Having just plugged "portfolios for long-term investors" again, I really should opine on its message about the recent stock market decline. If you didn't see this coming and get out ahead of time, or if it was perfectly obvious to you that this was coming but you didn't get off your butt and do anything about it, preferring to pontificate at the dinner table, just how bad should you feel about it?

Not as bad as you might think.

For once, one can make a plausible case what drove the market down: Investors figured out that the Fed is going to finally raise interest rates to do something about inflation. Prices being somewhat sticky, higher nominal interest rates will mean a higher real interest rate, a higher real discount factor, and, with no change in the risk premium for stocks, a higher expected return for stocks. So, the lower price today is matched by higher returns going forward, just as a bond price decline is matched by higher yields. The lower price does not, in this argument, signal lower earnings or dividends.

If that is the case, then a long-term investor really has not suffered any decline in long-run purchasing power. If your plan was to hold stocks for a long time, and effectively live off the dividends (including all cash flows), then nothing has changed. Sure, it would be better if you had gotten off your butt and sold ahead of the decline. But effectively market timing is difficult as a consistent strategy. Maybe inflation was all "transitory" "supply shocks" and the Fed would not have to do anything.

Likewise, should you sell now? Well, has the market priced in all the likely interest-rate rises coming either from the Fed or from markets whether the Fed likes it or not? Maybe the Fed's forecasts are right that inflation will largely die out this year. Maybe not. Place your bets. Also, if you sell, you have to have the courage to jump back in just when it looks bleakest. Effectively market timing is difficult as a consistent strategy.

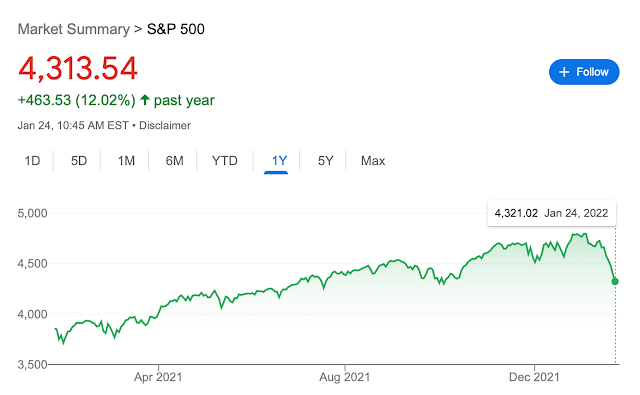

Is this story right? Interest rates are rising, but are they rising enough? Here are three rates, 10 and 30 year Treasurys and 10 year indexed TIPS. The rise is evident, but not shattering, and still smaller than the rise earlier this year. Hauling out the back of the envelope, the S&P500 is down about 10% from its peak. Bond yields are up about 0.5%, implying a roughly 5% decline in value for the 10 year and 15% decline in value for the 30 year bonds. So we are roughly in the ballpark.

Of course, not everything else is always constant. Higher interest rates might reduce those cashflows. Or higher interest rates might fight inflation, which raises real cashflows. Now we're back to betting.

The point today is just to bring to life a simple possibility: When real interest rates rise, other things held constant, stock prices fall, but (by definition since I said other things held constant) expected dividends and earnings do not fall. A long-term investor is not hurt. The value you get from selling all your stocks declines, but the cost of reestablishing the portfolio and living on it just declined too. Similarly, if the value of all houses falls, you really do not care to first order, since the value of the house you want to buy fell just as much as the value of the house you want to sell. Indeed, you save on property and capital gains taxes.

Just rephrasing your logic (which I find intuitive), long-term investors should care about cash flow news, but not really care about discount rate news.

ReplyDeleteHere's an interesting extension to your analysis (well, interesting from my perspective): how should long-term investors care about their exposures to market neutral investment strategies (like value, momentum, etc.)? It's less obvious how the returns to these strategies break down into their "cash flow" and "discount rate" components. I think a Campbell & Vuolteenaho (2004) style decomposition would be helpful in understanding the recent moves in these strategies, and help long-term investors think about their exposures to these strategies (either implicitly or explicitly).

I should have said "it's less obvious how _recent returns_ to these strategies break down into their...". Anyway, you get the idea.

DeleteLong term investors should care about discount rates. Even in the, very theoretical, case that future cash-flows remain the same they would be "paying" a diferent price for exercicing the "flexibility" of moving these cash-flows around that markets of liquid assets provide.

DeleteLet's imaging that I am a long term investor that has perfectly matched my future liabilities with the future dividend payments from my portfolio. Then unexpected liabilites come due (afterall live is what really happens while you are making wrong forecasts). I prefer to face those unexpected liabilities in the "December discount rate enviroment" rather than in the "last Monday discount rate enviroment", to be perfectly honest.

Brilliant post. Thanks for sharing.

ReplyDeleteAlso,

ReplyDeleteHow should long term investors structure their liabilities relative to their assets?

Note: We can't all be bankers, borrowing short to invest long.

"Prices being somewhat sticky, higher nominal interest rates will mean a higher real interest rate..."

Hmmm, if prices were so "sticky" then they should be sticky in both directions - up and down. So why did supposedly "sticky" prices rise to begin with?

Frank, my thoughts on why "sticky" prices rose. Large scale asset purchases by the FED. (9 trillion now on its balance sheet). Real interest rates were zero or negative. How does this affect CAPM or 3 factor models? Low nominal rates pushed investors searching for yield into risky assets. With a rise in rates, markets decline. As an exercise, play with interest rates in a Dividend Discount Model (DDM). It gives an insight to this discussion.

DeleteIt is not clear that the Fed will raise interest rates so quickly.

ReplyDeleteThe time to be frugal is before borrowing before you spend it all on poker chips. Once the game is lost, and the debt is owed, frugality eats into utility much more severely. Mechanically, because of declining marginal utility to wealth, being frugal before borrowing is less painful than afterwards, unless you invested wisely rather than consuming.

The US has found that it's "investment" in bailouts did not earn much in terms of long-run productivity. What should it do now?

Our borrowing gambler has two choices: eat into wealth in a way that was more painful than before he borrowed, or defaulting. If the political will to be frugal or investing prowess was not present before borrowing, it is unlikely to be there afterwards.

Thus, our gambler will almost certainly end up defaulting. The most painless way to default is via inflation, and that is most likely how this will go down.

My guess is that the US tried to avoid inflation in 1929-1930 to avoid the mistakes of Germany a few years prior. What the US didn't realize is that massive defaults on debt generates more political instability than inflation.

My vote would be the same here: Default on the debt via inflation.

In the long run, the only way to avoid inflation is by avoiding a budget deficit. As long as you have a deficit, it's just a matter of when.

Obviously, the advice to the US would be to run the Federal government profitably, but that is politically impossible given the incentives of voters and representatives.

Clueless.

DeleteAs the sage said: "in the short run, the market is a voting machine, in the long run, the market is a weighing machine." (attributed to Benjamin Graham)

ReplyDeleteUnless you are a "professional voter" best to stick to the weighing machine strategies.

Today's markets were fascinating from an intellectual standpoint. They went down at the start of the trading day, and continued in read only to recover and end up in green by the end of the day. Amazing. To me, this is a discount rate mechanism, which is what John (I believe) is suggesting in his post. But the come back we have seen at the end of the trading day seems to me more related to important players trying to cover their losses. Now, there are many news going on that are difficult to reconcile and that could potentially lead to cashflow story behind markets today (e.g., Ukraine-Russia war?).

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteI remember Larry Summers making a related point: that the increase in wealth in recent years has been accompanied by declining expected returns, leaving those with such wealth in pretty much the same place as they were before.

ReplyDeleteNice post. Some thoughts. Long term buy and hold tends to outperform actively managed portfolios. As an aside, my alpha as a hedge fund trader and manager was zero. Where on the long term horizon is the investor? If they are are 25, they have 40 years to build wealth with portfolios invested 100% in market ETF's. At age 65, they will have likely moved their holdings to about 60% cash. If some investors are truly rational, they will have bought in a declining market with a strategy such as, for every 5% market decline, they buy with 1% of their cash position.

ReplyDeleteA 65 year old 60% in cash is seriously underestimating the risk that he might live to 90.

DeletePeople are over reacting to volatility. Since 1950 the S&P 500 has spent ~50% of the time down more than 5% from the previous all time high and has averaged being down ~10% from the previous all time high. Anyone who is going to panic at a 10% drop has stumbled into the wrong bar.

ReplyDeleteOn a 10-12 years horizon, what the Fed does or doesn't do will have little influence on the stock market performance. Returns have been front loaded and the probability of positive real total return into 2032 are very low.

ReplyDeleteI have written an article demonstrating why here:

https://www.linkedin.com/posts/damiencleusix_uk-equity-markets-valuation-activity-6890281727840129024-QMc2/