation to climate change will be flawed (compare with a "textbook" example of "adaptation"). All the adaptations to all the challenges that Stuart Kirk is talking about were both, deeply flawed AND successful.

The "food adaptation example" is a really bad one. How we adapt to a 3-month long shock tells nothing about our adaptation skills to a 100 year long phenomena. Granted it would be near impossible for us to adapt to a meteorite coming out of the blue and hitting Earth next Sunday. But this tells us nothing relevant in the adaptation to climate change debate.

And what Stuart says about the average duration of the bank's loan book is that climate change is not a risk to TODAY's bank balances. Banks will be better positioned in 6 years’ time to evaluate and price the climate risk to their "in 6-year time balances". If you recover your investment every 6 years you will have the ability to avoid a "100 years in the making risk".

The risks that you could not avoid, because will caught you fully committed, are out of the blue wars, inflation increases under the watch of "too busy doing nonsense" central banks, etc...

Look, I'm just a retired car guy. But, the whole thing smacks of "how many angels can dance on the head of a pin." The entire climate risk question seems absurd when viewed from the outside. Where's the information coming from. How reliable is the data. Huge leaps are required at every turn. Assumptions- as evidenced by the swift reaction to Kirk by his employer- seem to smack of an orthodoxy reinforced- as always - by coercion.

ReplyDeleteI would just say as an amateur historian, that history is replete with predictions of doom. The sky has yet to fall. Club of Rome bet anyone? How about the population bomb? Has it gone off yet? Just how much cruelty to actual human beings living impoverished and diminished lives today are the wealthy of the earth willing to inflict in pursuit of climate goals that will in no way diminish their comforts and luxuries?

We see, right now, before our very eyes, that the run-up in fuel prices is reducing mobility, prosperity, heating and cooling, and the very availability of calories for uncounted millions of humans- not prospective humans sweltering in the projected overheated earth of a hundred years from now, but actual living humans alive and suffering today as the jets park nose to tail at Davos.

If one took the train from Boston to Philadelphia in 1850 the fields on all sides would be open and only scattered tree lots would be visible. Today, that area has ten times the population, but is a veritable unbroken forest. Why? Because the adaptive thesis is correct. England's oaks had been consumed by Nelson's fleets, but today are safe from the shipwright's axe. New Jersey's primeval forest had been consumed to produce charcoal for the scattered iron forges of the nascent industrial revolution. Today, they harbor McMansions and a vast herd of whitetail deer.

I do find the fear of global warming hyperbolic. People whose last science class was a 101 300 person freshman lecture cannot answer the basic question: "what is the correct temperature?" Does anyone note that we are tropical animals? Without our material culture none of us can survive overnight north what, 30-35 degrees or so?

You may find my comments beside the point, but isn't there an awful lot of noise being introduced into a system that purports to a rational pursuit of accurate estimation of risk, value, and profit?

Again, I appeal to history. We have done this before. If challenges to the "consensus" are met with repression, then just how confident are the guardians of the orthodoxy in their faith?

Great points. That's the way it is. Like with the "Corona pandemic": nothing's proven, everything depends on calculations the public is told are too high for them to understand. I'm just a former physicist, risk analyst and financial planner, assessing risks all day for my clients. And if s.th. quacks like a duck, walks like a duck and looks like one... it probably is. No man-made warming, if there were, it wouldn't be much of a problem anyway (think of the Medieval "climate optimum" as it was called 30 years ago, before all this warning of warming began), and if there are some unpleasant results from warming, there also were if there was cooling...

DeleteCan anyone tell us what the "right" temperature is?

DeleteThe questions "what is the correct temperature?" and "what is the correct level of CO2?" literally have no answers. Earth's temperature and the level of CO2 have varied widely over the history of the earth - there is no fixed value for either of them. The values have some consequences, of course, but the idea that you can pick a "right" value for either of them is laughable.

DeleteWe should do well to remember that we still live in the middle of a long ice age, at the end of a brief period of relative warmth. The really big risk is that the climate enters a new glacial period, turning our best croplands into tundra and consigning many of us to starvation. "NetZero" policies aim to return us to the climate of 1850 - there is nothing particularly benign about that date, the coldest period since the end of the last glaciation.

My background in geology is probably why the whole climate issue got my attention. Knowing the earth’s been going through significant climate changes for billions of years is something the alarmists don’t ever discuss. Far more dramatic changes billions of years longer than people have even been around.

ReplyDeleteAfter doing more current research, I find there are many intelligent scientists not being allowed to speak out. The carbon the alarmists want to reduce carbon dioxide; plant food. Greenhouse gases are 90% water vapor; the remaining 10% includes a very small part of carbon, and we need more, not less.

We’ve just passed 400 ppm. Professional greenhouses want to be 3 to 4 times that high. The earth’s agriculture benefits greatly from higher carbon ppm. We’re much closer to being too low (and vegetation destruction) than too high. In fact, the earth’s ppm has been significantly higher without adverse consequences many times throughout history.

It was great finding Gregory Whitestone’s book Inconvenient Facts, the science Al Gore doesn’t want you to know. It summarizes much of what I found very well. They even have a great app for your phone. Very substantive and credible. All sources included.

Even in the short timeframe of human history, we have experienced "Medieval Warming," and "The Mini-Ice-age." Romans grew grapes in Britain, Americans drove Model-T's across the Hudson River from NJ to NYC. Elizabethans could look forward to ice fairs on a frozen Thames. If we take the longer view, from where I sit typing it's 40 miles to New York City, and about 15 miles to the edge of the terminal moraine deposited by the mile thick ice sheet that covered half of North America just ten thousand years ago. To your point, I could also go climbing mountains rimming the great western basin to find fossilized sea creatures where desert now covers the center of the the US. There seems a tremendous sense of hubris in the notion that we can control the climate. It seems to be more a a gnostic claim than a scientific one.

ReplyDeleteThis comment has been removed by the author.

ReplyDelete"the transfers are popular vote-buying measures in the short-term." ... surprise, surprise!!

DeleteJust watched this for the first time. Didn't realise it was so short. And really I don't hear much hyperbole, just a lot of detail packed in. Points on mistaking volume for something else really hit the mark. Don't know how the outcome can be described as anything other than a witch hunt. The worst irony? This guy probably travelled to the event on the tube. Sharon would have flown trans Atlantic business. It ain't what you do, or what you know, it's that you say what people want to hear.

ReplyDeleteThere is one aspect of the speech I'd criticise. Meaning won't be 6 metres under in 2100. It will take a millenniumt least. The specific and latent heat capacities of water, are high and ice is a great insulator. It generally takes 10000 year for an ice age to end. As chief officer Montgomery Scott used to say, 'you canny change the laws of physics'.

ReplyDelete