The book isn't out yet, but I can't help myself... A revised draft of Chapter 5, fiscal theory in sticky price models is up on my website here. Giving talks over the last year and writing some subsequent essays, I see clearer ways to present the sticky price models. Bottom line, these three graphs provide a nice capsule summary of what fiscal theory is all about:

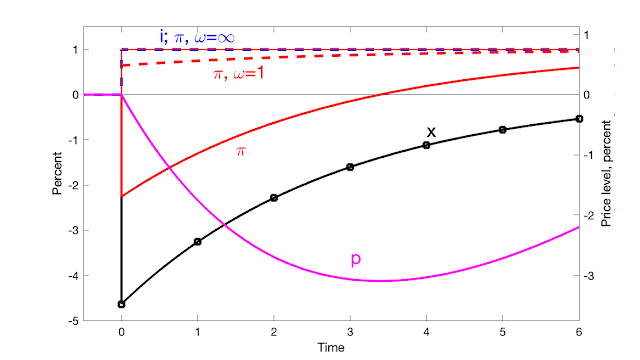

Response of inflation, output and price level to a 1% deficit shock, with no change in interest rates. Bondholders lose from a long period of inflation above the nominal interest rate. Inflation goes away eventually on its own.

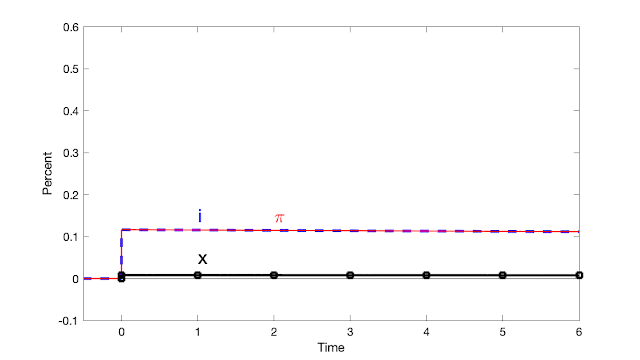

Response of inflation, output and price level to a permanent interest rate rise, with no change in fiscal policy, and sticky prices. The main line uses long-term debt. The omega=1 line uses roughly one year debt. The omega = infinity line uses instantaneous debt. Higher interest rates can temporarily lower inflation with long term debt. With short-term debt, despite sticky prices, inflation follows the interest rate exactly. Sticky prices do not imply sticky inflation.I'll keep updating as we go along. Comments and typos welcome.

And... there are still 4 days to go of the 30% discount at Princeton University Press. Use code P321.

Happy new year to all.

Hi John! Thank you for this excellent work. I am reading the July draft and particularly interested in s-shape surplus in ch. 5. However, I was stuck with eq. (5.100) (p. 169) because I think, in eq. (5.103) of u sub s (p. 170), you need a minus sign in front of eta in the denominator of r.h.s, which is manipulated from eq.(5.99). Does this u sub s differ u sub s,t? I also think beta sub s•d•epsilon sub s,t in eq.(5.98) and the above may well be out of the parenthesis, which is before dt. I can tell you a few more would-be minor typos if you need. I will definitely buy your book and look forward to it.

ReplyDeleteThank you! I just uploaded a manuscript and new typo list that, I hope, fixes these. Please let me know if you see more typos!

DeletePS, email me directly about typos or other matters of less interest to everyone.

DeleteIt appears that eqn. (5.36) on page 130 should be written as

ReplyDeleteEₜ{π(t+Δ) – π(t)} = (exp(ρ∙Δ) – 1)∙π(t) – exp(ρ∙Δ)∙κ∙x(t)∙Δ.

If so, then dividing through by the time increment, Δ , and then letting Δ go to zero from above gives the expected form for the continuous time O.D.E.

I.e., E{dπ(t)}/dt = ρ∙π(t) – κ∙x(t) , where l'Hospital's Rule has been applied to obtain lim Δ→ 0₊ [(exp(ρ∙Δ) – 1)/Δ] = ρ. Parameter κ is scaled by the time increment Δ , on the presumption that the longer the time increment the greater the weight of x(t) on π(t), where x(t) = ln[ y(t)/y⁺(t)] and y⁺(t) is the level of output that would obtain if prices were free to adjust instantaneously whereas y(t) is the level of output when price changes are scheduled (Taylor) or prices changes occur at random i.i.d. intervals for a random i.i.d. fraction of firms (Calvo; Poisson process).

Eqn. (5.37) as currently written, results in (exp(ρ∙Δ) – 1)∙π(t) going to zero as Δ→ 0₊ which does not agree, for example, with your continuous time O.D.E. that appears earlier on page 130, or with D. Romer's continuous time O.D.E. version of the new Keynesian DSGE model [Romer, D., Advanced Macroeconomics, 5th Ed., 2019, New York, McGraw-Hill Ed., p. 356, eqn. (7.100)].

Yes. Basically, get rid of square parentheses, the right hand side of (5.36) should only have a delta multiplying the last term. I will update. Thanks.

DeleteAmerican Economic Journal: Macroeconomics Vol. 15, Issue 1 (January 2023) has some articles which may prove of relevance to the FTPL, and inflation expectation modelling.

ReplyDeleteA partial table of contents, selected for relevance to recent discussions in this blog space, is presented below for information.

Anchored Inflation Expectations (#2): Carlos Carvalho, Stefano Eusepi, Emanuel Moench and Bruce Preston

Uncovering the Effects of the Zero Lower Bound with an Endogenous Financial Wedge (#5): Dan Cao, Wenlan Luo and Guangyu Nie

Consumption Heterogeneity: Micro Drivers and Macro Implications (#10): Edmund Crawley and Andreas Kuchler

Fiscal Policy, Relative Prices, and Net Exports in a Currency Union (#12): Luisa Lambertini and Christian Proebsting

Childcare Subsidies and Child Skill Accumulation in One- and Two-Parent Families (#15): Emily G. Moschini

Hi John. Greetings from India. Even though I do not have a background in economics, I have been trying to keep myself updated on many of the macroeconomic trends in the world.

ReplyDeleteI was wondering if the explanation of inflationary trends in France, in this (free to read) article by Financial Times is an example of your theory in action. Link - https://www.ft.com/content/1ecf7e39-3895-46f4-a0c5-78bb0e9fe95f?accessToken=zwAAAYYcQhE8kc8ez345OJVG9NOgxXi7Dp_pXwE.MEUCIDFl5gZqUCy_Vq_obXZJaCviB3_r2fJqjP4aiH-YtSXqAiEA8JbnD5wZhnwq8bVTyve5dZiPMhgQYurN5na7_2lpqF8&segmentId=8427d1c1-b917-3ecf-e579-66be586141bd

The way I see it is that basis Macron's political calculations, his government began providing subsidies and price controls on energy. Due to this, France has so far avoided the inflationary trends in Europe at the consumer level. However, pain exists at the wholesale level, and would eventually trickle into the consumer level as well. As this article shows, France's debt will also increase due to these subsidies.

At some point, the deficit will be required to be mitigated by either increasing borrowing, increasing tax receipts, or by reducing the deficit via budget cuts. Borrowing will increase the deficit and will lead to more reckless spending; increasing taxes may politically backfire as they did in 2018 during the Yellow-Jacket protests; and budget cuts will also be politically imprudent. The only way out: Inflation will eat into the debt, and will reduce the government's debt burden. However, it will also cause pain to consumers, and eventually bring France at par with the inflationary trends in Europe.

Can this be considered as a real-time example of how fiscal policies have a larger bearing on inflation than monetary policy?

Please help me with corrections in terminologies, concepts, or examples. Eagerly looking forward to hearing from you.